FXOpen

Yesterday, the main event of the week took place — the Federal Reserve meeting, which had a noticeable impact on the market of assets denominated in US dollars. But besides the Fed meeting, there are a number of other events this week related to central banks:

→ today at 10:30, a meeting of the Swiss National Bank took place. The interest rate remained at 1.75%, although there was a significant possibility of its increase to 2%.

→ today at 14:00 GMT+3, a decision on the Bank of England interest rate is expected;

→ news from the Central Bank of Japan is planned for tomorrow morning — there may be surprises.

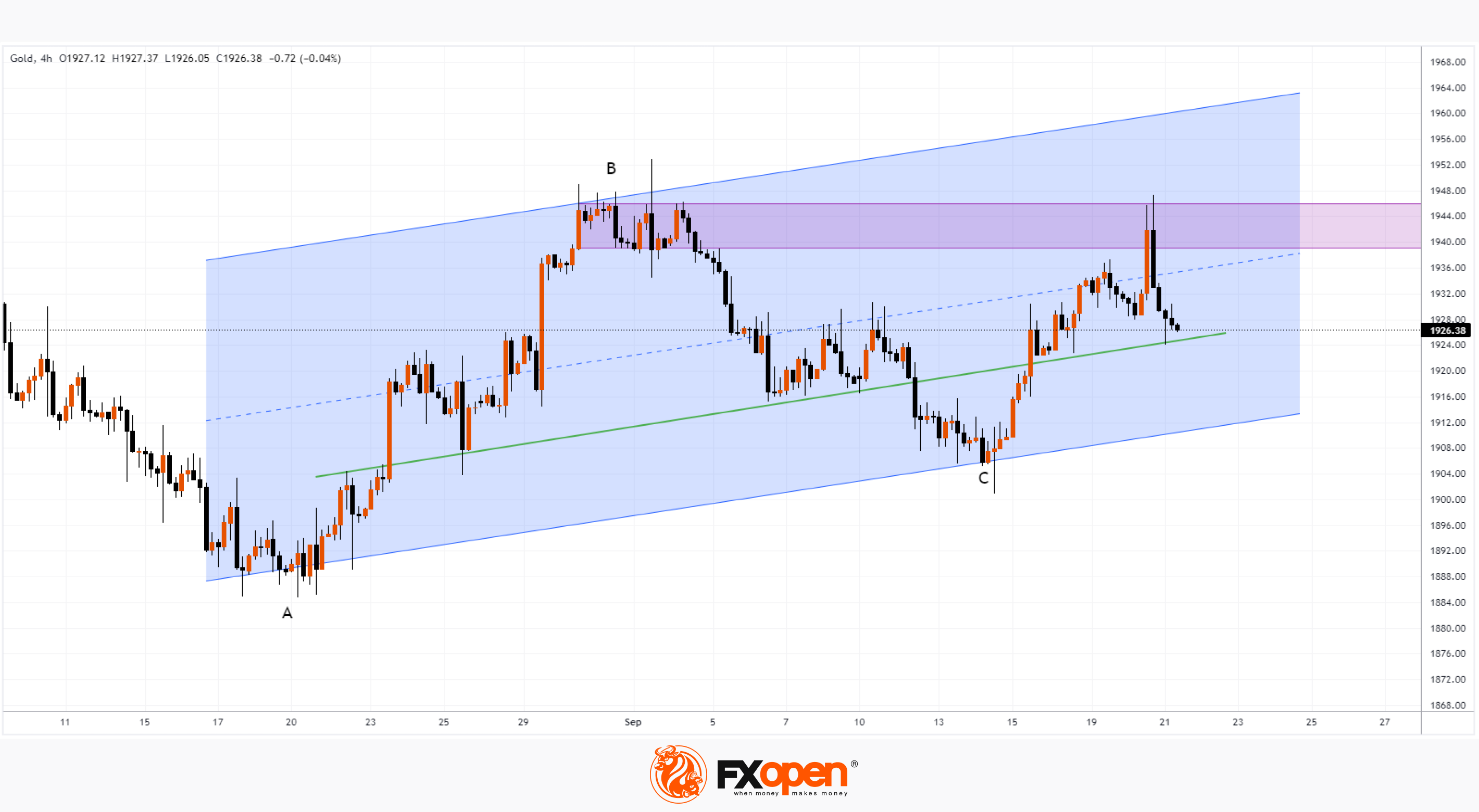

An important asset that is affected by the decisions of central banks is gold. And it is not surprising that the XAU/USD chart showed a surge in volatility yesterday; moreover, new impulses may appear before the end of the week.

Bearish arguments:

→ the price tested the 1,939-1,946 area, which formed in late August - early September. Sellers asserted their dominance in that area, and yesterday the price sharply turned down, attempting to rise into this area;

→ the median line of the ascending channel can now provide resistance to the rise in gold price.

Bullish arguments:

→ rising A and C peaks are a sign of an uptrend, and the lower border of the channel can resist the onslaught of bears;

→ there is a psychological basis to expect support at USD 1,900.

So far, the bulls are holding the line near the trend line, shown in green. And if a weak rebound occurs from it, which does not exceed 50% of the downward momentum that began at yesterday's high, the bears can gain even more confidence in their superiority.

Start trading commodity CFDs with tight spreads. Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.