FXOpen

Yesterday, one could observe measured range trading on the market. The main currency pairs once again tested the previously formed extremes, but neither the continuation of old trends nor the formation of reversal combinations was observed. Most likely, investors and market participants are waiting for today's inflation data in the US. The core consumer price index could provide more clues about the Fed's future monetary policy.

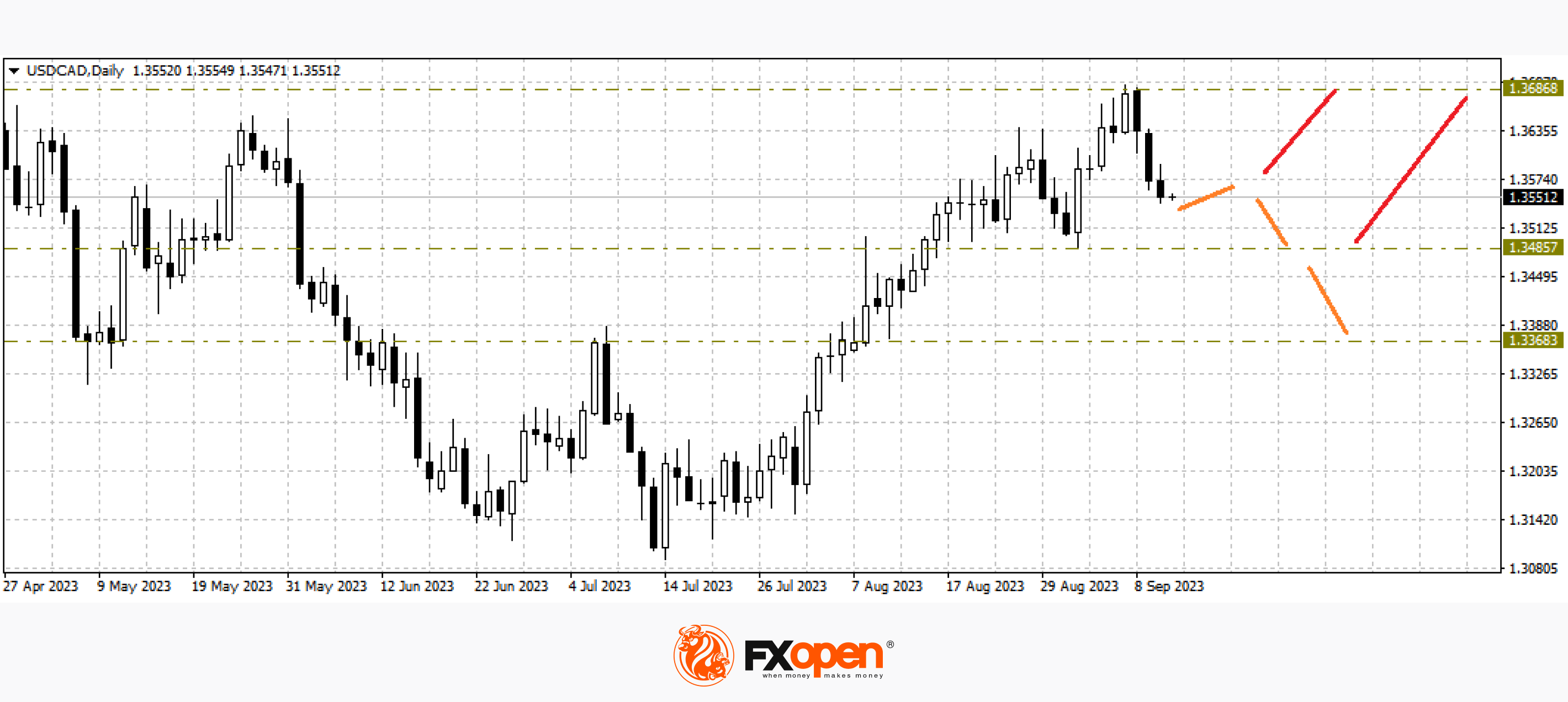

USD/CAD

The rise in oil prices prevented the USD/CAD pair from strengthening above 1.3680. Last week, greenback buyers were determined to move above 1.3700 and test the May highs of this year. The attempt was unsuccessful, and a sharp pullback from 1.3690 allowed sellers to seize the initiative and form a bearish tweezers combination on the daily timeframe. At the moment, the signal to decline is being worked out; the nearest target for sellers will be the range of 1.3500-1.3400. If the upcoming fundamental data of the next trading sessions are positive for the US currency, another approach to 1.3700 may occur. Otherwise, the pair will face a deeper downward correction.

Today at 15:30 GMT+3, we are waiting for data on inflation in the United States, and at 17:30 GMT+3, weekly data on crude oil reserves will be published. A little later, the main Thomson Reuters/Ipsos Canadian Consumer Sentiment Index (PCSI) for September will be released.

GBP/USD

Yesterday, pound sellers again tried to break through the support at 1.2460-1.2440, but, as we can see so far, without success. The pair is trading in a rather narrow range, which is not very typical for GBP/USD, so volatility can be expected to increase in the near future. If buyers manage to get above Friday’s high at 1.2550, a continuation of the upward correction in the direction of 1.2700-1.2800 may happen. A break of 1.2440 may lead to a resumption of the main downward movement.

At 16:15 GMT+3, it is worth paying attention to the speech of the Deputy Governor of the Bank of England, Sam Woods.

EUR/USD

Sellers of the single European currency are not giving up their attempts to break the support at 1.0700. Yesterday, the price once again dropped to this level but again rebounded sharply. In the pair, we can note sluggish range trading between 1.0780-1.0700, and to break through the lower boundary, a good news driver is needed, which market participants will most likely receive in the coming trading sessions. Indeed, in addition to today's inflation data, an ECB meeting is scheduled for tomorrow.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.