FXOpen

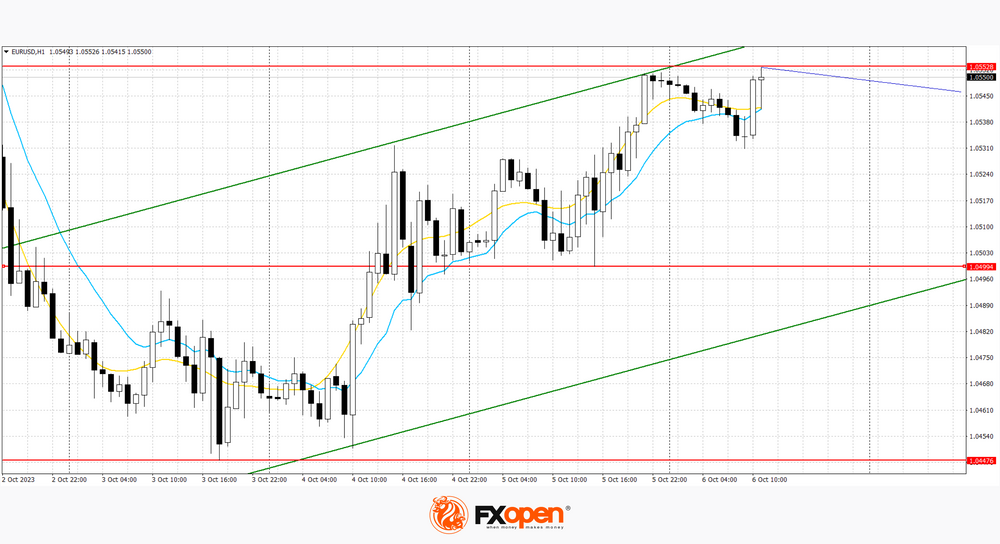

EUR/USD

The EUR/USD pair shows mixed dynamics, remaining close to 1.0540. The European currency ended the last two trading sessions with moderate growth, which allowed the pair to retreat from the record lows of December 2022. The driver of the correctional dynamics was the expectation of the publication of the September report on the labour market in the United States. Analysts are currently forecasting a slight decline in new nonfarm payrolls from 187.0k to 170.0k. Average hourly wages in September could rise from 0.2% to 0.3%, while the annual figure will likely remain unchanged at 4.3%. The unemployment rate is expected to correct from 3.8% to 3.7%.

At the same time, trading participants have information from the Automatic Data Processing (ADP) company presented on Wednesday: in September, the dynamics of employment in the private sector slowed from 180.0k to 89.0k, which turned out to be significantly worse than the 153.0k expected by experts. A more confident growth of the single currency was hampered by statistics on foreign trade in Germany, published the day before: export volumes in August decreased by 1.2% after -1.9% in the previous month, while analysts expected -0.4%, and imports, by 0.4% after -1.3% with a forecast of growth of 0.5%. Against this background, the country's trade surplus decreased from 17.7 billion euros to 16.6 billion euros, which turned out to be better than expectations of 15.0 billion euros.

Based on the highs of two days, a new ascending channel has formed. Now, the price has moved away from the upper border of the channel and may continue to move towards the lower border.

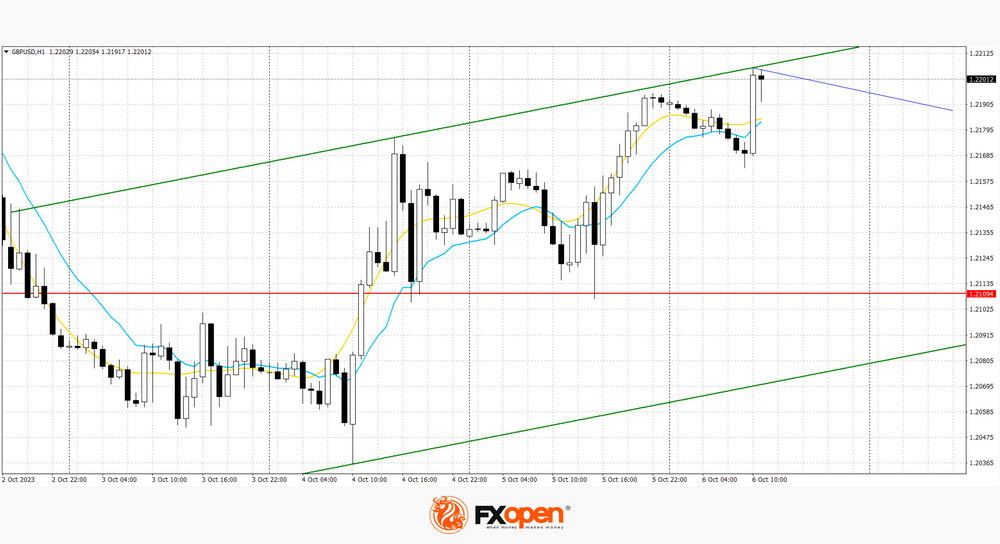

GBP/USD

The GBP/USD pair is consolidating near the level of 1.2175 and the highs of October 2, preparing to end the week with almost zero results against the backdrop of an active bullish correction of the last two days. The Bank of England abandoned its hawkish rhetoric at its last meeting, contrary to market expectations, amid weak macroeconomic statistics. Thus, the September index of business activity in the UK construction sector fell from 50.8 points to 45.0 points, significantly lower than the forecast of 49.9 points. In turn, American data on the dynamics of applications for unemployment benefits exceeded expectations: for the week of September 29, the indicator adjusted from 205.0k to 207.0k compared to expectations of 210.0k. The number of repeated applications for the week of September 22 decreased from 1.665 million to 1.664 million compared to the preliminary estimate of 1.675 million.

Based on the highs of two days, a new ascending channel has formed. Now, the price has moved away from the upper border of the channel and may continue to move towards the lower border.

USD/JPY

The USD/JPY pair shows slight growth, located near the 148.80 mark. The pair is being pressured by corrective sentiment for the US currency, as well as expectations of the publication of the September report on the US labour market. Meanwhile, macroeconomic statistics from Japan put pressure on the yen: wages increased by 1.1% in August, which coincided with the revised dynamics of last month with expectations of 1.5%, and household spending decreased by 2.5% after -5.0% in July with a forecast of -4.3%. In turn, the index of coinciding indicators rose from 114.2 points to 114.3 points, and the index of leading indicators increased from 108.2 points to 109.5 points, while experts expected 109.0 points. The yen is further supported by concerns about possible currency intervention by the Bank of Japan, as the instrument remains near the record level of 150.00.

Based on the lows of two days, a new downward channel has formed. Now, the price is near the upper border of the channel, from where it can continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.