FXOpen

After a sharp strengthening of the American currency at the end of the week, the main currency pairs entered the correction phase. The dollar's rise was largely due to the hawkish statements of Jerome Powell. The head of the Federal Reserve said that if necessary, the American regulator will continue to raise the base rate, taking into account incoming macroeconomic indicators. Jerome Powell's statements contributed to the USD/JPY pair renewing its recent high at 151.70. Commodity currencies fell to recent lows, with the pound and euro giving up much of their recent gains.

GBP/USD

The British currency, after a spectacular rise to 1.2400, returned to 1.2200. However, buyers of the pair managed to gain a foothold above the alligator lines on the daily timeframe, and as long as the range 1.2200-1.2180 remains in support status, the likelihood of a resumption of the upward movement is quite high.

Today is an important fundamental day for the British currency. At 9:00 GMT+3 we are waiting for the publication of data on average wages for September, taking into account bonuses. Indicators on the unemployment rate for the same period will also be released.

EUR/USD

Buyers of the single European currency are not giving up hope of going above the significant support level at 1.0700. Hawkish statements from Jerome Powell led to a retest of 1.0650, but support at the alligator lines on the daily timeframe remained intact. Most likely, market participants believe that the ECB may begin tightening monetary policy as early as next year, and this investor sentiment is keeping the pair from breaking through the support at 1.0600.

Today at 10:00 GMT+3 it is worth paying attention to the speech of the representative of the European Central Bank, Robert Lane. A little later at 12:00 GMT+3, data on the ZEW economic sentiment index in Germany for November will be released. Eurozone GDP for the third quarter will also be published at the same time. Analysts predict a decline in the indicator, which may contribute to the price moving below 1.0600.

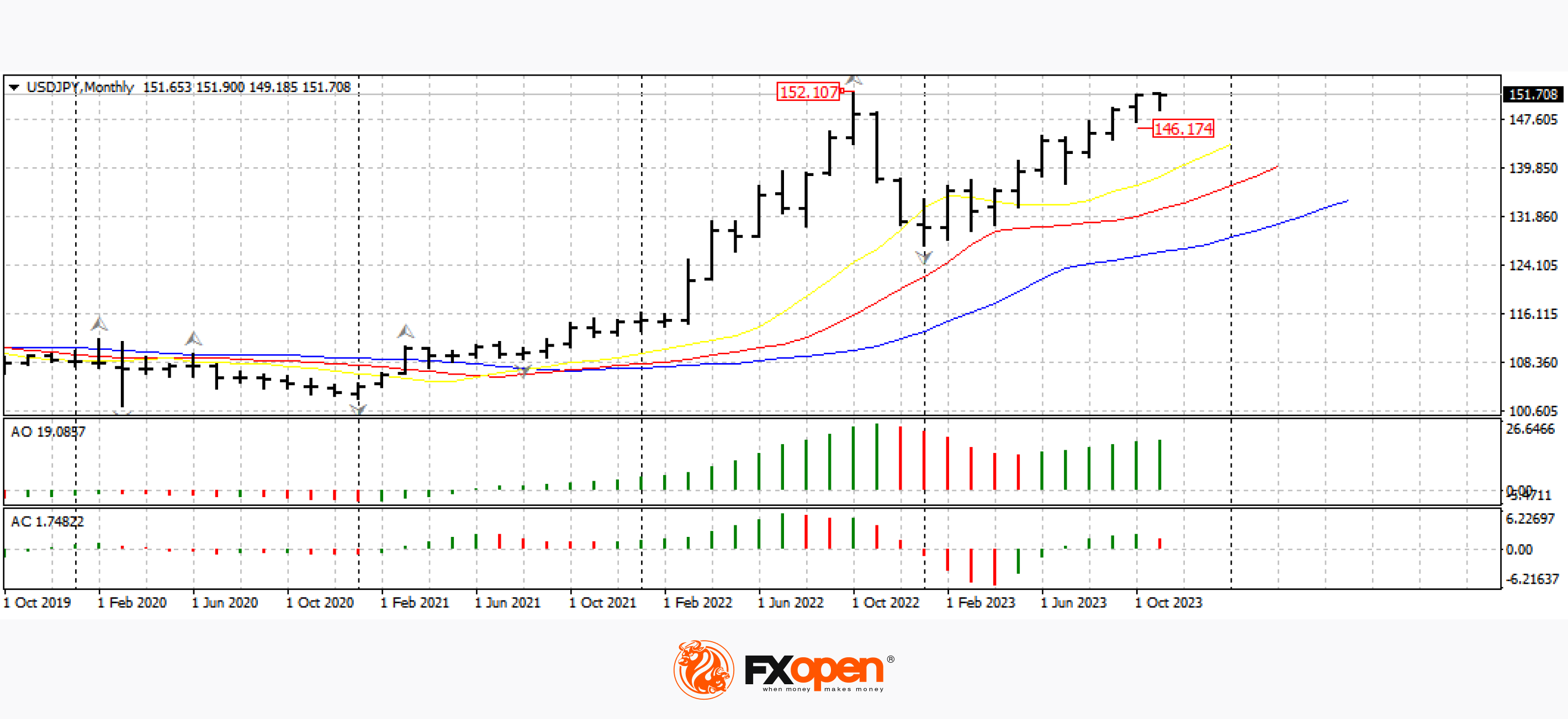

USD/JPY

Last week, greenback buyers in the dollar/yen pair almost reached last year's highs near 152 figures. At the moment, we are seeing a downward correction in the pair, but if there is a positive foundation for the greenback, the USD/JPY currency pair may strengthen above 152.00.

Today at 15:30 GMT+3, we are waiting for data on the consumer price index in the US for October.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.