FXOpen

American dollar quotes continue their local correction, the US dollar index is trading at 103.400 against the backdrop of weak statistics on the real estate market: sales volumes on the secondary housing market in October decreased by 4.1% after -2.2% in the previous month, from 3.95 million to 3.79 million, below preliminary estimates of 3.90 million. Investors hardly reacted to the published minutes of the US Federal Reserve meeting. Members of the Open Market Committee noted that they expect the value to remain at a high level for quite a long time. In addition, the regulator does not exclude the possibility of further tightening of monetary conditions if the rate of decline in inflation continues to slow down. Macroeconomic statistics published the day before put moderate pressure on the position of the American currency.

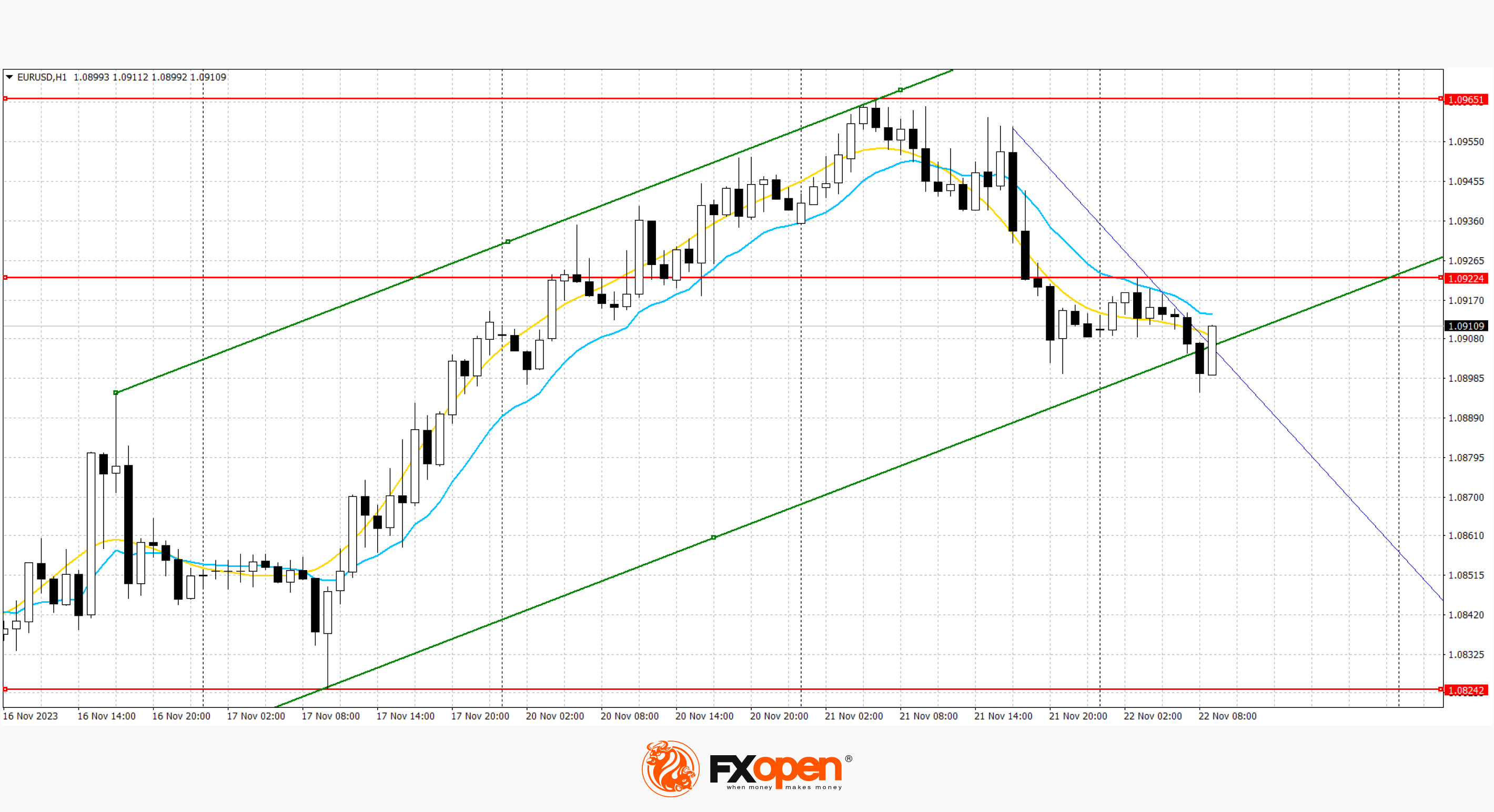

EUR/USD

According to the EUR/USD technical analysis, the EUR/USD pair is showing mixed trading, consolidating near the 1.0900 mark, awaiting the emergence of new drivers in the market. The immediate resistance can be seen at 1.0985, a breakout to the upside could trigger a rise towards 1.1000. On the downside, immediate support is seen at 1.0900, a break below could take the pair towards 1.0883.

The day before, the pair managed to move away from the new local highs of August 11, forming a new impulse for the development of a full-fledged corrective trend in the nearest time intervals. The day before, ECB head Christine Lagarde made a speech, warning against prematurely declaring victory over high inflation. According to her, the department will closely monitor the situation until the consumer price index decreases to the target of 2.0%, which it is projected to reach in 2025. At the same time, Lagarde also pointed to the rather tense situation in the labour market, where there is still a noticeable increase in wages. Earlier this week, the head of the Bank of France and ECB member François Villeroy de Galhau said that interest rates in the eurozone had reached a plateau, where they were likely to remain for several more quarters while officials assessed the effect of measures already taken.

At the highs of the week, a new ascending channel has formed. Now, the price is near the lower border of the channel and may continue to decline if it breaks through.

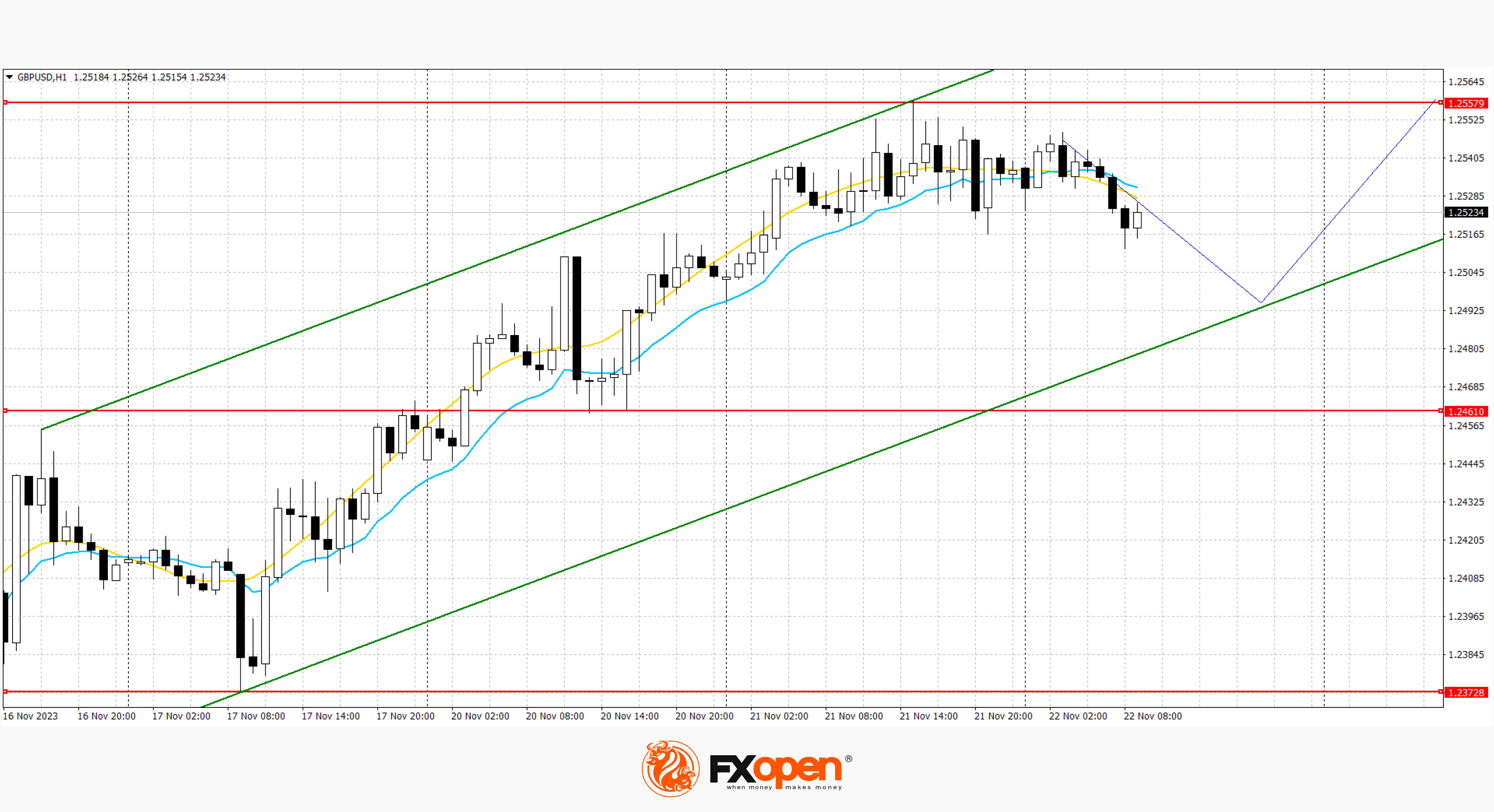

GBP/USD

Against the backdrop of stabilisation of the American currency rate, on the GBP/USD chart, the pair is adjusted at the level of 1.2534. The nearest resistance can be seen at 1.2554, a breakout to the upside could trigger a rise to 1.2597. On the downside, immediate support is seen at 1.2495, a break below could take the pair towards 1.2464.

Yesterday, Bank of England Governor Andrew Bailey said that investors are placing too much emphasis on macroeconomic data that points to a decline in headline inflation, but as long as the figure is above 2.0%, its dynamics should not be viewed as positive. According to the official, price growth in the country is steady and it will take several years to reach the target level. According to the latest publications, the annual consumer price index fell last month from 6.7% to 4.6%, the lowest since October 2021, but the regulator does not rule out the possibility of additional adjustments to borrowing costs. On the other hand, labour productivity fell 0.2% in November and vehicle registrations fell 43.7% in October, slowing overall annual growth from 21.0% to 14.3%. Data on the volume of government borrowing was positive: from April to October the figure amounted to 98.3 billion pounds, 22.0 billion pounds more than in the same period last year, but almost 17.0 billion pounds below the forecasts of experts from the Office for Budget Responsibility Great Britain (OBR).

At the highs of the week, a new ascending channel has formed. Now, the price is in the middle of the channel and may continue to rise after approaching the lower border.

USD/JPY

The USD/JPY pair is consolidating around the 148.50 level. Strong resistance can be seen at 148.80, a break upward could trigger a rise to 149.60. On the upside, immediate support is seen at 148.20, a break below could take the pair towards 147.15.

In the absence of significant economic releases, the movement of the yen is determined by external factors. It is only worth noting that investors expect a significant divergence between the monetary rates of the Bank of Japan and regulators of other developed economies: according to forecasts, next year Japanese officials will finally switch to hawkish rhetoric, while the US Federal Reserve, the ECB and the Bank of England have already begun maintaining interest rates at current levels and considering starting a cycle of reduction in the future. This situation leads to a strengthening of the yen's position relative to competing assets and is likely to support it in the medium term.

The downward channel is maintained. Now, the price has approached the upper border of the channel, from where it can continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.