FXOpen

The Wyckoff method is a complex yet robust trading approach that supports traders when identifying market behaviour through price and volume patterns. Developed by Richard D. Wyckoff in the early 20th century, it may help traders determine repeated market trends and build entry and exit strategies. This article explores the key principles of the Wyckoff method, its market cycles framework, and schematics and provides examples of how they can be applied to modern Wyckoff trading strategies.

What Is the Wyckoff Method?

The Wyckoff method is a type of technical analysis developed in the early 20th century by Richard D. Wyckoff, a renowned stock market trader and analyst. The method is based on the belief that markets are driven by fundamental supply and demand forces and that these forces can be traded through repeatable patterns.

The Wyckoff methodology offers traders a comprehensive system that gives them all the tools they need to create a trading strategy. This system includes the relationship between price and volume, the identification of market structure, and the role liquidity plays in financial markets.

Why the Wyckoff Model Works

To fill big trades, financial institutions require a counterparty like everyone else, i.e., a seller if they want to buy, and vice versa. But when you’re trading billions of dollars at any one time, how do you fill your order at an optimal price without slippage?

They enter stop-losses and breakout trades. These “smart money” players know that there are stop losses above and below equal highs/lows, trendlines, and support and resistance levels that may facilitate their trades. There are also traders waiting to get in on the breakout.

They realise there is liquidity above and below these levels ready to be used to fill their orders. By pushing prices past these levels and playing on retail traders' emotions, they may get in without risking millions of dollars trying to get their orders filled at suboptimal prices. This is the fundamental idea behind the Wyckoff theory in forex, commodities, crypto*, stocks, and more.

Key Principles of the Richard D. Wyckoff Method

There are a few fundamental principles of the Wyckoff methodology that are critical to your understanding: the Composite Man and the three laws.

Composite Man

The Composite Man is the idea that traders should imagine that just one party controls the markets and that they should study them as such. He is, in essence, the “smart money.” Wyckoff believed that the Composite Man carefully plans and executes his trades, encouraging buyers (or sellers) only after he has accumulated a sizable position.

The Law of Supply and Demand

Simply put, if the demand for an asset is larger than its supply, prices will rise. On the other hand, if the supply of an asset is larger than its demand, prices will decrease.

The Law of Cause and Effect

This law states that the dynamics of supply and demand are determined by specific Wyckoff events (the cause), like accumulations and distributions. It also says that the effect, or the price movements, are proportional to the cause. An accumulation that occurs on the daily timeframe will produce a much more significant effect than one on the 1 minute, for instance.

The Law of Effort vs Results

This law says that price movements are a result of effort, characterised by volume. If a bullish trend is supported by strong volume, it will likely continue. Moreover, if a trading range has a high volume but remains consolidated (a minor result), a potential trend reversal could be about to start.

The Market Cycle

The Wyckoff methodology frames the markets in four repeated phases. These are accumulations, markups, distributions, and markdowns.

Accumulations

Most often seen in ranges, the Wyckoff accumulation pattern represents areas where large players are building up a position to go long before the market reveals its true direction to other traders.

Markups

Once they hold a large enough position, these players start to bid the price up, encouraging other traders to jump in and push the price up further. This self-reinforcing cycle of more and more traders getting involved causes the price to shoot up out of the range and begin an uptrend. Note that a markup may have multiple re-accumulations where it pauses and consolidates before breaking higher.

Distributions

Once the price reaches its target and the buying pressure from other traders subsides, the big players will begin to distribute (sell) their positions while building up shorts. This Wyckoff distribution will, again, look like a range before a sharp move down.

Markdowns

This sharp move down is known as the markdown. It’s essentially the opposite of a markup: financial institutions push the price down and encourage traders to enter short positions to begin a downtrend. Like markups, there are also phases of redistribution that consolidate before moving lower.

Wyckoff Schematics

While this might sound like a lot to take in, the cycles can be spotted using the time-tested Wyckoff chart patterns. If you want to test your own understanding, you may use the TickTrader platform with us at FXOpen.

Note that Wyckoff accumulations and distributions are practically identical, just flipped upside down. The key concepts, points, and phases across Wyckoff schematics are all the same.

Type 1 Schematics

Wyckoff Accumulation Schematic

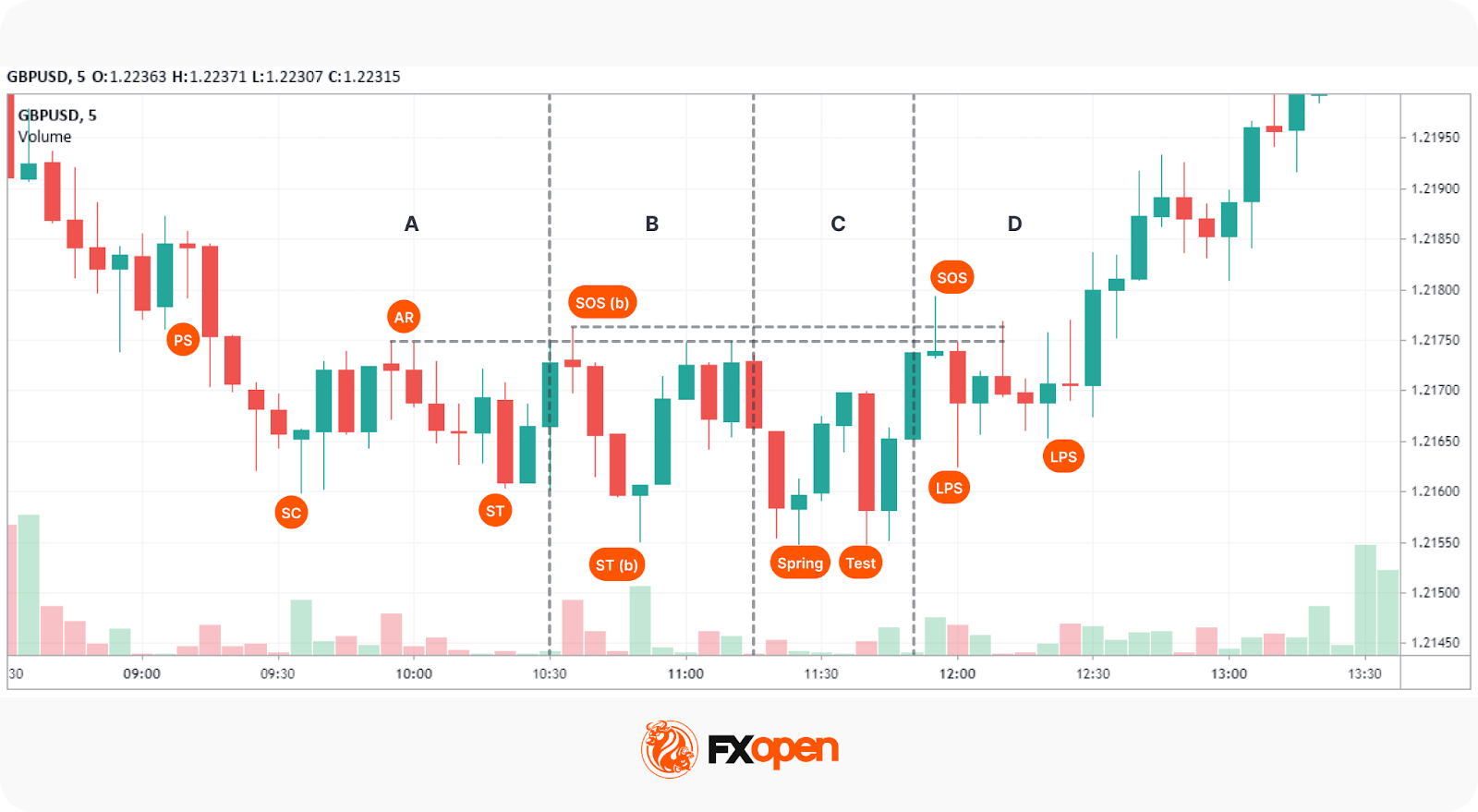

Phase A

- Preliminary Support (PS): After a markdown, buying action interrupts the downtrend and causes a slight uptick in price. Volume increases.

- Selling Climax (SC): Long traders have their stop losses triggered, while breakout traders jump in short, believing the downtrend will continue. Here, the Composite Man absorbs the selling pressure. The SC may sometimes leave a long wick that shows the buying pressure.

- Automatic Rally (AR): Given that selling pressure is exhausted, buy orders push prices up easily, and shorts exit their trades, typically below PS. Note that the high of the AR sets the first upper bound for the accumulation, as seen in the Wyckoff accumulation examples above.

- Secondary Test (ST): The price falls from the AR to form a low near the SC, creating the ST. It can create equal lows or end up slightly higher or lower than the SC. This may also occur multiple times, creating a visual area of support. Volume is likely to be low.

Phase B

- Sign of Strength in Phase B (SOS(b)): After the ST, the price can rebound higher than the AR, forming the SOS(b). This won’t always occur, but if it does, it creates our second upper bound. Again, it is supposed to fall below the PS.

- Secondary Test in Phase B (ST(b)): This is the first “liquidation” event of the accumulation. A sharp move downward takes out the ST and, ideally, the SC. Here, the Composite Man taps into the stop losses below the ST and breakout sell orders to fill his buy orders, creating the Cause.

Phase C

- Spring: Following the ST(b), the price will likely test the first and second upper bounds, but it is supposed to always stay within them. After doing so, the Composite Man will push the price down for the last time below the ST(b), liquidating any orders resting below here to form the Spring.

- Test: After creating the Spring, the Composite Man will often test the area to see if there’s any supply left. The price will make a higher low near the Spring, often with a lower volume. Note that there can be multiple tests.

Phase D

- Last Point of Support (LPS): Following the test and another leg higher, the price will pull back to test supply once again. LPSs are usually much higher than the initial Tests and are often the last move before the markup begins. LPSs can form both before and after the SOS, depending on how the price action plays out.

- Sign of Strength (SOS): Here, the price breaks above the highest upper bound and confirms the schematic, often with higher volume. As mentioned, the LPS can form after the breakout and fall back in the range or test the upper resistance line. After the SOS forms, the markup begins and produces the Effect as seen in the Wyckoff accumulation chart above.

Wyckoff Distribution Schematics

Phase A

- Preliminary Supply (PSY): After an uptrend, the Composite Man begins to unload his position, causing the price to fall slightly.

- Buying Climax (BC): Like the SC, the BC is where buying pressure is at its most extreme, coinciding with high volume.

- Automatic Rally (AR): After buying subsidies, prices fall to form the AR, usually above the PSY. This is our first lower bound, shown in the Wyckoff distribution examples.

- Secondary Test (ST): The price revisits the BC area to create another high usually below the BC, building up liquidity for future phases. The volume should be low.

Phase B

- Sign of Weakness in Phase B (SOW(b)): A move down past the AR that indicates supply is entering the market. Like the SOS(b), the SOW(b) doesn’t always occur, but if it does, it forms our second lower bound.

- Upthrust (UT): This is the distribution equivalent of an ST(b). It must reach higher than the ST and may take out the BC. Here, the Composite Man uses short stop losses and breakout trades to fill his sell orders.

Phase C

- Upthrust After Distribution (UTAD): The UTAD is analogous to an accumulation’s Spring. Following the UT, one last tap into areas of liquidity is made before the markdown.

- Test: Similar to accumulation, there are usually one or more tests made near the UTAD attempting to see if any demand remains.

Phase D

- Last Point of Supply (LPSY): After the price declines, the final demand tests are made. Like accumulations, these points can occur before or after the Sign of Weakness. They’re typically the last bullish moves made before the markdown begins.

- Sign of Weakness (SOW): The lowest bound is broken as the price begins to confirm its bearish structure. Another LPSY can be made, but this is the final step before the markdown.

Type 2 Schematics

Type 2 Wyckoff schematics have all of the same ingredients, just without a Spring or UTAD. How do you know if what you’re looking at is a Type 2 schematic? Just wait for the SOS or SOW to occur. If you have just a single ST and an ST(b), or an ST and UT, and the markup or markdown begins, you know it’s a Type 2. This is seen in the Wyckoff graph above. Both can be traded in the same ways as a Type 1.

Wyckoff Trading: Pros and Cons

The Wyckoff trading method offers a systematic approach to analysing market trends and making trading decisions. Like any trading strategy, it comes with its advantages and disadvantages that traders often consider.

Pros

- Structured Framework: The Wyckoff method provides a clear framework for identifying market phases, supporting traders when building entry or exit strategies.

- Focus on Market Psychology: It emphasises understanding the behaviour of the "Composite Man," which can offer insights into market sentiment and potential moves.

- Versatility: The Wyckoff strategy can be applied across various markets, including forex, stocks, commodities, and cryptocurrencies*.

- Incorporates Volume Analysis: Analysing volume in relation to price action may help traders to gauge the strength of trends and potential reversals.

Cons

- Complexity: The Wyckoff trading method requires a deep understanding of market mechanics and chart patterns, which may be challenging for beginners.

- Requires Patience: Identifying the correct phase of a Wyckoff accumulation or distribution can take time, and trades may require waiting for confirmation signals.

- Subjective Interpretation: Like many technical analysis tools, the Wyckoff method depends on the trader's interpretation, leading to varying results.

- Not Foolproof: While the Wyckoff market cycle method is powerful, it is not infallible and is typically used in conjunction with other analysis tools.

The Five-Step Wyckoff Trading Strategy

Luckily for us, Wyckoff developed a five-step strategy for using his methodology. This could be used to create your own Wyckoff forex trading strategy.

1. Determine the current market trend. Assess whether the overall market is bullish or bearish.

2. Choose your market. Find a pair that strongly correlates to this overall trend.

3. Find a pair currently undergoing accumulation or distribution.

4. Determine the pair’s readiness to move. This involves examining the Wyckoff phase of the asset and volume. If a Spring or UTAD has just occurred, you could consider it viable.

5. Find your entry. Traders often enter on Tests or LPS/LPSYs.

Final Thoughts

Despite nearly being a century old, Wyckoff’s logic in forex trading may help traders around the world to develop trading strategies. It reflects important price–volume relationships and market structure, which support traders when determining key turning points. It may form the basis of a trading approach when combined with other types of technical analysis, such as harmonic patterns, indicators, and support/resistance levels.

If you want to apply the Wyckoff method or test other trading approaches, you can consider opening an FXOpen account to trade over 700 markets with tight spreads and low commissions.

FAQ

What Are the 4 Stages of the Wyckoff Cycle?

The Wyckoff cycle consists of four stages: accumulation, markup, distribution, and markdown. Accumulation is where large players build positions, markup is the uptrend, distribution is where positions are sold, and markdown is the downtrend.

What Are the Three Laws of Wyckoff?

The three laws of Wyckoff are the Law of Supply and Demand, which dictates price movement; the Law of Cause and Effect, which links accumulation/distribution to market movements; and the Law of Effort vs Results, which compares price action with volume to analyse trends.

What Is the Wyckoff Trading Range?

The Wyckoff trading range refers to the price range where accumulation and distribution occur. It represents areas of consolidation where major players accumulate or distribute positions before the market trends up or down.

What Timeframe Is Popular for the Wyckoff Method?

The Wyckoff method can be applied to various timeframes, but it is mostly used on daily and weekly charts, where the patterns are more clearly defined.

Can You Use Wyckoff for Day Trading?

Yes, the Wyckoff method can be adapted for day trading, but it requires a good understanding of short-term market dynamics and quick decision-making skills.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.