FXOpen

Hedging in Forex is useful for maximizing profits in fluctuations and minimizing risks.

But what is risk? Total exposure of your capital isn’t a good attitude because the market can show you a different side of the coin and could be detrimental for your equity.

The Buy and Sell of a currency is a hedging practice where 50 % of your decision is right and 50% is wrong. But 50 % (profit) – 50 % (loss) = zero. Spreads decrease the percentage of earnings, and then your balance is apparently negative.

An interesting part of trading is to repeat N-times covering the losses of the 1st trade. So, if you decide to buy and sell euro/usd at the same time, 50 % of your decision is right. And you also know that there are several pullbacks making Forex attractive and dynamic.

The following picture shows euro depreciating against the dollar, which is graphically shown by a black candle. In the next hour you know that there will soon be a correction and then you decide to buy 2x EURUSD to recover the investment made on the first trade and its equity remains positive again as desired.

For example:

EUR/USD is traded at 1.36 on the 1st day.

The trader applies 0.1 lot on an account of $1.000.

On Day 2, the currency is depreciated by 1.35 and you got 100 positive pips and 100 negative (pips + spread) pips.

The trader closed a lot at 1.35 and got $100.

But he lost – $102 (a loss of $ -2).

On the same day EUR/USD had a 50 % correction of the last zig zag curve and the price is now at 1.3550 that you decided to buy 2x (0.1 lot) because euro was rising.

Difference = (1.3550-1.3500)*0.2lot = $100

So, your profit would be $100 – $2 = $98.

Their risk was lower and your day was happier.

In times of high volatility, you shall try applying hedging if you are not sure about what direction to trade. Forex tends to fluctuate a lot on economic releases, which triggers strong currency fluctuations. The higher the fluctuation is, the greater will be the opportunities to recover the investment in pullbacks. But how do you know what the next curve is? We need to observe the overvaluation of the pair. If EUR/USD is oversold, so one should go long for a correction. When there is a negative sentiment about the currency, investors naturally sell before the news.Nobody knows exactly how the currency will react with the data factored it. Within a few moments we can expect absolutely different and unpredictable movements.

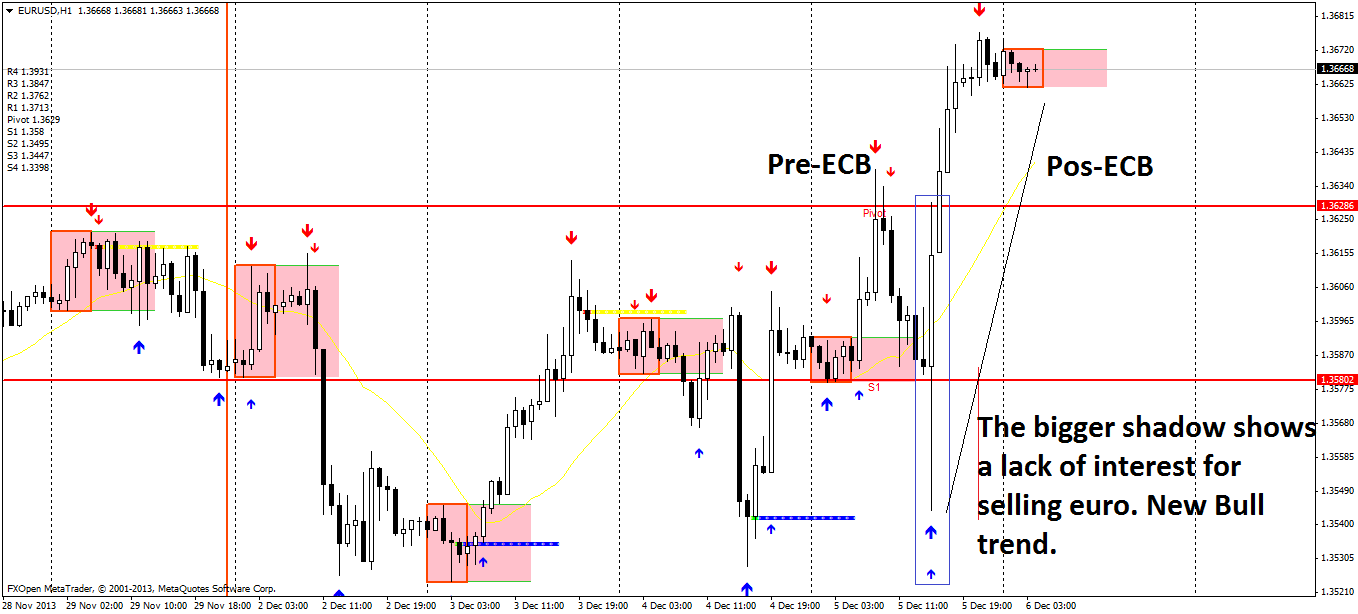

No one has greater influence on euro than ECB. When traders think that the euro is depreciating, they start placing many orders (short/sales).

Suddenly, euro gains muscle and candle will be white with a larger shadow. This shadow indicates that investors are buying, according to the decisions of the ECB not imagined before.

In the next few hours, the behavior of the euro will be determined by the price action. If investors are buying under the influence of the ECB, then one should continue with long orders up to find a new resistance. What would be your risk by trading on important days? Forex hedging will make your risks lower.

The article is written by Igor Titara and is participating in the Forex Article Contest. Good luck!

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.