FXOpen

A descending triangle is a technical analysis pattern, one of the triangle group of setups. It can be easily spotted on the price chart. Therefore, traders like implementing it in their trading strategies. However, this formation is challenging, as it provides reversal and continuation signals. This FXOpen guide will help you distinguish between the descending triangle signals.

What Is a Descending Triangle Pattern?

A descending or falling triangle is a bearish formation that is formed in up and downtrends. Thus, it signals a trend reversal if it appears in an uptrend and a trend continuation if it’s in a downtrend. Although both signals are used by traders when predicting a trend direction, the continuation signal is primary.

The triangle formation consists of two trendlines, a horizontal lower line, which connects swing lows, and a falling upper line which goes through declining swing highs. The formation occurs in periods of market consolidations.

The psychology behind the pattern is that sellers try to pull the price down, but fail due to a strong support level, so the price rebounds. That is, the price bounces back and forth within a triangle between the two trendlines. Still, sellers are strong, which is reflected in lower highs. The idea is that sellers' strength allows them to pull the price below the support level despite the short-term consolidation.

An advantage of triangles is that they can appear in any timeframe. Therefore, the period during which the triangle exists depends on the period of the price chart. For instance, on a daily chart, the triangle may exist for over a week and even for several months, while on an hourly chart, it's usually in place for a few days.

Descending, Ascending, and Symmetrical Triangles: The Differences

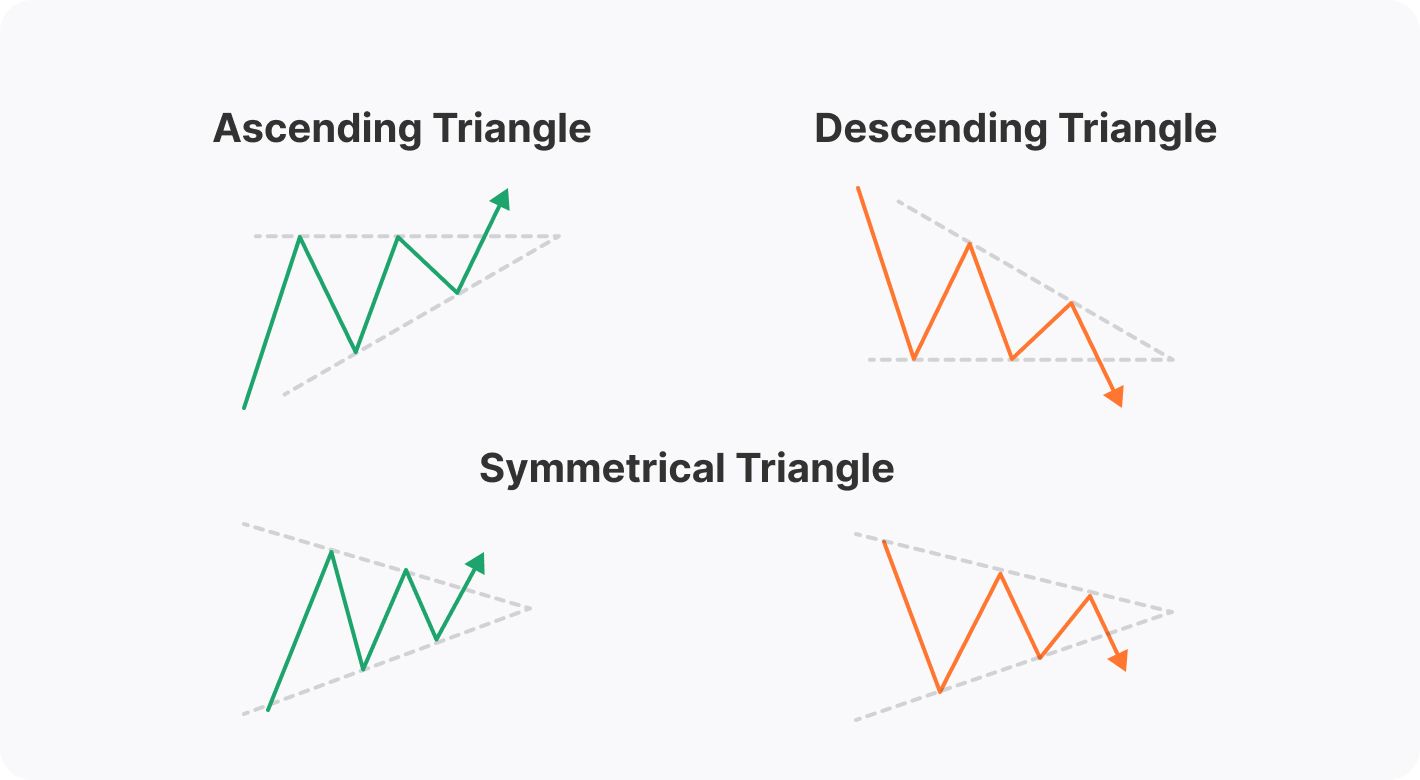

The triangle group of formations includes descending, ascending, and symmetrical triangles. While a descending triangle pattern provides bearish signals, an ascending triangle forecasts a price rise and a symmetrical triangle may be both bearish and bullish.

The picture above shows differences in how the three formations look.

- The descending triangle has a horizontal lower boundary, while the upper boundary is angled down.

- The ascending triangle has a horizontal upper trendline, while the lower trendline is angled up.

- The symmetrical triangle has a falling upper boundary and a rising lower boundary.

How to Trade the Descending Triangle

As with many chart patterns, the descending triangle has specific entry and exit rules. You can change them if you have enough experience so they work for your trading approach. If you don't have time or willingness to develop new trading methods, you may use general rules. Both methods can be tested on live charts. For this, you can open an FXOpen account.

Although the descending triangle chart pattern may signal a trend reversal in an uptrend and a trend continuation in a downtrend, trading rules are the same in both cases.

Entry

The idea of the descending triangle is to show that sellers are strong and can take control of the market. Therefore, traders open a sell position after the price breaks below the strong support level (the lower band). Although the rule is simple, it may be tricky as a breakout may be false, which means the price may return to the setup.

There are two options. First, a trader goes short as soon as the price falls below the lower trendline and the breakout candlestick closes below it. Second, a trader goes short after at least several candlesticks are formed in the breakout direction.

Although triangles are considered reliable, they may fail. Therefore, traders use various methods to confirm their signals.

- Volumes. A real breakout is accompanied by high trading volumes. If the price breaks below the lower trendline but the volumes aren't higher than those before the breakout, there is a risk the price will return to the setup.

- Trend indicators and oscillators. Another method is trend indicators and oscillators. If the descending triangle is in a downtrend, then traders use trend-strength tools to confirm a trend continuation. If the falling triangle is in an uptrend, traders look at reversal indicators, including the relative strength index, the moving average convergence divergence, and the stochastic oscillator.

Take Profit

The take-profit target equals the size of the triangle's largest part and is measured from the breakout trendline.

Stop Loss

A stop-loss distance can be measured in a few ways. The first option is the risk/reward ratio. The theory suggests that the ratio of 1:2 and 1:3 is the most common. However, it depends on the trader’s risk aversion. Also, traders set the stop-loss order just above the lower trendline.

Descending Triangle Trading: Example

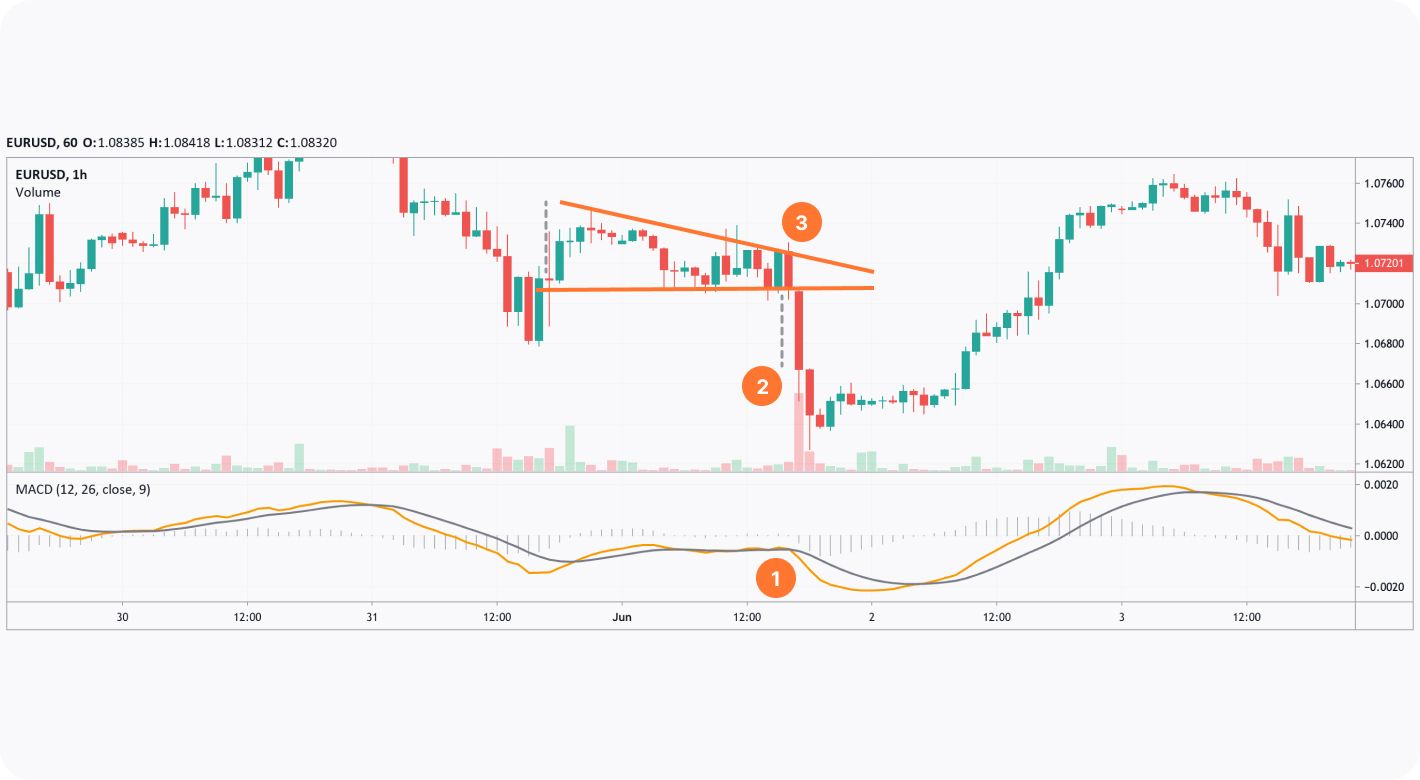

The chart above shows a descending triangle setup in a downtrend. If a trader used standard rules and opened a sell position after the breakout candlestick closed, the pattern rules couldn’t be applied anymore as the target would be reached. Therefore, a trader could consider a surge in volumes and a sell signal of the MACD indicator to open a position earlier during the breakout candle formation (1).

A take-profit level would equal the widest part of the setup and is measured from the lower trendline (2). However, significant trading volumes would allow a trader to trail a take-profit target. A stop-loss order could be half of the take-profit size or be placed above the upper band of the triangle (3).

Falling Triangle: Benefits and Drawbacks

The falling triangle has advantages and disadvantages that may affect your trades.

Benefits

- It appears in any timeframe. Triangles can occur in any timeframe. Still, as the falling triangle is a consolidation formation, its signals may be stronger in solid trends, thus, on charts with longer periods.

- It can be used when trading various assets. Descending triangles can be found on a chart of any asset. It’s common to find descending triangles on stock, commodity, index, cryptocurrency*, and currency price charts.

- It’s easy to spot. The formation consists of two trendlines, standard tools on any trading platform. You can examine how to place trendlines on the TickTrader platform.

- It provides exact entry and exit points. Triangles provide traders with particular entry and exit points. They don’t guarantee a successful trade but help traders with little experience and those who develop their own trading strategy.

Drawbacks

- It may confuse traders. Is the descending triangle bullish or bearish? Traders constantly ask this question because this setup provides reversal and continuation signals. Still, it’s a bearish formation.

- It bears the risk of false breakouts. Every breakout method and strategy bears the risk of a fakeout. Therefore, traders use additional confirmation tools.

- It may fail. Although the downward triangle pattern signals a price fall in down and uptrends, the price may rise.

- Its trading rules may not work. Standard pattern rules are supposed always to work, but there is no guarantee. It’s a well-known fact that every trade bears risks.

Does the Descending Triangle Work?

The descending triangle is used by many traders, especially in Forex trading. However, it doesn’t mean that it only provides working signals. Every trading and investing activity involves risks. Therefore, traders practise and learn new analysis techniques to be equipped with various tools.

You can open a live trading account at FXOpen to examine how triangle patterns work.

*At FXOpen UK, Cryptocurrency CFDs are only available for trading by those clients categorised as Professional clients under FCA Rules. They are not available for trading by Retail clients.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.