FXOpen

Kill Zone trading is a method that focuses on the most liquid and volatile periods of the trading day. It aims to align trades with institutional activity during specific time windows. Kill Zone trading has become increasingly popular among professional traders and algorithmic systems alike, as it leverages the behavior of market participants during key sessions. Understanding these market dynamics and knowing how to trade them strategically may support traders in making trading decisions.

This article explores the concept of Kill Zone trading in Forex — its core principles, major trading sessions, and techniques for identifying institutional order flow.

Understanding Kill Zones

What are ICT Kill Zones? A Kill Zone in forex trading refers to a specific time period during which currency pairs experience increased volatility and volume. The concept, popularised by Michael Huddleston, also known as the Inner Circle Trader, highlights the importance of timing in trading strategies.

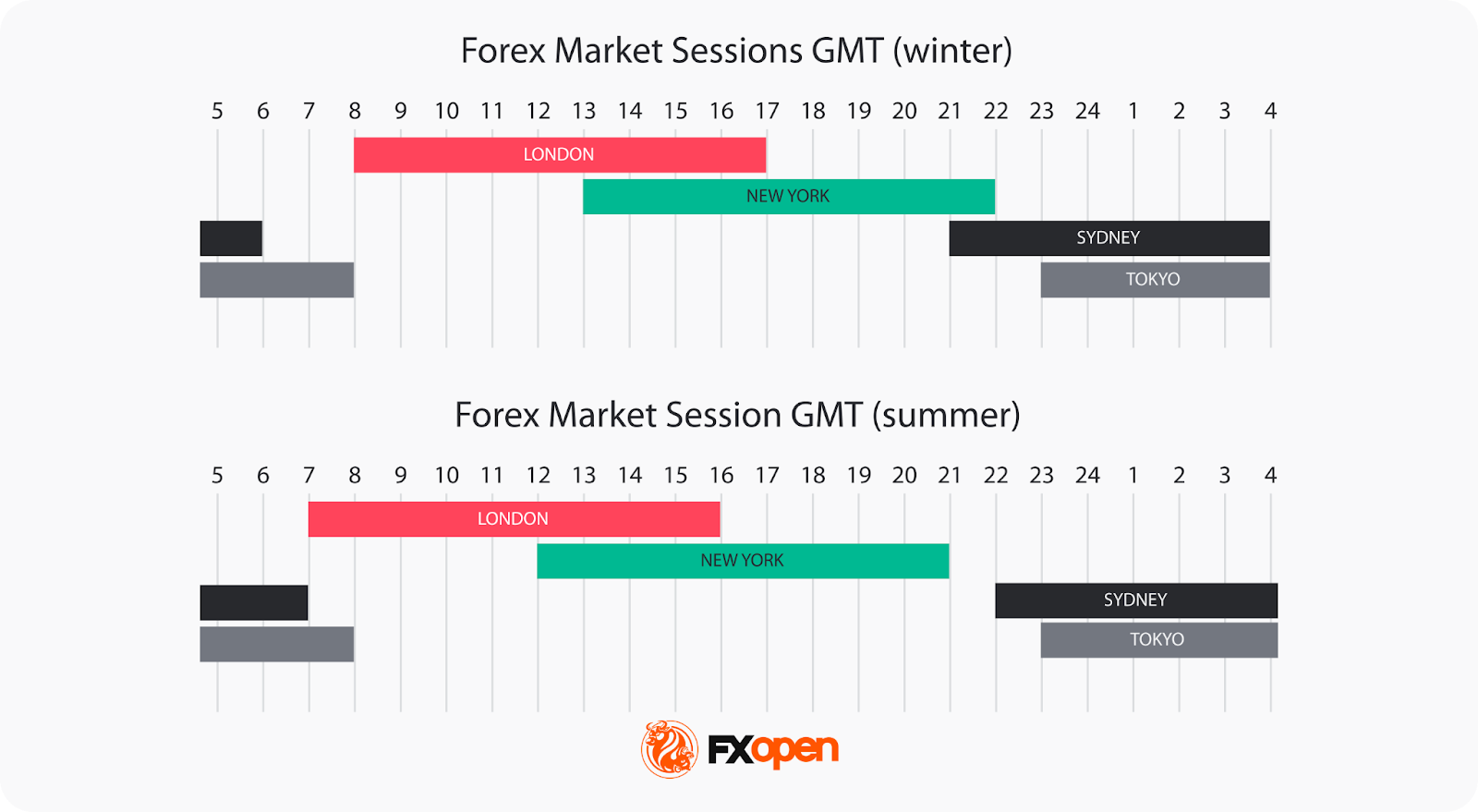

The strategies are based on global forex hours. The forex market operates 24 hours a working day across four major sessions: Sydney, Tokyo, London, and New York. The interaction between these sessions, particularly at their opening and closing times, creates unique conditions for traders. The heightened activity during these periods is supposed to lead to higher liquidity and faster price movements.

The Four Primary Kill Zones

The four primary Kill Zones represent strategic windows where trading volume and volatility peak due to the interplay of global market sessions. Each period corresponds to transitions in major forex markets worldwide.

Below, we’ve described each along with the key ICT Kill Zone times. You can see how currency pairs react during these times in FXOpen’s TickTrader trading platform.

1. Asian Kill Zone

Asian Kill Zone Time Period: 23:00 GMT to 02:00 GMT in winter and in summer.

This window coincides with the opening of Asian markets, primarily Tokyo. This period sees increased activity in currency pairs with AUD, NZD, and JPY. The US dollar typically shows consolidation, providing an environment ripe for scalping strategies. Traders often monitor for optimal trade entry (OTE) patterns, another ICT concept, during this time, capitalising on the day’s initial movements and setting the stage for the European session.

2. London Kill Zone

London Kill Zone Time Period: 08:00 GMT to 11:00 GMT in winter (07:00 GMT to 10:00 GMT in summer).

This window is known for its volatility and significant trading volume, particularly involving EUR and GBP. As the London session opens, it often establishes the daily highs (in bullish markets) or lows (in bearish markets), reacting to developments from the Asian session. Traders analyse market movements to prepare for potential breakouts or reversals. This window can be crucial when setting up trades, especially for currency pairs that show little activity overnight but become volatile with the London opening.

3. New York Kill Zone

New York Kill Zone Time Period: 13:00 GMT to 16:00 GMT in winter (12:00 GMT to 15:00 GMT in summer).

This window marks the overlap of the London and New York sessions, creating a critical period for USD-paired currencies. The dynamics of this period are influenced by the activity of traders from both continents being concurrently active. Traders seek continuation or reversal of the trends established over the London session, employing strategies that capitalise on the volatility to maximise returns.

4. London Close Kill Zone

London Close Kill Zone Time Period: 15:00 GMT to 17:00 GMT in winter (14:00 GMT to 16:00 GMT in summer).

As the London session concludes, this window typically exhibits less volatility but still offers conditions for strategic trades. Traders might observe retracements or continuations of earlier trends. During this period, strategies often revolve around identifying trend exhaustion and preparing for potential reversals as European traders close their positions, influencing pair directions before the close of the American session.

Practical Considerations for Trading Kill Zones

When engaging with Kill Zones in forex, practical considerations are important for leveraging these periods. Keep in mind these things:

Navigating Time Zone Shifts

Traders must account for time zone shifts such as British Summer Time (BST) and Eastern Daylight Time (EDT) when planning their trading schedules. These shifts can impact the real-time operation of forex markets by altering the relative timing of session openings and peak activity periods.

BST is GMT+1, moving the London window to an hour earlier for those trading on GMT. During BST, which typically runs from late March to late October, the London Kill Zone shifts from 07:00 to 10:00 GMT. Conversely, EDT, which is GMT-4, affects those in the US by advancing the New York window to start and end an hour earlier. This period typically extends from the second Sunday in March to the first Sunday in November.

Risk Management

Trading during these windows involves navigating periods of high volatility, where price movements are rapid and unpredictable.

- Volatility-Based Position Sizing: Adjusting position sizes based on volatility may be useful. In more volatile periods like the London or New York openings, reducing position size might help manage potential losses.

- Time-Specific Stop-Loss Orders: Stop-loss orders that reflect the heightened activity levels is another risk management tool. For example, wider stop-loss margins might be necessary across the New York window due to the significant price shifts that can occur when both American and European markets are active.

- Real-Time Monitoring: Active monitoring during these volatile times is vital. Rapid response to price changes may help traders when dealing with the risk of losses. Setting alerts at particular levels and indicators may aid in a proactive approach.

The Bottom Line

Kill Zone strategies are used to identify entry and exit points during periods of heightened volatility and liquidity. These strategies focus on specific time windows when significant price movements may occur, allowing traders to interact with institutional market activity.

Those looking to refine their market timing and participate in high-impact trading sessions may consider opening an FXOpen account to access a wide range of currency pairs during these critical periods of volatility.

FAQ

What Is a Kill Zone in Trading?

A Kill Zone refers to a specific time window during the trading day when market activity, liquidity, and volatility are at their peak. These periods — such as the London Open, New York Open, or session overlaps — often coincide with institutional trading activity, creating conditions for identifying high-probability entry and exit points in the Forex market.

How Could You Use a Kill Zone?

Traders use a Kill Zone to time entries and exits during periods of high volatility and liquidity, capturing significant price movements during specific time windows — usually at the beginning or end of a trading session or when sessions overlap.

How May Traders Participate During ICT Kill Zones?

Traders can engage by monitoring price action, identifying high-probability setups, and executing trades on currency pairs during major institutional trading windows.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.