FXOpen

Market structure gives traders a way to read price behaviour beyond indicators and short-term noise. One of the tools within Smart Money Concept analysis is the Break of Structure, a framework used to assess whether a trend is continuing or losing control.

Rather than focusing on individual candles, a BOS looks at swing points, closes, and context across timeframes to build a clearer directional picture. Used correctly, it may support market analysis and trade alignment. This article explores what a Break of Structure is, how it’s identified, and how traders use it in practice.

Takeaways

- A Break of Structure refers to the Smart Money concept, confirming a trend continuation. It appears when the price breaks a key swing level in the direction of the existing trend, confirming that market structure remains aligned with that direction rather than signalling a reversal.

- To identify a Break of Structure, traders analyse swing highs and lows within a clear trend and look for a decisive close beyond them.

- A Break of Structure is commonly used as a confirmation tool. It may help traders frame directional bias and filter setups that align with higher-timeframe structure.

- A Break of Structure on a lower timeframe may sit within a pullback on a higher timeframe, so market structure is always relative to the chart being analysed.

- When combined with tools like Fibonacci Retracements, Order Blocks, or Imbalance Zones, a Break of Structure may help traders structure entries, invalidation levels, and trade management more clearly.

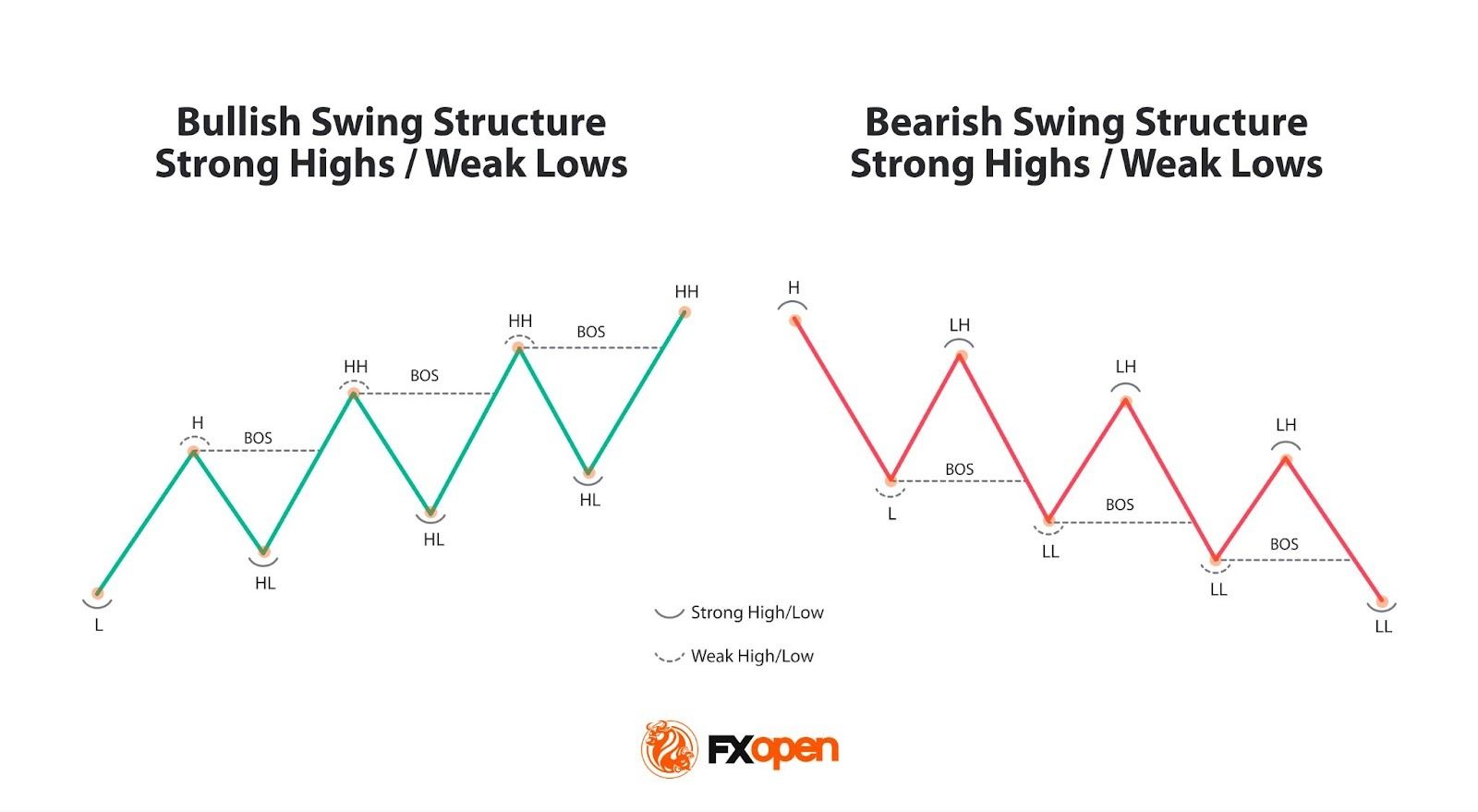

Strong and Weak Swing Points

In Smart Money Concept trading, understanding the basics of market structure may be important, particularly when discerning between strong and weak swing points. These points are pivotal in analysing the current trend and play a significant role in identifying potential breaks in structure.

A strong swing point, whether it be a high in a downtrend or a low in an uptrend, is considered to be likely to hold if the price revisits the area. A bullish trend, for example, is denoted by a series of higher highs and higher lows. For the trend to remain, traders typically watch that the last higher low is not breached.

Conversely, a weak swing point is seen as vulnerable and more likely to be breached. In an uptrend, a peak or area of resistance is expected to be traded through, continuing the trend.

Recognising these points is not just about spotting highs and lows; it's about understanding their context within the market's narrative. They illuminate the path for traders, indicating where the market might head next and highlighting potential areas for a Break of Structure.

What Is a Break of Structure?

A Break of Structure (BOS) is a concept used to determine a trend continuation. It forms when the price breaks a key swing level in the direction of the existing trend, signalling that market structure remains intact. In an uptrend, this means price pushes beyond the most recent swing high while the prior higher low remains untouched.

That break shows buyers are still in control and that demand has been strong enough to absorb selling pressure at previous highs. Similarly, in a downtrend, a BOS is identified when a new low is established lower without moving beyond the prior high, showing sellers are in control. Rather than hinting at a reversal, a BOS reflects continuation, with structure confirming that the current directional bias is still valid.

How Traders Identify a Break of Structure

Identifying a BOS, as dictated by the Break of Structure theory, starts with discerning the current trend through an analysis of existing peaks and troughs. This involves observing whether there are consecutive higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend.

It's crucial to recognise that structure can vary across different timeframes; a pattern appearing bullish in one may be just a corrective phase within a broader bearish movement on another.

To accurately identify a BOS, traders focus on pinpointing key swing points: the strong swing point, which shouldn't be breached for the trend to remain valid, and the weak swing point, which is expected to be surpassed if the trend continues.

A genuine BOS is confirmed when the price not only trades through but also closes convincingly past the weak swing point, marking a new high or low in the trend. While a wick beyond this point can suggest a BOS, it's considered less reliable and might simply be an attempt at a liquidity grab.

To have a go at identifying your own Break of Structure examples, you can consider using FXOpen’s TickTrader platform to access real-time forex, commodity, stock, and crypto* CFD charts.

Break of Structure Trading Strategy

This BOS strategy leverages the natural ebb and flow of trends, capitalising on the continuation patterns that emerge. This approach hinges on the identification of a BOS, followed by strategic positioning to take advantage of the expected trend continuation.

Utilising tools like the Fibonacci retracement between significant points allows traders to pinpoint potential entry zones within the context of a BOS, aligning with key levels where price retracements often stall and reverse back in favour of the prevailing trend.

Entry

- Traders typically identify a BOS in line with the current trend, employing a Fibonacci retracement tool between the high and low (in an uptrend) or low and high (in a downtrend) of the range the BOS originated from.

- They look for potential retracement to the 61.8%, 50%, or 38.2% levels, areas where the price is likely to retrace before continuation. The 50% level serves as a common medium for entry if the retracement depth is uncertain.

Stop Loss

- A stop loss might be placed just below the trough (in an uptrend) or above the peak (in a downtrend) of the swing that prompted the BOS.

Take Profit

- Take-profit orders might be placed at the previous high or low that initiated the retracement or at another strategic point, like an order block that aligns with the current momentum.

Within the SMC framework, tools like order blocks and imbalances/fair value gaps can complement this strategy. Specifically, if an imbalance exists, there’s a decent probability it’ll be filled before the trend continues. Likewise, the price will often meet an order block before continuing a trend.

In this context, a trader might prefer to set an order at one retracement level, particularly if it aligns with an imbalance fill or order block.

Difference Between a Break of Structure, Change of Character, and Market Structure Shift

Understanding the differences between a Break of Structure (BOS), Change of Character (ChoCh), and Market Structure Shift (MSS) is pivotal for navigating structure.

Break of Structure (BOS)

A BOS indicates a continuation of the current trend. It occurs when the market forms a new top in an uptrend or a new bottom in a downtrend, reinforcing the existing directional momentum. This action signifies strength in the prevailing trend without suggesting a reversal.

Change of Character (ChoCh)

While a BOS aligns with the trend's direction, a Change of Character (ChoCh) represents a break in the opposite direction. It happens when a previously strong swing point, which should act as a barrier to protect the trend, is breached. This breach, especially if it involves a significant swing point, might suggest the onset of a new trend, challenging the current trajectory.

Market Structure Shift (MSS)

A Market Structure Shift (MSS) embodies the principles of a ChoCh but with additional confirmation of a potential trend reversal. Before a strong swing point is decisively broken, the market first fails to continue the trend by plotting a higher low (bull) or lower high (bear) but failing to create a higher high or lower low.

It then proceeds to break a strong swing point with a ‘displacement’ (a strong impulse move) that significantly penetrates through this point. Essentially, an MSS is a comprehensive indication that not only has the trend paused, but a new trend in the opposite direction has begun to establish itself, marked by lower highs in an uptrend or higher lows in a downtrend before the break.

In summary, a BOS aligns with the current trend, a ChoCh hints at a reversal by moving against the trend, and an MSS is a ChoCh that has already started plotting a new direction before strongly breaking through the current trend.

The Bottom Line

Navigating the complexities of market structure—particularly concepts like Break of Structure—may help traders interpret trend dynamics. Applying these principles may contribute to informed trading and strategy development. By focusing on how price reacts to key levels, traders can align their analysis with prevailing market conditions and reduce reliance on isolated signals.

If you want to test the Break of Structure concept, you can consider opening an FXOpen account to access over 700 instruments, tight spreads, and low commissions (additional fees may apply).

FAQs

What Is the Break of Structure in Trading?

A Break of Structure (BOS) in trading refers to a scenario where the market surpasses a previous peak in an uptrend or falls below a previous bottom in a downtrend, indicating the continuation of the current trend. It serves as a signal that the momentum may still be in favour of the prevailing trend direction.

How Can Traders Identify a Break of Structure?

Identifying a BOS involves observing the formation of new highs or lows within the context of a relevant trend. Traders look for a conclusive move past the most recent significant swing point that aligns with the current direction, often confirmed by a strong closing beyond this point.

What Is the Difference Between BOS and ChoCh?

While a BOS signifies trend continuation by producing new highs or lows, a Change of Character (ChoCh) occurs when the market breaks a significant swing point in the opposite direction of the current trend, potentially indicating the start of a new trend or reversal.

What Is the Difference Between BOS and MSS?

Both BOS and Market Structure Shift (MSS) involve breaking significant points, but an MSS is generally associated with a step further. It not only indicates a potential trend reversal, like a ChoCh, but also establishes the beginnings of a new trend by setting a lower high or higher low before breaking through the existing trend's strong swing point, signalling a more definitive shift in market direction.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.