FXOpen

The publication of data on the basic consumer price index in the United States contributed to sharp fluctuations in the foreign exchange market. Thus, the EUR/USD currency pair retested the important level of 1.0900, buyers of the GBP/USD pair did not hold 1.2800 as support, and the USD/JPY pair was sandwiched between 148.00 and 147.00. At the same time, commodity currencies reacted more calmly to US inflation data and continue to trade in rather narrow flat corridors.

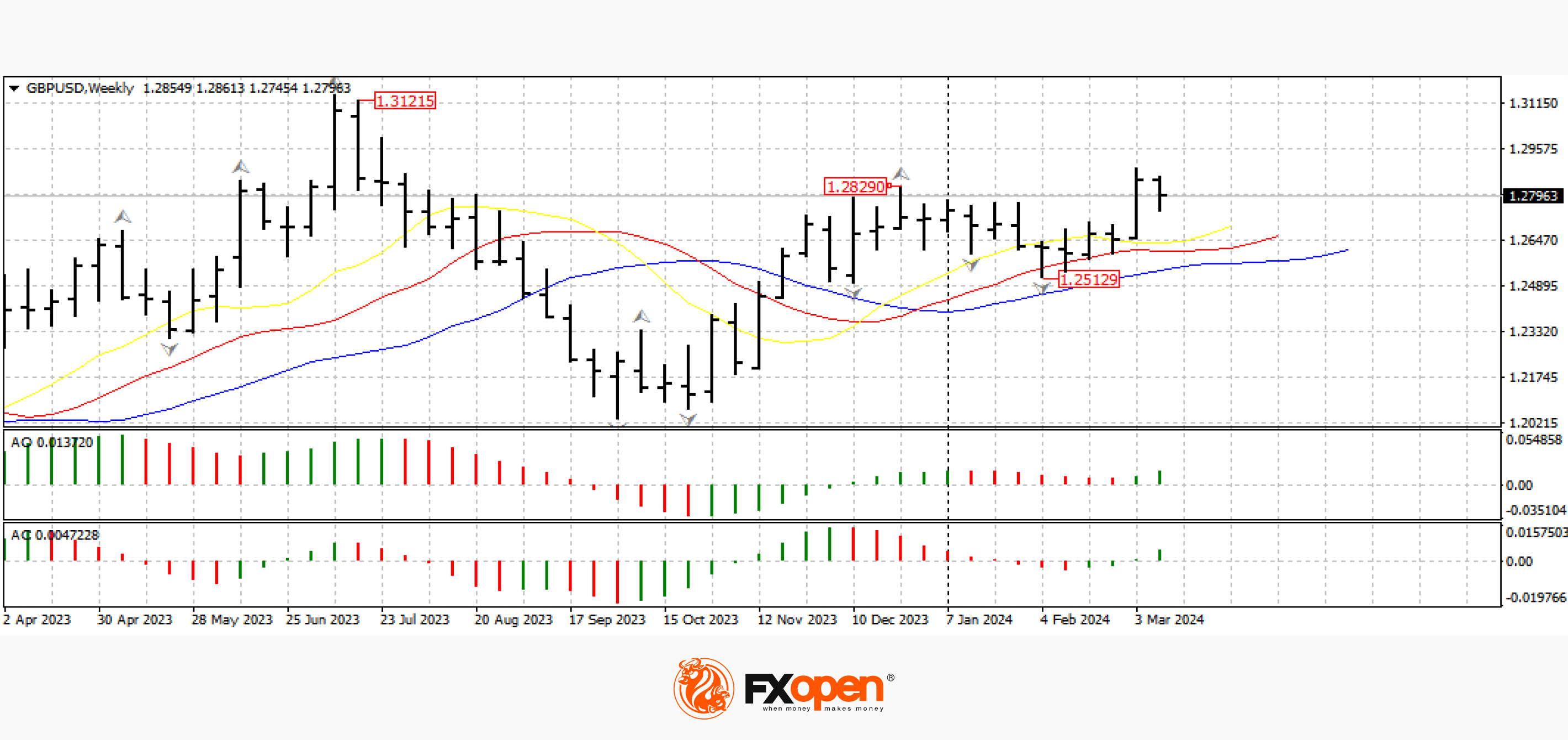

GBP/USD

Weak data on industrial production in the UK for January and an increase in the unemployment rate to 3.9% against the forecast of 3.8% did not allow buyers of the pound/dollar pair to develop a full-fledged upward trend. If on the GBP/USD chart the range of 1.2820-1.2800 retains its support status, the price may continue to rise in the direction of 1.3100-1.3000. Cancellation of the upward scenario can be considered when moving below the alligator lines on higher time frames.

From the point of view of fundamental analysis, today at 15:30 GMT+3, it is worth paying attention to the publication of data on the producer price index (PPI) in the US for February. Also at the same time, the core retail sales index for the same period will be published.

EUR/USD

Despite rising inflation in the United States, which casts doubt on whether the American regulator will cut rates in the near future, the EUR/USD pair managed to stay above the important support level of 1.0900. Technical analysis of EUR/USD shows that intensive development of the upward trend has not yet been observed, but if buyers of the pair manage to gain a foothold above the psychological level of 1.1000, the price may continue to rise in the direction of 1.1200-1.1100.

Today at 11:00 GMT+3, it is worth paying attention to the publication of data on the core Spanish CPI for February. Also at 14:00 GMT+3, it is worth paying attention to the speech of the representative of the European Central Bank, Isabel Schnabel.

USD/CAD

At the beginning of the current five-day period, buyers of the dollar/loonie pair made another attempt to strengthen above 1.3500. But, as we can see, it was not possible to resume growth and the price returned below the alligator lines on the daily time frame. With the appropriate fundamental driver, the price on the USD/CAD chart may update the recent low at 1.3419.

Today at 15:30 GMT+3, we are waiting for data on sales volumes in the Canadian manufacturing sector for January.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.