FXOpen

An important week for financial markets has just started. On Thursday, the Jackson Hole Symposium starts, and on Friday, Fed Chair Jerome Powell is scheduled to hold a speech on the U.S. economic outlook.

The Jackson Hole Symposium is an annual event held by the Federal Reserve of the United States in August. It is an event where central bankers from around the world meet and discuss the global economy, monetary policy, and the events threatening financial stability.

Very often, the comments from central bankers during the event have moved financial markets drastically. Last year, for example, the Fed chose the August event to announce that it is changing its inflation-targeting mandate. It moved from a fixed 2% target to an Average Inflation Targeting – AIT of 2%.

By announcing it in August, when the markets’ volatility is typically low, the Fed reinstated the importance of the event. As such, traders should be on the outlook this week, as the Fed may surprise them again.

Tapering and Inflation – Two Things That May Move Markets

Lately, investors’ focus was on two things – the tapering of the asset purchases and inflation. The Fed wants to avoid a taper tantrum such as the one in the aftermath of the Great Financial Crisis in 2008-2009. As such, it chose to communicate to market participants its intentions early, and it wants to be predictable.

The markets do know that the tapering of the asset purchases is coming – only the timing is unknown. Therefore, the Fed may choose to announce officially the schedule for the tapering at this event.

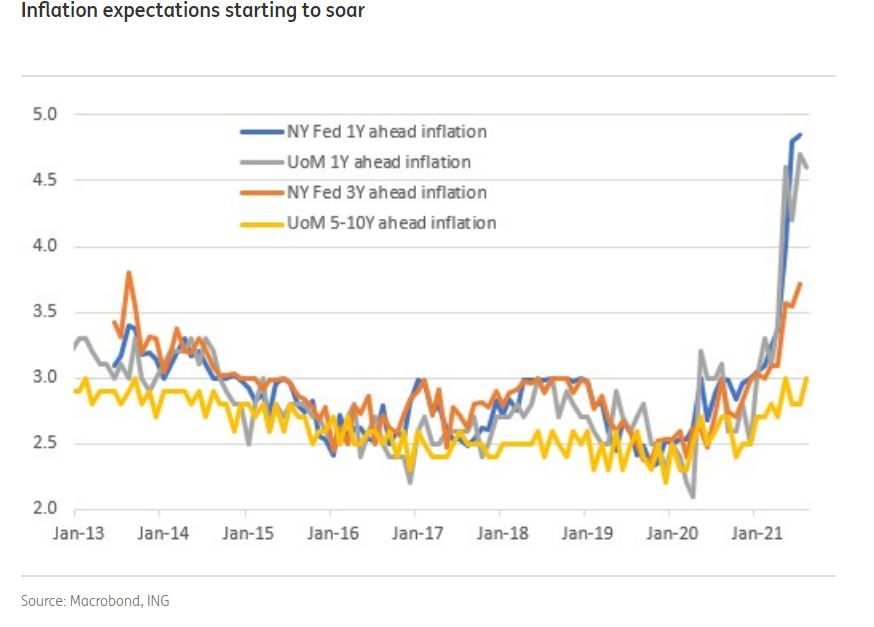

Inflation is an issue in the United States and the world. During the pandemic, central banks and governments have pushed the monetary and fiscal policies to limits. Central banks have eased, engaging in unconventional monetary policies, while governments complemented their moves with easy fiscal policies.

As a result, inflation galloped in the last few months – something unusual in the developed economies. Next Friday, the Core PCE data is expected to be out in the United States. The market expects 0.3% on the month, and the data comes out before Powell’s big speech on Friday. Because this is the Fed’s favored way of measuring inflation, it has the power to move markets significantly.

All in all, expect a quiet week ahead until the Jackson Hole Symposium starts – but expect volatility to rise shortly after.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.