FXOpen

The diamond chart pattern is a technical analysis tool used by traders in different financial markets for breakout trading. The diamond pattern can provide valuable insights into potential price movements and trend reversals. However, it can be challenging to find it in a price chart. In this FXOpen article, we will tell you how to spot the diamond pattern and build a trading strategy on it.

Overview of the Diamond Pattern

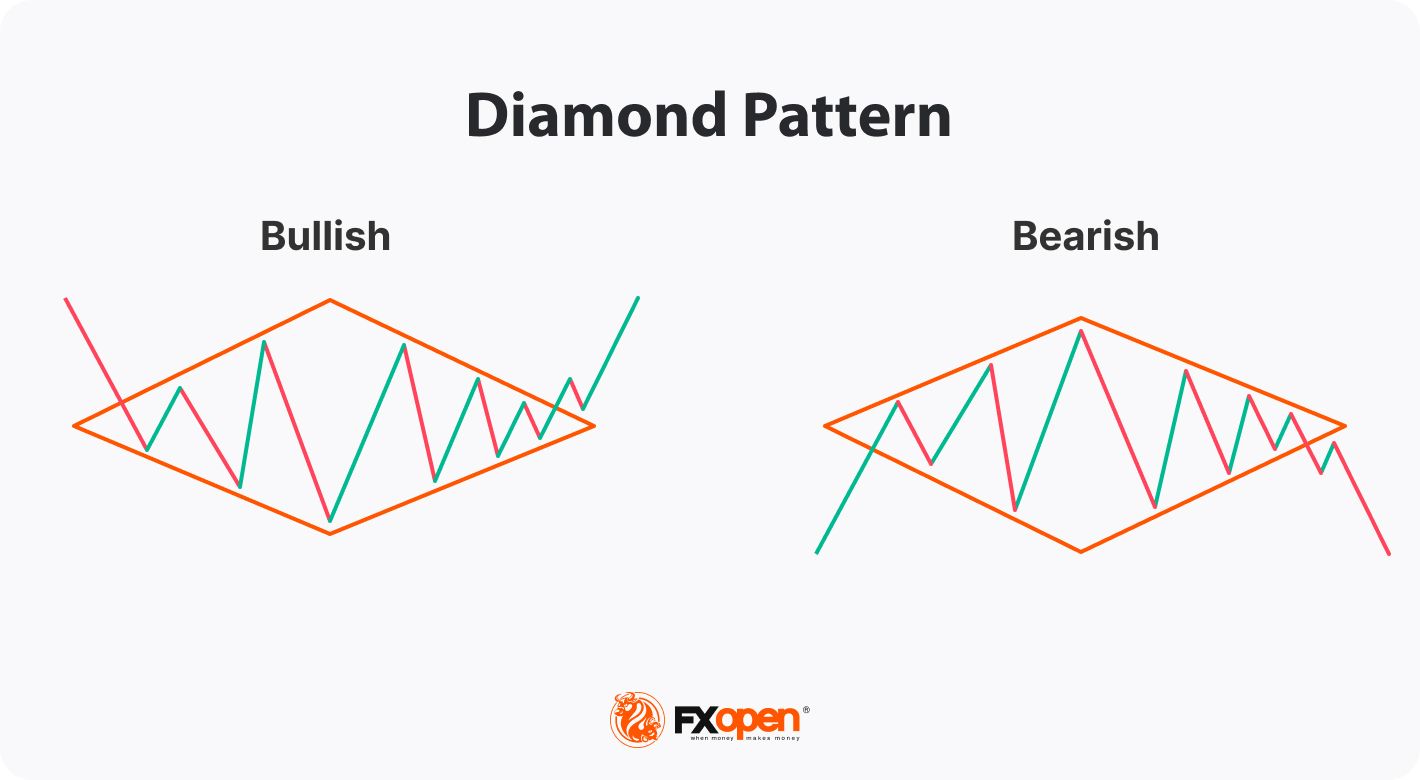

The diamond is a reversal pattern, meaning it can signal a potential trend change in the market. It typically occurs after an extended trend and indicates a period of consolidation before a potential breakout in the opposite direction.

The diamond pattern can be either bearish or bullish, and it is also known as the diamond top pattern and diamond bottom pattern for trading. A bearish formation typically occurs during an uptrend and signals a potential reversal to a downtrend, while a bullish diamond pattern in trading forms during a downtrend and signals a potential reversal to an uptrend.

The diamond pattern is characterised by a series of higher highs and lower lows, which are then turned into lower highs and higher lows, regardless of the trend direction. This formation indicates that buyers and sellers are in a state of equilibrium, with neither of them able to gain control of the price. The breakout from the diamond formation is typically expected to occur in the opposite direction to the prevailing trend; that is, down after an uptrend and up after a downtrend.

How to Trade the Diamond Pattern

Like most chart patterns, this formation has particular rules traders can use to build their own trading strategies. These rules can be applied to the diamond pattern in forex, stock, commodity, and cryptocurrency* markets.

Entry

The diamond pattern is typically followed by a breakout, which is a significant price movement outside it. The breakout can occur in either direction, indicating a potential trend reversal. If the breakout occurs above the upper trendline after a downtrend, it signals a bullish reversal. On the other hand, in the bearish diamond pattern, the breakout occurs below the lower trendline, which signals a bearish reversal.

The breakout should be accompanied by an increase in trading volume, which adds further confirmation to its validity. Low trading volumes usually signal a false breakout, whereby the price returns to its previous trend after a breakout. False breakouts can be caused by market volatility, news events, or other factors that disrupt its validity.

Traders may also use multiple timeframe analyses for confirmation. For example, if a diamond is forming on the hourly chart, traders may look at higher timeframes, such as the 4-hour or daily chart, to confirm the breakout direction. If the breakout aligns with the trend on multiple time frames, it may provide a stronger trading signal.

Target

Once the breakout occurs, traders can use the diamond to project a potential price target. To do this, they can measure the vertical distance between the widest part of the formation (the distance between the highest high and the lowest low) and add that distance to the breakout point in the bullish formation and subtract this distance in the bearish formation.

Special Consideration

Although the diamond is primarily considered a reversal formation, it can also indicate the continuation of an existing trend. Traders can see it appearing within the context of a strong trend and interpret it as a pause before it resumes.

In the case of a diamond continuation pattern, traders will go short on the breakout of the lower trendline of the diamond formation in a downtrend and go long on the breakout of the upper trendline in an uptrend. Still, the profit target will be calculated similarly to the reversal formation.

Diamond and Head and Shoulders Patterns

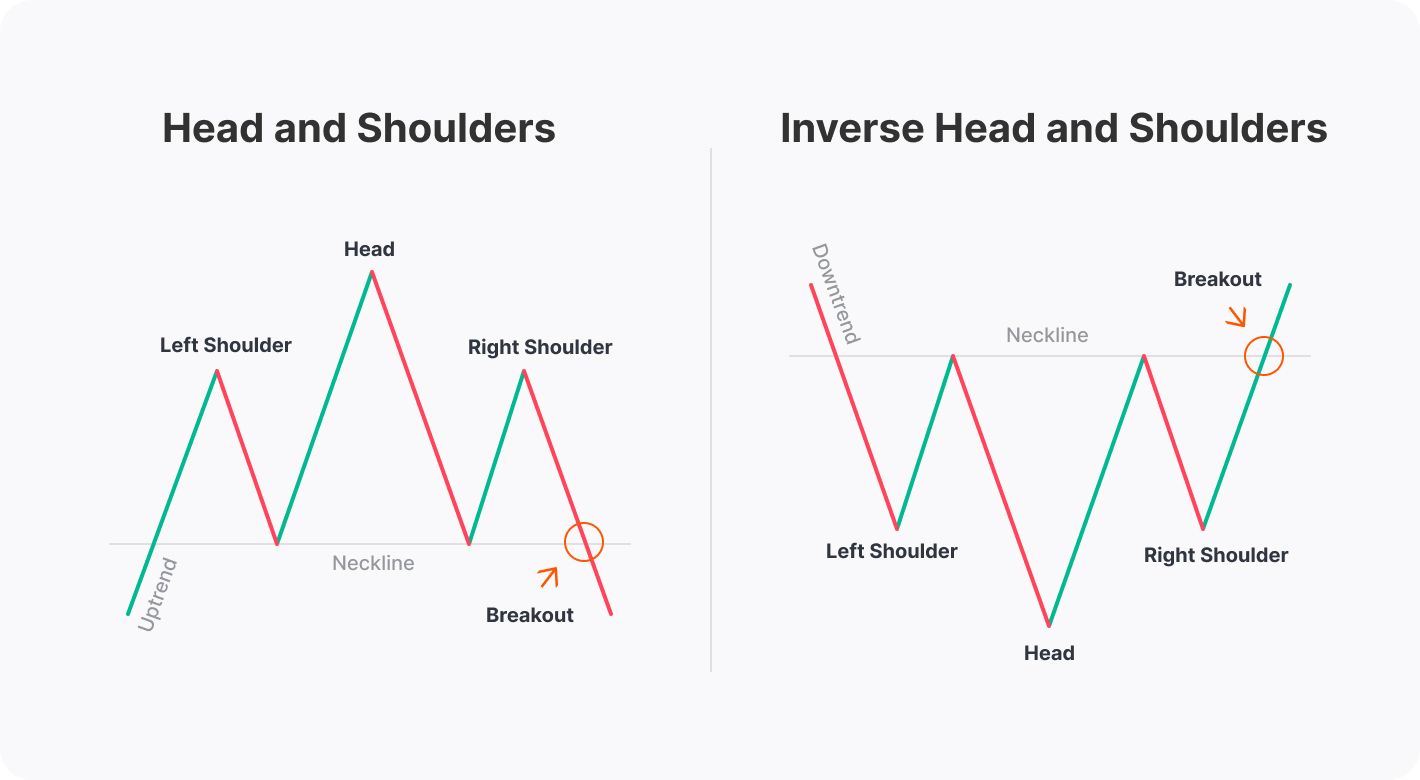

The diamond formation is commonly compared to the head and shoulders setup. However, they have different trading rules; therefore, it’s vital to learn how to distinguish between them.

The head and shoulders formation consists of three peaks, with the middle peak (the head) being higher than the other two peaks (the shoulders) and is formed at the end of an uptrend. The inverse head and shoulders pattern consists of three troughs, with the middle one being lower (head) than the other two troughs, and it appears at the end of a downtrend. On the other hand, the diamond is characterised by a series of higher highs and lower lows which turn into lower highs and higher lows.

When trading the (inverse) head and shoulders pattern, traders measure the distance between the head and the neckline (the line drawn through troughs in the head and shoulders and through peaks in the inverse head and shoulders) and add it to the breakout point.

How to Trade with the Diamond Pattern

This formation can be used in various trading strategies. Here are some common approaches that traders can utilise.

Breakout Trading

One of the most straightforward strategies is to trade breakouts. Traders can wait for the price to break above the upper trendline in a diamond bottom trading pattern or below the lower trendline in a diamond top trading pattern and then enter the market in the breakout direction. Traders usually place a stop-loss order below the lower line in a bullish formation or above the upper line in a bearish formation or consider the risk-reward ratio. A trader can consider a trailing stop-loss option. If they trade in a solid trend, a take-profit target can be trailed the same as the stop-loss point.

In the chart above, the price formed a bullish diamond after a prolonged downtrend. The price broke above the upper line (1). However, it couldn’t stay there and later returned to the pattern. The volumes on the breakout increased significantly, so a trader could have expected bulls to try again. If a trader had placed a stop-loss level below the lower line, the price return wouldn’t have affected the trade (2). The price broke above the upper line again and continued rising. A trader could have measured the distance between the highest and the lowest points and added this to the breakout point (3). The bullish trend was strong, so a trader could have trailed that take-profit target.

Retracement and Reversal Trading

Another strategy is to look for price retracements after the breakout. Traders can wait for the price to retest the broken trendline after the breakout and then enter a trade in that direction. A profit target will also be calculated based on the distance between the highest and the lowest points. The distance should be added to the breakout point in the bullish formation or subtracted from the breakout point in a bearish formation. A stop-loss order will be placed below the retracement level in the bullish pattern and above the retracement level in the bearish pattern. In this approach, traders usually use a limit order. Trailing stop-loss and take-profit orders can be applied to this approach too.

In the chart above, the price formed a diamond bottom pattern. It broke above the formation's upper line, but it retested the pattern later (1). A trader could have placed a buy limit order at the upper line. A stop-loss could have been placed below the lower line (2), while a take-profit target could have equalled the distance between the highest and the lowest points of the formation (3).

This strategy can be effective in catching potential trend reversals with better entry points and an improved risk-reward ratio. However, there is a risk of a missing trade as the price may keep moving in a breakout direction without a retracement.

Limitations of the Diamond Pattern

While the diamond can be a valuable tool, it is not without limitations.

- Low frequency. It is a reliable but rare pattern. It can be spotted on various timeframes of different assets – for instance; you can find the diamond pattern in the stock, forex, commodity, and cryptocurrency* markets. However, it’s not very common. This limitation negatively affects the ability of traders to practise frequently to improve their skills for trading it successfully. To avoid mistakes due to a lack of experience, you can use TickTrader, a free trading platform with numerous technical analysis tools and assets.

- False breakouts. As with any chart pattern, false breakouts can occur after the diamond. Sometimes, the price may break the trendline only to reverse back within the formation. Traders should be cautious and wait for confirmation with increased trading volume and follow-up price action before entering a trade.

- Subjectivity. Like other chart patterns, it requires subjective judgement in its identification. Traders may interpret it differently, leading to variations in the placement of trendlines and potential breakout points. This subjectivity can sometimes lead to false signals or confusion, and traders should be mindful of this and use other technical indicators or tools for confirmation.

- Lack of precision in price targets. While the diamond provides a projected price target based on the vertical distance between the highest and the lowest points, it is not always precise. The price may not reach the projected target, and the actual price movement may deviate from the projected target due to various factors such as market volatility, liquidity, and news events. Therefore, traders should use the projected price target as a rough guideline and consider other factors in their trade management.

- Market conditions. The effectiveness of the pattern can vary depending on the market conditions. In ranging or choppy markets, the formation may not be as reliable as in trending markets. Traders should consider the overall market context and use the diamond in conjunction with other technical tools or indicators for better accuracy.

Final Thoughts

The diamond pattern is a popular technical analysis tool used in trading to identify potential trend reversals. You can spot the diamond pattern in crypto*, stock, currency, and commodity charts. However, like any other trading tool, this formation has pitfalls, and traders should be aware of them before entering the live market. Proper risk management, multiple timeframe analysis, and consideration of other market factors are crucial when using it. Once you feel confident enough to trade with the diamond formation, you can open an FXOpen account and open live trades.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.