FXOpen

The OPEC+ meeting was held this week. CNBC reports the words of its head, Haitham al-Ghais, here’s a brief summary:

→ the organization (which currently consists of 13 countries) is looking for new members;

→ the macroeconomic situation is unclear due to the banking crisis, high inflation, the possibility of a recession and new outbreaks of COVID;

→ nevertheless, the organization is positive about the demand for oil in the second half of 2023.

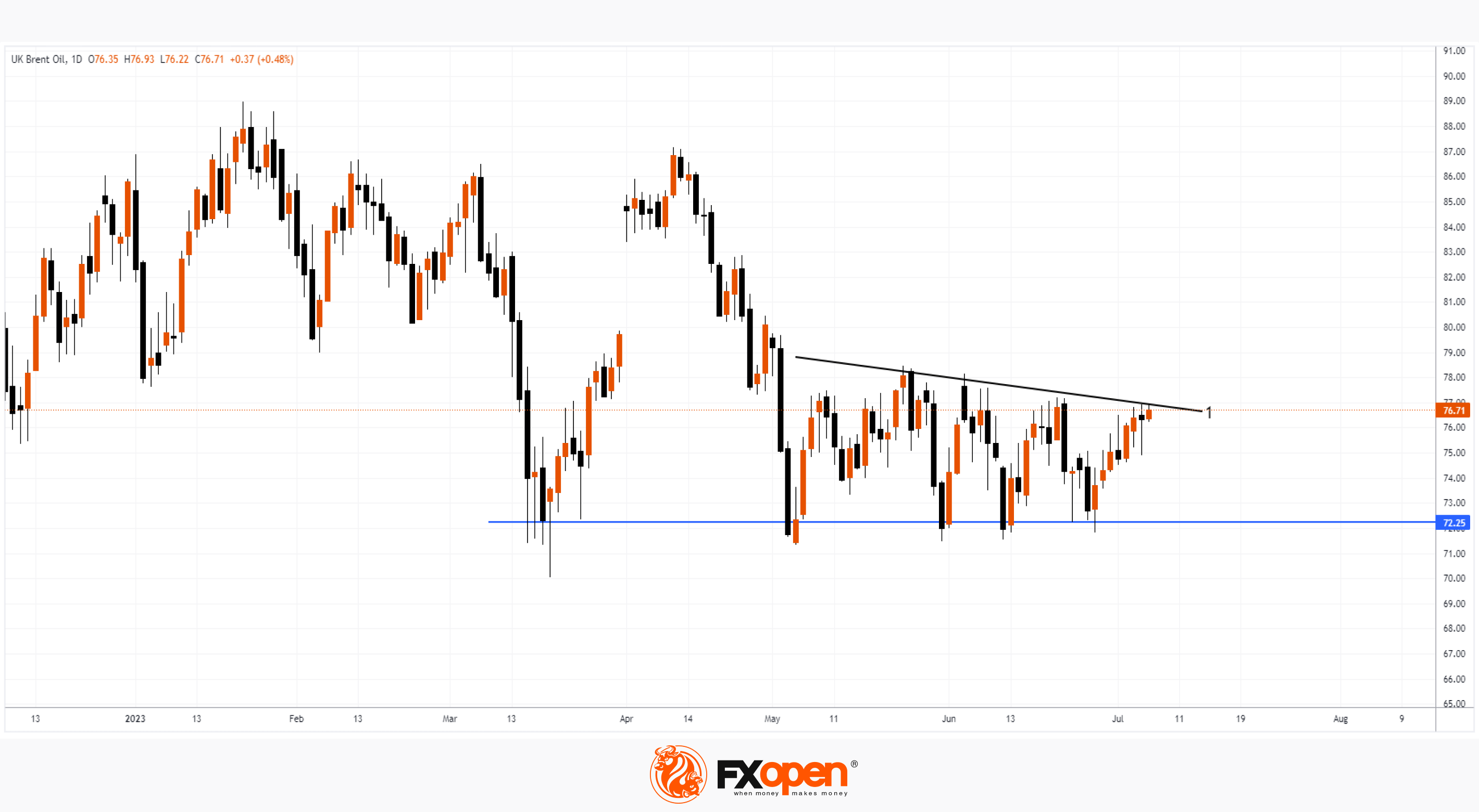

Judging by the fact that no sharp statements were made, OPEC members are satisfied with the current situation. The oil price chart shows that the level of 72.25 in June confirmed its support for the market. It may be based on the decisions of OPEC to reduce production volumes when prices fall to these levels.

It can be stated that the market has been in the consolidation stage for 2 months already. But with strong support from OPEC, the bulls may try to break through the current resistance level (1).

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.