FXOpen

The double top is a classic technical analysis pattern that often signals a potential trend reversal after a strong uptrend. It can be identified across all timeframes and asset classes. However, interpreting it correctly requires precision. In this article, we will explain how to identify a double top setup and how traders apply it to trading strategies.

What Is a Double Top Pattern?

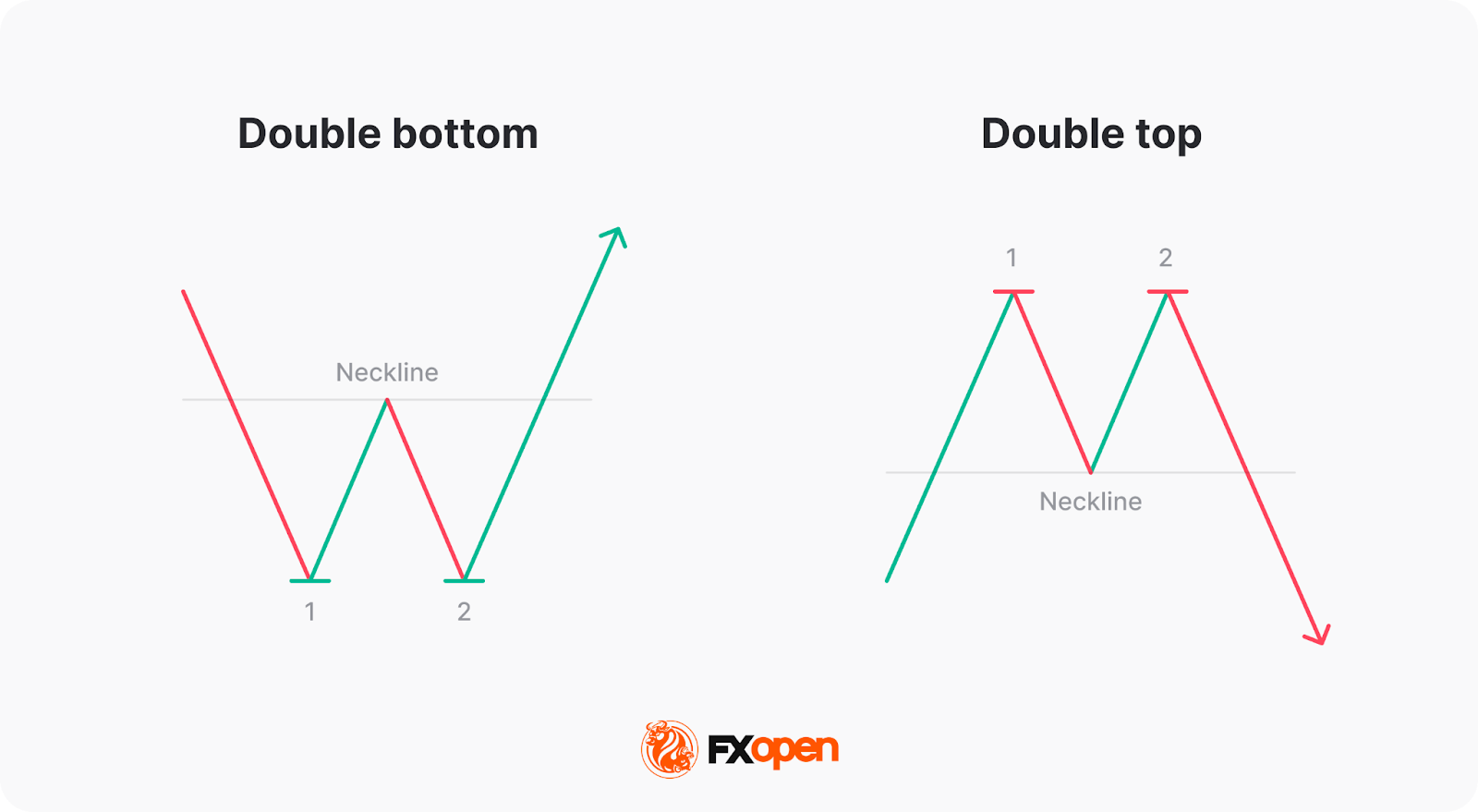

In technical analysis, a double top pattern meaning refers to a chart pattern that consists of two swing highs with a trough in between, and the two highs should be at the same or almost the same level. Some traders confuse a double top with a double bottom formation. Therefore, the question “Is the double top bullish or bearish?” is common. The double top pattern appears at the end of an uptrend, and it’s always bearish. Conversely, the double bottom setup occurs at the end of a downtrend, and it’s always bullish.

Another common question is, “What does double top mean in stocks?” Regardless of the market, the double top appears before a trend reversal. You can find this formation when trading currencies, stocks, commodities, and cryptocurrencies*.

What Does a Double Top Indicate?

Understanding a pattern's psychology may help you learn how to spot it on a price chart and read its signals. As a double top is a bearish formation, it occurs only in an upward trend. The first high indicates that the trend is in place. However, the second high, which appears at the same level, shows that bulls don't have the strength to push the price up further. Therefore, traders expect an end to the uptrend.

How Traders Use the Double Top Pattern

The double top pattern's entry and exit rules are relatively simple. Although they may vary depending on the timeframe you use or the trading approach you implement, the standard points can be considered fundamental.

Entry

The two tops aren’t as important as the trough between them. This serves as the threshold that signals whether a trend reversal is occurring. A trader draws a horizontal line (neckline) through it and waits for the price to fall below it after the second high is formed.

There are several options that traders can consider before entering the market. They can sell just after the breakout occurs; this is at the double top’s breakout candlestick, so usually, they wait for the candle to close. Additionally, they can wait for at least two candles to be formed in the breakout direction.

The choice depends on the timeframe and the risk approach. It’s risky to enter the market as soon as the breakout occurs because of a fakeout, the situation when the price turns around after the breakout and continues to move in the same direction. The chances the breakout is valid might increase when the candle closes below the neckline. If the timeframe is high, traders can even wait for the price to form a few candles. However, measuring the take-profit target and considering trading volumes is vital.

Take Profit

A take-profit level is typically determined by measuring the distance between the tops and the neckline. The theory states that the price will go the distance equal to the height between the neckline and the tops.

Stop Loss

A stop-loss level is typically calculated using the risk/reward ratio. The ratio is determined by considering the current market conditions, but many traders believe that it should be at least a third of the take-profit target. Additionally, the common rules state that it should always be placed above the neckline.

Note: there is a common rule that a support level becomes a resistance after the price falls below it.

This means that the neckline will turn into a resistance level after the breakout. A rise above it will signal either a market consolidation or a continuation of an uptrend.

Double Top: Trading Examples

The chart above reflects a double top chart pattern formed on a 5-minute chart of the GBP/USD pair. The price tested the neckline after the breakout candlestick closed (1). However, if a trader used a stop-loss, they wouldn’t worry about the retest. The take-profit target would equal the distance between the tops and the neckline (2). As the tops aren’t high, a 1:2 risk/reward ratio would be large, so a trader could use a 1:3 ratio (3). If fundamental analysis and high trading volumes confirmed a continuation of a price fall, a trader could use a trailing take-profit order and place the second target at the nearest support level (4).

The Difference Between a Double Top and a Failed Double Top

A double top pattern may fail like any other pattern or technical indicator.

On the chart above, the price forms a double top pattern at the end of an uptrend. The RSI indicator has a bearish divergence with the price chart, which is supposed to confirm a price decline (1). After the second top, the price breaks below the middle line of the Bollinger Bands indicator (2), which is also a sign of a price decline. However, the pattern doesn’t work, and the price doesn’t reach the target (3).

How Can You Confirm a Double Top Chart Pattern?

The example above confirmed that the double top formation can’t provide signals that are 100% accurate. Moreover, it showed that even implementing additional tools when confirming the signals will not guarantee effective trades. Therefore, traders practise constantly.

You can consider using the TickTrader platform to practise various combinations of the double top setup and technical analysis tools that may help confirm its signals.

Confirming a double top pattern involves using various technical indicators. Here are the most common technical analysis tools traders use to catch reversal signals.

- Volume Analysis. A significant increase in selling volume when the price breaks below the neckline may confirm high downward pressure.

- Moving Averages. The most popular types of moving averages are simple and exponential. When the price moves below an MA after forming a second peak, it may be a signal of a potential change in the trend direction.

- Momentum Indicators. Momentum indicators such as the Relative Strength Index, Stochastic Oscillator, and Moving Average Convergence Divergence provide divergence signals that can strengthen the reversal signal. Additionally, overbought conditions on top of an uptrend on high timeframes may confirm a decline in the price.

- Fibonacci Retracement Levels. The most significant retracement levels, 50% or 61.8%, near the neckline can act as a confirmation level. A break below them strengthens the pattern's validity.

- ADX (Average Directional Index): ADX rising above 25 during the downtrend after the second peak indicates a strong bearish trend.

By combining these indicators, you can confirm a double top pattern, which might reduce the number of false signals and support you in your trading decisions.

Advantages and Limitations of the Double Top Formation

Although the double top is used by traders around the globe, it has limitations that you can consider when implementing it into your trading strategy.

Advantages

Reliability. The double top is considered a reliable indicator of a potential trend reversal, especially when confirmed with other technical indicators.

Clear Entry and Exit Points. The pattern provides clear entry points for short positions (break of the neckline) and exit points (targets based on the height of the pattern).

Clarity. The formation is relatively straightforward to spot on price charts, making it accessible for traders of all experience levels.

Appearance Across Timeframes. The double top pattern can be applied to various timeframes, from intraday charts to weekly or monthly ones, making it versatile for different trading strategies.

Limitations

False Signals. Like all technical patterns, double tops can produce false signals, especially in volatile or choppy markets.

Subjectivity. The exact level of the peaks and the neckline can be subjective, leading to differences in interpretation among traders.

Trend Dependency. The pattern is considered in the context of a preceding uptrend. In a sideways market, the pattern isn’t typically used.

Potential for Late Entries. Waiting for confirmation might result in late entries, causing traders to miss the optimal entry point and reduce potential returns.

Double Top and Other Chart Patterns

Chart patterns are essential tools in technical analysis, helping traders identify potential market movements. Here are the patterns that the double top is commonly confused with.

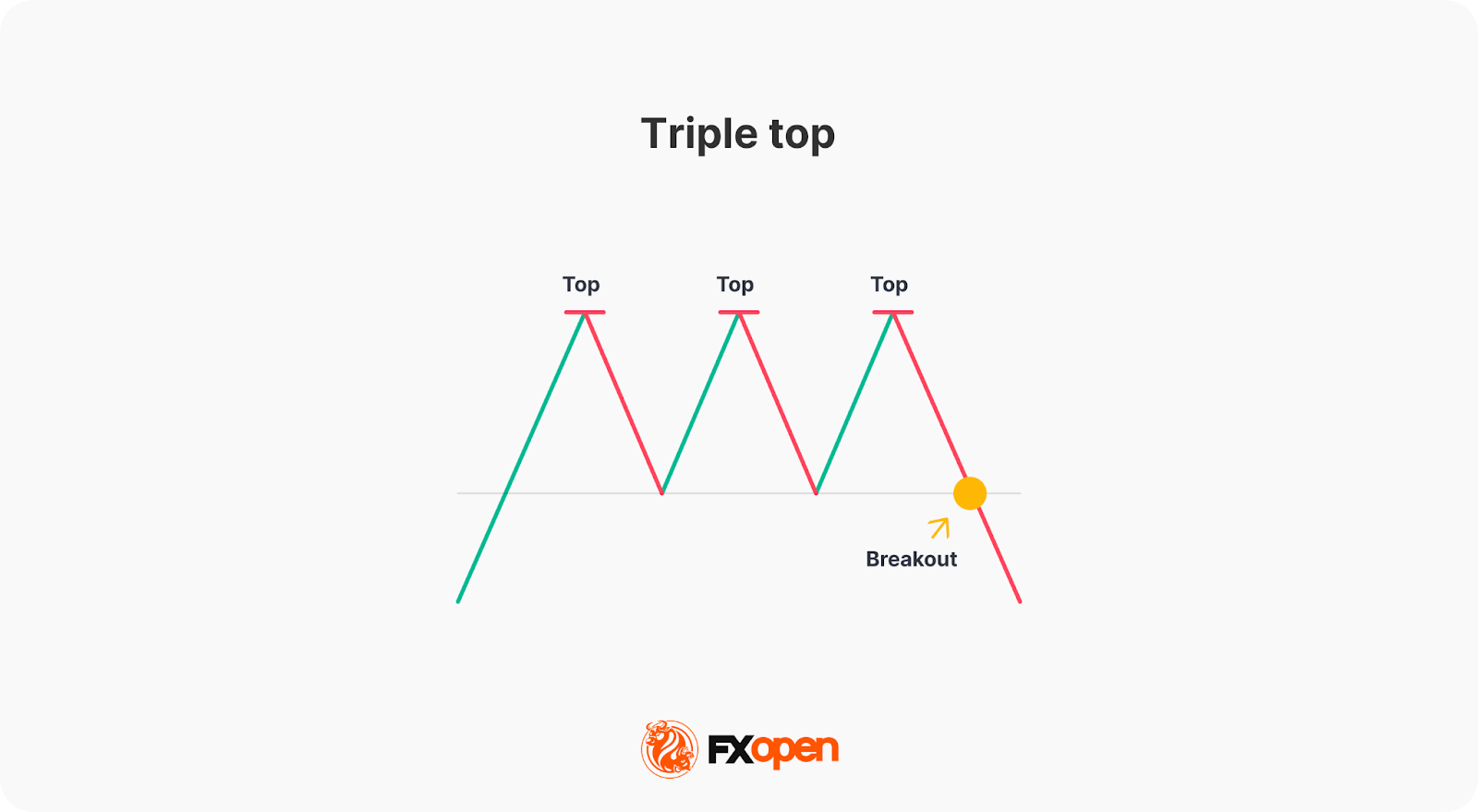

Triple Top

The triple top pattern indicates a stronger potential reversal from an uptrend to a downtrend, suggesting even more bearish sentiment in the market compared to the double top pattern. This is because the bulls failed to break above the strong resistance three times. The pattern is confirmed when the price breaks below the neckline with increased volume.

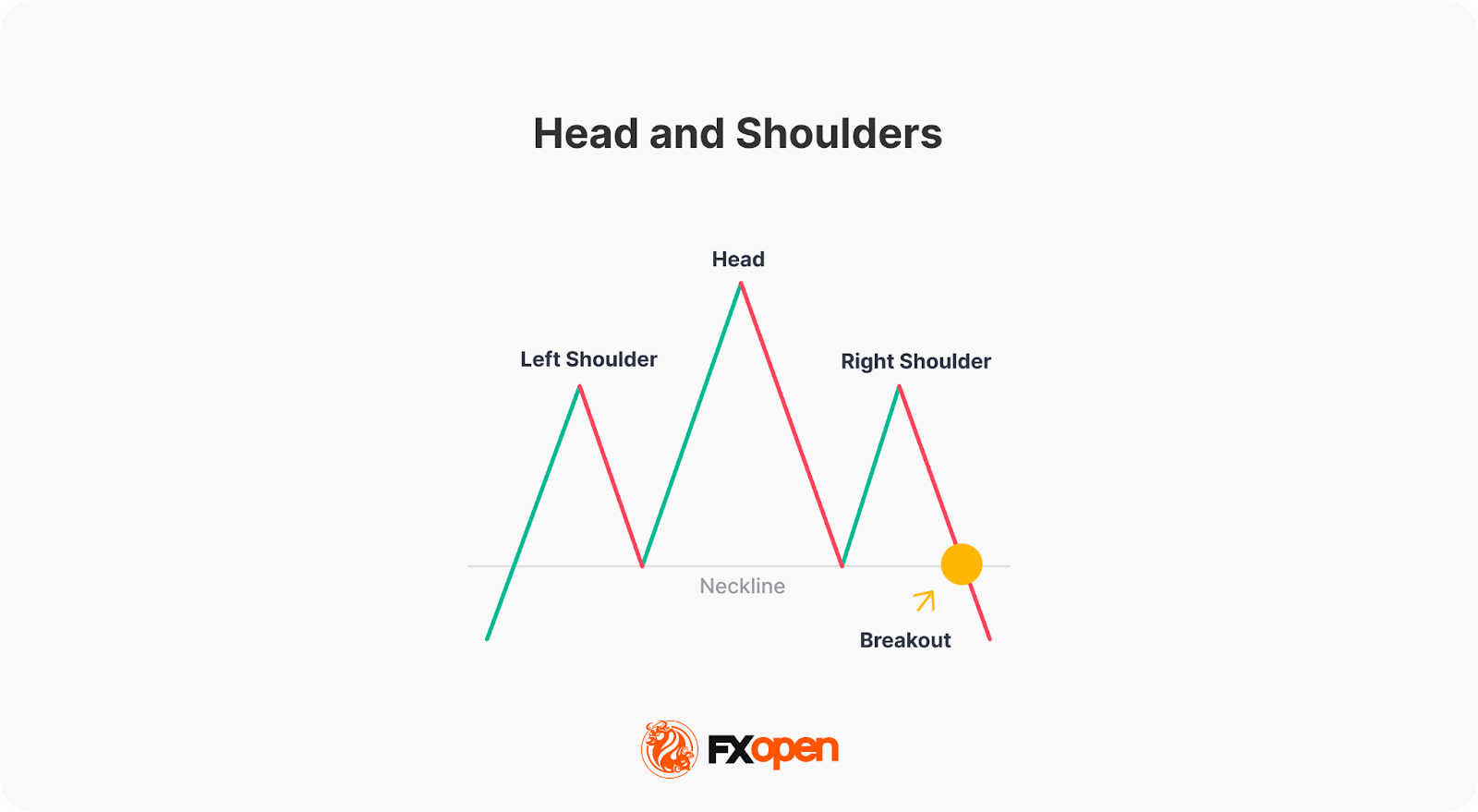

Head and Shoulders

The head and shoulders pattern signals a potential reversal from an uptrend to a downtrend and has similar trading rules, where traders wait for a break below the neckline (drawn through the lows between the head and shoulders) with increased volume. However, it consists of three peaks: a higher peak (head) between two lower peaks (shoulders). So, it can be said that it’s more complex than the double top pattern.

Takeaway

The double top trading pattern offers valuable insights into changing market sentiment and potential reversal points. Understanding how to identify, confirm, and trade this formation can support traders when building trading strategies in forex, stocks, and commodities markets. Recognising and trading the double top pattern requires patience, confirmation, and discipline.

If you want to trade with the double top pattern, you can consider opening an FXOpen account and examine how it works in over 700 markets on 4 trading platforms with low commissions from $1.50 per lot and tight spreads from 0.0 pips.

FAQ

How Can You Identify a Double Top in Trading?

To identify a double top in trading, traders look for two distinct peaks at approximately the same price level, separated by a trough. This pattern forms after an uptrend and suggests the price is struggling to move higher. Confirmation occurs when the price breaks below the neckline with increased volume.

What Does a Double Top Mean in Stocks?

A double top in stocks indicates a potential bearish reversal. This means that the upward trend may be ending, reflecting that buyers are unable to push the price higher past the resistance level established by the two peaks. It’s worth saying that the pattern means the same on any asset, including currencies, commodities, and indices.

What Is the Target for a Double Top Pattern?

The target for a double top pattern is typically calculated by measuring the vertical distance between the peaks and the neckline and then subtracting this distance from the breakout point below the neckline, providing an estimated price level to which the price may fall once the pattern is confirmed.

What Is a Double Top Entry Strategy?

A double top entry strategy involves identifying the pattern and waiting for confirmation by entering a short position only after the price breaks below the neckline with increased volume or when technical indicators confirm a price fall.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.