FXOpen

The US dollar fell sharply on Wednesday following the Federal Reserve’s decision to cut rates by 0.25%. However, by the end of the session it had regained part of its losses, reflecting ongoing uncertainty over the regulator’s next moves. The pound, meanwhile, after an initial rise on the back of the weaker dollar, turned lower ahead of today’s Bank of England meeting, which could bring fresh volatility to the GBP/USD pair. The Bank of Canada meeting also added to the overall market mood, with the regulator signalling a cautious stance on future policy.

During today’s trading, the market’s attention is focused on fresh US releases: labour market data, initial jobless claims, as well as the Philadelphia Fed’s business activity index and capital expenditure figures. These numbers could either support a corrective rebound in the dollar or renew pressure if they confirm an economic slowdown. For the pound, the key drivers will be the outcome of the Bank of England’s voting and accompanying statements, with uncertainty still surrounding how far the regulator is willing to go in easing policy.

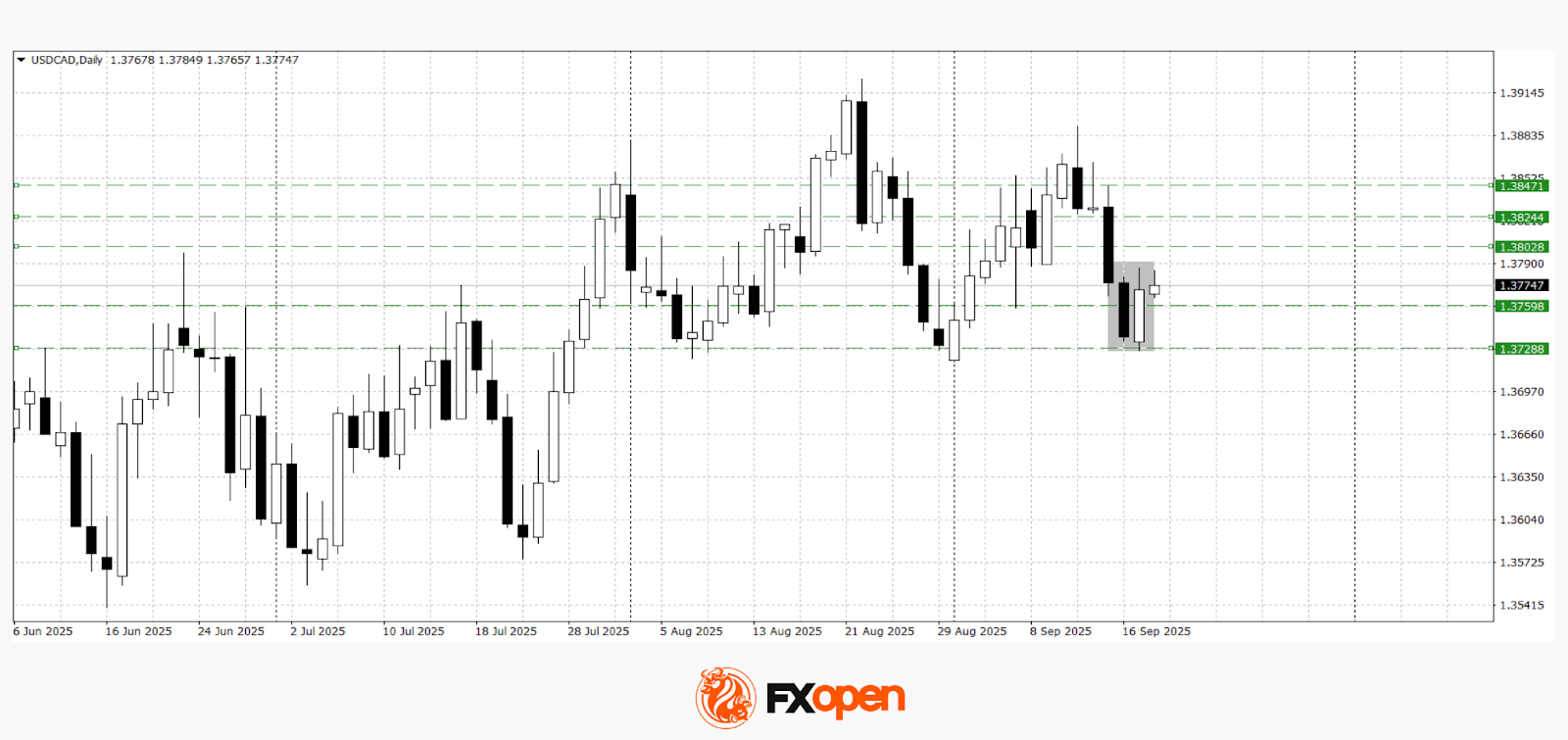

USD/CAD

Yesterday, the price tested 1.3730 and bounced sharply from that level, forming a bullish piercing line pattern. Technical analysis of USD/CAD suggests a potential continuation of the rise towards 1.3800–1.3820, in line with confirmation of the mentioned pattern. Should negative US data emerge, the pair may fall back towards 1.3730–1.3760.

Events that could influence USD/CAD’s direction:

- Today, 15:30 (GMT+3): US Initial Jobless Claims

- Today, 15:30 (GMT+3): Philadelphia Fed Manufacturing Index

- Tomorrow, 15:30 (GMT+3): Canada Core Retail Sales Index

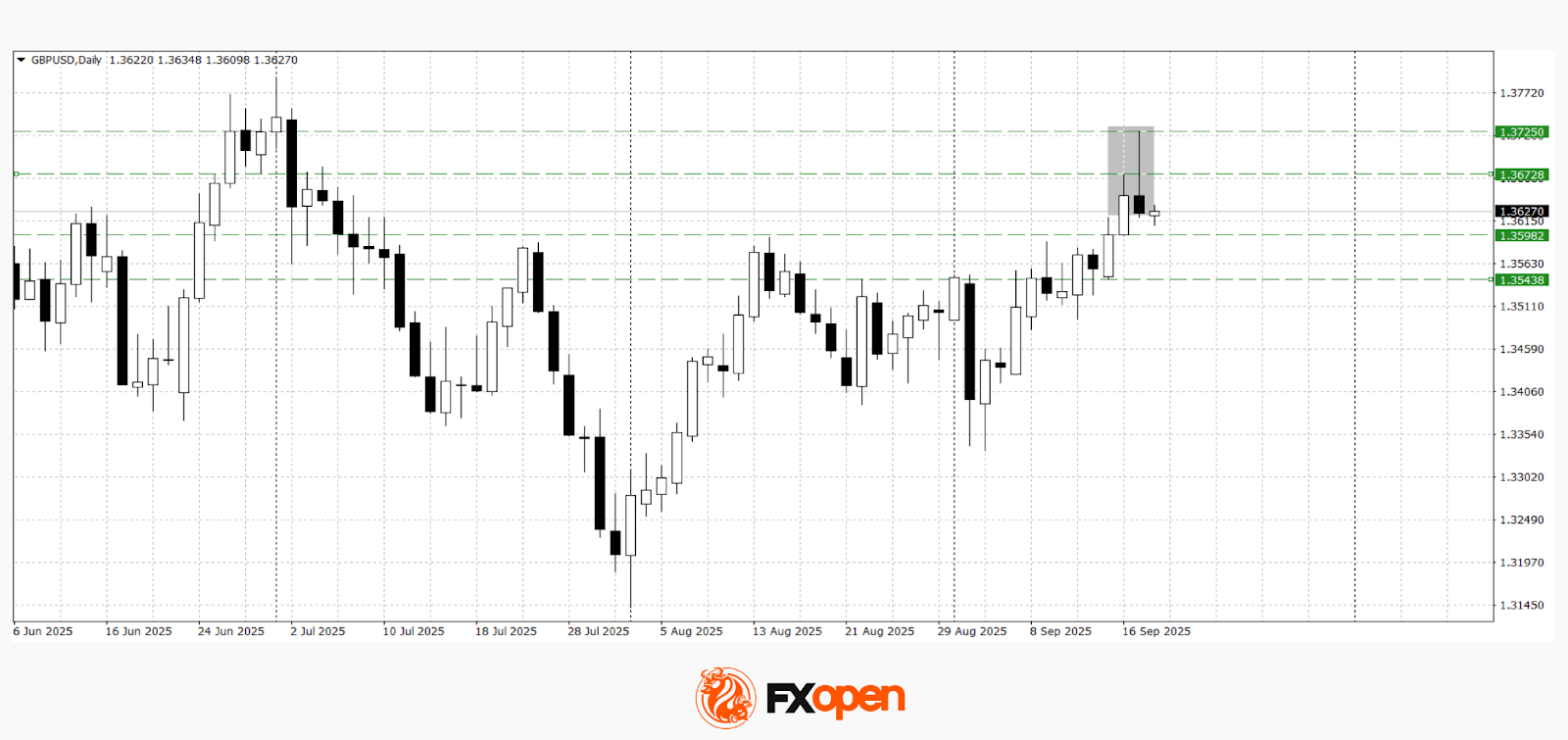

GBP/USD

A three-day rally in GBP/USD ended with a rejection at 1.3725 and the formation of a bearish shooting star pattern. Technical analysis of GBP/USD points to a possible decline towards 1.3540–1.3560. If the pair manages to consolidate above 1.3670, yesterday’s high may be retested.

Events that could influence GBP/USD’s direction:

- Today, 14:00 (GMT+3): Bank of England Votes on Rate Cut

- Today, 14:00 (GMT+3): Bank of England Interest Rate Decision

- Today, 14:00 (GMT+3): Bank of England Monetary Policy Committee Minutes

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.