FXOpen

European currency is consolidating and retreating slightly from local highs ahead of the ECB meeting. Friday’s weak US labour market data gave the euro a boost, but at the start of the week the market remained undecided on how to interpret the signals: after an attempt to strengthen, a correction followed, and traders returned to a wait-and-see approach. In the coming sessions, attention will be focused on the ECB’s decisions, updated macroeconomic forecasts, and comments from the ECB President, as well as on US releases that could influence expectations for the Fed (mortgage data and producer price indicators). In this environment of uncertainty, trading remains range-bound: a break above Friday’s highs in the euro would require confirmation from ECB rhetoric and weak US data; in the absence of such signals, the base case remains further consolidation with the risk of a deeper correction towards support levels.

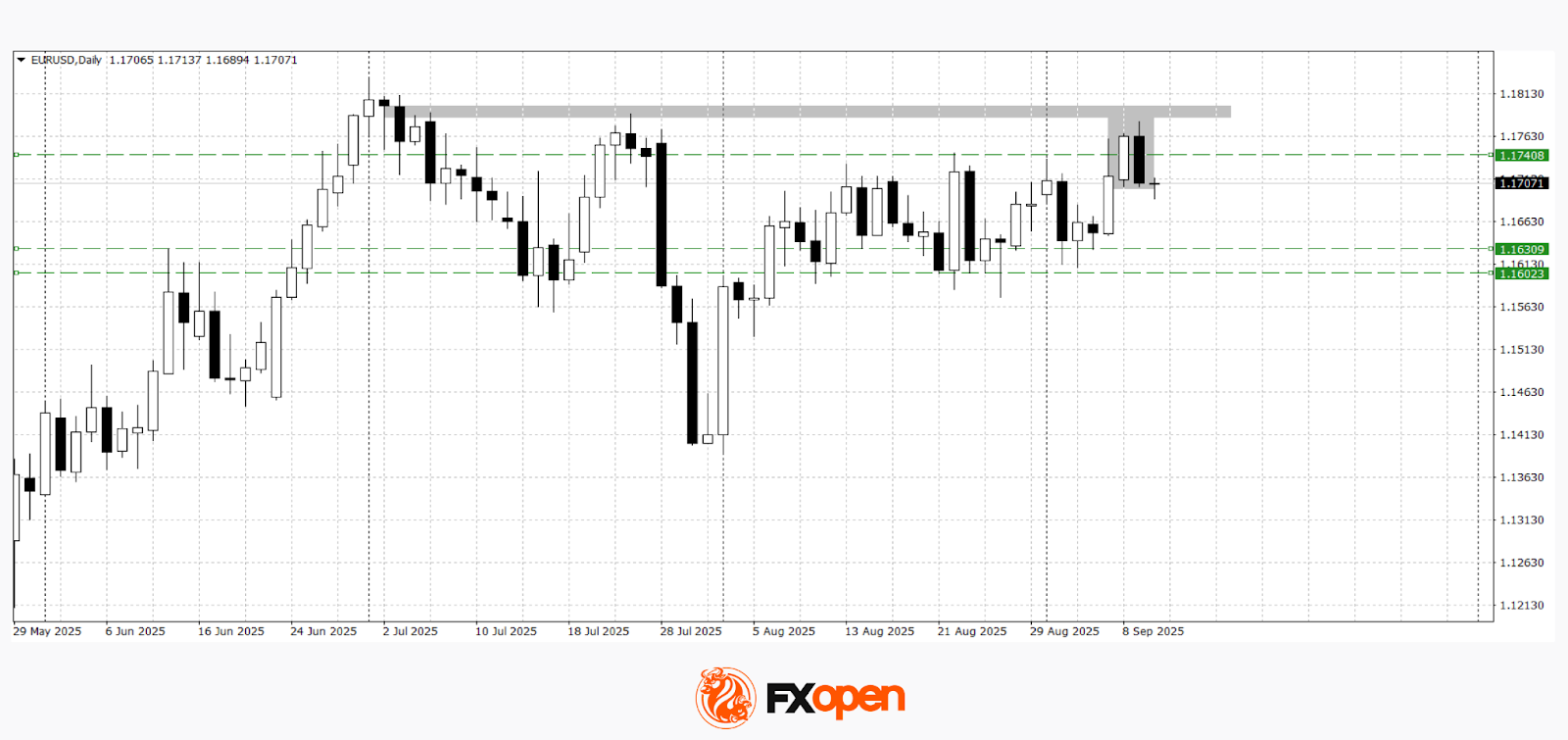

EUR/USD

The pair has pulled back from recent highs and is holding near short-term support, reflecting caution ahead of the European regulator’s rhetoric. Technical analysis of EUR/USD suggests a possible decline towards 1.1600–1.1630, as a bearish engulfing pattern has formed on the daily timeframe. If the price returns above 1.1740, a retest of Friday’s highs near 1.1800 is possible.

Events that could influence EUR/USD movement:

- Today at 15:00 (GMT+3): Speech by Bundesbank Vice President Buch

- Today at 15:30 (GMT+3): US Producer Price Index (PPI)

- Today at 20:00 (GMT+3): Atlanta Fed GDPNow indicator

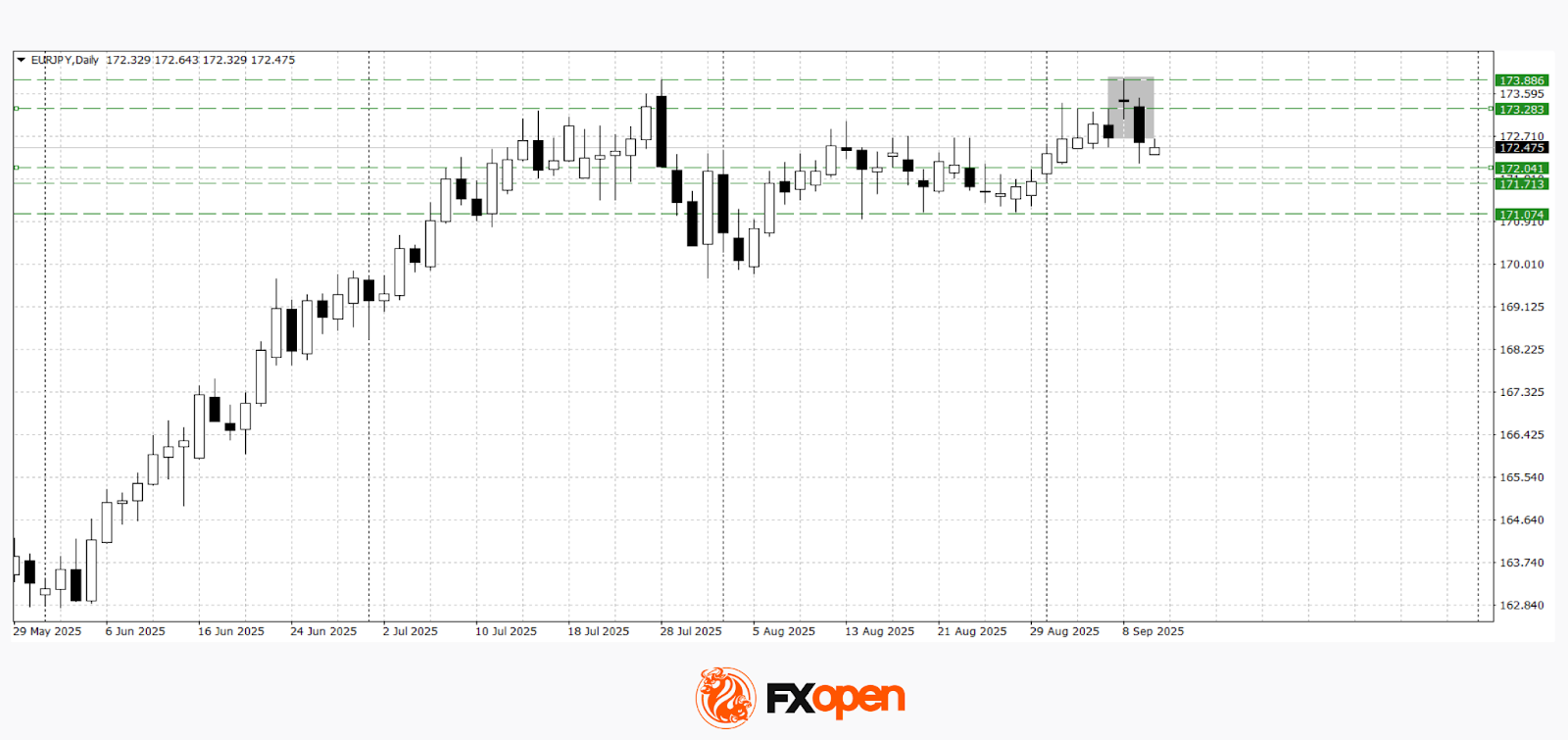

EUR/JPY

On Friday, EUR/JPY buyers managed to update July high near 174.00. However, they failed to consolidate above 173.90 and continue the upward momentum. A sharp rebound from the yearly highs allowed euro sellers to seize the initiative and form a bearish doji pattern, which has already been confirmed. If the downward move continues, the EUR/JPY pair might test the 171.70–172.00 area. A bearish scenario might be cancelled if the price firmly consolidates above 173.30.

Events that could influence EUR/JPY movement:

- Tomorrow at 02:50 (GMT+3): Japan Large Manufacturers’ BSI Business Conditions Index

- Tomorrow at 15:15 (GMT+3): ECB interest rate decision

- Tomorrow at 15:45 (GMT+3): ECB press conference

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.