FXOpen

As the chart shows, the day before yesterday, a barrel of WTI cost USD 87.87, but this morning, the price exceeded the level of USD 93. That is, the growth was more than 6% in just 2 days.

The main driver of such growth remains the voluntary reduction in oil production by OPEC+ countries. Added to this was the market's reaction to yesterday's news about the reduction in oil reserves in the United States (expected = -0.7 million barrels, actual = -2.2 million). Inventories are approaching historical lows, according to Reuters. Probably, the US authorities, by releasing oil from storage, are trying to reduce the impact of its high price on inflation, but the graph shows that these efforts are unlikely to give the desired result.

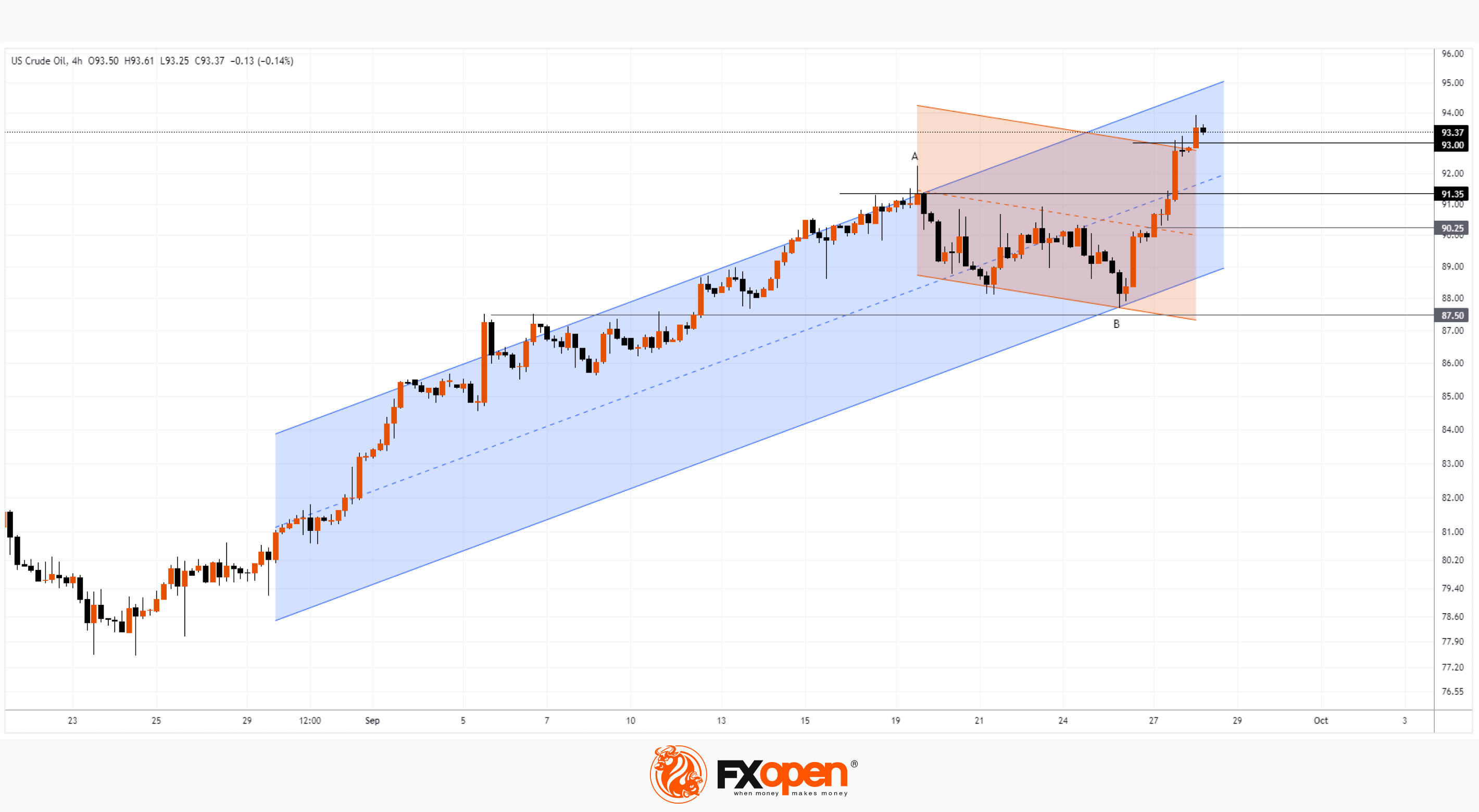

The A→B decline in oil prices observed since September 19 was merely a correction (shown in red) within a longer-term uptrend (shown in blue). Wherein:

→ the price sharply pushed off from the lower border of the blue channel around 87.5 - we wrote about this scenario earlier;

→ after a short respite, it broke through the median line of the red channel at around 90.25;

→ confidently overcame the level of 91.35, where growth clearly slowed down 10 days ago when approaching point A;

→ exceeded the upper limit of the red channel.

Now it is important for the bulls to gain a foothold at the achieved highs around USD 93. But if the upward impulse has not exhausted itself, then we may witness continued growth towards the upper border of the blue channel.

On the other hand: overbought market, the desire to lock in profits from long positions before the weekend, a possible reaction at the level of statements from the US authorities — all these can become factors contributing to the formation of a correction (for example, to the median line of the blue channel).

Start trading commodity CFDs with tight spreads. Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.