FXOpen

There are numerous candlestick patterns and these are divided into two main categories: continuation and reversal. Reversal formations help traders enter the market at the early stages of a new trend to make the most of the trend trading. 3 white soldiers pattern is one of these. It’s a combination of three candles formed together and it is used to predict a price rise after a solid downtrend. It’s one of the simplest formations and it appears on price charts very often. Therefore, traders with any level of experience can use it when trading. What is the 3 white soldiers in stock, forex, commodity, or cryptocurrency trading*? What is the difference between the 3 white soldiers and the 3 black crows? This FXOpen guide will answer these questions.

What Is the Three White Soldiers Pattern?

The three white soldiers, the three white candles and the 3 green soldiers are all terms that refer to a bullish reversal pattern that appears at the end of a downtrend. It indicates that bulls are taking control of the market. It’s quite simple; a trader looks for three candlesticks opening within the previous candle's real body and closing above the high or close price of the previous candlestick. Either the candles have no upper shadow, or the shadow is very small.

What Is the Difference Between 3 White Soldiers and 3 Black Crows?

Almost every candlestick formation is represented by two versions – the one occurring in a downtrend and the other appearing in an uptrend. Three white soldiers also have a pair. The three black crows formation is the opposite of three white soldiers. Three black crows is a bearish reversal setup formed at the end of a bullish move, composed of three consecutive long bearish candles, each opening within the previous candle's real body and having a close exceeding the previous low. It suggests strong selling pressure and a potential change in trend from bullish to bearish, whereas the 3 white soldiers appear in an uptrend, indicating that the momentum is changing from the bears to the bulls.

How to Identify a Three White Soldiers Formation

To identify the three white soldiers candlestick pattern while trading, the following conditions must be met:

- Trend: There should be a previous downtrend in place for the formation to signal a potential reversal.

- Consecutive candles: The setup consists of three consecutive bullish (or white) candles.

- Length: Each candle should have a long real body, with small or no shadows. A long body indicates solid buying pressure.

- Market context: It's important to consider the overall market context when interpreting the three white soldiers. If the formation appears during a broader market uptrend, it is more likely to be a valid signal.

If these conditions are met, it is a strong indication of a potential change in trend from bearish to bullish, and traders may use it as a signal to enter long positions. However, it is always recommended to confirm the pattern with additional technical analysis tools, including moving averages, trend lines, Fibonacci retracements, and market data before making a trade decision.

You could use the TickTrader platform to view charts and discover trading opportunities.

How to Trade the Three White Soldiers

As the three white soldiers signal for a potential bullish reversal in the market, a trader can consider trading volumes. Increasing volumes reflect the rising strength of market participants and often identify the formation of a new trend. Traders may choose to enter long positions based on this signal. However, it is essential to consider the following before making a trade:

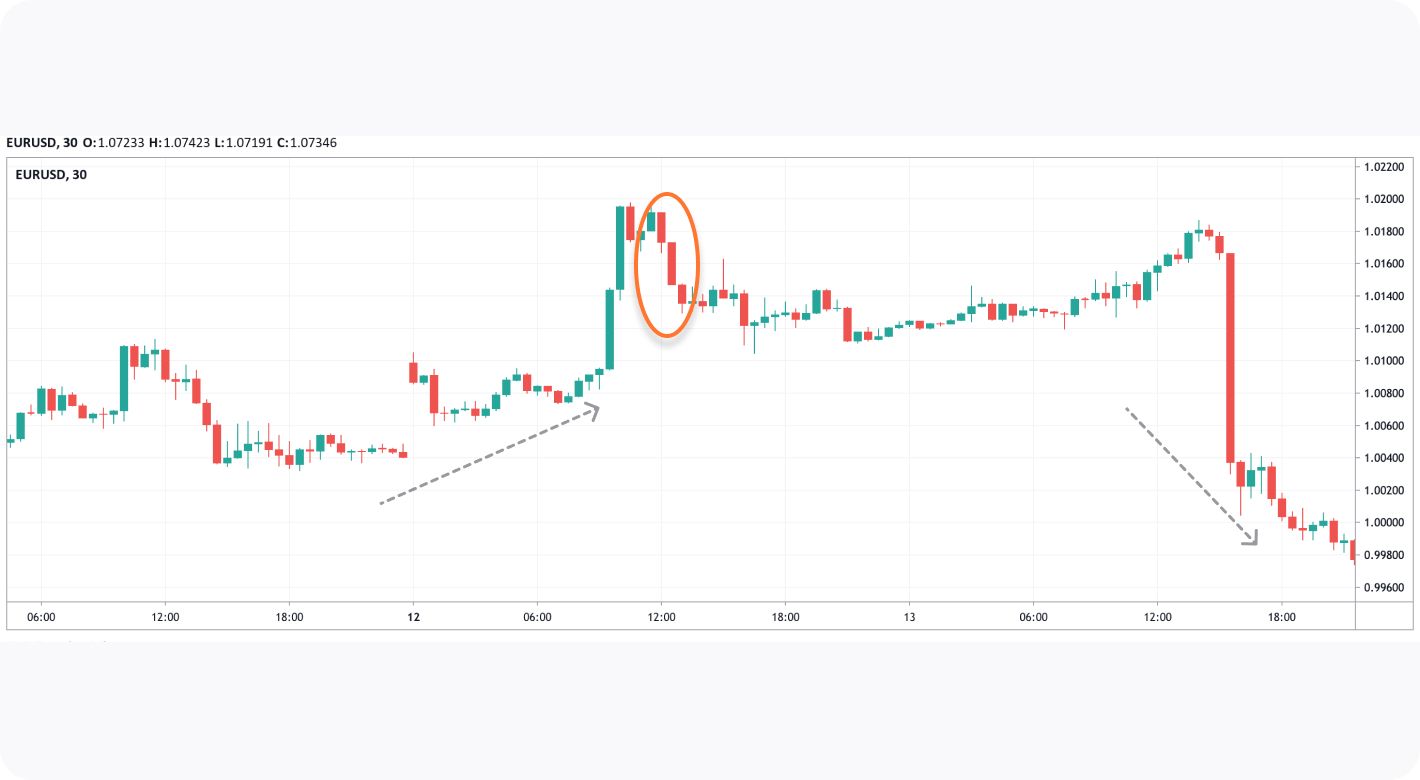

- Identify the pattern: Look for three consecutive long green (or white) candles with higher closes that occur after a downtrend or during consolidation (1).

- Determine the entry point: Once the formation is confirmed, you can place a buy order at the close of the third candle or slightly above it (2).

- Determine the exit points: Commonly used exit strategies when trading the three white soldiers setup involve taking profit at the next resistance level or using the trailing stop method, which allows you to lock in profits as the price moves in your favour. As in our example resistance levels are too close to an entry point (3), it would be better to follow the market sentiment and trail the take-profit target. You can place a stop-loss order below the third candle's low or the most recent significant low, to help protect your capital (4).

Please note that this is just a basic guide and does not guarantee success in trading. It is important to also consider other technical and fundamental factors before making a trade.

Final Thoughts

When making trading decisions, most traders consider candlestick analysis. They employ 3 candlestick patterns, such as the 3 black crows and the three white soldiers for stock, ETF, commodity, cryptocurrency*, and forex trading, since the formation can predict the future movement of the present trend. Some traders employ a single formation, while others use a mix to execute trades.

You can open a live trading account at FXOpen to explore 3 white soldiers pattern trading.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules, respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.