FXOpen

European currencies opened the week under pressure after last week’s upward momentum failed to extend further. EUR/USD and GBP/USD had been strengthening for several consecutive days, supported by soft US inflation data, which reduced expectations of a more aggressive Federal Reserve stance. However, both pairs encountered significant resistance zones and were unable to break through them, prompting profit-taking and a move lower.

Market attention is now firmly on upcoming macroeconomic releases from Europe and the UK. For the euro, key indicators will include business activity data, German consumer inflation figures, and industry sentiment surveys. Persistently weak inflation or further deterioration in economic indicators could place additional short-term pressure on the single currency.

The pound also remains sensitive to the data due out this week, with traders watching UK PMIs and retail sales reports. Despite last week’s corrective rebound, GBP/USD failed to establish itself above key resistance levels, signalling investor caution ahead of major publications.

EUR/USD

The EUR/USD pair has been trading within a narrow range of 1.1490–1.1650 for more than four weeks. Yesterday, the upper boundary of this corridor was tested, but the attempt to break higher proved unsuccessful. If buyers manage to keep the price above 1.1600 in upcoming sessions, another move towards 1.1650 is possible. Otherwise, a renewed downward impulse towards 1.1490–1.1470 cannot be ruled out.

Key events for EUR/USD:

- 11:00 (GMT+3): Spain Unemployment Change

- 13:00 (GMT+3): Eurozone CPI

- 13:00 (GMT+3): Eurozone Unemployment Rate

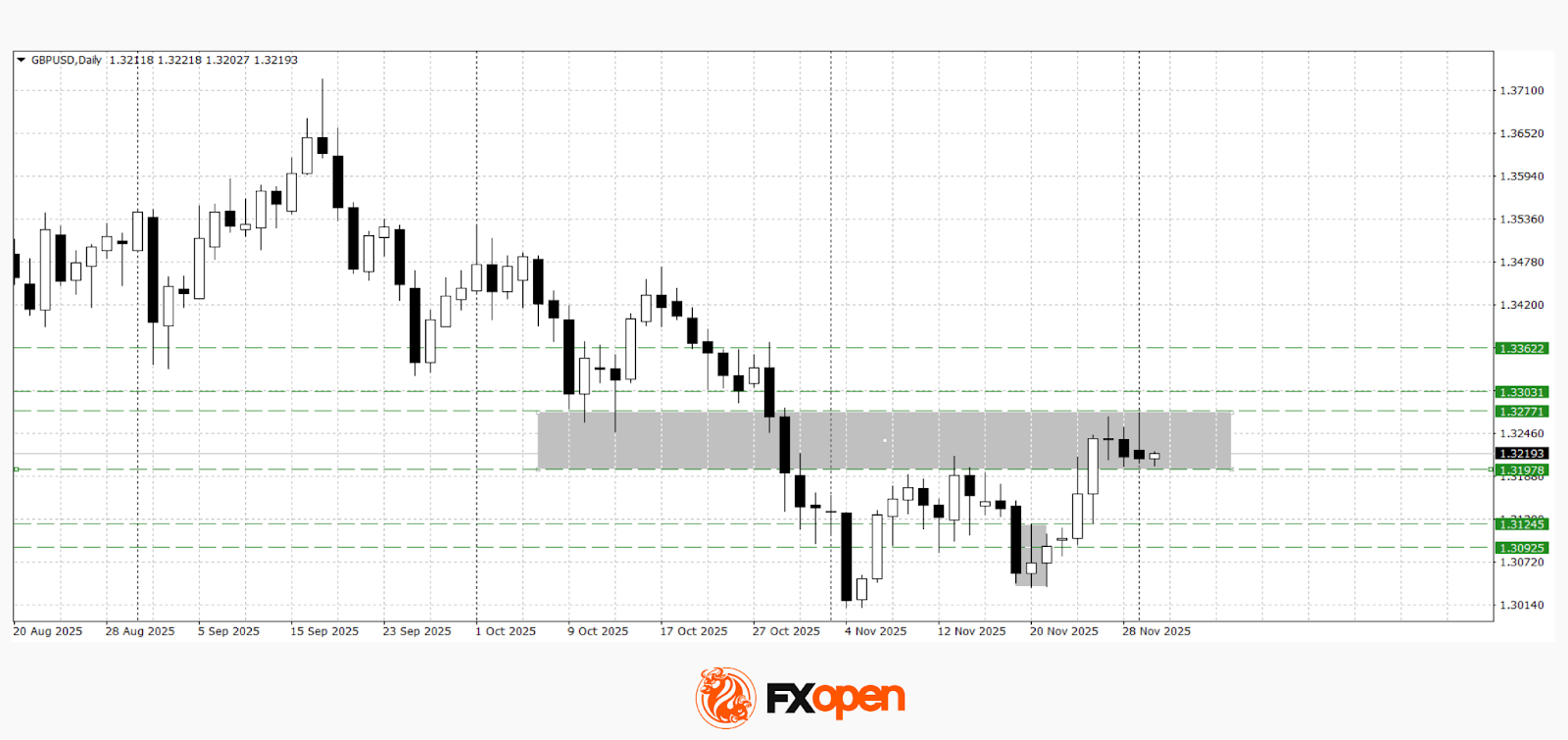

GBP/USD

A test of the 1.3040 support level last week resulted in a bullish reversal pattern — a “piercing line” candle — indicating fading selling pressure. However, the rise stalled around 1.3270, and current price action suggests the likelihood of continued range-bound trading between 1.3200 and 1.3270. A break lower could push the pair towards 1.3090–1.3130, whereas a break above 1.3270 would open the path for a deeper upward correction.

Key events for GBP/USD:

- 10:00 (GMT+3): Bank of England Financial Stability Report

- 10:00 (GMT+3): UK Nationwide House Price Index

- 18:00 (GMT+3): US JOLTS Job Openings

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.