FXOpen

Silver continues to sit at the intersection of monetary confidence, industrial transformation, and geopolitical tension. Its price history shows repeated phases of sharp repricing followed by consolidation, reflecting shifts in macro conditions rather than steady progression.

Looking ahead, silver’s role in electrification, combined with fiscal and currency dynamics, keeps it firmly in focus for market participants. This article examines silver’s historical price behaviour and provides analysts’ silver price predictions for the next 5 years, placing recent developments within a broader market context.

Analytical Forecast Summary

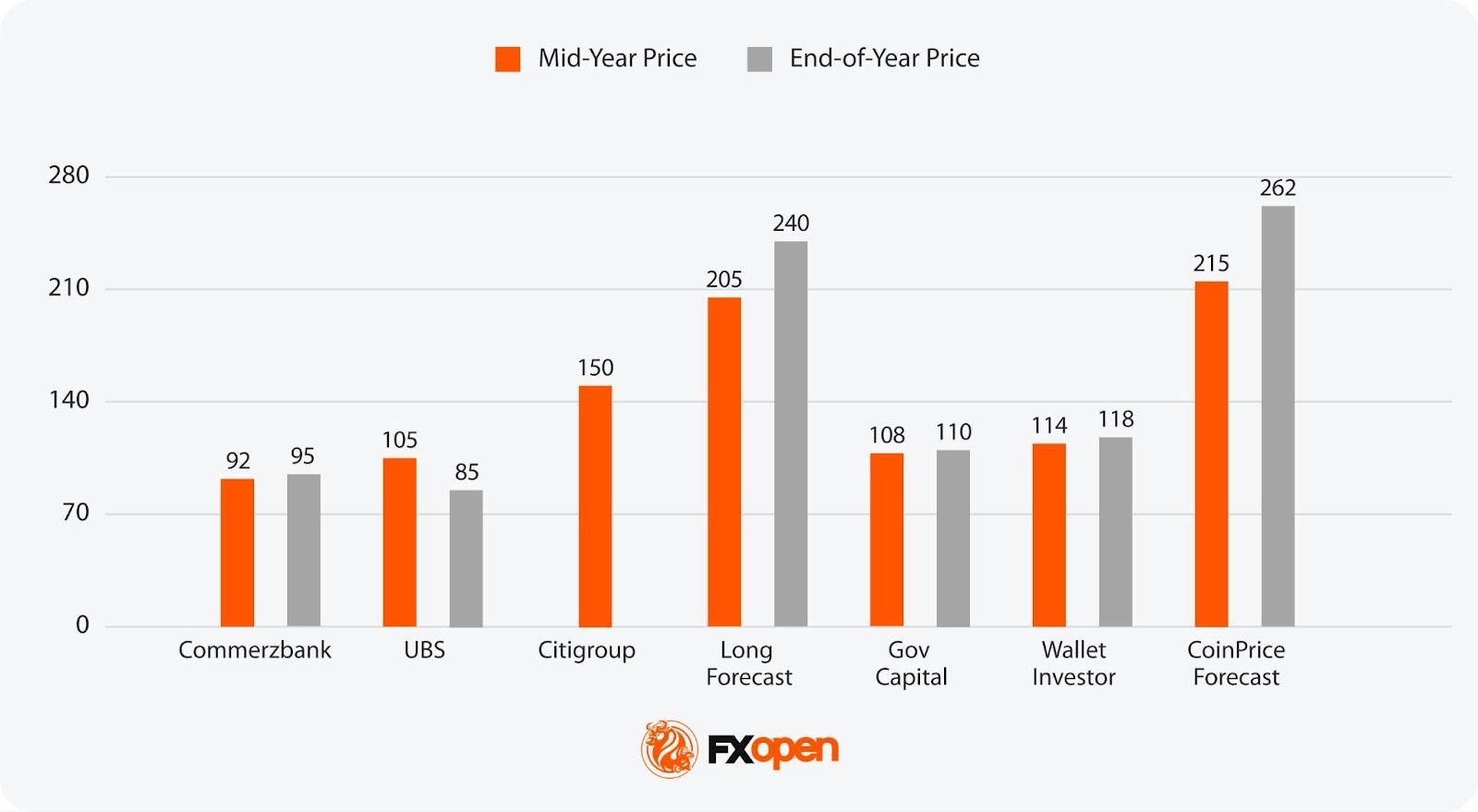

2026

For 2026, estimates span roughly $92 to $262, with bank views clustering around $100 while some retail-aggregator models extend far higher. The spread reflects uncertainty around real yields, dollar direction, and how long physical tightness persists after the January volatility spike.

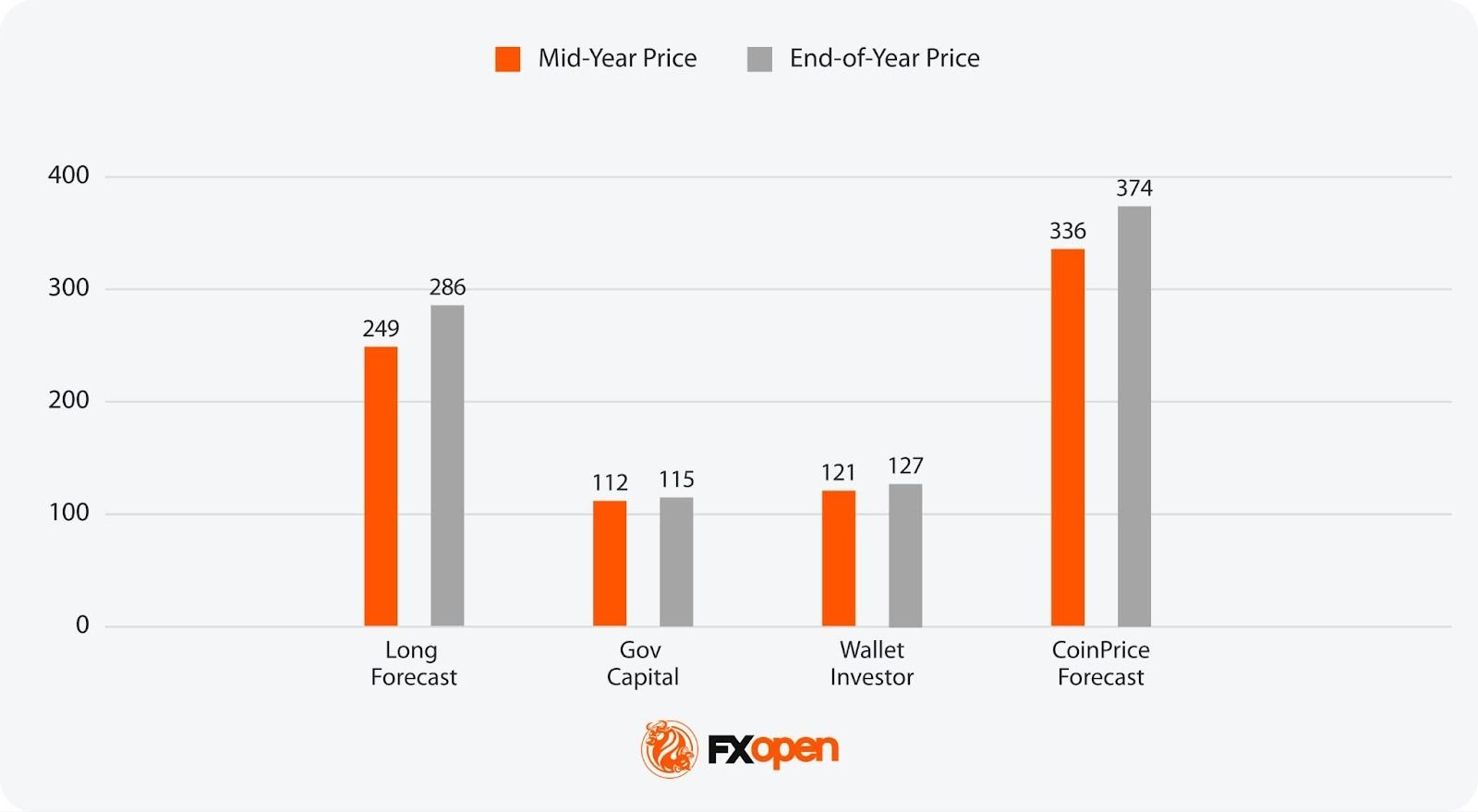

2027

In 2027, forecasts widen further, from about $112 to $374. Some views lean on a lower gold-silver ratio as a driver of relative upside, while others assume industrial thrifting and substitution cap follow-through after any sharp repricing

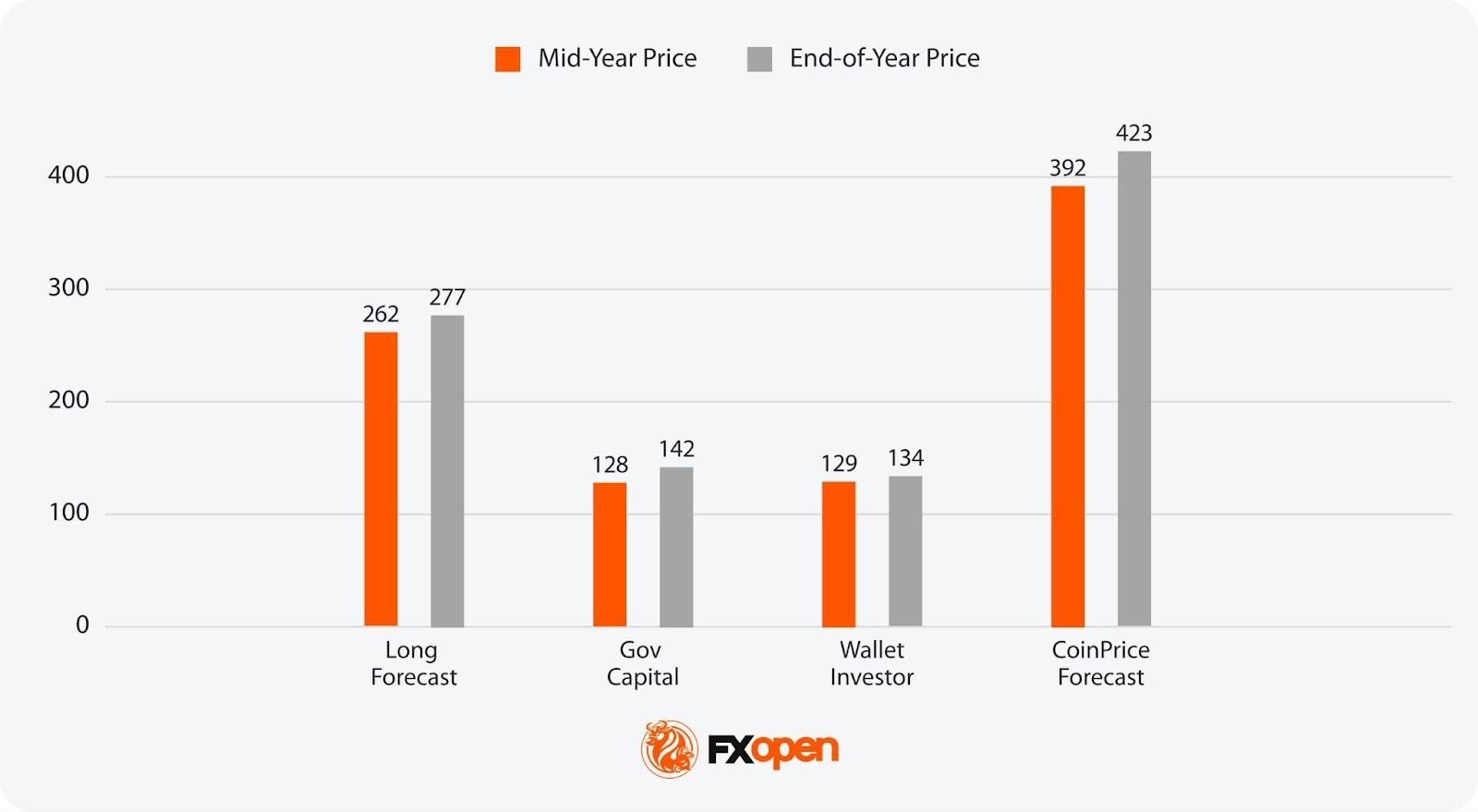

2028

Silver's projected price in 2028 ranges from around $128 to $423. This gap largely comes down to how much PV and electrification demand offsets lower silver intensity per unit and whether supply response remains slow.

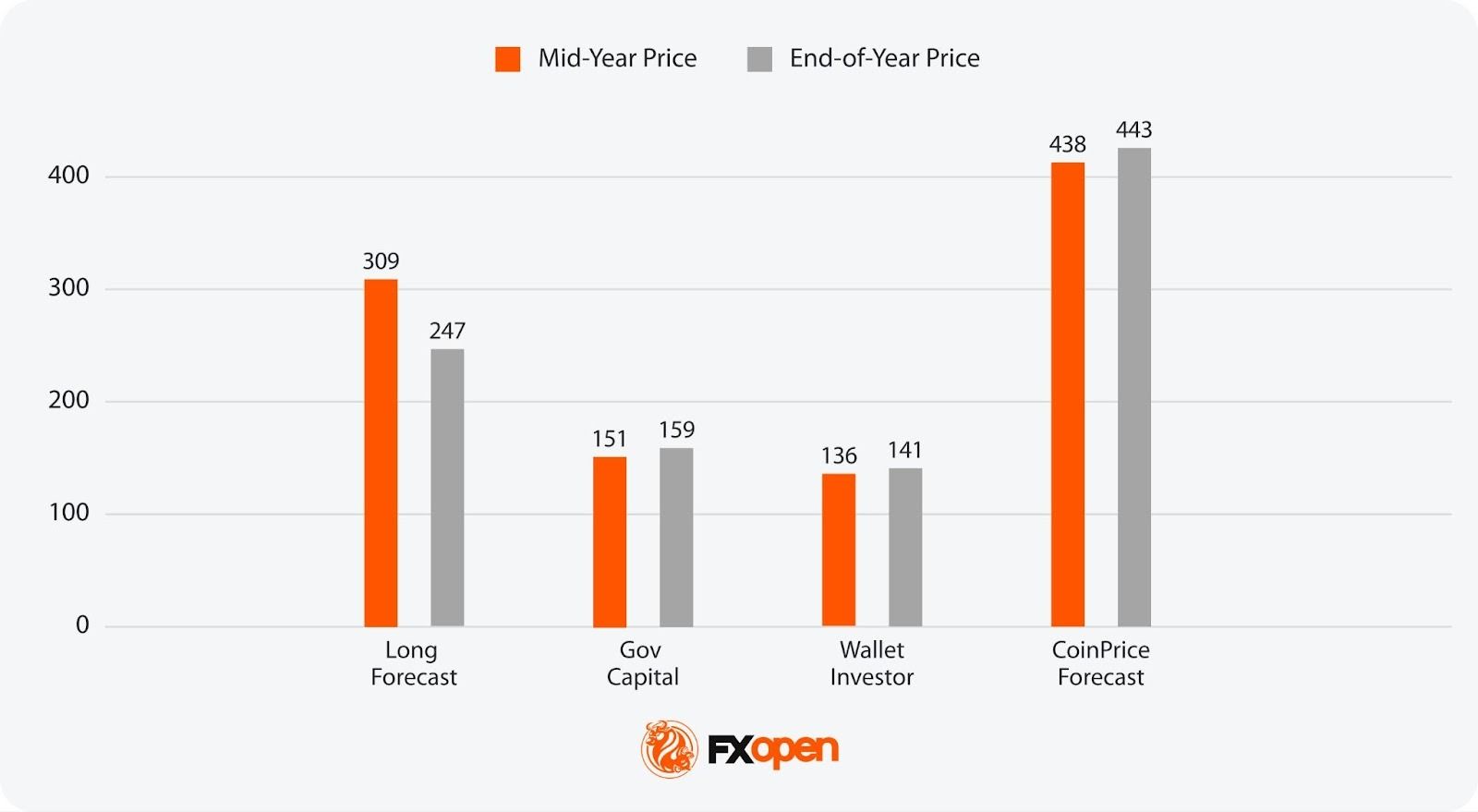

2029

2029 estimates run from roughly $136 to $443. Longer-range numbers diverge on whether investment demand remains episodic or returns in multi-quarter waves during macro stress.

2030

Forecasts for 2030 sit between about $143 and $499, implying continued volatility rather than a linear trend, with outcomes hinging on fiscal dynamics, monetary credibility, and the balance between demand growth and supply constraints.

Silver’s Price History

Silver's price history is marked by dramatic fluctuations, reflecting the interplay of market forces, geopolitical events, and investor behaviour.

Silver Thursday (1980)

One of the most significant periods was in the late 1970s and early 1980s, notably during the Silver Thursday event of 1980. After the precious metal began climbing in the latter half of the 1970s, an attempt by the Hunt brothers to corner the market in January 1980 led to silver prices reaching an all-time high of $49.45 per troy ounce—from the 1979’s high of $28— before crashing to a low of $4.90 at the end of 1982.

The Early 21st Century (2000-2011)

Following the dot-com bubble burst in the early 2000s, silver and other precious metals began a bullish run as investors sought so-called safe-haven assets amidst economic uncertainty. However, after surging from a low of around $4.43 in November 2002 to a high of $15.23 in May 2006, prices stalled. It eventually rose again, driven by a combination of investment demand, industrial applications, and concerns over fiat currency devaluation in the run-up to the Great Financial Crisis of 2008.

While it dipped as the crisis unfolded, silver spiked in the following years, reaching an all-time high of roughly $50 in April 2011.

A Volatile Period in Silver's History (2012-2026)

However, silver then reversed hard, ending 2011 near $27.80 and sliding again as tighter policy expectations built. The downswing carried into the mid-2010s, with a trough around $13.9 in late 2015/early 2016. For much of 2014-2019 it rotated in a $15-$20 band as US rates rose and the dollar firmed.

In March 2020, the COVID liquidity shock pushed silver below $12, then stimulus and reflation trades drove a fast rebound towards $29 by August 2020. A retail-driven “silver squeeze” wave in early 2021 lifted it to around $30 before momentum faded.

Fed tightening and a stronger dollar weighed again in 2022, taking prices back toward $18 before stabilising. A break higher gathered pace from May 2024 (moves through $32-$35 linked to tight physical conditions and strong solar-related demand signals), then 2025 accelerated: silver cleared the prior nominal record in October near $54.50 and pushed higher into year-end. In January 2026, price action became disorderly, with a spike to over $121 late in the month. At the time of writing on the 29th of January, silver stands at around $114.

Interested readers can head over to FXOpen’s TickTrader platform to explore silver price trends using our interactive XAG/USD charts.

Analytical Silver Prices Forecasts for 2026

Silver enters 2026 after a steep 2024–January 2026 run and a sharp volatility spike. The key issue for silver price predictions is whether the metal rises on strong fundamental factors, or corrects as the factors change.

Macro, Rates, and Debasement Concerns

Rate-path pricing and the US dollar remain central. If real yields drift lower and fiscal deficits stay elevated, concerns about currency depreciation may continue to influence investment flows into precious metals. Persistent budget imbalances, heavy Treasury issuance, and questions around long-term currency purchasing power remain a central part of the backdrop.

Industrial Demand and Manufacturing Thrift

Solar, electrification, and electronics demand stay in focus, but 2025 highlighted a clear constraint: higher prices encouraged reduced silver loadings in PV cells and components. If prices remain elevated, further thrifting and substitution may lower silver demand.

Supply, Inventories, and Physical Tightness

The silver market has recorded several annual deficits in recent years. Analysts note a decline in above-ground inventories and heightened sensitivity to regional physical flows. While recycling supply may rise in response to price incentives, primary mine output is likely to remain relatively inelastic given silver’s predominantly by-product production profile.

Volatility and Positioning

After the January spike, silver may trade in wide ranges driven by ETF flows, futures positioning, and liquidity conditions. The 2025 breakout zone around $28-$35 remains important; sustained trade below it could point to a deeper reset.

Analytical Silver Price Predictions for 2026

Silver price forecasts for 2026 reflect a market adjusting after sharp repricing, with views shaped by macro policy uncertainty, physical availability, and shifting investor positioning.

- Most Pessimistic Projection for Mid-Year 2026: $92 (Commerzbank)

- Most Optimistic Projection for Mid-Year 2026: $215 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2026: $85 (UBS)

- Most Optimistic Projection for End-of-Year 2026: $262 (CoinPriceForecast).

Citigroup outlines one of the most aggressive near-term outlooks, pointing to $150/oz by mid-2026. Commodities strategist Max Layton links this view to strong Chinese buying, supply constraints, and persistent structural imbalances. Citi characterises silver as behaving like “gold squared”, arguing the move may persist until valuations appear stretched relative to gold.

Commerzbank has lifted its expectations materially, now seeing $92/oz by mid-2026 and $95/oz by year-end, up sharply from late-2025 assumptions. Analyst Carsten Fritsch points to escalating geopolitical tensions, including unrest in Iran and the risk of wider confrontation, while cautioning that higher prices may accelerate industrial thrifting or substitution towards cheaper metals.

Analytical Silver Price Forecasts for 2027 and Beyond

Beyond 2026, silver price predictions become less about short-term positioning and more about structural forces shaping demand, supply, and capital allocation.

Structural Demand Versus Intensity Decline

Solar, grid expansion, EVs, and data infrastructure continue to absorb material volumes, but the focus shifts from headline installation growth to silver intensity per unit. PV manufacturers, battery systems, and electronics producers are expected to keep reducing silver loadings where technically feasible. This creates a tension: total volumes may rise, but marginal demand growth becomes more sensitive to price. Periods of elevated prices risk flattening fabrication demand.

Fiscal Dynamics and Monetary Credibility

Longer term, silver remains exposed to currency debasement narratives rather than cyclical rate expectations alone. Persistent fiscal deficits, rising sovereign debt servicing costs, and political resistance to austerity may keep precious metals embedded in asset-allocation discussions. Unlike 2024–2026, this influence is expected to express itself episodically rather than through sustained one-way moves.

Supply Response Lag

Mine supply response beyond 2027 remains constrained. Supply elasticity remains low: as most silver is mined as a by-product, production levels are often dictated by the economics of copper, lead, or zinc rather than silver market trends. Recycling growth faces natural limits after several years of elevated prices pulling forward scrap supply. This could keep the market sensitive to demand shocks.

Analytical Silver Price Predictions: 2027

The 2027 outlook points to a continuation of longer-cycle themes, with some analyses focusing on relative valuation against gold while others factor in demand moderation from industrial thrift.

- Most Pessimistic Projection for Mid-Year 2027: $112 (Gov Capital)

- Most Optimistic Projection for Mid-Year 2027: $336 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2027: $115 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2027: $374 (CoinPriceForecast)

HSBC's James Steel expects physical market tightness to ease gradually through 2027 as supply-side pressures resolve. The bank projects the global deficit narrowing further as industrial demand weakens, while mine output and recycling rise. Steel notes that elevated prices are encouraging "substitution, thrifting and design changes" across industrial applications, with jewellery demand "especially vulnerable."

Oxford Economics, in a December 2025 report on behalf of the Silver Institute, projects that electric vehicles will overtake internal combustion engine (ICE) vehicles as the primary source of automotive silver demand by 2027. Electric vehicles consume, "on average, 67-79 percent more silver than ICE vehicles."

Data centres powering AI systems represent another expanding offtake channel; as digitisation accelerates, demand for silver's superior conductivity in servers and infrastructure is expected to rise in tandem. Oxford Economics characterises silver as a "next-generation metal," concluding it will "remain an essential component across multiple high-growth sectors as industries race to embrace digital innovation and meet clean energy mandates."

Analytical Silver Price Predictions: 2028

By 2028, projections diverge more clearly as assumptions vary around supply response timing, sustained electrification demand, and the durability of investment flows.

- Most Pessimistic Projection for Mid-Year 2028: $128 (Gov Capital)

- Most Optimistic Projection for Mid-Year 2028: $392 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2028: $142 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2028: $423 (CoinPriceForecast)

Analytical Silver Price Predictions: 2029

The 2029 outlook reflects growing uncertainty over macro structure rather than short-term cycles, with outcomes tied to fiscal dynamics, currency credibility, and episodic capital rotation.

- Most Pessimistic Projection for Mid-Year 2029: $136 (Wallet Investor)

- Most Optimistic Projection for Mid-Year 2029: $438 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2029: $141 (Wallet Investor)

- Most Optimistic Projection for End-of-Year 2029: $443 (CoinPriceForecast)

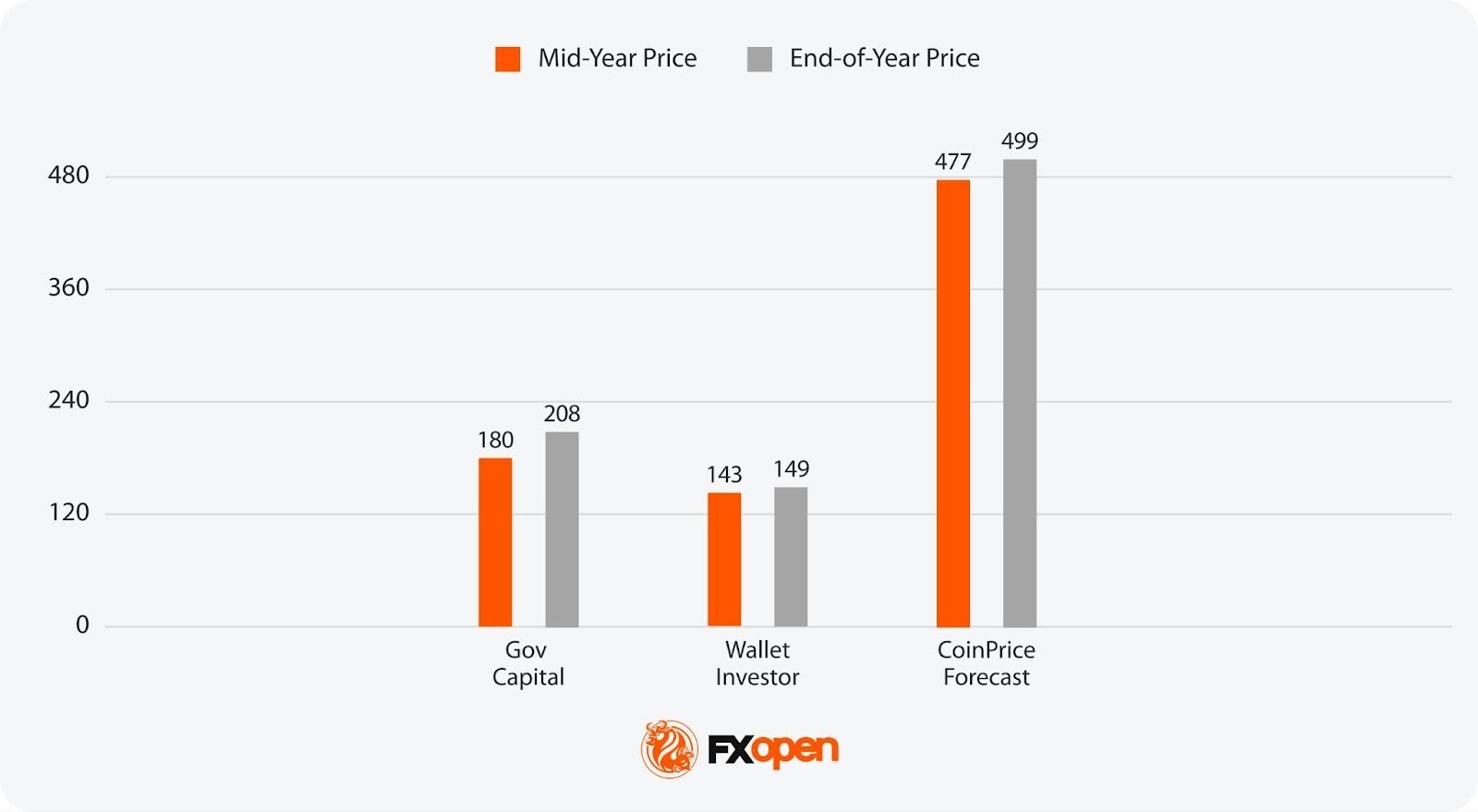

Analytical Silver Price Predictions: 2030

Looking at long-term silver price forecasts in 2030, estimates frame silver as a hybrid asset, where price behaviour depends on whether structural demand pressures outweigh gradual supply adaptation and periodic volatility.

- Most Pessimistic Projection for Mid-Year 2030: $143 (Wallet Investor)

- Most Optimistic Projection for Mid-Year 2030: $477 (CoinPriceForecast)

- Most Pessimistic Projection for End-of-Year 2030: $149 (Wallet Investor)

- Most Optimistic Projection for End-of-Year 2030: $499 (CoinPriceForecast)

Factors That Might Affect Silver Prices

Silver prices are shaped by a dynamic blend of economic, geopolitical, and industrial factors, reflecting its dual role as both an investment and an industrial metal. Key factors going forward include:

- Industrial Demand: Silver's extensive use in technologies like solar panels and electronics directly influences its price.

- Economic Conditions: Economic growth increases silver demand in manufacturing, while downturns often boost its appeal as a so-called safe-haven asset.

- Monetary Policy: Interest rate changes can shift investor preference between silver and yield-bearing assets.

- US Dollar Strength: An inverse relationship exists between XAG prices and the US dollar; a stronger dollar can suppress its price.

- Geopolitical Tensions: Conflicts and instability tend to increase investment in silver as a so-called protective measure.

- Gold/Silver Ratio: This indicator may help investors decide when to buy silver over gold, affecting demand and prices.

The Bottom Line

Silver’s outlook remains shaped by a mix of macro uncertainty, fiscal dynamics, and structural industrial demand. Price behaviour over the coming years is likely to reflect shifts in real yields, currency confidence, and supply constraints rather than linear trends, with volatility remaining a defining feature.

If you are looking to trade Silver via CFDs, you can consider opening an FXOpen account and get access to the advanced trading tools and more than 700 instruments.

FAQ

Will Silver Go Up in 2026?

Silver’s direction in 2026 depends on real yields, dollar trends, and physical market conditions. Some analysts point to support from tight supply and debasement concerns, while others highlight scope for consolidation after the January volatility spike.

Is Silver a Good Investment in 2026?

Silver is analysed as a hybrid asset with both industrial and monetary drivers. Its role in electrification and sensitivity to macro stress may support portfolio diversification, though price behaviour in 2026 is expected to remain uneven.

Will Silver Hit $200?

Some analyses outline scenarios above $200 based on historical gold-silver ratios compressing sharply. These outcomes assume sustained macro stress and strong investment flows, and sit well outside base-case assumptions from major banks.

What Will Silver Be Worth by 2030?

By 2030, analytical estimates range widely between $143 and almost $500, reflecting uncertainty around fiscal dynamics, supply response, and industrial demand intensity. Longer-range views agree that the future of silver prices will likely be volatile and shaped by macro structure and capital flows.

How Do Traders Trade Silver in Forex?

Silver cannot be traded on the forex market, as it is a currency market. However, it can be traded in the XAG/USD pair via CFDs. If you are interested in CFD trading, you can consider opening an FXOpen account and get access to over 700 instruments and 1,200 analytical tools.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.