FXOpen

The United Nations currently recognises 180 world currencies as legal tender. They are traded in the forex market with an average daily turnover of $7.5 trillion as of April 2022, and the major currency traded in the international market is the US dollar. Forex trading is especially popular among central banks, government institutions, and traders.

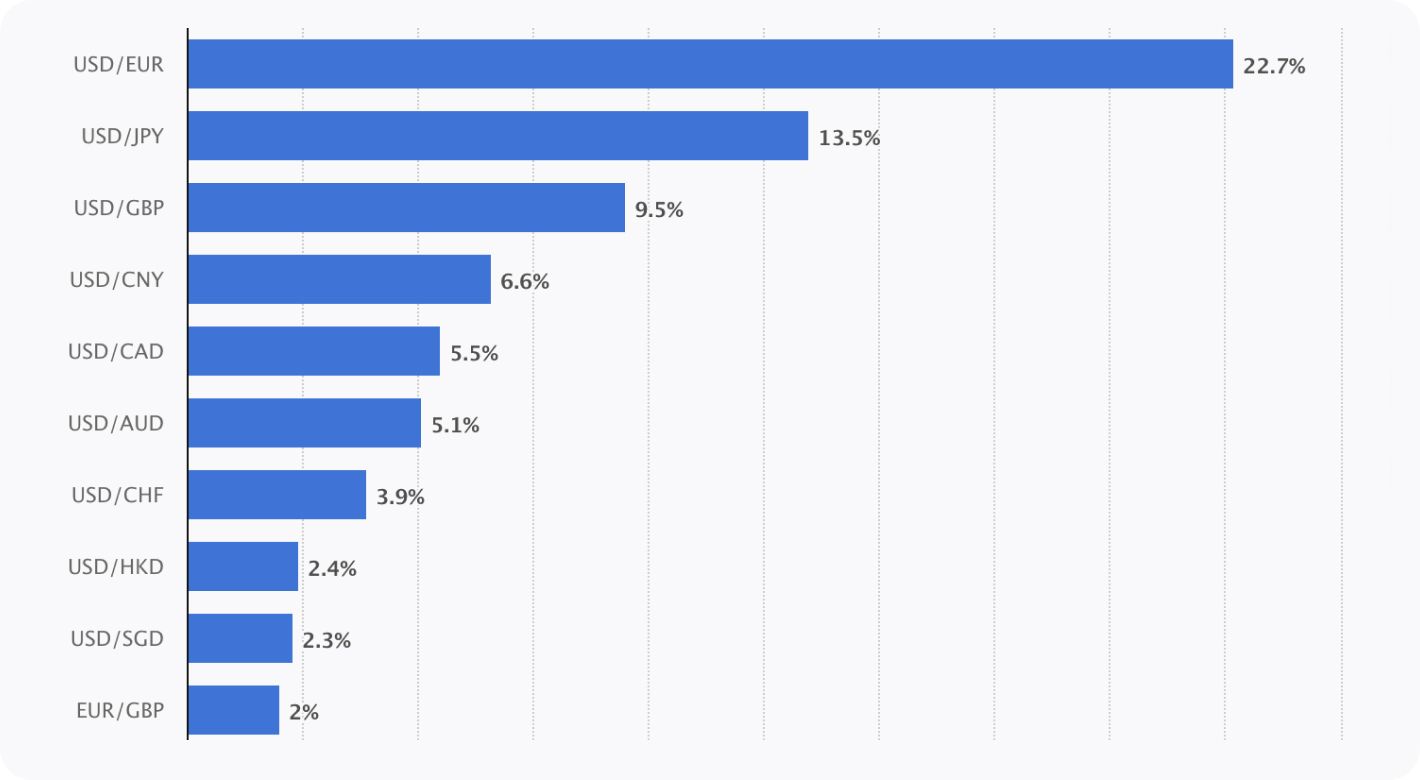

There is no common opinion on what the best currency pair for forex trading is, but we can surely see a trend. According to Statista, most of the leading forex currency pairs include the US dollar – it is the constituent currency in nine out of the ten most traded pairs as of April 2022. In this article, we will explore the 10 most traded currency pairs in more detail and highlight the main factors influencing their rates.

Source: Statista

The USD dominated the list of the best forex trading currencies in 2022. The most common forex transaction was the EUR and the USD: it accounted for about 23% of the daily turnover. It was followed by the USD and the Japanese yen. The third place was taken by transactions in the US dollar and the British pound. The only pair without the US dollar was the euro and the British pound, which accounted for 2%.

Forex Pairs Explained

A currency pair refers to the quote for two currencies traded in pairs on the foreign exchange market. When placing a buy order, the first or base currency is bought, while the second or quote currency is sold. For EUR/USD, the euro is the base currency and the US dollar is the quote currency.

Currency pairs can be classified by trading volumes. There are major and minor pairs. Majors are defined by a high trading volume and tight spreads.

At FXOpen, you can trade major currency pairs with leverage of up to 1:30 (1:500 for Professional clients, or clients at FXOpen INT).

Minors are less popular for transactions, so they have lower trading volumes and wider spreads. The major world currencies are the US dollar, the euro, the British pound, the Japanese yen, and the Swiss franc. However, major pairs comprise more than just EUR/USD, GBP/USD, USD/CHF, and USD/JPY. You can check the list of major currencies at FXOpen.

There are also exotic currency pairs that include the currency of a developing country. They may have large trading volumes but their spreads are also typically wider than the major forex pairs.

It’s worth knowing that those pairs that don’t include the US dollar are called cross pairs— for example, EUR/GBP.

Let’s look closer at the forex currency pairs list and learn which currencies are traded the most.

Note: The information below doesn’t indicate which currency pair is most profitable in forex. Profitability and high trading volumes aren’t interconnected.

1. EUR/USD

EUR/USD is the highest trending pair in the world. This is the ticker that tells traders how many US dollars are needed to buy euros. The Euro/US dollar pair is popular because its components represent the two most influential economies in the world.

The US dollar is influenced by the Fed’s monetary policy, its direct market interventions, and the country’s economic situation. The EUR quotes are affected by European Central Bank monetary policy, and such economic factors as employment rates, budget deficits, and national debt levels.

2. USD/JPY

US dollar/Japanese yen accounts for about 13.5% of the daily turnover of the forex. USD/JPY indicates how many yen you need to pay to buy one US dollar. It has high liquidity, so it may have tight spreads. The yen value is determined primarily by economic metrics such as GDP, retail sales, industrial production, inflation, and trade balance.

3. USD/GBP

USD/GBP is in the top 3 most traded pairs with 9.5% of the daily turnover. Its exchange rate corresponds to the number of British pounds required to buy one US dollar. The pair quotes are influenced by the strength of both UK and US economies as well as the monetary policies of the Federal Reserve and the Bank of England.

4. USD/CNY

USD/CNY represents the exchange rate of the US dollar against the Chinese yuan. It’s classified as an exotic pair because one of its constituent currencies relates to a developing country. USD/CNY has a smaller trading volume and relatively high spreads. The People’s Bank of China establishes interest rates and other conventional monetary tools that affect CNY value.

5. USD/CAD

USD/CAD is the ticker for the US dollar to the Canadian dollar pair. It’s a commodity pair along with AUD/USD and NZD/USD. Analysts mention a high correlation between commodity prices, especially oil, and the value of the Canadian dollar. As one of the most heavily traded pairs, USD/CAD deserves close attention. Be aware that the economic ties between the US and Canada can sometimes make it highly volatile.

6. AUD/USD

The Australian dollar (AUD) is the official currency of Australia and an important ‘commodity dollar’ in the exchange market. AUD/USD is very popular among forex traders thanks to its liquidity and correspondence with global economic trends. It usually reacts quickly to economic data. The AUD rates are affected by the Reserve Bank of Australia’s policies and reports from the Bureau of Statistics. Also, Australian and Chinese economies are interconnected, as China is Australia's largest bilateral trading partner, accounting for about a third of all trade.

7. USD/CHF

The pair with the US dollar and the Swiss franc, also known as “swissie,” is the seventh most traded instrument in the market. USD/CHF has significant daily volumes, high liquidity, as well as tight spreads. The CHF rates are influenced by the Swiss National Bank and economic data published by the Swiss Federal Statistical Office (FSO).

8. USD/HKD

Unlike other currency pairs that suffer from enormous volatility, the USD/HKD rate is quite predictable. The Hong Kong Monetary Authority, which is a central bank de facto, has the authority to keep the exchange rate between 7.75-7.85. The USD/HKD rate fluctuates depending on geopolitical events and announcements about the condition of the respective economies.

9. USD/SGD

USD/SGD is made up of the USD and the Singapore dollar (SGD). The pair offers a path to the Pacific market. The SGD is regulated by the Monetary Authority of Singapore (MAS) and is affected by the value of raw materials, political stability, and economic growth of both economies.

10. EUR/GBP

EUR/GBP is the symbol for the euro to British pound sterling pair. It’s a cross pair as it doesn’t include the US dollar. It represents two of the largest economies in Europe – the UK and the EU, which are closely interconnected. The flow of capital between these economies allowed EUR/GBP to maintain a relatively stable price movement compared to other trading instruments.

Where Can I Trade Forex Currency Pairs?

We can’t tell you what the best currency to trade right now is. The list above includes the instruments that are traded the most. To choose the suitable one for you, you can use the TickTrader platform, which offers boundless opportunities for traders in the Forex market.

Also, with FXOpen you can trade contracts for difference (CFDs) on such assets as stocks, cryptocurrencies*, ETFs, indices, and commodities. For this, you just need to open an FXOpen account.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.