FXOpen

Trading indices can be an exciting way to take advantage of macroeconomic trends and volatility in the stock market. Want to learn more about index trading? In this article, we’ll break down what indices are, learn what factors influence their prices, and give you some tips on how you can get started trading indices today.

What Are Indices in Trading?

Indices, also referred to as stock indices, are used to gauge the performance of a specific stock market or sector. Indices are made up of a set number of stocks in a particular country or industry and reflect the overall performance of these stocks. Traders can use indices to gain exposure to an entire industry or economy without purchasing individual shares, which can be time-consuming and costly.

The S&P 500, one of the most popular indices, consists of the 500 largest publicly traded companies in the United States. Another commonly-traded index is the Dow Jones Industrial Average (DJIA), which tracks the performance of the top 30 blue-chip stocks in the USA. The Nasdaq 100, meanwhile, allows traders to gain exposure to the broader US technology market.

Interestingly, the price of an index can be disproportionately affected by its components compared to another index. For instance, many companies in the S&P 500 are also included in the technology-based Nasdaq 100. However, since tech stocks are usually more speculative and seen as riskier investments, key market movers can cause more volatility in tech stocks than in other sectors included in the S&P 500, like industrials or healthcare.

Indices are commonly used as a benchmark by investment fund managers, who aim to beat the annual returns offered by a particular market. Many retail investors choose to invest passively in index-based exchange-traded funds (ETFs), which are designed to be held long-term. In contrast, traders can trade index contracts for difference (CFDs) and exchange-traded funds.

How Are Indices Compiled?

Specialised committees oversee the management of indices and determine the standards that a stock must meet to be included in the index. These committees periodically meet – typically annually or quarterly – to assess the index’s guidelines and determine whether companies should be added or removed. If a stock fails to meet the index criteria, the committee may opt to remove it or offer a grace period for it to comply with the requirements.

What Are Indices in Forex?

While many traders focus on just stock indices, there are other types, like forex indices. These indices reflect the strength of a currency against a basket of currencies in the foreign exchange market. DXY is the most well-known and measures the performance of the US dollar against six other currencies.

However, while useful for helping traders to guide their analysis, few participate in trading forex indices. In this article, we’ll be talking about stock indices specifically.

How Are Stock Indices Calculated?

There are three ways in which the price of an index is calculated: price-weighted, market capitalisation-weighted, and unweighted.

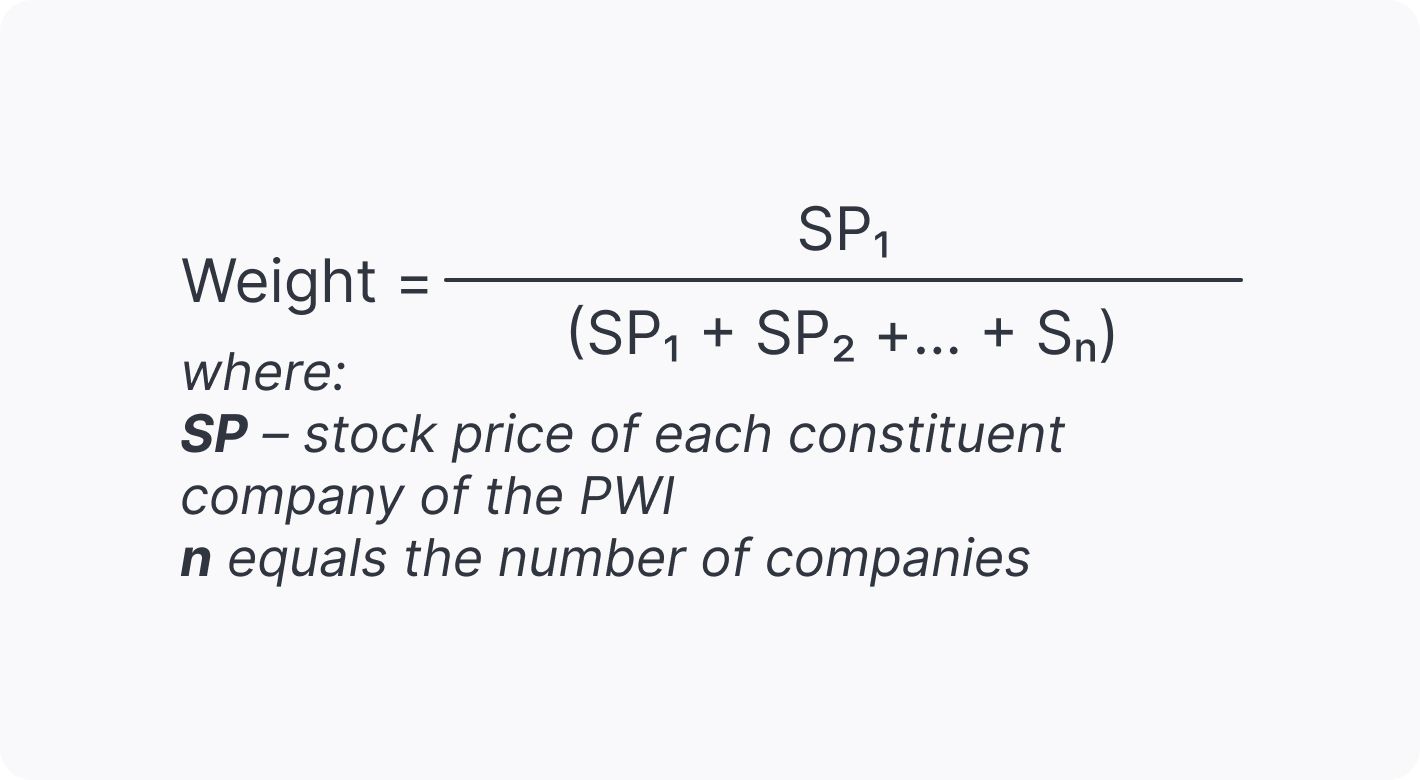

Price-Weighted Index (PWI)

Price-weighting gives more weight to stocks according to their share price. So, if stock A is worth $10, and stock B is worth $100, stock B will have 10x the impact on the overall price of the index.

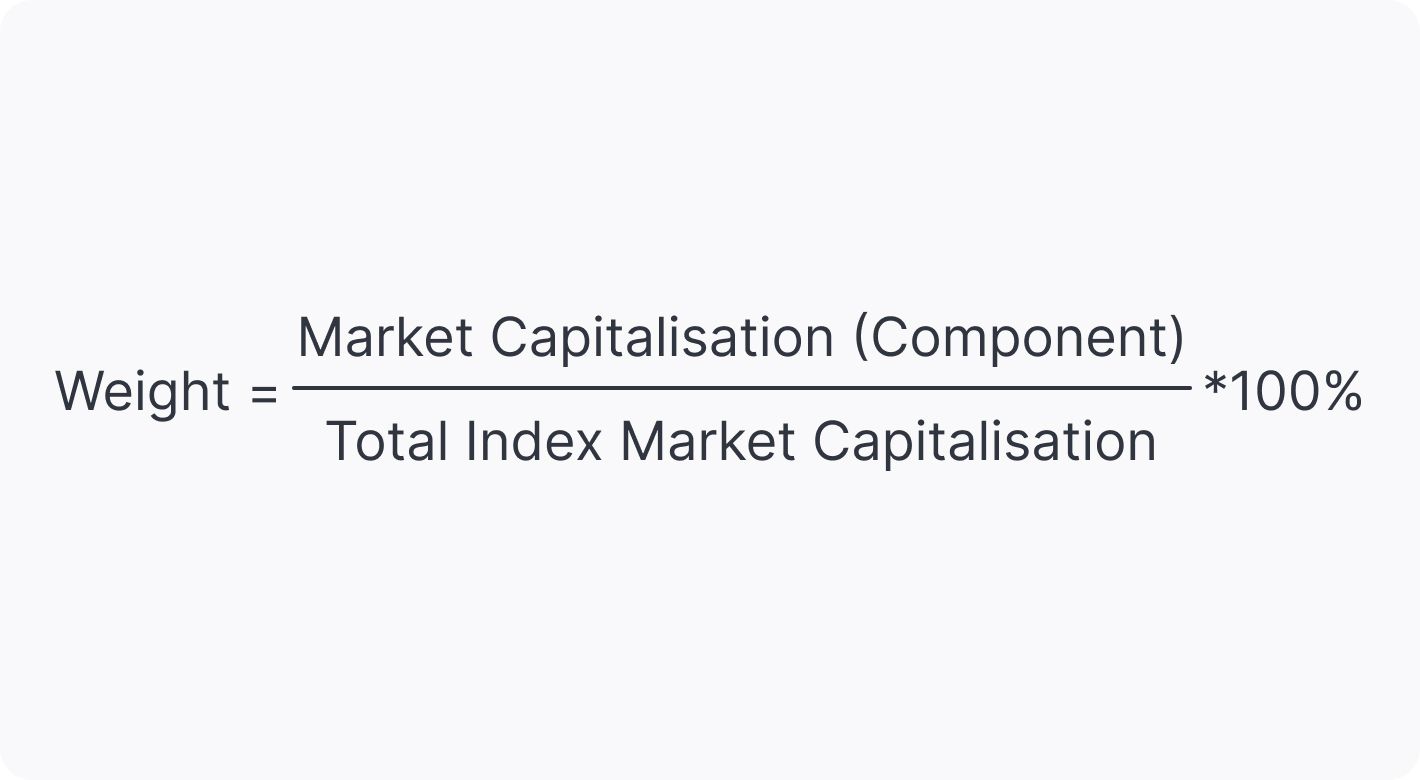

Market Capitalisation-Weighted

Market capitalisation refers to the value produced by multiplying a stock’s price by its number of outstanding shares. Instead of assigning weight based on current stock prices, indices that use market capitalisation-weighting are heavily influenced by the companies with the highest market capitalisation.

Unweighted

Unweighted indices, on the other hand, give equal weight to all stocks in the index, regardless of their price or market capitalisation. This means that each stock has an equal impact on the index value. Unweighted indices are less sensitive to fluctuations in individual stocks and are usually much more stable than price or market capitalisation-weighted indices.

What Moves the Price of Indices?

Many factors can influence the positions traders take when index trading, meaning that it’s essential to understand the ins and outs of these markets before you begin trading them. Note that some of these factors also influence currencies, so understanding what affects indexes may also help develop your forex trading skills.

Economic Releases and Events

Economic releases, like gross domestic product (GDP), employment data, and inflation reports can significantly affect indices. Generally speaking, positive data will strengthen an index’s price, while negative data can harm investor sentiment and increase selling pressure.

Central bank interest rate decisions can also play a major role in the performance of stocks. A hawkish monetary policy, characterised by rising interest rates, can make investing in stocks less attractive, reducing demand and causing prices to fall. On the other hand, a dovish monetary policy, where interest rates are lowered, can boost investor sentiment and increase demand for stocks.

Company Earnings

Earnings season, usually a period at the end of the quarter where companies report their earnings, can cause tremendous volatility in indices. Earnings from companies with the most weight can have an outsized effect on the price of an index, especially if they are far beyond analysts’ expectations.

Company Announcements

Whether a company has significant weight in the index, as well as mergers, acquisitions, leadership changes, employee lay-offs, and other corporate news can impact the price of a company’s shares, which could affect the market index.

Currency Strength

When a country's currency becomes stronger, it becomes more expensive for other countries to import goods from that nation, which can negatively impact the performance of indices that contain many exporting companies. This is because it reduces profits and sales for individual firms. On the other hand, a weaker currency typically leads to the opposite effect.

Global Events

Negative world events can cause investors to rush for the exit door as they scramble to convert their holdings into cash. Times of uncertainty such as the days following 9/11, the 2008 financial crisis, and the start of the COVID-19 pandemic, can lead to a broad sell-off in the stock market and severely affect indices. These events often result in wild swings in an index’s price as investors try to assess the potential impact on their investments.

Index Rebalancing

Indexes are typically rebalanced at set points over the year, usually quarterly or annually. Stocks that fall below the minimum requirements are dropped from the index, while stocks with a high enough share price or market cap are included. These changes to the index’s composition can lead to higher volatility.

Commodity Movements

Finally, changes in the price of commodities can grow or damage commodity-focused economy indexes. The ASX 200, Australia’s primary stock index, has benefitted from higher commodity prices, like gold, iron ore, and crude oil. BHP, one of the index’s largest components, is one of the country’s key exporters of raw materials and saw bumper profits as the price of these commodities rose. This helped to boost the ASX significantly.

How to Trade Indices via CFDs

CFDs allow traders to speculate on the price movements of an underlying asset, such as a stock index, without actually owning it. Using CFDs, traders can also go long or short, meaning they can profit from both rising and falling markets. If you’re ready to start trading stock indices, here are some steps you can follow.

1. Choose Your Market

Many traders prefer to stick with the S&P 500, but there are plenty of other options. You could trade the Nasdaq 100. Alternatively, you might want to go with what you know and trade your home country’s stock index, like the UK’s FTSE 100, France’s CAC 40, or the German DAX 40. Note: at FXOpen, these indices can be found under US SPX 500 (mini), US Tech 100 (mini), UK 100, France 40, and Germany 40 (mini) tickers, respectively.

At FXOpen, we offer commission free CFD trading for many of the world’s leading stock indices. Also, traders can enjoy index CFD trading with the minimum trade size of 0.01 lot. At FXOpen, index CFDs are traded as leverage products – you can increase your initial capital with leverage of up to 1:20 for retail clients (1:10 for retail traders of the Hong Kong 50 index) and up to 1:500 for professional clients and clients at FXOpen International.

2. Create an FXOpen Account

The next step is to open an FXOpen account so that you can start trading index CFDs. If you’d like to demo trade until you find your feet, you can also open a free demo account.

3. Determine Your Strategy

Based on the factors listed here, you might deduce that a hypothetical interest rate hike by the Australian central bank will strengthen the Australian dollar and reduce profits for companies in the export-focused ASX 200. Or, you might think that an upcoming GDP report will show a significant US economic slowdown and send tech stocks in the Nasdaq 100 plummeting.

Alternatively, you can employ technical analysis to help you find entry points when trading stock indices. Fibonacci retracements, candlestick patterns, and pullbacks can help traders determine where trends are likely to reverse or continue. More advanced techniques, like the Wyckoff method, Elliott waves, and harmonic chart patterns, can also be used to gain an edge when trading a stock index. You can use the TickTrader platform to examine technical analysis tools and build your strategy.

4. Keep Up to Date With Market News and Developments

Finally, make sure to follow the latest market developments, including upcoming economic releases, earnings reports, and world events, that could affect your chosen stock index. You could learn more about and anticipate the factors that might have the most significant impact on a given market, like Non-Farm Payrolls for the S&P 500. You can also follow financial news and read analyst reports to stay on top of the latest developments for the indices you’re trading.

Final Thoughts

If you were wondering, “what is indices trading?”, we hope this article has given you a comprehensive overview of how indices work, what affects their price, and how you can get started trading them. Becoming an index trader requires a slightly different approach than forex trading, but with practice, dedication, and the right mindset, you can learn how to trade indexes effectively in any market condition.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.