FXOpen

The Jackson Hole Symposium ended, and the Federal Reserve’s message is that the tapering of the asset purchases comes sooner rather than later. It was the Fed’s intention to communicate to markets consistently and clearly how and when it will remove the monetary accommodation, and it succeeded, at least if we look at the way financial markets reacted.

The stock market liked what it heard and reached new record-high levels after Friday’s statement. It seems they understood that tapering is not tightening but only a slowdown of the asset purchases.

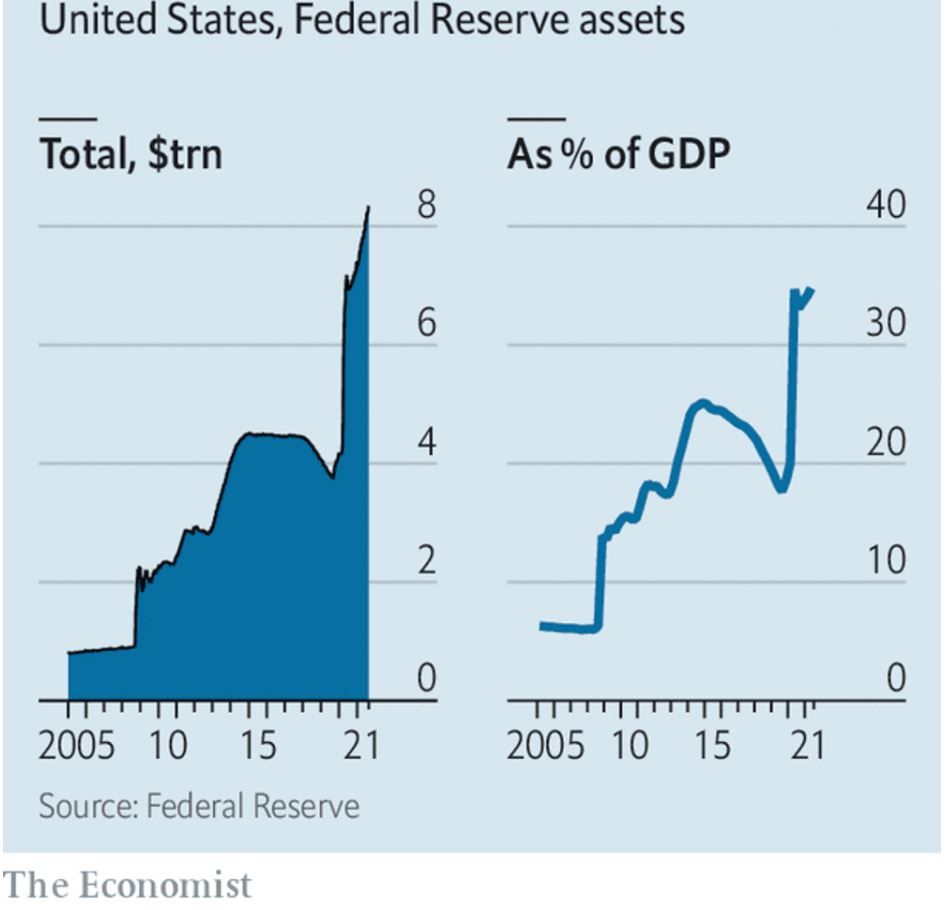

After the COVID-19 pandemic started, the Fed began easing the monetary policy at an unprecedented pace. Economists have the habit of comparing economic crises and the measures taken by central banks. If we use this metric, the Fed has bought $4 trillion worth of assets, much more than it did in response to the Great Financial Crisis of 2008-2009. Roughly, it has bought government bonds worth 18% of the U.S. GDP.

As its balance sheet exceeded $8 trillion, the Fed faced the ingrate challenge of communicating to markets when it will start tapering. Tapering means a slowdown of the asset purchases and not tightening. Therefore, even after the Fed starts the tapering process, the balance sheet will keep rising, albeit at a slower pace.

Fed Message in Short – Dovish on Rate Hikes but Hawkish on Taper

The Fed was hawkish on taper. Some voices argued before the Jackson Hole speech that the Fed would never taper. But it is forced to do so by an economy that it is booming and by a rising inflation rate.

The slowing down of the asset purchases means easing remains in place. By literally guaranteeing the tapering to start this year, the Fed did not scare markets because financial market participants already knew the Fed’s intentions.

Moreover, to sweeten the deal, the Fed vowed to keep rates low for a long period. In other words, the message on rate hikes was dovish, while the one on taper was hawkish.

The markets reacted as the Fed intended – the U.S. dollar weakened and closed at its lowest levels of the week, while the stock market reached new all-time highs. Moving forward, the challenges for the Fed remain the same – employment and inflation. If the Delta variant affects the U.S. GDP more than the Fed expects, the dovish message on rates may be prolonged.

All in all, the easy monetary conditions remain in place despite the economy booming and inflation soaring. The markets understood that the Fed intends to keep the easy monetary policy for a long period beyond the tapering ends.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.