FXOpen

The Ethereum Merge is the most significant upgrade made to the network since its launch in 2015. But what is The Merge, and what effects will it have on Ethereum in the long term? In this article, we’ll break down exactly what The Merge is, why it’s necessary to Ethereum’s longevity, and how it could affect your crypto holdings.

What Is The Merge?

Ethereum is one of the world’s most valuable smart contract-enabled networks and it’s the blockchain of choice for developers looking to build decentralised products. In recent years, however, Ethereum has been criticised for its high gas fees, slow transaction speeds, and substantial environmental impact due to its growing demand. The Merge, and subsequent planned upgrades, aim to solve these issues.

Proof-of-Work (PoW)

Before The Merge, Ethereum used a proof-of-work (PoW) consensus mechanism. Miners had to invest in costly computing equipment to solve cryptographic puzzles and validate transactions. While this is great for maintaining the network’s security, the time and resource-intensive nature of PoW restricts how many transactions can be processed at any one time.

Not only does this limit Ethereum’s scalability, but it also means that transaction fees could cost the sender hundreds of dollars during periods of high congestion. Moreover, it led to Ethereum consuming energy at a rate equivalent to that of a small country.

Proof-of-Stake (PoS)

Unlike PoW, proof-of-stake (PoS) lowers the barriers to entry for validating transactions on the Ethereum network. Instead of solving cryptographic problems, PoS requires that validators “stake,” or lock up, their ETH in a smart contract. The more ETH you have, the better your chances of being selected to add the next block to the chain and earning the block reward. In Ethereum’s case, users need 32 ETH to become network validators.

The Scalability Trilemma

Now that we understand PoW and PoS, we can put the scalability trilemma into perspective. Termed by Ethereum co-founder Vitalik Buterin, the scalability trilemma refers to the need to balance scalability, security, and decentralisation in blockchain networks. PoW-based cryptocurrencies, like Bitcoin and pre-merge Ethereum, are decentralised and secure yet struggle to scale.

PoS could increase decentralisation by allowing more users to participate in validation. Moreover, it allows for higher transaction throughput and paves the way for sharding, which we’ll touch on shortly.

The Merge

The Merge is the most significant Ethereum upgrade to date and refers to the “merging” of the Ethereum mainnet and the Beacon Chain. The Beacon Chain was a PoS sidechain launched in 2020 that ran parallel to the main Ethereum chain. It allowed developers to extensively test the transition to PoS while letting users stake their ETH to receive rewards. After several delays in the Ethereum Merge countdown, the transition from PoW to PoS finally went live on September 15th, 2022.

In order to stake their ETH, users had to agree not to withdraw their funds or rewards until The Merge was complete. Since this feature was announced, the lock-up period has been extended and it has not been announced when it will expire.

What’s Changed After the Ethereum Merge Update?

These are the major changes to the Ethereum network.

Validators Have Replaced Miners

The most significant change to the network was that, instead of needing an expensive mining rig, users can become transaction validators as long as they have 32 ETH, a computer, and an internet connection. Mining pools, where users pool their computing power and receive a share of mining rewards, have been replaced by staking pools. These pools allow users who don’t have 32 ETH to put together their funds to activate a set of validator keys.

Lower Energy Consumption

One of the biggest benefits of The Merge has been a drastic drop in Ethereum’s energy consumption. According to the network’s developers, the chain’s energy use dropped by approximately 99.5%.

ETH Could Become Deflationary

Since implementing the London hard fork in August 2021, Ethereum has burned a portion of its transaction fees (removing them from circulation). The Merge has reduced the number of ETH tokens entering circulation by cutting block rewards by roughly 90%. In combination with burning, this lowered issuance rate has the potential to make ETH a deflationary asset.

ETH’s Long-Term Price Trajectory

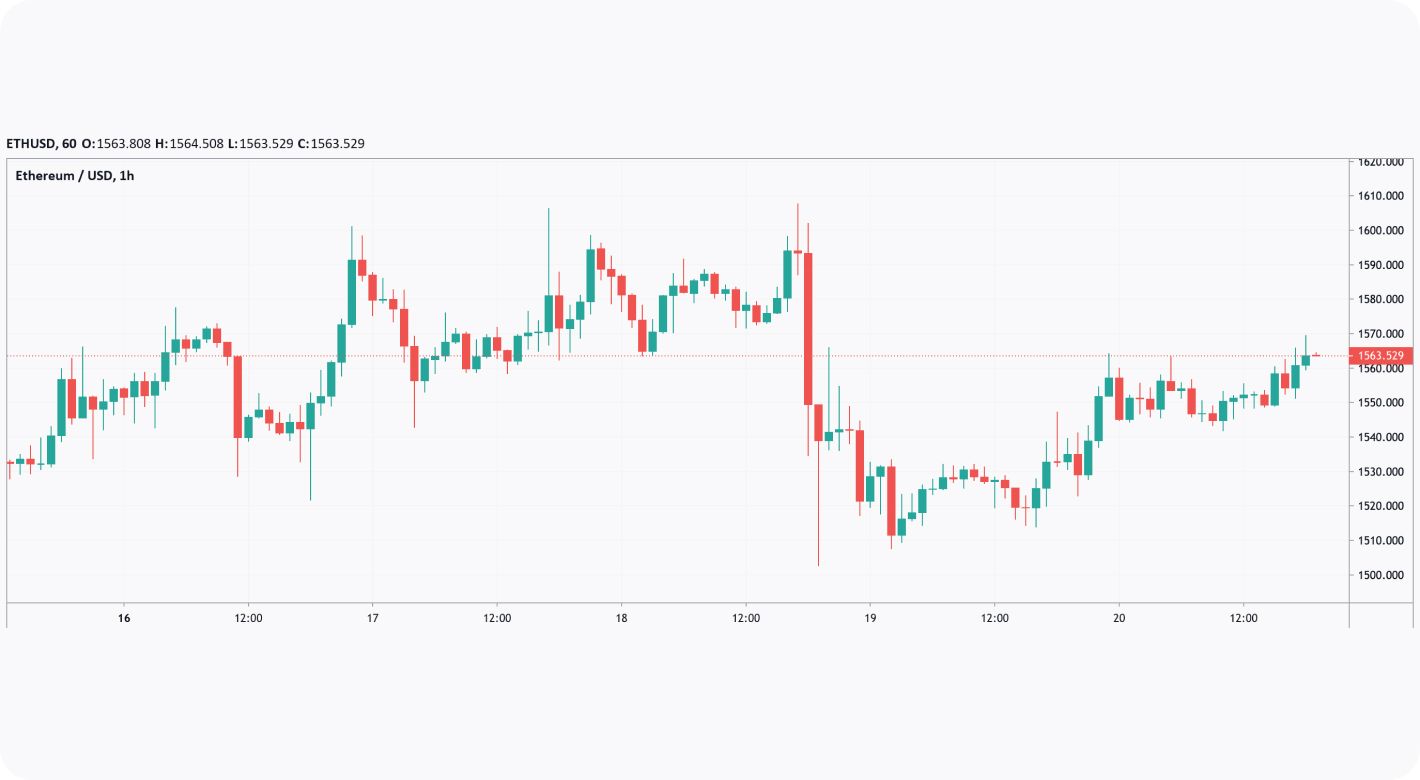

ETH fell around 25% in a week following The Merge and has yet to recover fully, given the ongoing crypto bear market. However, many argue that The Merge is a good thing for Ethereum’s price in the long term, thanks to the doors it opens for future upgrades.

Think they’re on to something? At FXOpen, we don’t just offer Forex trading; you can also trade Ethereum contracts for difference (CFDs)* if you want to take advantage of ETH’s price movements post-Merge.

ETH Merge Update: Long Run

Many of the changes will benefit Ethereum users in the long term, but not much has changed for the majority in the short term. There’s no need to do anything; there’s no new ETH token or swap you need to make.

Future Upgrades

Perhaps the biggest effect of The Merge is that it sets the scene for sharding. Simply put, sharding splits up transactions into more manageable loads across 64 separate chains. This vastly reduces network congestion and increases the network’s throughput.

In fact, the upgrade is expected to increase Ethereum’s transactions per second (TPS) from around 15 to over 100,000 - more than Visa and Mastercard’s 65,000 TPS. It also reduces the hardware requirements for becoming a validator, allowing nodes to be run on smartphones and laptops.

Sharding is the next significant change to the Ethereum network, and this ETH upgrade countdown is set for some time in 2023. Once sharding is implemented, the number of use cases for Ethereum is expected to increase, paving the way for greater adoption. It could also render other rival smart contract-enabled projects irrelevant and cause significant volatility in the crypto markets.

Want to practise your trading skills before exploiting this volatility? You can open an FXOpen account and hone your strategy* with the TickTrader terminal!

FXOpen offers the world's most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service. Open your trading account now or learn more about crypto CFD trading with FXOpen.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.