FXOpen

Traders prefer to trade with the trend. That’s where a simple yet effective indicator known as Supertrend comes in. This tool can help you identify and get in early on emerging trends. Therefore, it has found significant popularity amongst crypto day traders. In this article, we’ll take a closer look at the Supertrend indicator, discussing its signals, the best Supertrend settings, and four strategies you can get started with right away.

What Is the Supertrend Indicator?

The Supertrend indicator is a technical analysis tool designed to help traders identify and follow market trends. It’s a lagging indicator that can be used to develop comprehensive trend-following strategies, assisting traders in spotting reversals and the start of new trends. Supertrend incorporates a volatility metric called average true range (ATR) into its calculations and is plotted with a single line overlaid on the chart.

This line represents the trend direction. When price is above the Supertrend line, the line will turn green to signal bullishness. Conversely, when price is below the Supertrend line, the line will turn red, so the market is considered bearish. The indicator’s signals are simple and effective in trending markets but can be incorrect in ranging markets, meaning it’s best to seek extra confirmation before considering entries.

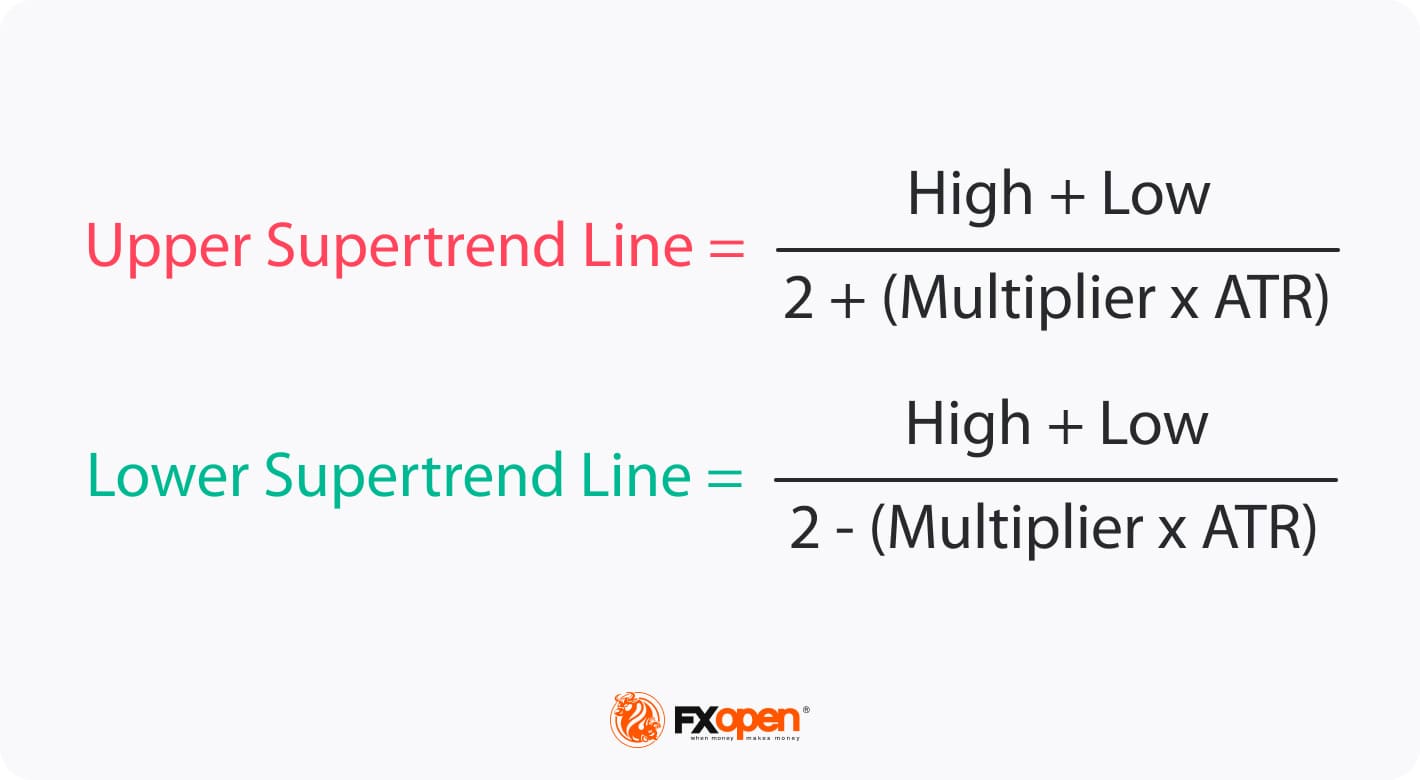

Supertrend Indicator: Formula and Calculation

The Supertrend indicator is calculated using two key components: ATR and a multiplier. The ATR measures the overall price range of an asset, offering an indication of its volatility. The multiplier allows traders to change the sensitivity of the indicator.

The formula for the Supertrend indicator is as follows:

The default settings for ATR and the multiplier are typically 10 periods and 3, respectively. A shorter ATR will give more weight to recent price action, while a longer ATR will smooth out values. However, changing this value won’t have as much bearing on the indicator as the multiplier.

By moving the multiplier up or down, traders can adjust the Supertrend’s sensitivity. A lower multiplier increases the number of overall signals and false signals while allowing for a tighter stop loss. A higher multiplier will generate fewer entries and false signals, often at the cost of a wider stop.

Identifying Trade Signals

The Supertrend indicator offers fairly simple buy and sell signals, determined by observing the relationship between the price and the line.

Buy signals occur when price crosses above the Supertrend line. In this scenario, the Supertrend line often acts as a dynamic support level, which could be an ideal entry point for a long position. The bullish trend is considered intact as long as the price stays above the Supertrend line.

Sell signals are generated when price falls below the Supertrend line. Similarly, the Supertrend line acts as a dynamic resistance level, which may be a suitable entry point for a short position. Traders can maintain their short positions if the price remains below the Supertrend line.

How to Use the Supertrend Indicator for Crypto Trading

The indicator can be applied to various timeframes, from intraday charts to daily and weekly charts. However, shorter timeframes, such as the 5-minute or 15-minute charts, are more common for day trading, as they offer more frequent trading opportunities.

What Are the Best Supertrend Settings for Crypto Trading?

But what Supertrend settings are optimal for crypto trading? In truth, there is no one-size-fits-all setting. Generally speaking, the theory says it’s best to keep the ATR value somewhere between 10 and 20 since this will provide a good mix of sensitivity to recent price action and smoothing.

As for the multiplier, the standard factor of 3 is suitable. Some traders may prefer to adjust it to 4, 5, or 6, to account for crypto volatility, although this may lead to a reduced risk/reward ratio. Ultimately, the best settings will depend on market conditions and the crypto asset you’re trading, so it’s wise to experiment to find your optimal configuration.

Supertrend Indicator Settings for Crypto Intraday Trading

For intraday trading focusing on short-term price movements, you could consider adjusting the Supertrend settings to increase sensitivity to price fluctuations. One possible configuration is to use a multiplier of 2 and an ATR period of 10. This setup can help identify more trade signals and adapt to rapid market changes, allowing traders to enter and exit within a few minutes or hours.

Supertrend: Best Settings for Crypto Swing Trading

Given that swing trading typically involves holding positions for several days or weeks, swing traders may prefer to adjust the settings slightly higher. This will offer a clearer reading of the broader trend. The ATR can be set anywhere between 10 and 20, while a multiplier of 5 will reduce the number of false signals.

Trend-following swing traders may also benefit from setting a bias using the Supertrend on the 4-hour or daily charts and then using the hourly chart to enter trades. It’s not uncommon for an asset to range on the hourly chart and whipsaw above and below the Supertrend while remaining bullish or bearish on the higher timeframes. This can help to avoid confusion when the market ranges.

How to Create a Supertrend Indicator Strategy for Crypto Trading

Now that we have an idea of what the Supertrend indicator is, how it works, and the best settings to use, we can begin to formulate some strategies. If you want to test them for yourself, you can try our free TickTrader platform at FXOpen. There, you’ll find the Supertrend indicator and dozens of other technical tools waiting for you to use.

1-Minute Supertrend Scalping Strategy

Using the 10-period ATR and 2-factor multiplier mentioned, we can create a 1-minute Supertrend crypto scalping strategy.

Entry: When the line turns green/red, we can enter with a long/short market order as the candle closes.

Stop Loss: Above or below the nearest swing high/low, depending on the direction of the trade.

Take Profit: You can close the trade when Supertrend switches to another colour.

As seen in the example, this provides traders with some decent scalping opportunities to enter early with relatively tight stop-loss levels.

Double Supertrend Strategy

This strategy uses two Supertrends with different settings to reduce the number of false signals. It aligns the more sensitive Supertrend’s signals with a less reactive version while still allowing for relatively tight entries.

Requirements: A fast Supertrend with lower settings (blue and orange) – default 10-period ATR and 3-factor multiplier is suitable. A slow Supertrend with higher settings (green and red), like 20 and 6.

Entry: The fast Supertrend will typically precede the slow Supertrend, so observe the fast signals and wait for the slow lines to confirm the direction (both should show either bullish or bearish). Traders can enter with a market order once confirmed or wait for a retrace to the slow Supertrend and enter with a limit order.

Stop Loss: Above or below a nearby swing high/low, depending on the trend direction.

Take Profit: You can close the trade when the slow Supertrend signals a change in direction.

In the example shown, we can see that while the faster Supertrend switches back and forth between bullish and bearish, our strategy stays aligned with the stronger overall trend, allowing us to capture the bulk of the move until it reverses.

3 Supertrend Strategy

This strategy seeks extra confirmation using three Supertrends and an exponential moving average (EMA). The EMA helps us classify the trend in another way (above = bullish, below = bearish). Simply put, we wait until all three align before considering an entry.

Requirements: Three Supertrends with varying settings. We’ve used 10 and 2, 20 and 4, and 30 and 6. You’ll also need a 200-period EMA.

Entry: You may wait until all three Supertrends are green and price is above the 200 EMA for a long entry, and vice versa, to enter with a market order.

Stop Loss: Above or below a nearby swing point.

Take Profit: You may close the trade when all three turn red if bullish or green if bearish.

While this strategy won’t offer many entries throughout the day, it can help traders jump on trends with strong confirmation.

Relative Strength Index (RSI) Supertrend Strategy

While the relative strength index (RSI) is best known for its ability to spot overbought and oversold conditions, it can also help us confirm trends. The midpoint (50) is regarded as the defining boundary, with action above indicating bullishness and below demonstrating bearishness. Here, we’ve also increased the Supertrend multiplier to 5 to get a clearer picture of the trend.

Requirements: The default RSI with 14 periods and the Supertrend with a length of 10 and multiplier of 5.

Entry: When Supertrend gives a bullish or bearish signal, confirm that RSI is above or below 50, depending on the direction. If both line up, traders may enter with a market order.

Stop Loss: Above or below a nearby swing point.

Take Profit: You may close the trade when the Supertrend switches or if RSI is above 70 or below 30, indicating extreme overbought or oversold conditions.

The added benefit of using RSI means that traders can anticipate trend reversals when the indicator reads overbought or oversold or when divergences appear, allowing for some predictability as to when the Supertrend might switch.

Stochastic Supertrend Strategy

The stochastic indicator is similar in principle to RSI, helping traders spot overbought and oversold conditions. However, it frequently flashes these signals, offering us a way to confirm Supertrend signals and entries.

Requirements: The default stochastic indicator, with settings 14, 1, and 3. Set the Supertrend to a multiplier of 5.

Entry: After the Supertrend signals a certain direction, wait for the first time Stochastic reaches below 20 if bullish or above 80 if bearish to enter with a market order. Avoid trading if it’s not the first time.

Stop Loss: Above or below a nearby swing high or low.

Take Profit: You may close the trade when Supertrend changes colours.

The Stochastic indicator allows traders to identify areas where the market is likely to reverse and, when combined with Supertrend, can assist us in finding optimal entries with strong confirmation.

The Bottom Line

In summary, the Supertrend indicator is a versatile tool that can help traders capitalise on new trends with fairly simple entry and exit signals. While it can produce false signals, particularly in ranging markets, the strategies described should help you filter out some of these losing trades.

Moreover, these strategies aren’t exclusive to crypto; you can apply and adjust them to any market you see fit, including forex, commodities, and stocks. If you’re thinking of implementing these strategies, you can open an FXOpen account. You’ll be able to access over 600 markets in the highly customisable TickTrader platform alongside low-cost trading and tight spreads. Just complete the signup process to get started. Good luck!

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.