FXOpen

Various chart patterns give an indication of possible market direction. A falling wedge is one such formation that indicates a possible bullish price reversal. This FXOpen article will help you understand whether the falling wedge pattern is bullish or bearish, what its formation signifies about the market direction, and how it can be used to spot trading opportunities.

What Is a Falling Wedge Pattern?

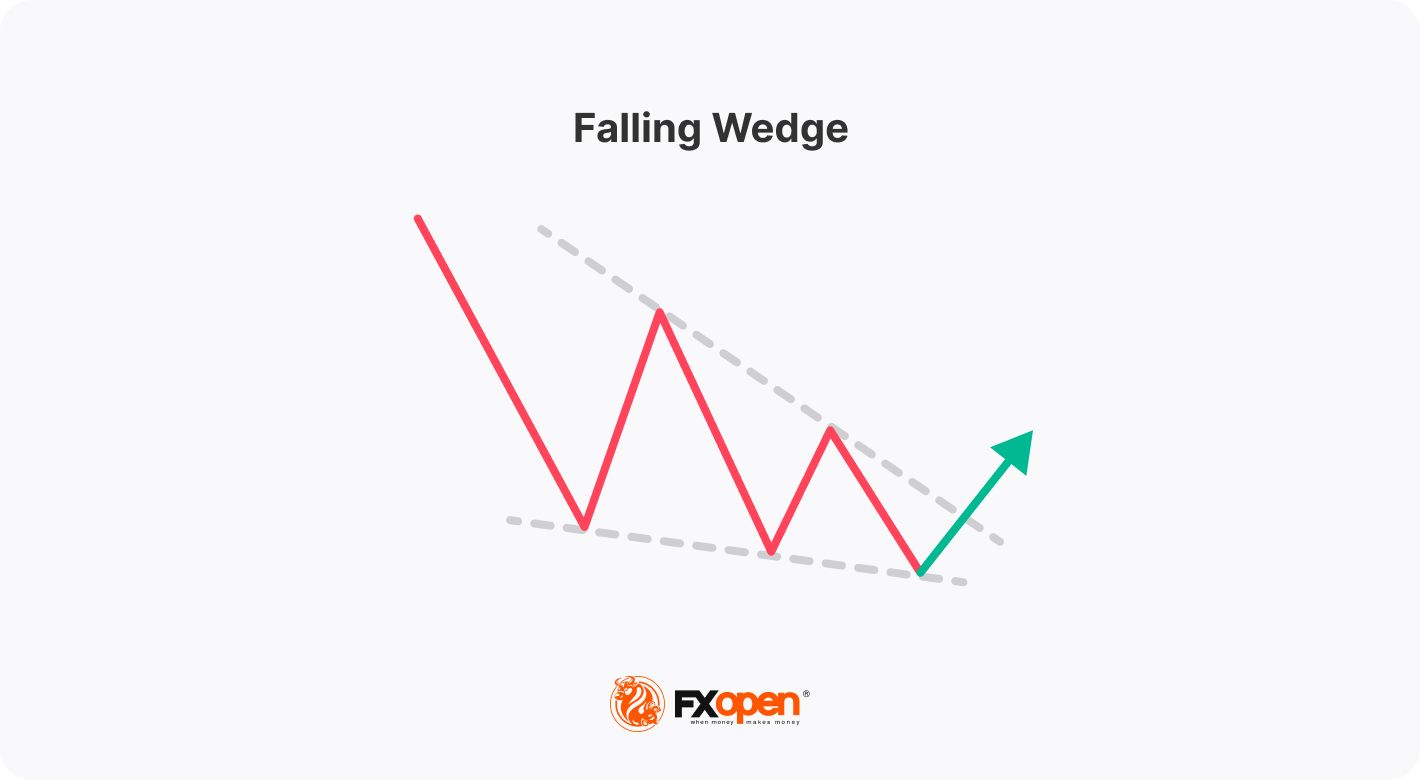

Also known as the descending wedge, the falling wedge technical analysis chart pattern is a bullish formation that can occur in trend continuation or trend reversal scenarios. It forms when an asset's price drops, but the range of price movements starts to get narrower. As the formation contracts towards the end, the buyers completely absorb the selling pressure and consolidate their energy before beginning to push the market higher. A falling wedge pattern means the end of a price correction and an upside reversal.

How to Spot a Falling Wedge in the Chart

It can be spotted in a downtrend, which would indicate a possible bullish reversal, or in an overall uptrend, which would signify a continuation of the upside trend after a temporary price correction. The descending formation generally has the following features.

- Price Action. The price trades lower, forming lower highs and lower lows.

- Trendlines. There are two trendlines. One connects the lower highs, and the other connects the lower lows. Finally, they intersect towards a convergence point known as the apex. Each line should connect at least two points. However, the greater the number, the higher the chance of the market reversal.

- Contraction. The contraction in the range signals decreasing volatility in the market. As the formation matures, new lows contract as the selling pressure decreases. Thus, the lower trendline acts as support, and the price consolidating within the narrowing range creates a coiled spring effect, finally leading to a sharp move on the upside. The price breaks through the upper trendline resistance, indicating that sellers are losing control and buyers are gaining momentum, resulting in an upward move.

- Volume. The trading volume ideally decreases as the pattern forms and increases with the breakout above the upper trendline, reflecting a shift in momentum towards the buyers.

Falling and Rising Wedge: Differences

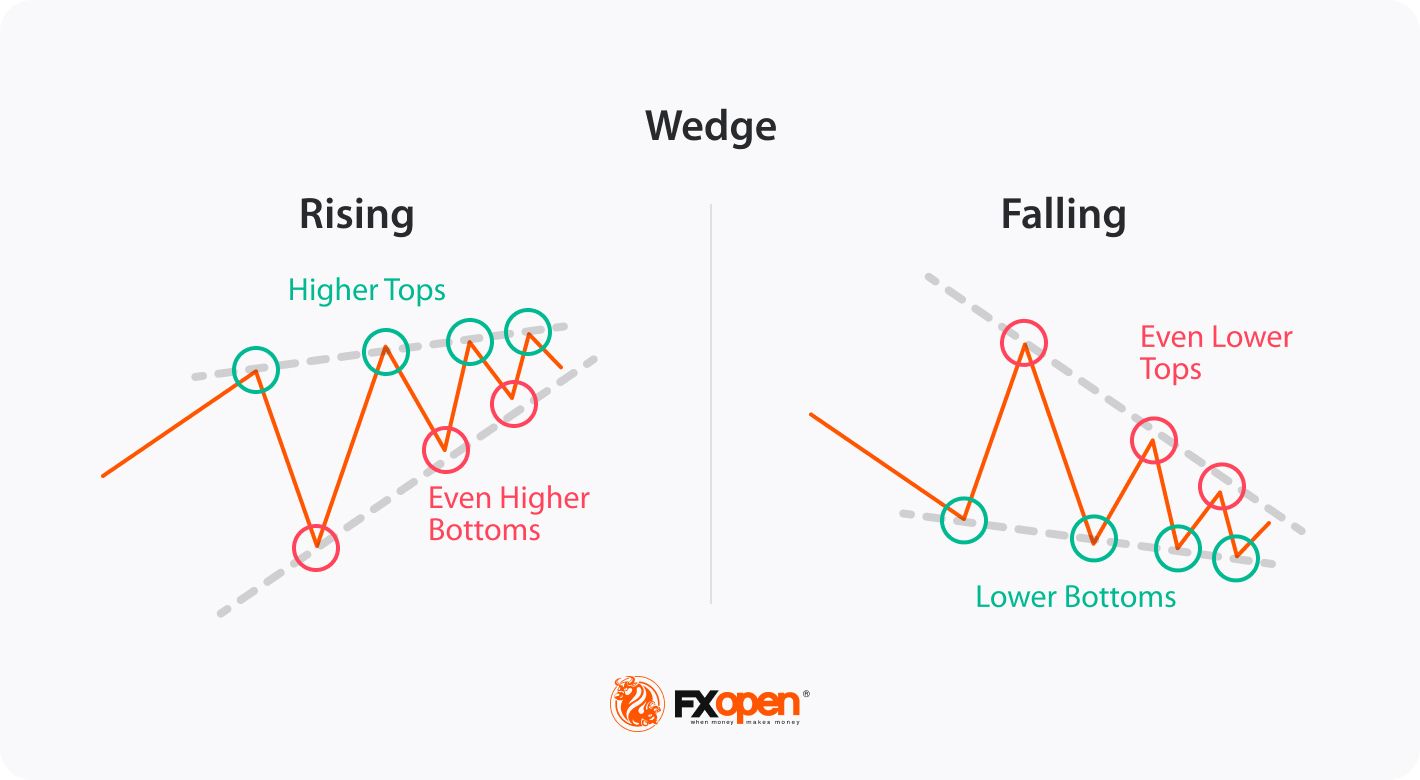

There are two types of wedge formation – rising (ascending) and falling (descending).

An ascending formation occurs when the slope of both the highs and lows rises, while a descending wedge pattern has both slopes sliding. In an ascending wedge, the slope of the lows is steeper and converges with the upper trendline at some point, while in a descending formation, the slope of the highs is steeper and converges with the support trendline at some point.

Usually, a rising wedge indicates that sellers are taking control, resulting in a downside breakdown. Conversely, a descending wedge pattern indicates that buyers are gaining momentum after consolidation, generally resulting in an upside breakout.

How to Trade the Falling Wedge

Trading the falling or down wedge pattern involves waiting for the price to break above the upper line, typically considered a bullish reversal. The pattern’s conformity increases when it is combined with other technical indicators, such as volumes. If you notice an increase in volume when the price breaks the upper resistance, then it indicates that buyers are taking charge.

- Entry

The ideal entry point is after the price has broken above the upper boundary, indicating a potential upside reversal. Furthermore, this descending wedge breakout should be accompanied by an increase in trading volume to confirm the validity of the pattern.

The price may retest the broken upper resistance level before continuing its upward movement, providing another opportunity to enter a long position. But, again, the entry point should be based on the traders' risk management plan and trading strategy.

- Take Profit

It is essential to determine an appropriate target level for a successful trade. One approach is to set a profit target by measuring the distance of the widest part of the pattern and adding it to the breakout of the falling wedge. Then, it can provide a rough estimate of the potential target after the breakout. Another approach is to look for significant resistance levels, such as previous swing highs.

- Stop Loss

Traders typically place their stop-loss orders just below the lower boundary of the wedge. Also, the stop-loss level can be based on technical or psychological support levels, such as previous swing lows or significant technical levels. In addition, the stop-loss level should be set according to the trader's risk tolerance and overall trading strategy.

You can try TickTrader to learn trading different chart formations in the live market.

Falling Wedge: Trading Example

The above figure shows the formation of the descending wedge on a daily timeframe of the EUR/USD currency pair. Traders can initiate a long position after the breakout from the upper trendline at 1.07769 (1) and place the stop loss just below the lower support line at 1.06464(2). The minimum target can be the widest part of the chart added to the breakout point, which comes at 1.16910 (3).

Falling Wedge and Other Patterns

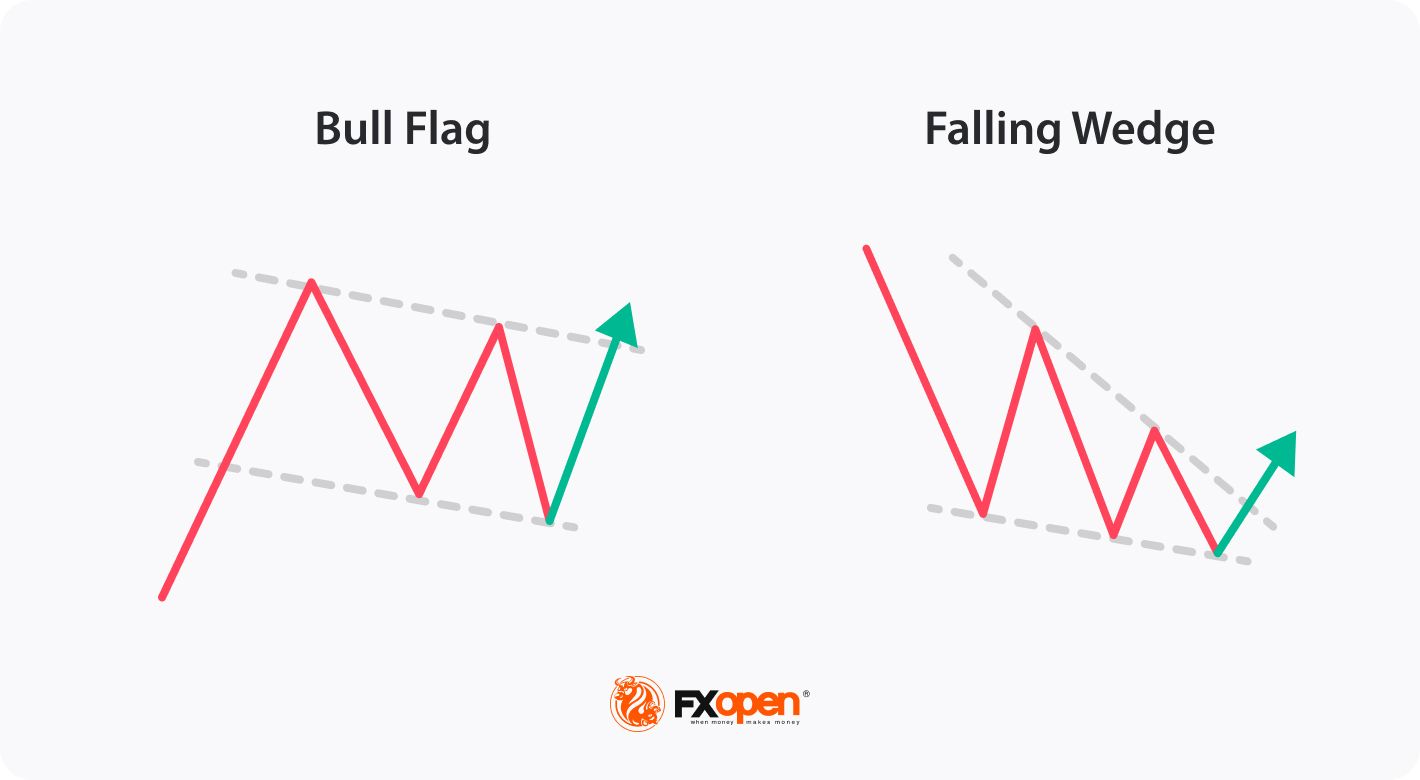

Falling Wedge vs Bullish Flag

These are two distinct chart patterns used to identify potential buying opportunities in the market, but there are some key differences between the two.

A descending wedge is a bullish pattern, forming in a downtrend with a narrowing shape. As it matures, the lower highs and lows converge. The price finally breaks above the upper line, indicating that buyers are taking control. It can provide reversal and continuation signals, but it is mostly considered a reversal pattern.

A bullish flag, on the other hand, is formed with a brief consolidation period in a narrow range after the uptrend so that it’s a continuation pattern. The price is supposed to break above the upper boundary, indicating that buyers are taking control.

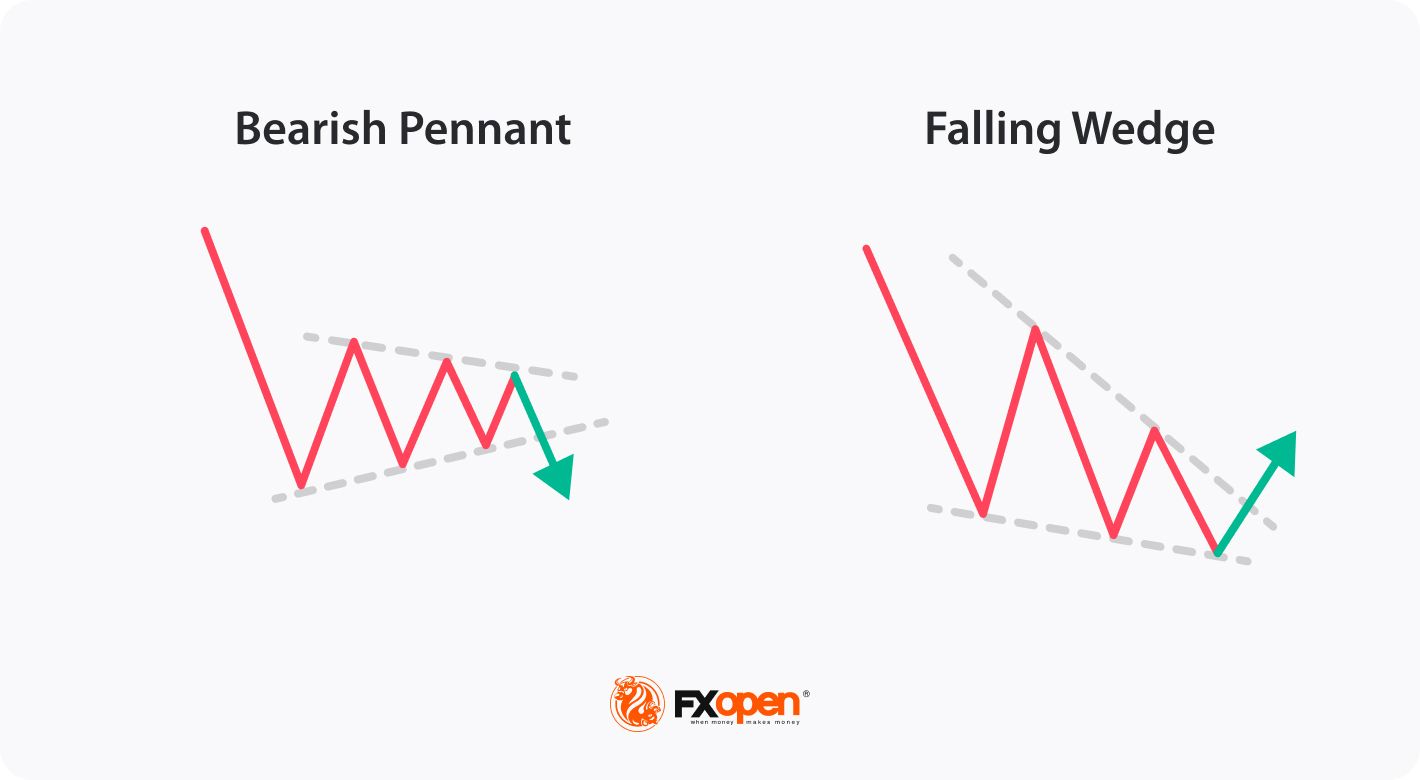

Falling Wedge vs Bearish Pennant

A descending wedge is a bullish chart pattern that usually forms in a downtrend but begins to narrow and is characterised by a series of swing highs and swing lows that converge at the intersecting apex point. The price finally breaks above the upper line, signalling that buyers are taking control.

A bearish pennant is a continuation pattern that forms after a strong downtrend. It is characterised by a brief consolidation period in which the market moves in a narrow range, forming a symmetrical triangle shape that finally breaks below the lower boundary, signalling that sellers are back in control.

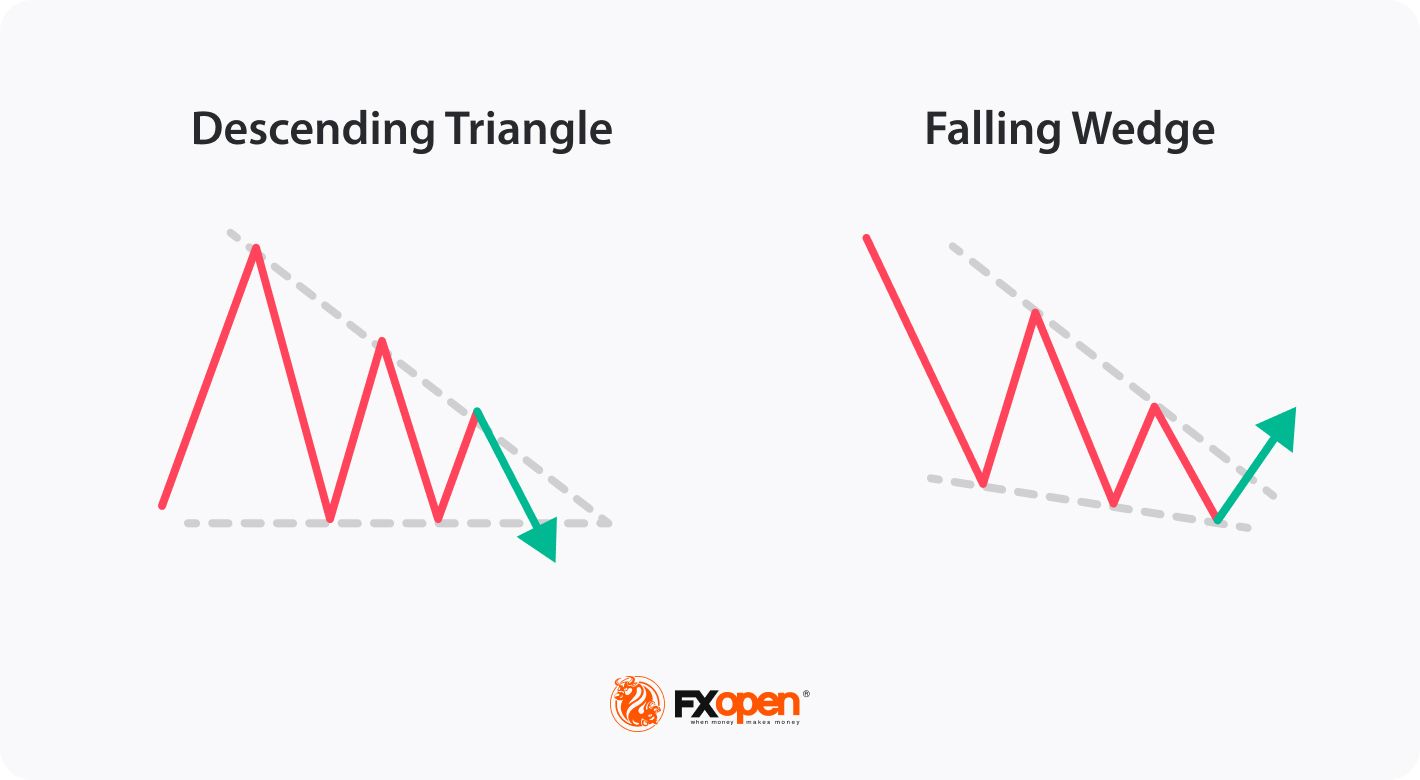

Falling Wedge vs Descending Triangle

A falling wedge is a bullish reversal chart formation in a downtrend and a bullish continuation formation in an uptrend with the trendlines converging downward. It usually results in a breakout above the upper resistance line.

A descending triangle is a bearish chart pattern that forms when the price trades downward and consolidates into a flat bottom with a series of lower highs and a horizontal support line connecting the downswings. The price usually breaks below the support, signalling that sellers are taking control.

The Bottom Line

A descending wedge is a bullish pattern that can help traders to identify a trend reversal in a downtrend and a continuation of an uptrend. As it can provide both signals, it should be used together with other technical analysis tools, including volumes, to confirm its validity.

There is a descending wedge stock pattern and also forex, commodity, and crypto* setups. You can open an FXOpen account to practice technical patterns and learn how to use different chart formations to identify trade opportunities.

FAQs

Is a falling wedge bullish?

Yes, the falling wedge is a bullish continuation pattern in an uptrend, and it acts as a bullish reversal pattern in a bearish market.

What does a falling wedge pattern indicate?

It indicates that the buyers are absorbing the selling pressure, which is reflected in the narrower price range, and finally results in an upside breakout.

Are falling wedges bearish?

No, they are not bearish, but upside reversal patterns are formed in a bearish market.

What is the difference between a bull flag and a falling wedge?

A bull flag normally results in upside momentum after a brief price consolidation in an overall bullish market. However, a falling wedge usually forms in a falling market, resulting in an upside reversal.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.