FXOpen

The Quasimodo (QM) pattern is no more difficult than Head and Shoulders. Still, only a few traders know about it, and some even confuse one with the other. However, this is not a reason to avoid this tool in your Forex trading strategy.

Read on the FXOpen guide to discover the definition of the Quasimodo pattern, and learn how to choose the right one according to current market conditions.

What Is QM in Forex?

Quasimodo is a reversal pattern forming at the end of a solid trend.

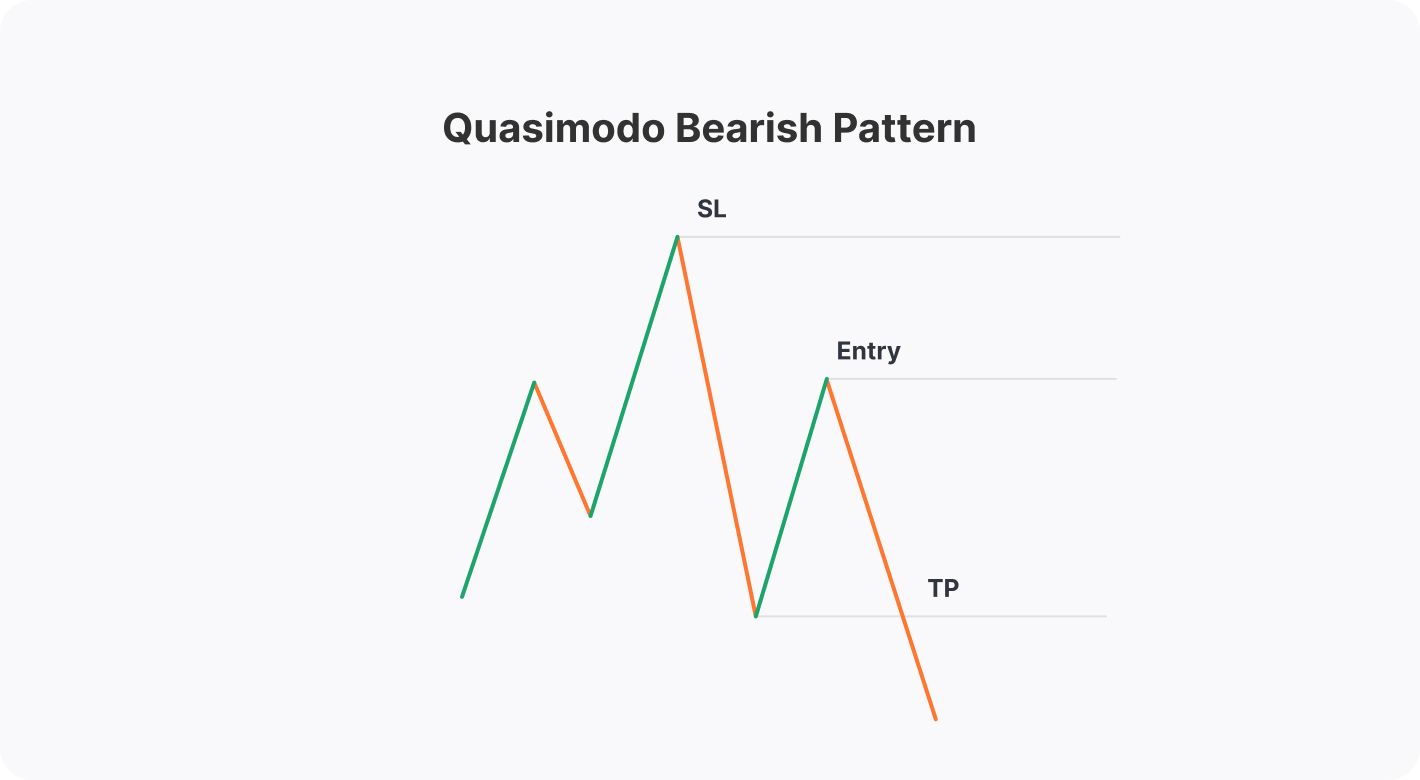

Bearish Quasimodo

A bearish QM occurs at the end of an uptrend and signals the formation of a new downtrend. It consists of three peaks (a head in the middle and two shoulders at the sides) and two troughs. The second peak (head) is the highest, and the second trough is the lowest.

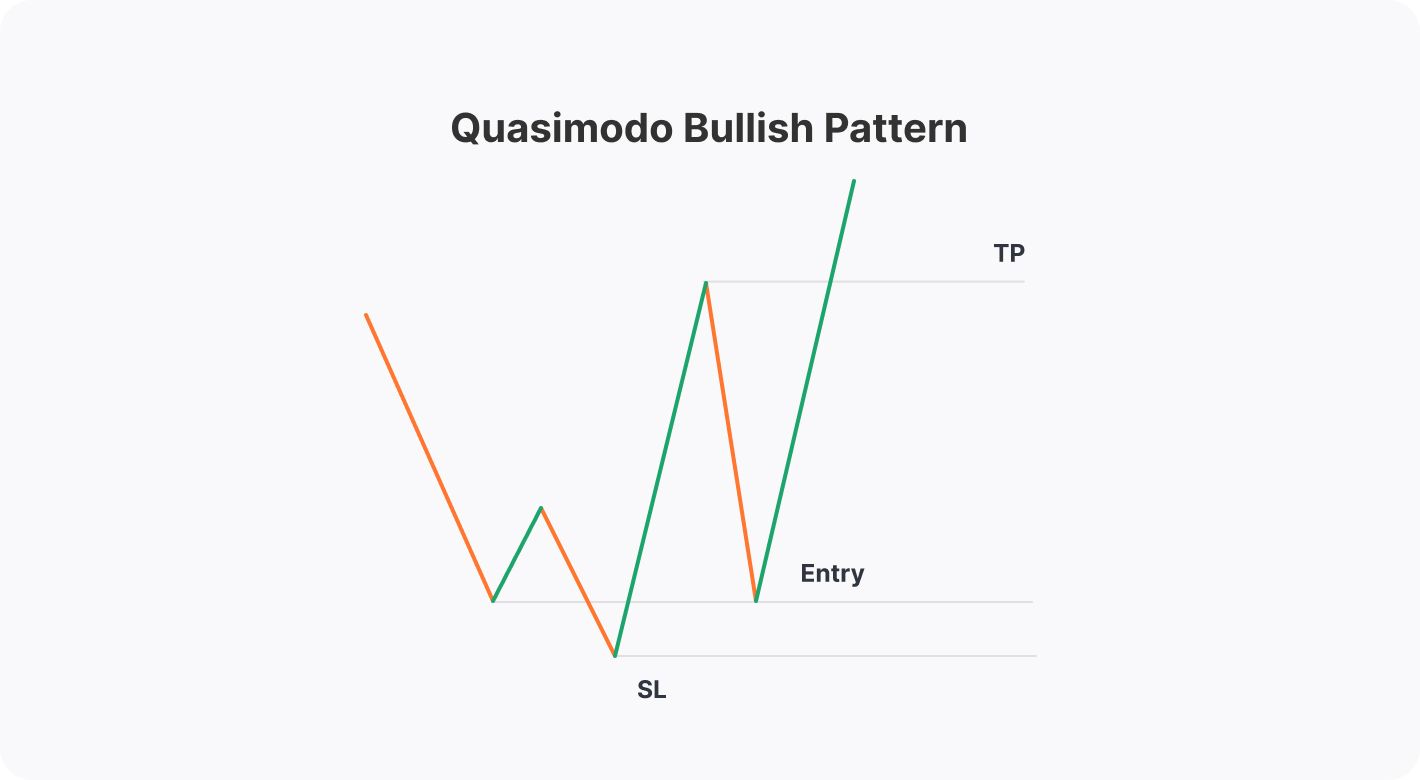

Bullish Quasimodo

A bullish (inverse) Quasimodo occurs at the end of a downtrend and signals a potential uptrend. It consists of three lows (a head in the middle and two shoulders at the sides) and two maximums, where the second trough (head) is the lowest and the second top is the highest.

The QM Forex Trading Strategy

A significant advantage of the QM formation is that it helps traders identify entry and exit points to open various trades.

Go Short

The theory suggests that a trader should open a sell position as soon as the lower high (the second shoulder) is formed. The trough between the head and the right shoulder could be used as a take-profit target. The head would serve as the stop-loss target.

Go Long

According to the pattern’s rules, a buy position could be opened as soon as the second shoulder appears. To enter the market at the best possible level, consider the price’s higher low (the second shoulder) as a potential entry point. You may set a take-profit order at the peak between the head and the right shoulder and use the head as a stop-loss target.

Non-Standard Formations

Any theory is always based on perfect conditions, but the actual market often differs. For example, on the chart below, the take-profit target (1) is three times smaller than the stop-loss level (2). In such cases, standard rules don't work.

In this particular case, we would either reduce the size of the stop-loss order or increase the take-profit value. Your decision will depend on the market conditions. For instance, you could increase the take-profit value if there are strong signals of a trend reversal from other reliable indicators. If trading volumes are low, the strategy suggests shortening the stop-loss distance.

Quasimodo and the Head and Shoulders: Differences

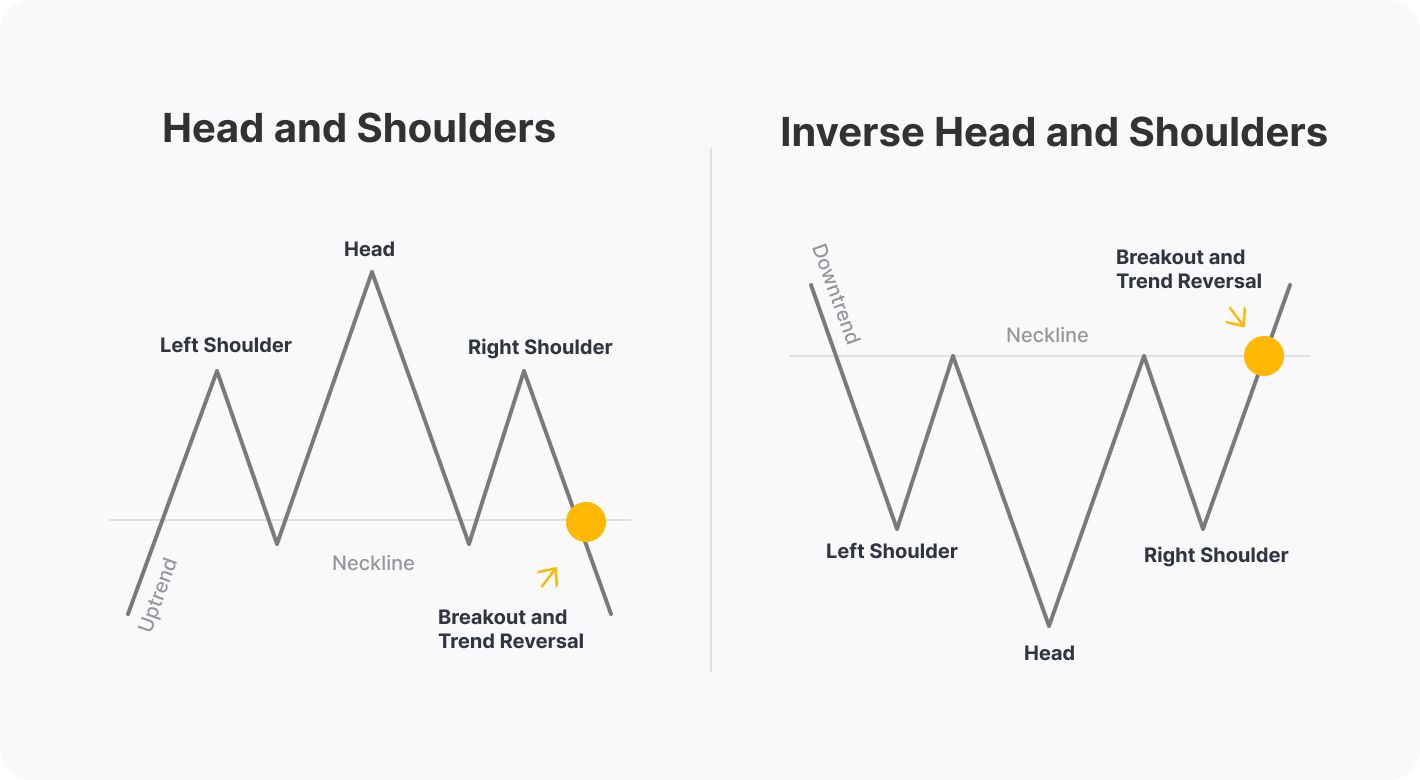

The QM and the Head and Shoulders are reversal patterns. They look similar but differ in formation and entry/exit points. Take a look at the chart below.

The bearish Head and Shoulders also has three maximums and two minimums, where the second peak (head) is the highest. However, the second trough is at the same level as the first one. This is the difference between the QM and the Head and Shoulders patterns.

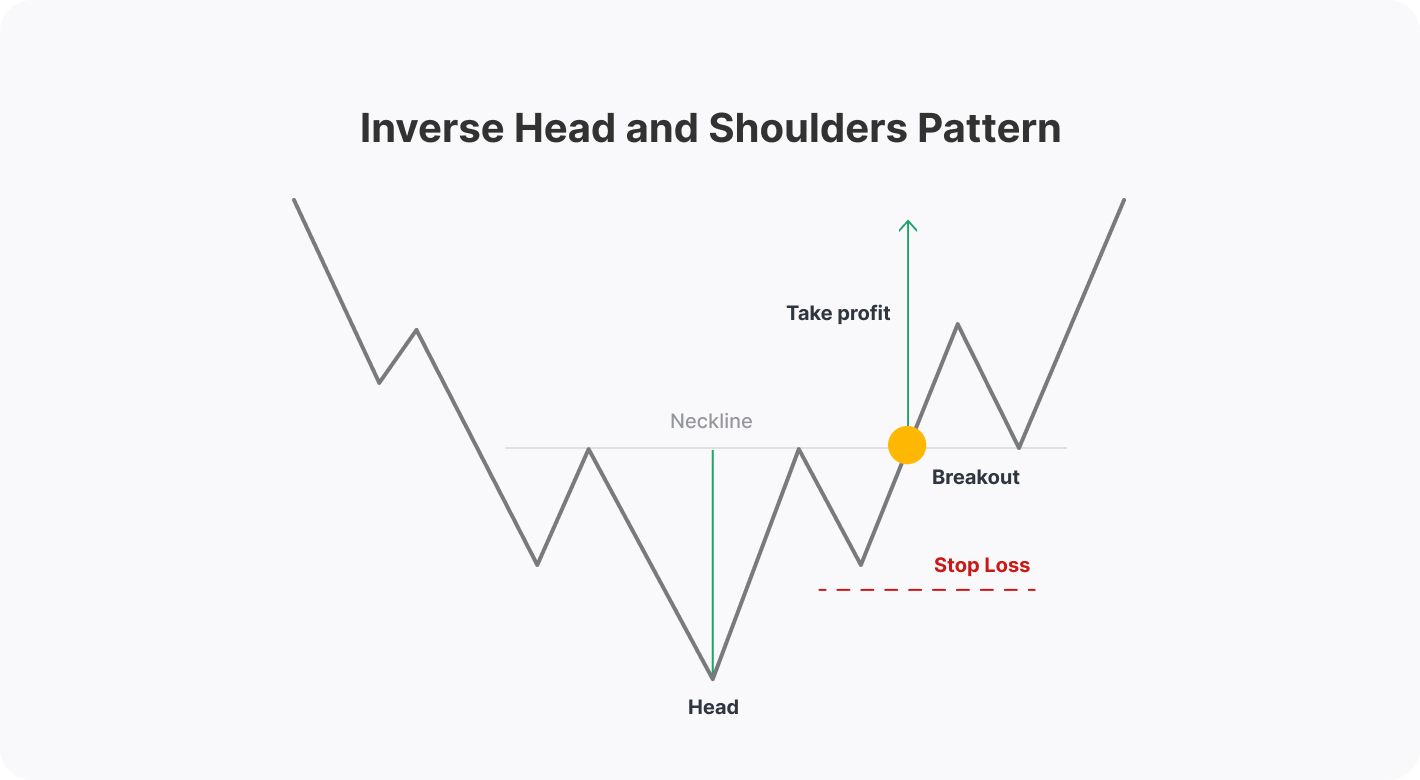

The inverse Head and Shoulders consists of three lows and two peaks, where the second trough (head) is the lowest, and the second top is at the same level as the first.

To make it easier, draw a line, a so-called ‘neckline’, through the two troughs in a bearish formation and the two maximums in a bullish one. If the neckline is horizontal, it's the Head and Shoulders. If it's angled, it's the Quasimodo.

Why Distinguish Between Patterns?

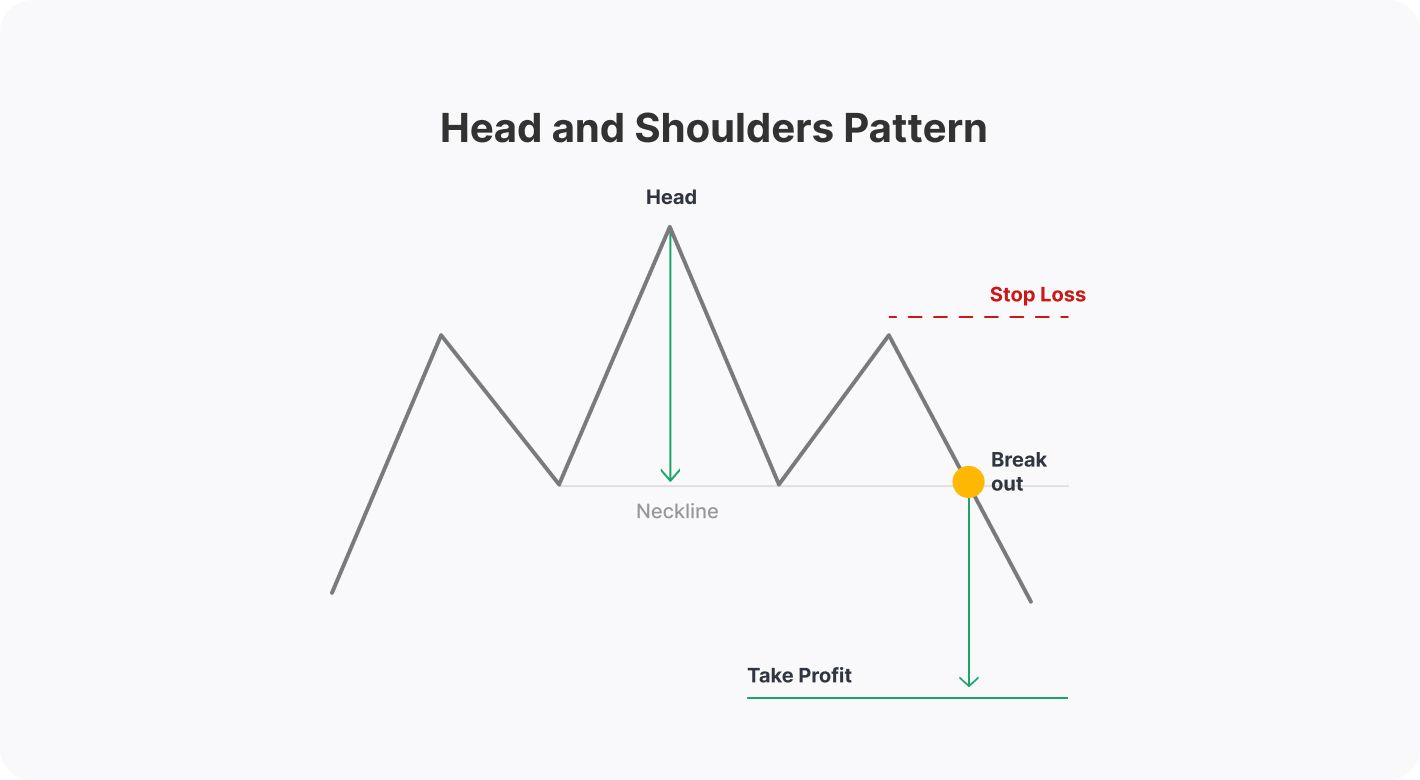

Although the QM and the Head and Shoulders look similar, they have different trading rules.

- When trading the bearish QM pattern, you are supposed to go short on the right shoulder. In the Head and Shoulders, you would wait for the price to break below the neckline after the right shoulder.

- In the inverse QM, you could enter the trade at the third trough (right shoulder). But when trading on the inverse head-and-shoulders formation, the common rule is to enter the market not on the second shoulder but after the price breaks above the neckline.

The stop-loss and take-profit levels will differ, too.

In the bearish Head and Shoulders, the take-profit target equals the distance between the head and the neckline. The stop-loss level can be placed slightly above the third top or in accordance with the risk/reward ratio.

In an inverse head-and-shoulders formation, the profit target is the same as the distance between the head and the neckline. The stop-loss level can be set slightly below the third bottom or corresponding with the risk/reward ratio.

How to Verify QM Signals

Although patterns are reliable technical analysistools, they must be validated. There are several methods to confirm a Quasimodo, meaning using various indicators and tools that predict a trend reversal.

The most popular indicators are the relative strength index (RSI), moving average convergence divergence (MACD), and simple moving average (SMA).

Divergence

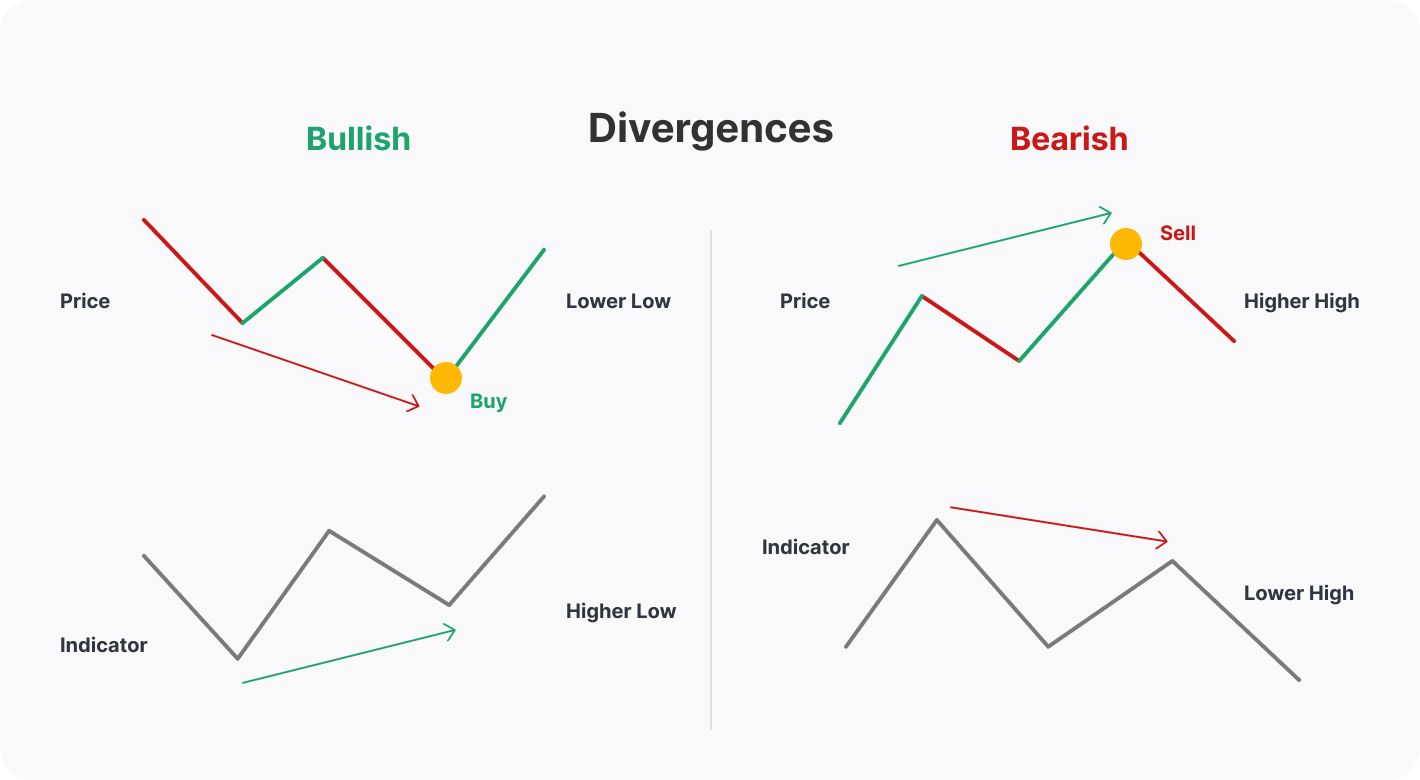

RSI and MACD signal a trend reversal in several ways, but the divergence method is the most dependable. There are hidden and regular divergences. The latter provides more reliable alerts. Therefore, it makes sense to use this type for trade confirmations.

- A regular bullish divergence appears when an indicator forms higher highs, but the price goes down. It’s a buy signal.

- A regular bearish divergence is formed when the indicator forms lower highs, but the price still increases. It’s a sell signal.

The chart above shows a regular bullish divergence between the price chart and the RSI indicator. As the RSI formed a higher high and left the oversold area, you can anticipate a price reversal. Once the second shoulder of the Quasimodo appears, the market creates conditions for a buy trade.

Moving Averages

A simple moving average is widely used to confirm a trend reversal. You will need two MAs with different periods, depending on the timeframe you trade on. 50-, 100-, and 200-period MAs are used on high timeframes, while 9-, 12-, and 21-period MAs are effective on shorter-term periods.

Look at the 4-hour chart of the EUR/USD pair. The price formed an inverse QM. When the second bottom appeared on the chart, a 9-hour MA crossed the 21-hour MA from bottom to top (1). It's a so-called golden cross that signals an upward movement. As the cross occurred before the price formed the third bottom of the QM, you could open a buy trade immediately after the cross.

Practice spotting the QM pattern in FXOpen TickTrader.

Tips on How to Trade the Quasimodo Pattern on Forex

Trading seems simple until you enter the real market. So, always be ready for exceptions and follow some rules that may help to protect you from potential losses.

- It’s risky to open a trade until the QM is fully formed.

- Medium- and long-term timeframes work best for the Quasimodo setup.

It takes time to identify the pattern. Therefore, using it on short-term timeframes may lead to missed trades. - Identify a strong trend.

The stronger the trend, the more reliable the signal is supposed to be. - Recheck the stop-loss level.

Although the rule offers a particular stop-loss distance, the QM may look different. Therefore, you could use the risk/reward ratio of 1:2, 1:3, or larger to limit potential losses. - Don’t confuse bearish and bullish formations.

A QM is formed at the end of an uptrend, while an inverse QM appears when the downtrend ends. - Don’t confuse the Quasimodo trading pattern with the Head and Shoulders.

Takeaway

The QM is a meaning Forex pattern despite being less popular than the Head and Shoulders. It's an effective tool for identifying working entry and exit points. Try a free demo account and practice the Quasimodo today.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.