FXOpen

A new trading month has started pretty much on the same note as the previous one: rising inflation and a stronger US dollar. Last Friday, inflation in the Eurozone and the United States exceeded expectations.

In Germany, for example, it is above 4%, and the last time the annual inflation was as high, the interest rates were higher still. In the US, the Core PCE inflation rose by +0.3% in the previous month. This is the Fed’s favorite way of measuring inflation because it does not consider energy and food prices.

Speaking of energy prices, they are going through the roof. Last week, some interesting milestones were reached. First, Brent crude oil has reached $80/barrel, a 3-year high. Second, Asian coal has reached $203 a tonne, also a record. Natural gas in Europe and Asia hit a record high as well, $34/mBtu.

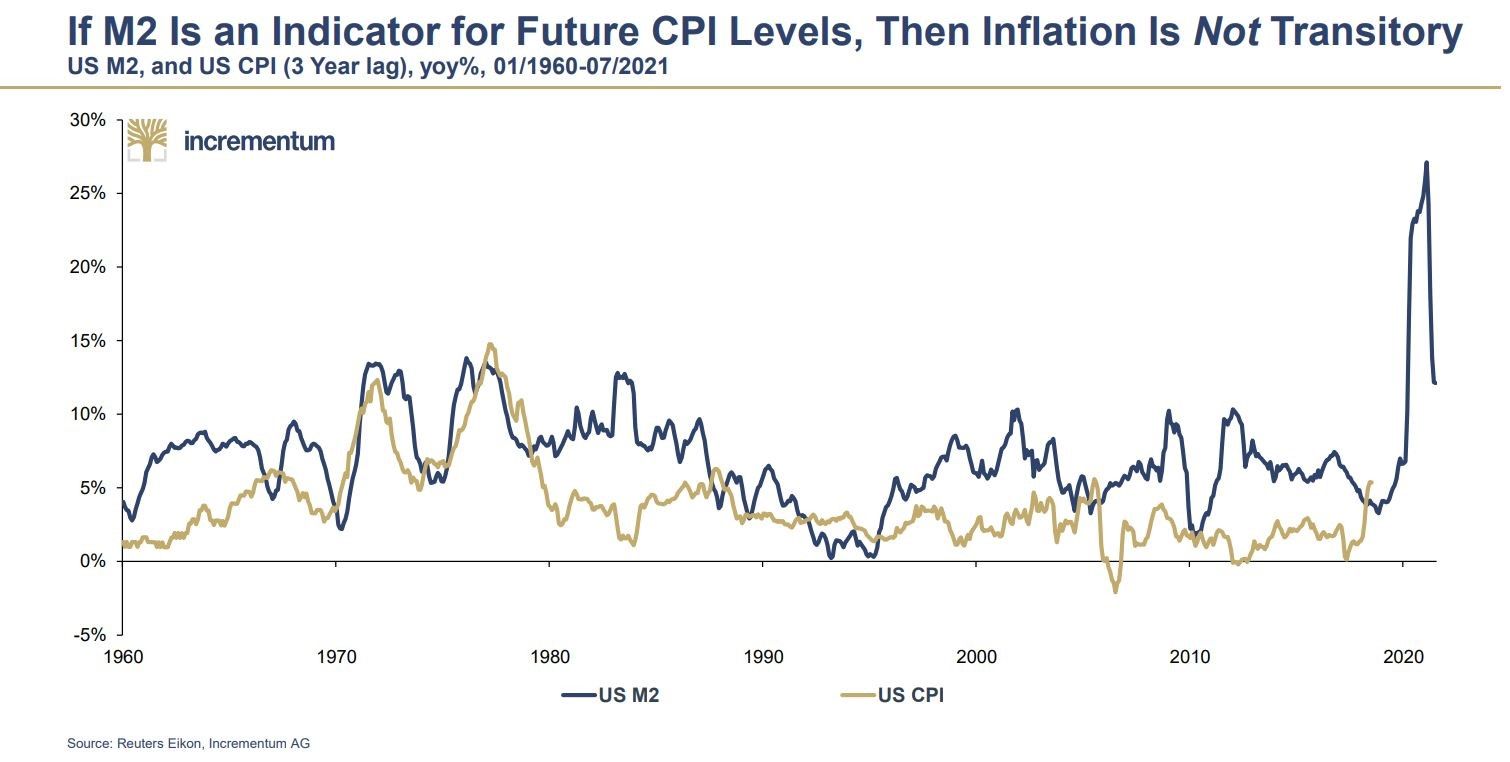

Although energy prices are not included in the Core PCE calculation, Core PCE is still on the rise, which is evident from Friday’s data. If we judge by the M2 (i.e., money supply)’s correlation to inflation, as shown by the chart below, then inflation is just about to explode.

Why Is US Dollar Getting Stronger Despite Rising Inflation?

One of the questions that many traders and investors are asking is, why is the US dollar getting stronger in a rising inflation environment? Indeed, the US dollar gained against its peers in 2021. Take the EUR/USD exchange rate: it started the year above 1.23 and closed last Friday around 1.16 – a decline of over seven big figures (i.e., seven hundred pips).

There are a few reasons for this. First, USD’s status as the world's reserve currency has not changed during the pandemic despite the US Federal Reserve printing more money than ever.

Second, the Fed prepares to remove some of the monetary accommodation. Most likely, the Fed will announce the start of the tapering of its asset purchases program in November, and the actual reduction in bond-buying in December. Thus, there will be no more bond-buying from the Fed by the middle of next year, as quantitative easing will have officially ended.

In doing so, the Fed is way ahead of other central banks. And it responds to – you guessed it – rising inflation.

Rising inflation prompts central banks to tighten the monetary policy. The quicker the response, the easier it would be to contain the rise in the prices of goods and services. Judging by how far the prices went, it could be that the Fed and other central banks in the world are behind the curve with their monetary policy measures.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.