FXOpen

Problems in the Chinese economy and the unexpected decision of the People's Bank of China to cut the base interest rate put pressure on commodity currencies, as China is one of the main trading partners of Australia, Canada, and New Zealand. However, this week, we can observe a slowdown in the downward movement in USD/CAD, AUD/USD, and NZD/USD, which signals a possible start of corrective rollbacks.

AUD/USD

The AUD/USD currency pair found support just above 0.6300 last week and is currently trying to strengthen above 0.6400. There are no confirmed reversal combinations for bullish movements on higher time frames yet; the nearest area for an upward rollback is the range of 0.6500-0.6600. If bulls fail to strengthen above these marks, the resumption of the downward movement in the direction of 0.6300-0.6200 may occur.

As for fundamental analysis, today at 15:00 GMT+3, we are waiting for data on the number of building permits issued in the US in July; at 16:45 GMT+3, there will be data on the business activity index (PMI) in the service sector for August.

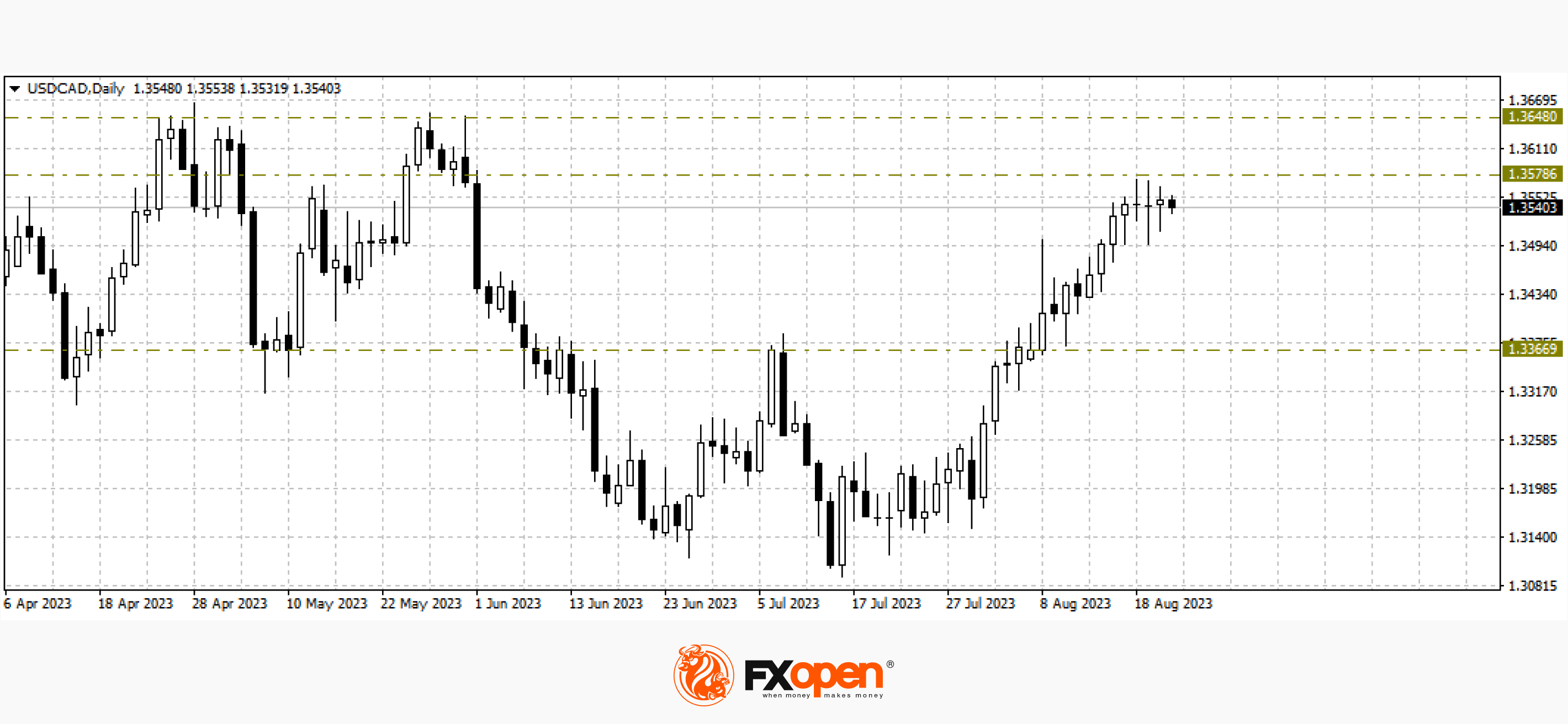

USD/CAD

The resistance at 1.3600 turned out to be unbearable for greenback buyers. The price is consolidating for the fifth day near the range of 1.3500-1.3570. If the upper limit is not broken in the coming trading sessions, there might be a larger downward correction in the direction of 1.3400-1.3300.

Today at 15:30 GMT+3, we are waiting for important data from Canada. In particular, the Retail Sales data for June. A little later, weekly data on crude oil inventories in the US will be released.

EUR/USD

In the euro/US dollar pair, the price yesterday updated a recent low and is heading towards 1.0800. If this support is broken, the decline could extend to 1.0600-1.0500. At 17:00 GMT+3, the consumer confidence index for August will be published.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.