FXOpen

A double bottom is a chart formation that is paired with a double top pattern. Both setups signal a trend reversal, but a double bottom appears only in a downtrend, while a double top is formed in an uptrend. Why do traders confuse the signals? Read the FXOpen guide to learn the unique features of the double bottom formation and find out how to use it in trading.

What Is a Double Bottom Pattern?

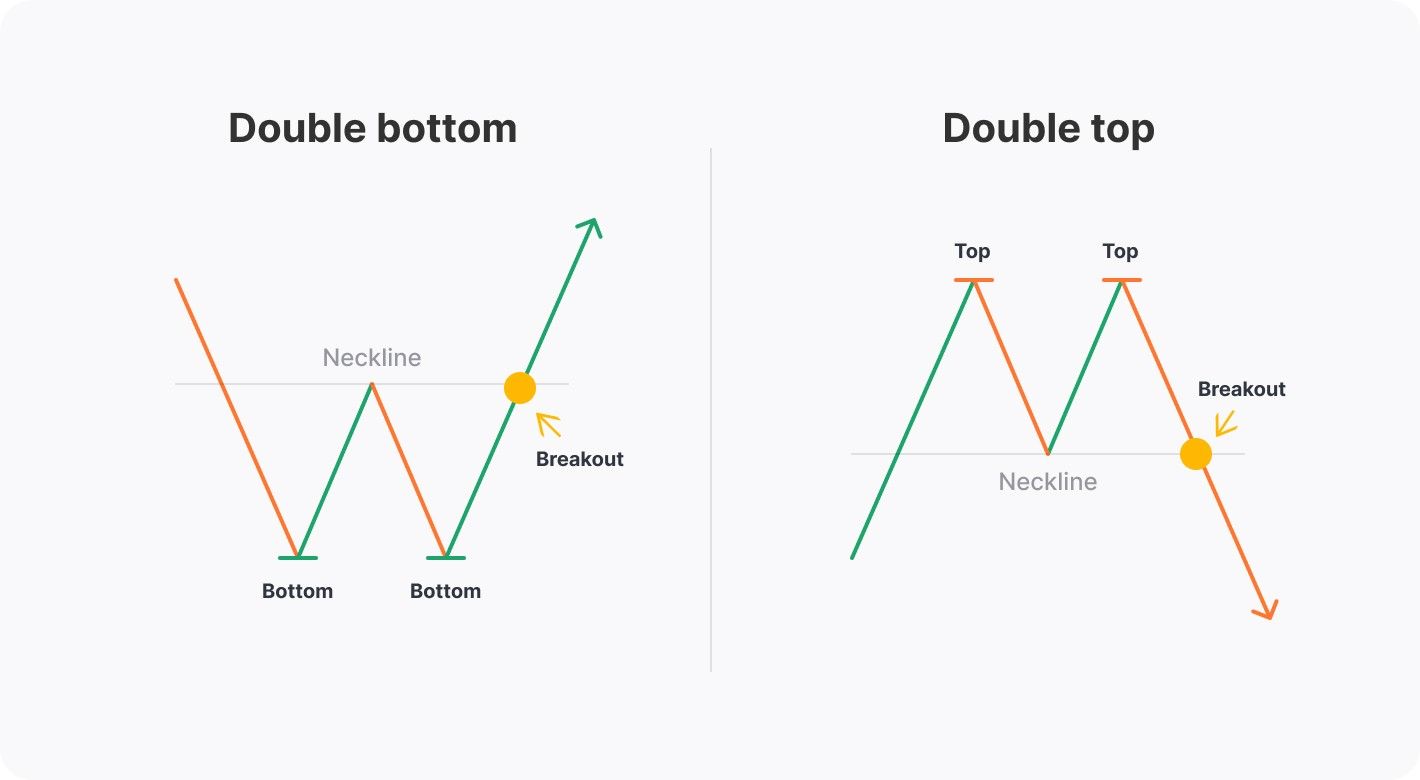

A double bottom is a technical analysis chart pattern that consists of two lows, formed at equal or almost equal levels, and a peak between them. This formation forecasts a trend reversal and appears at the end of a downtrend. Conversely, a double top pattern occurs at the end of an uptrend, with two tops and a trough between them. It’s worth learning the psychology of the formations to know how to distinguish between them.

A forex double bottom setup doesn’t differ from stock, commodity, or cryptocurrency* double bottom formations. Therefore, after you learn this pattern, you will be able to use it in stock, cryptocurrency*, commodity, and forex trading.

What Does a Double Bottom Indicate?

The double bottom setup starts with a low that confirms a downtrend. However, the second low is formed at the same or almost the same level, signalling that sellers don’t have the strength to drive the price down. Here, traders doubt the downtrend will continue and start closing sell positions, thus pushing the price up.

Note: in trading, traders close current trades by opening the opposite ones. Simply put, when traders close buy positions, they sell the asset. Conversely, when they close sell positions, they buy the asset. This is how a new trend is formed.

As for the double top pattern, it appears at the end of an uptrend. Therefore, it has tops, not bottoms. The first top stands for an uptrend continuation, while the second signals the buyers' weakness.

Remember that a double bottom setup won't work in an upward trend, while a double top setup can't be used in a downtrend.

How to Trade a Double Bottom Pattern

The idea behind the double bottom pattern is to enter a market on the breakout of a neckline, a line drawn through a peak between two bottoms. The same idea applies to many patterns, including double top, triple top, triple bottom, head and shoulders, inverse head and shoulders, and Quasimodo.

Entry

Usually, traders go long at a breakout. Still, there are several options to enter the market.

A trader can open a position as soon as the price rises above the neckline. In this case, the risks are enormous because the price often retests the breakout level, like in flag, triangle, and wedge setups.

Another opportunity is to wait for either a breakout candlestick or several candlesticks to close. On the charts with long periods, a trader can wait for the price to form a few candles. However, if the timeframe isn’t high and the distance between the bottoms and the neckline is short, a trader may open a position too late, which will result in either small profits or a lack of them.

Take Profit

A take-profit target is equal to the distance between the bottoms and the neckline and is set just from the neckline. A trader may use a trailing take-profit order if the market sentiment is bullish and there are fundamental factors that can push the price up.

Stop Loss

A stop-loss level can be calculated with a risk/reward ratio. The most common ratios are 1:2 and 1:3, but traders can develop their own trading rules. You can open an FXOpen account and practise trading with the double bottom pattern.

Double Bottom: Trading Examples

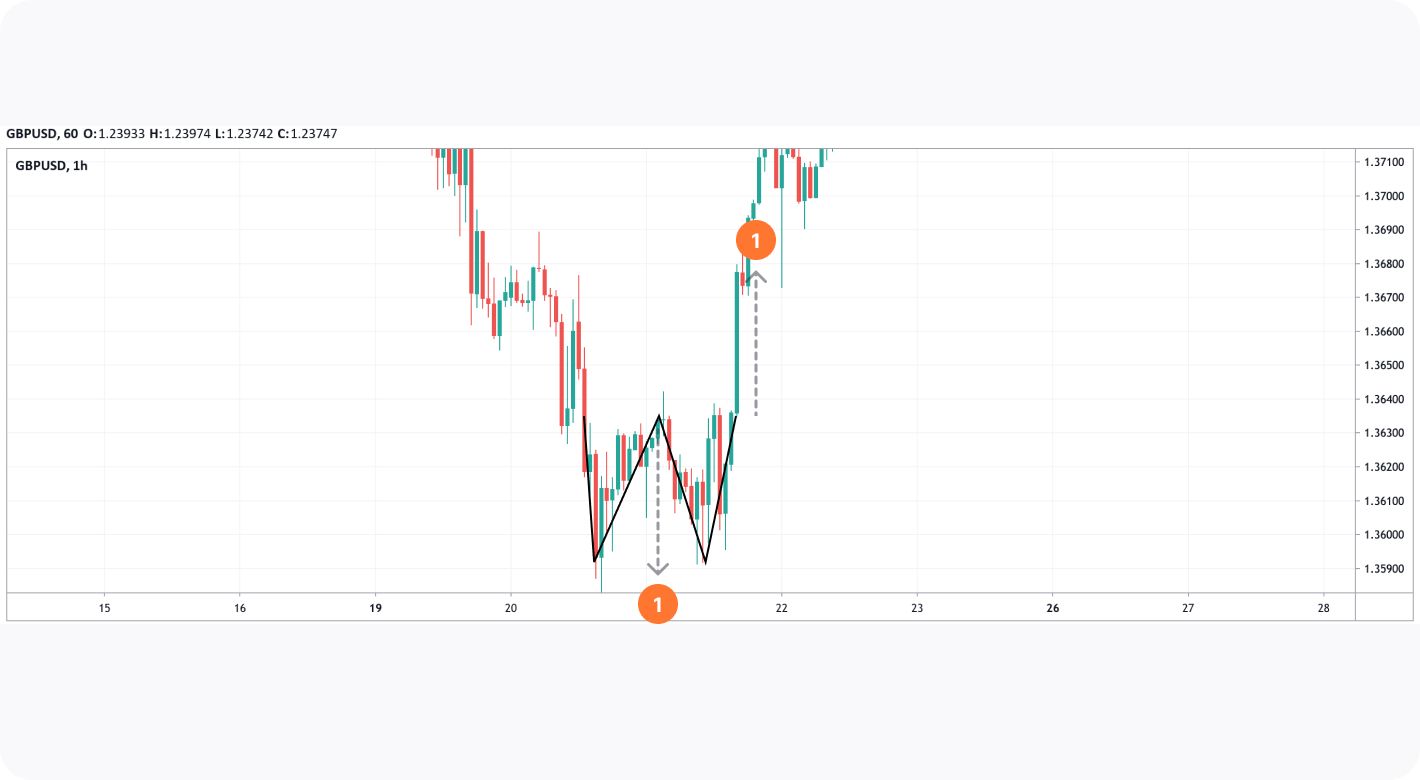

Let’s consider an example of a potential double bottom trade.

On the chart above, the price formed a double bottom setup at the end of a downtrend. According to the common rule, the price moved the distance equal to the difference between the neckline and the bottoms (1). If a trader waited for the breakout candlestick to close, they would miss the opportunity to trade with the pattern. Therefore, when noticing a large trading volume, a trader could go long at any time the breakout candle was forming.

A take-profit target would equal the distance between the neckline and the bottoms regardless of the entry point. However, as the rise continued, a trader could trail a take-profit level. The stop-loss would depend on the entry point and the take-profit level, but if it equalled a 1:2 or 1:3 risk/reward ratio, the trade would be successful.

How to Confirm a Double Bottom Pattern

A double bottom pattern can be confirmed with standard technical analysis tools. As a trader uses a breakout to enter the market with this formation, trading volumes can be used as a barometer of the bulls' strength. If trading volumes grow when the price rises above the resistance level, the price is more likely to continue surging.

On the chart above, the on-balance volume (OBV) indicator is growing, although the price is consolidating (1). It’s the first sign the price will break above the resistance level and keep rising.

Another option is to use trend indicators. For instance, traders can apply moving averages to the price chart to find well-known golden cross and death cross signals. In the picture below, moving averages formed a golden cross pattern (1), which signalled a price rise. A trader could use it to confirm a breakout.

Note: most of the trend indicators are lagging, meaning they provide delayed signals. Therefore, if you implement them when trading on a short-period chart, it’s worth changing their parameters to smaller values.

You can use the TickTrader platform to examine which indicators and candlestick patterns can help you confirm the double bottom signals effectively.

Final Thoughts

A double bottom formation is one of the most common tools a trader with any experience can implement when trading. Although the pattern may fail, it has a high level of accuracy which can be increased by practising on a demo account or live charts. It’s worth remembering that double bottom trading requires confirmations from other technical analysis tools.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.