FXOpen

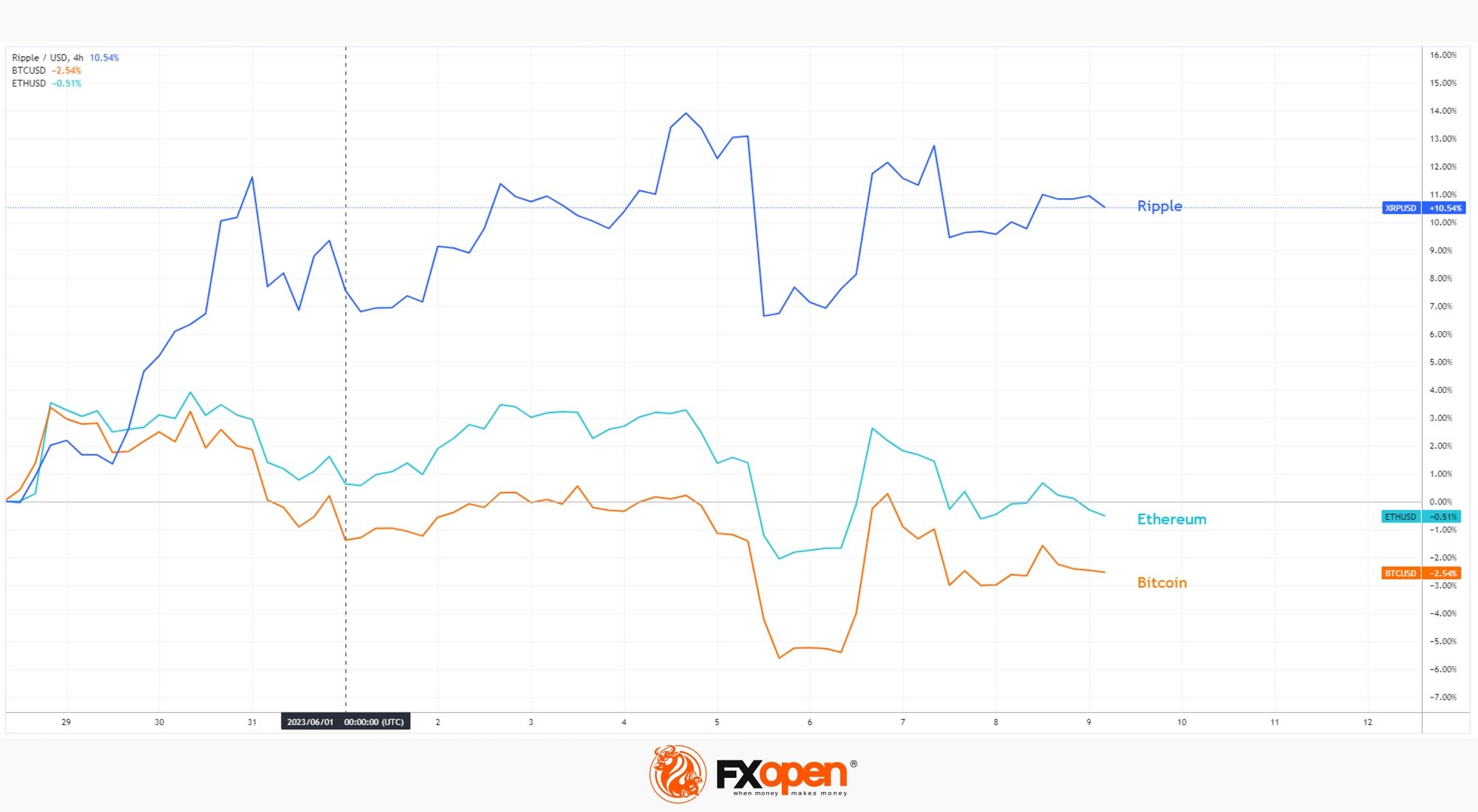

This week, the financial regulator SEC launched an attack on the cryptocurrency industry, suing the Binance and Coinbase exchanges, while classifying a number of popular coins as securities. As a result, since the beginning of June:

→ the price of bitcoin decreased by approximately 2.2%;

→ the price of Ethereum decreased by approximately 1.8%;

→ the price of BNB, the native token of the Binance exchange, has decreased by approximately 16%.

However, if we look at the Ripple chart today, we will see that the price of XRP has risen by about 2.5% since the beginning of the month. The fact is that Ripple has been in a state of litigation with the SEC since December 2020 (the commission also considers XRP a security). And the latest claims of the regulator have a lesser effect on the XRP exchange rate against the US dollar.

Moreover, rumors are circulating that the SEC has a presentiment that it can lose in a dispute with Ripple. And therefore, with new lawsuits against Binance and Coibase, it is trying to influence the decision in the case with Ripple, to reduce reputational risks.

According to John Deaton (a lawyer defending Ripple): The SEC is “well aware” that the decision of the judge in the Ripple case will be published “in the very near future.” If it turns out to be in favor of Ripple, on a wave of optimism, the price of XRP may rise to the psychological level of $1.

FXOpen offers the world's most popular cryptocurrency CFDs*, including Bitcoin and Ethereum. Floating spreads, 1:2 leverage — at your service. Open your trading account now or learn more about crypto CFD trading with FXOpen.

*At FXOpen UK and FXOpen AU, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules and Professional clients under ASIC Rules respectively. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.