FXOpen

An ascending triangle is a chart pattern that usually signals a trend continuation but can be used for a reversal signal. It’s the biggest challenge of all the triangles. Usually, patterns are divided into continuation and reversal; however, triangles are setups that may provide both signals. This FXOpen guide will explain how to identify when the rising triangle signals a price reversal and when it forecasts a trend continuation.

What Is an Ascending Triangle?

An ascending or rising triangle is a bullish setup that is framed by two trendlines. The upper line connects highs placed at almost the same level, while the lower line is angled and connects higher lows.

The triangle’s appearance is explained as follows: buyers try to push the price up, but they meet a strong resistance level, so it rebounds. Still, buyers have strength, which is reflected in higher lows. Therefore, they continue pushing the price until it breaks above the resistance level. The period during which the price bounces back and forth between the two lines depends on the timeframe. On daily charts, the triangle can be in place for over a week.

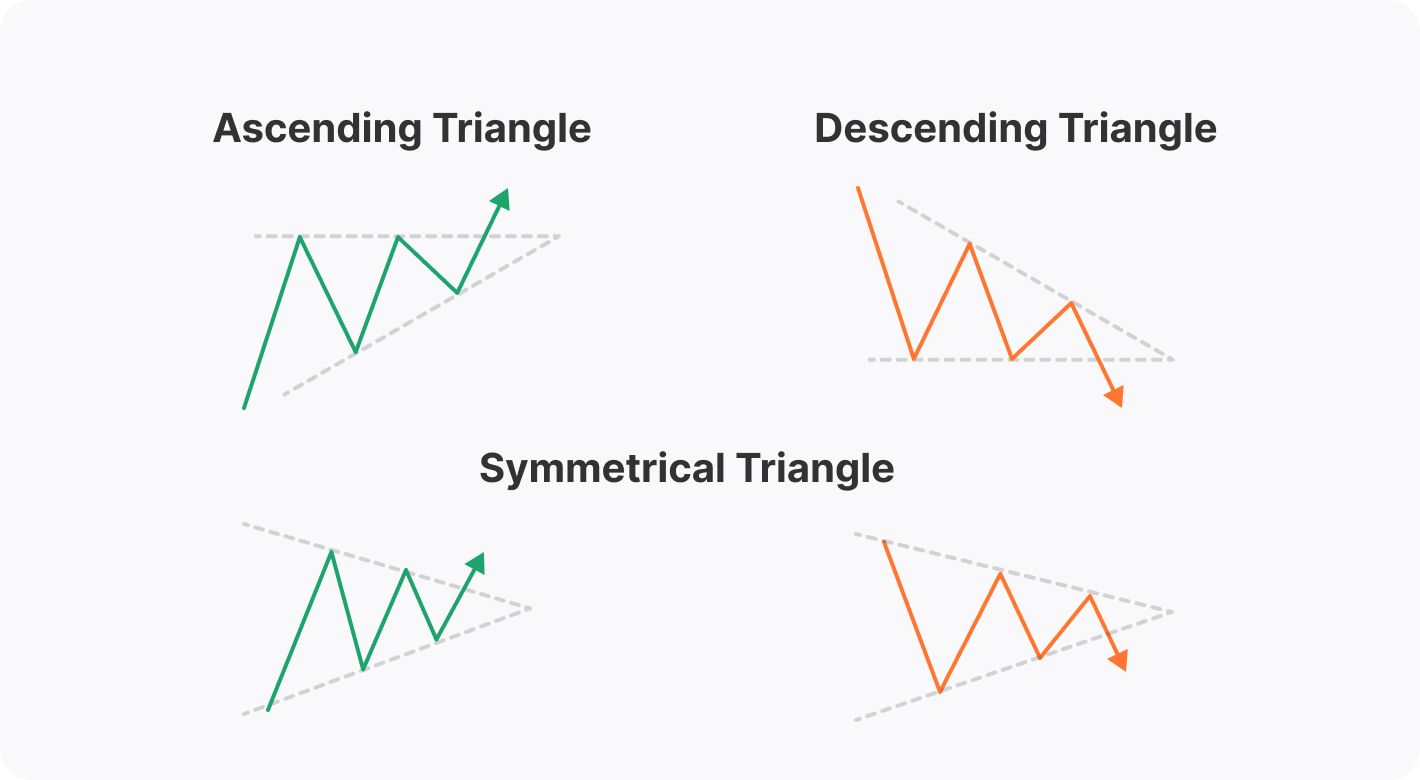

The rising triangle is one of the setups in the triangle group. There are also descending and symmetrical formations.

Ascending, Descending, and Symmetrical Triangles: The Differences

The triangle group of patterns comprises ascending, descending, and symmetrical formations.

The patterns can be formed in any trend, but their signals will differ. While the ascending triangle is a bullish formation, the descending triangle is bearish. At the same time, the symmetrical triangle is a bilateral setup that signals a rise and a fall in the price.

To distinguish between them, traders draw trendlines. In a rising triangle, an upper trendline is horizontal and connects equal or almost equal highs, while the lower trendline is rising as it connects higher lows. In a descending or falling triangle, the lower trendline is horizontal and connects equal or almost equal lows, while the upper trendline declines, going through lower highs. A symmetrical triangle has a falling upper line that connects lower highs and a rising lower line that connects upper lows.

How to Spot the Ascending Triangle

It’s quite easy to identify the formation on a chart. Still, there are a few rules that may help a trader determine its strength.

- The trend strength. Although the setup may appear on any timeframe, traders look for strong long-term trends as risks of a fakeout on low charts are higher.

- Consolidation. Triangles appear when the market consolidates within an overall trend.

- Trendlines. Trendlines must be drawn through at least two points. Still, the larger the number of points, the higher the possibility the setup works.

- Breakout. Can the ascending triangle pattern be bearish? No. It is a bullish formation that appears in a bullish and a bearish trend but always signals a potential price rise.

How to Trade Ascending Triangles

The rising triangle is usually considered a continuation setup formed in an uptrend. Still, if the ascending triangle is in a downtrend, it may signal a trend reversal. The trading rules will be the same in both cases.

As with most chart patterns, triangles have specific rules that help traders place entry and exit points.

Entry

The theory suggests trades go long when the price breaks above the setup's upper boundary. In a conservative approach, traders wait for the price to form at least several candles before entering the market. In a risky strategy, traders open a position as soon as the breakout occurs, and the breakout candlestick closes.

It's worth considering trading volumes as breakouts often turn into fakeouts, meaning the market returns to its previous trend. The chance of a successful breakout is higher if the volumes are high.

However, increased volumes aren't the only tool used to confirm a breakout. Many traders consider trend indicators and oscillators to limit the risks of bad trading decisions.

- If traders use the rising triangle as a reversal setup, they usually implement indicators that may predict a trend reversal, including the moving average, the relative strength index, the moving average convergence divergence, and the stochastic oscillator.

- If the triangle serves as a continuation setup, it may be helpful to look at the signals of trend-strength indicators, including the average directional index.

Take Profit

A standard take-profit target equals the size of the largest part of the setup and is measured just from the breakout trendline.

Stop Loss

Traders consider several options when placing stop-loss levels. In a conservative approach, they implement the risk/reward ratio, which is usually 1:2 or 1:3 but depends on the trader's willingness to take risks. Also, traders utilise the upper trendline as a threshold and place the stop-loss order just under it.

Note: these are general rules. However, traders can develop their own trading strategies and adjust the pattern's parameters and rules according to their trading approach. You may try the FXOpen TickTrader platform to practise identifying triangles on charts.

Ascending Triangle: Trading Example

A pattern formed on the daily chart of the EUR/GBP pair. The price skyrocketed, and as a result, the rising triangle formed, allowing bulls to take a break. As the trend wasn’t solid, a trader could go long as soon as the breakout candle closed (1). Otherwise, the trade would fail. A take-profit target would equal the size of the triangle’s widest part (2) and measured just from the upper trendline. A stop-loss level of 1:2 or 1:3 risk/reward ratio would work (3).

Rising Triangle: Benefits and Drawbacks

This formation has advantages and pitfalls that traders consider when developing their strategies.

Benefits

- It can be used on any timeframe. Triangles are formed on charts of any period. Still, its success rate may be higher if the setup appears in a solid trend on a high timeframe.

- It can be used for any asset. Another advantage is that the ascending triangle pattern is used for stock, commodity, cryptocurrency*, and Forex trading.

- Easy to spot. A trader only needs to draw two trendlines to define this setup on the chart.

- Exact entry and exit points. Although traders can develop their entry and exit points, the setup assumes there are specific rules traders with any experience utilise.

Drawbacks

- It can confuse traders. As the rising triangle is used as a reversal and continuation formation, traders with less experience may be confused with its signals.

- False breakouts. The setup works when a price breakout occurs. However, there is a high risk the breakout will appear to be a fakeout, and the price will return to its previous moves.

- The pattern may fail. Aside from a fakeout, there is another risk when trading with triangles. The price may break another side of the formation, and the formation will fail.

- The trading rules may not work. Although specific rules indicate where a trader should place entry and exit points, buyers may be too weak to push the price to the take-profit target.

Does the Ascending Triangle Work?

The ascending triangle is one of the more common chart patterns traders use when trading various assets. Still, there is no 100% guarantee that it will work every time you spot it on a price chart. It's vital to remember that every signal must be confirmed with other indicators, chart patterns, and candlesticks. Also, it's a well-known fact that any trade involves risks that should be considered every time a trader enters the market.

You may open a live trading account to learn to measure risks when applying technical analysis and the ascending triangle pattern.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.