FXOpen

The relative strength index is one of the most common oscillators. Many traders prefer it to other momentum indicators because it provides numerous signals and can be used in different timeframes and for various assets with minor changes in its settings. In this FXOpen guide, you will learn how to calculate the RSI and use it in trading strategies.

What Does Relative Strength Index Mean?

The relative strength index (RSI) is a momentum indicator. It was developed by J. Welles Wilder Jr. It was presented for the first time in 1978 in his book entitled New Concepts in Technical Trading Systems. The indicator was introduced as a tool for identifying overbought and oversold market conditions by measuring the speed and magnitude of recent price changes. Today, traders use it for identifying divergences, buy and sell signals, and trends.

Wilder developed some other popular technical analysis indicators, including the average true range (ATR), the average directional movement index (ADX), and the parabolic stop and reverse (Parabolic SAR).

What Does It Look Like?

The RSI is an oscillator, which means it’s plotted below the price chart, so it doesn’t interact with the price itself. It includes only one line that moves within the 0-100 range.

A common question is, ‘What is RSI in stock charts?’ It’s the same as in commodity, currency pairs, and cryptocurrency* charts. Below you can find examples of the RSI in the chart of Amazon stocks and the EUR/USD pair.

How to Calculate RSI

It’s quite difficult to calculate the RSI. Fortunately, you don’t need to do it manually, as it’s one of the standard indicators implemented in most trading platforms. For instance, you can use TickTrader to examine the RSI without making complicated calculations.

However, it’s worth understanding how the indicator is measured to know which metrics can affect its performance.

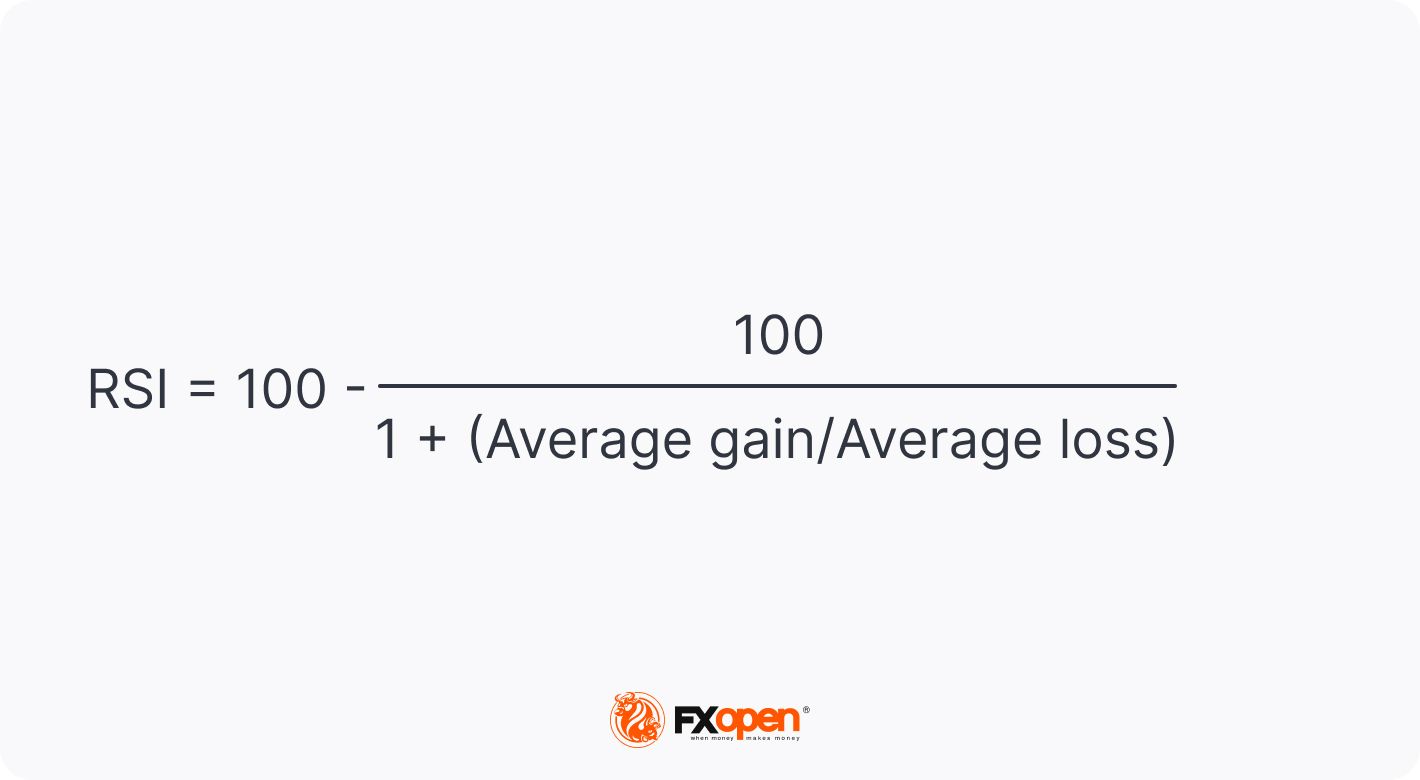

The formula is:

The most popular RSI period is 14, meaning its values are based on closing prices for the latest 14 periods, regardless of the timeframe. We will use this period in example calculations.

Step 1: Average Gain and Average Loss

To calculate average gains and losses, you need to calculate the price change from the previous period.

Note: if the current price is higher than the previous one, you need to add the gain to a total gain variable. If the price declined from the previous period, you need to add the figure to a total loss variable.

After you calculate the change for all 14 periods, you need to add up the gains and divide them by 14 and sum up the losses and divide the total by 14.

Step 2: Calculate the Relative Strength (RS)

RS = Average Gain / Average Loss

To calculate the relative strength, you need to divide the average gain by the average loss.

Step 3: Calculate the RSI

Now that you calculated the RS, you can proceed with the RSI value. For this, you need to add 1 to RS, divide 100 by the sum, and subtract the result from 100.

Relative Strength Index = 100 – 100 / (1 + RS)

How to Interpret the RSI Indicator

Aside from identifying overvalued and undervalued assets, the oscillator helps traders determine trend reversals and corrective pullbacks. Also, you can get buy and sell signals using the RSI indicator.

Relative Strength Index: Overbought/Oversold Conditions

Want to learn how to read the RSI indicator? The common rule is that when the oscillator is below 30, the asset is oversold, so the price is expected to rise soon. Conversely, when the price rises above 70, the asset is overbought, and the price should fall soon. Traders usually buy when the oscillator rises above 30 and sell when it falls below 70.

Still, it’s vital to remember that a cross of a particular level doesn’t actually mean the price will reverse immediately.

On the daily chart of the GBP/USD pair, the RSI entered the oversold area on April 22, left it for a while on May 4, but returned to it and continued moving upwards only on May 15.

Additionally, when using the overbought/oversold signal, traders keep in mind that they can predict an upcoming correction, not a trend reversal. The GBP/USD pair was trading in a strong downtrend, and the RSI provided a signal of a short-term correction only.

To distinguish between corrections and reversals, traders combine the RSI with other tools. A cross of a simple moving average and an exponential moving average can confirm a change in the trend.

On the chart below, the RSI broke above the 30 level on September 28. A trader could go long, using a trailing take-profit order. After the MA/EMA cross occurred (1), a trader could trail the take-profit target. Another option would be to place the take-profit target at the closest resistance level (2) and wait for the cross to confirm the reversal signal. After the confirmation, a trader could open another buy position and drive the uptrend.

Divergence

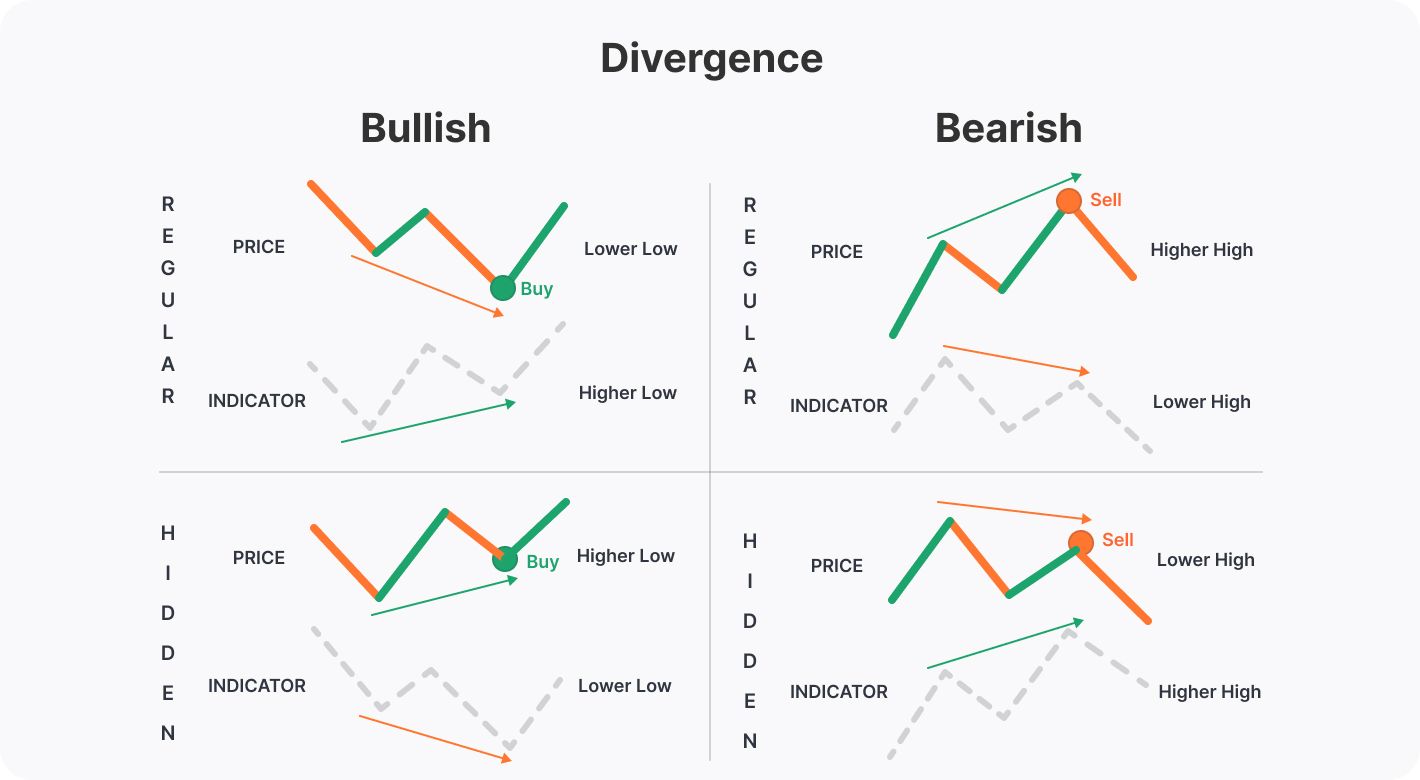

Another option for using the RSI is to look for divergences between the indicator and the price chart. The rules are:

Regular divergences:

- Bullish. When the price moves down, forming a lower low, but the relative strength index moves up with higher lows, the price is expected to rise.

- Bearish. When the price rises, forming higher highs, but the relative strength index moves down with lower highs, the price is expected to decline.

Hidden divergences:

- Bullish. When the price rises with higher lows, but the relative strength index declines with lower lows, traders expect that the price will turn up.

- Bearish. When the price falls with lower highs, but the relative strength index moves upwards with higher highs, traders believe the price will decline.

In the RSI example chart below, the indicator and the price formed a regular bearish divergence. As a result, the price fell (1).

However, there was another divergence before the fall, and the price decline was quick (2). This highlights risks associated with the incorrect signals the RSI divergence may provide. To limit such risks, traders can implement trend strength indicators, for instance, the Average Directional Index, or the tools that show a trend change, for example, moving averages, as in the example above.

Failure Swings

Another signal that traders can consider is failure swings of the RSI which predict a strong trend reversal. Although this is less common than the others, traders can add it to their list of tools.

The theory suggests that traders don’t consider price actions but look at the indicator alone.

- Bullish reversal. A trend may turn bullish when the RSI breaks below 30, leaves the oversold area, falls to 30 but doesn’t cross it and rebounds, continuing to rise.

- Bearish reversal. A trend may reverse down when the RSI enters the overbought area, crosses below 70, and returns to 70 but bounces and continues falling.

In the chart above, the RSI trading indicator broke below 30, left the oversold area, and retested the 30 level (1). At the same time, the price formed the bottom, and the downtrend reversed upwards (2).

Failure swings are more common on short-term timeframes and do not always predict a trend reversal. Therefore, traders combine the RSI with trend and volume indicators.

Trend Identification

The RSI can be used to identify a trend direction. Constance Brown, the author of multiple books about trading, noticed in her book Technical Analysis for the Trading Professional that the RSI indicator doesn’t fluctuate between 0 and 100. In a bullish trend, it moves in the 40-90 range. In a bearish trend, it fluctuates between 10 and 60.

To identify the trend, traders consider support and resistance levels. In an uptrend, the 40-50 zone serves as support. In a downtrend, the 50-60 range acts as resistance.

In the chart above, the RSI stayed above 40 as the price was moving in a solid uptrend. Once it broke below the 40-50 support level (1), the trend changed (2).

However, there may be incorrect signals. In the chart below, the RSI broke below the support level twice, but the trend didn’t change.

Ranges may vary depending on the strength of a trend, price volatility, and the period of the RSI.

RSI and Simple Moving Average

Usually, the RSI indicator consists of a single line. However, there are variations of the indicator. It can be combined with the simple moving average. The moving average usually has the same period as the RSI.

The rule is: when the RSI breaks below the SMA, the price is supposed to fall (1). When the RSI rises above the SMA, the price is expected to increase (2).

However, there are some aspects to consider. Firstly, traders avoid using RSI/SMA cross signals in the ranging market as the lines move close to each other and cross all the time, providing many fake signals. Secondly, a cross doesn’t determine the period of a rise or a fall. Traders use additional tools to identify where the price may turn around.

How to Use the Relative Strength Index with Other Indicators

Traders can develop their own strategies and decide what combinations of indicators work best for them. However, there are some standard recommendations you may want to refer to.

RSI and MACD

RSI and MACD (moving average convergence divergence) are oscillators. However, they measure momentum differently, which allows one to confirm the signals of another. Usually, traders look for RSI overbought/oversold signals and MACD divergence. For instance, when the RSI is in the oversold zone but the MACD has a bullish divergence with the price chart, traders consider this a confirmation of a coming price rise.

RSI and Moving Averages

Early signals are one of the limitations of the RSI indicator. Therefore, traders often combine them with lagging technical analysis tools. Exponential moving averages (EMAs) are one of the options. Traders add two EMAs with different periods to the chart and wait for a cross to confirm the trend reversal signal the RSI provided.

RSI: Benefits

The relative strength index is a useful tool because it provides:

- Numerous signals. The RSI provides different signals so traders with different trading approaches can add it to their tool list.

- Numerous assets and timeframes. One of its advantages is that you can use RSI in any timeframe of any asset. What does RSI stand for in stocks? The same thing that it stands for in forex, commodity, and cryptocurrency* markets.

- Simplicity. Despite the wide range of signals, it’s easy to remember them. If you are familiar with other oscillators, for instance, the Stochastic oscillator, you will quickly learn how to use the RSI.

- Standard settings. Although you can change the period of the RSI, its standard period of 14 will be effective for many trading strategies.

- Working signals. The RSI is one of the most popular trading tools as its signals are reliable. However, the reliability depends on trader skills and market conditions.

RSI: Limitations

Although the RSI is a functional tool, there are some pitfalls that traders should consider to increase its effectiveness.

- Weak at trend reversals. The indicator may provide early signals when spotting trend reversal.

- False signals. The relative strength index isn’t very effective in ranging markets, so it can provide false signals.

Final Thoughts

The relative strength index is a popular technical analysis tool. It can be effective for traders with any level of experience and any trading approach. However, it will take time to adjust it to your trading strategy before it really works. You can use the TickTrader platform for free to test the indicator. When you are confident, you can open an FXOpen account to enter the live market.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.