FXOpen

The beginning of the current five-day period turned out to be rather sluggish for the major currency pairs. The US employment report published last week was ambiguously received by market participants. The dollar first fell and then sharply strengthened. However, yesterday, there was no continuation of the uptrend for the greenback; most likely, the passivity of investors was associated with the weekend in the US and Canada. A lot of important foundation is expected in the coming trading session; one should be prepared for a possible surge in volatility.

GBP/USD

The British currency failed to strengthen above the alligator lines on the daily timeframe last week, thus failing another reversal attempt. The rebound from 1.2750 led to losses of more than 150 pp. Last week, the pair traded below 1.2600. Yesterday, the buyers managed to correct the price - 1.2640, but since no strong reversal combinations have been formed, GBP/USD will most likely continue to decline towards the lower fractals at 1.2570-1.2540. If this range turns into resistance, there may be a new downward momentum towards 1.2400-1.2200. Cancellation of the downward scenario may be considered only after the price stays above 1.2750.

Today at 11:30 GMT+3, we are waiting for data on the composite index of business activity (PMI) of the UK for August; also, at this time, the index of business activity in the services sector will be released.

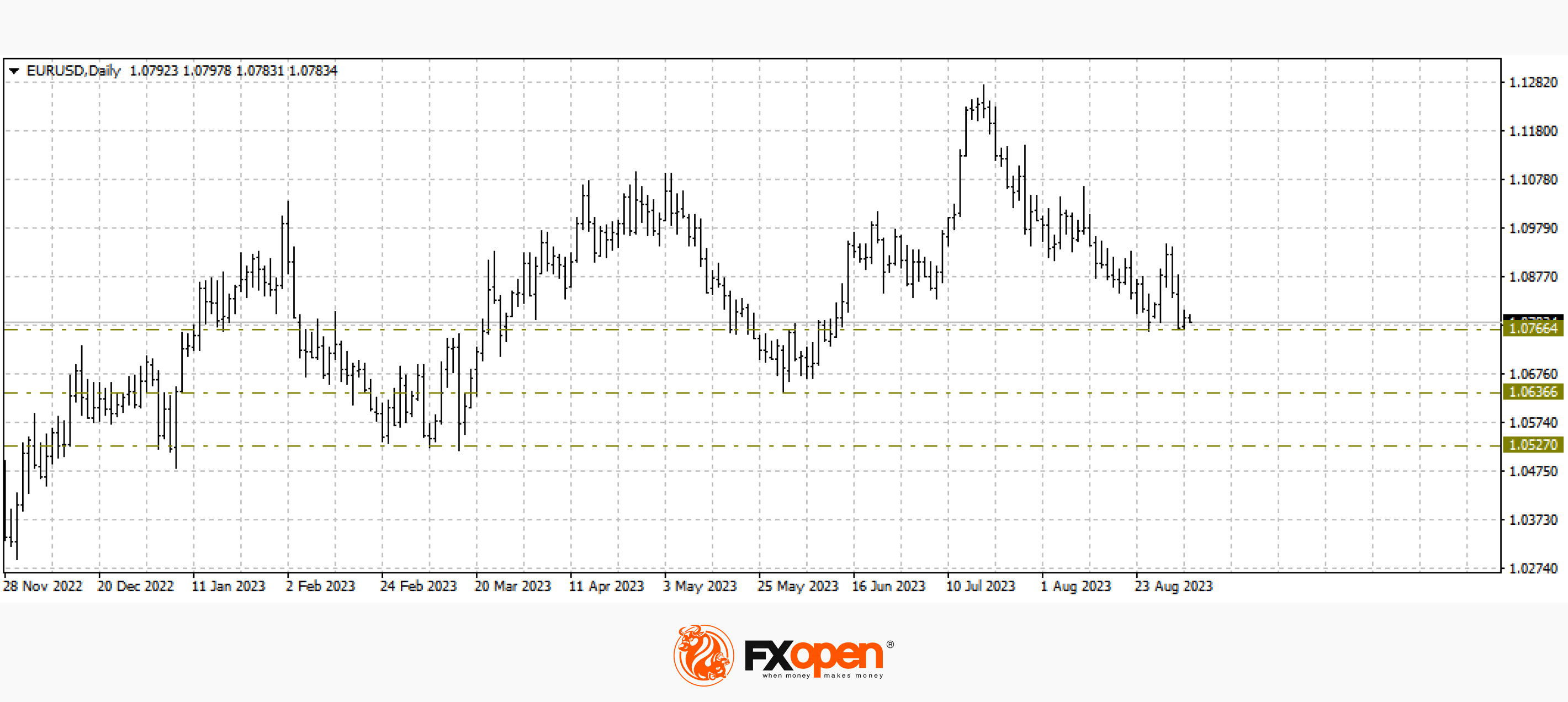

EUR/USD

We can also see the breakdown of the ascending combination in the EUR/USD pair. Buyers of the single European currency failed to stay above 1.0900, and at the moment, the price is trading below 1.0800. If there are no fundamental prerequisites for a reversal in the coming trading sessions, the pair's decline may intensify. The nearest supports are located at 1.0600-1.0500, and their breakdown may bring the price back to parity.

Today, it is worth paying attention to the publication of data on the index of business activity in the eurozone services sector for August. ECB President Christine Lagarde and ECB representative Isabel Schnabel are also scheduled to speak.

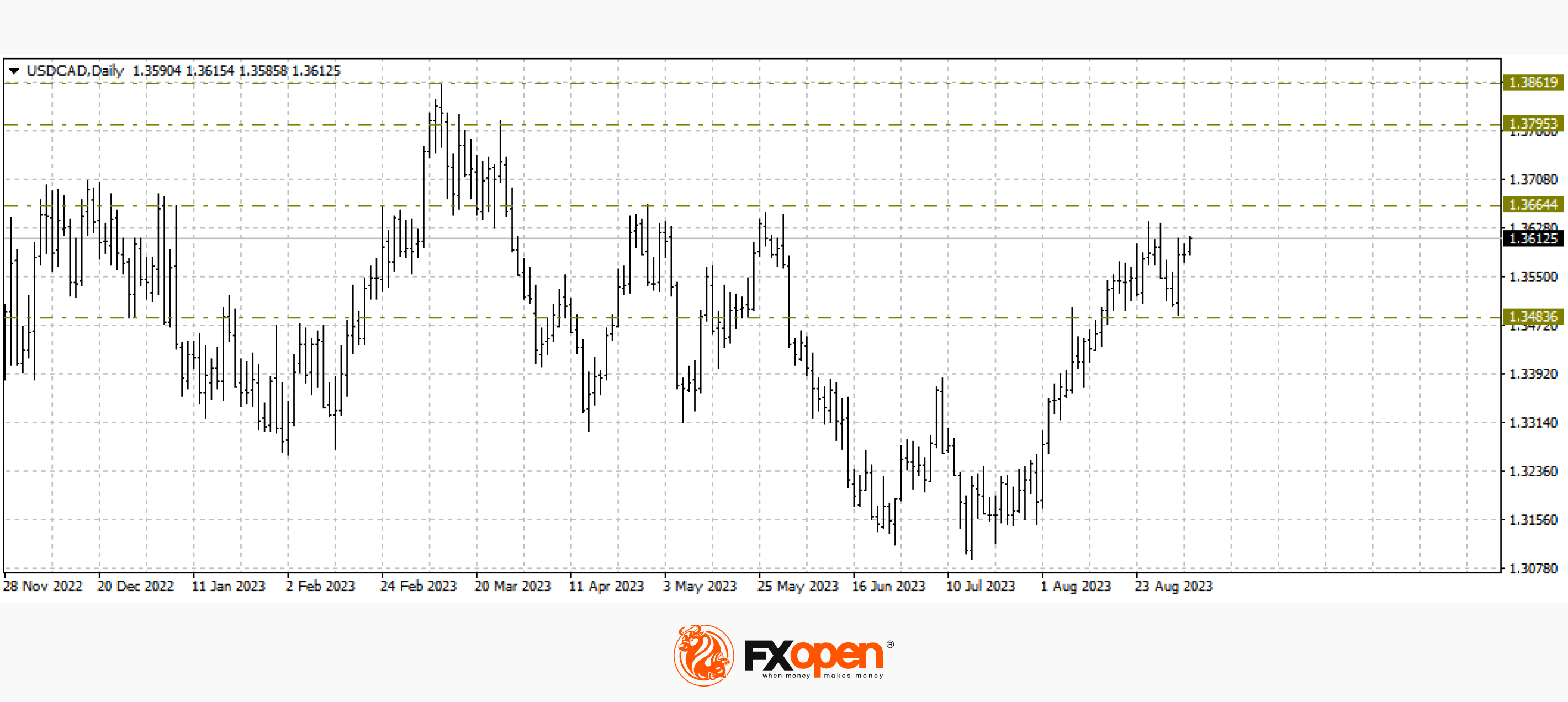

USD/CAD

The USD/CAD currency pair is again trading above 1.3600. This is the third attempt to overcome the important resistance, which has been beyond the control of greenback buyers since April of this year. In this case, the range of 1.3640-1.3620 is vital since the variants of breakdown with upward movement and rebound with the subsequent development of a downward correction are equivalent.

Tomorrow is important for the pricing of the pair, a meeting of the Bank of Canada is scheduled at 17:00 GMT+3.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips. Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.