FXOpen

Gold continues to attract attention as investors search for a so-called safe haven in an increasingly uncertain global environment. Rising geopolitical tensions, currency volatility, central bank reserve shifts, and questions about long-term economic resilience have all pushed gold back into focus.

With prices reaching repeated record highs in 2025, many are now looking beyond the immediate rally and asking what comes next. This article breaks down the factors shaping gold’s trajectory and examines analytical gold price forecasts for 2026 to 2030.

Forecast Summary

2026

Predictions range from around $3,950 to $6,376, suggesting a broad possible outcome. The midpoint sits near the $4,500 level, with sentiment driven by interest rate cuts, slowing growth, and ongoing de-dollarisation.

2027

Outlooks extend between $4,579 and roughly $7,819. Many forecasters see gold pushing meaningfully higher as structural demand from institutions and emerging markets remains strong while supply growth stays limited.

2028

Estimates fall between $5,133 and $8,619. The gap reflects uncertainty around inflation persistence and global financial stability. Long-term projections lean bullish as miners struggle to increase production.

2029

Most projections fall between $5,710 and $8,504. Sources note that if geopolitical fragmentation or currency debasement accelerates, gold could outperform these expectations.

2030

Long-range forecasts suggest $5,900 to over $9,300, indicating a continued upward structural trend. Much of this depends on whether monetary policy remains loose and global reserve diversification continues.

Gold Price History

Gold has been a cornerstone of economic systems and wealth preservation for millennia. Revered for its scarcity and intrinsic value, the precious metal has been used as a form of currency, a symbol of wealth, and a reserve asset across different civilisations. Its unique qualities, such as durability and resistance to corrosion, have made it a preferred choice for monetary systems until the modern era introduced fiat currencies.

In the 20th century, gold retained its prominence through the establishment of the gold standard, where currencies were directly linked to gold reserves. Although this system was eventually abandoned, gold has continued to play a significant role as a store of value and a hedge against economic uncertainties, maintaining its relevance in global markets.

The journey of gold's value over time is marked by significant fluctuations influenced by economic policies, global crises, and shifts in demand. Traders can observe how these various factors influenced the spot gold price (XAU/USD) CFDs on FXOpen’s TickTrader platform.

Post Bretton Woods and 1970s Inflation

The collapse of the Bretton Woods system in 1971 initiated a free float of currency values against gold, leading to a decade of volatility. The 1970s experienced a dramatic increase in the price of gold, fueled by inflation, geopolitical tensions, and energy crises, peaking at around $843 in 1980.

1990s Stabilisation and a Dip

The 1990s saw gold stabilising, then dipping to a low of approximately $253 per ounce in 1999 amidst a robust US economy and strong US dollar, diminishing gold's attractiveness as an alternative investment. However, in the second half of 1999, the gold price recovered and fluctuated between $275 and $325 in late 1999 and early 2000.

2000s to Great Recession (2008-2010)

The early 2000s witnessed a gradual rise in prices, surging sharply during the Great Recession of 2008. Its appeal as a so-called safe-haven investment drove it from about $730 in October 2008 to ~$1,300 by October 2010.

European Debt Crisis (2010-2012)

Gold soared to new heights, reaching around $1,825 in August 2011, as concerns over the eurozone's stability and global economic health spurred investor demand for the precious metal.

Post-2013 Economic Recovery

The period following 2013 saw gold decline by 29%, from around $1,695 in January 2013 to around $1,200 in December 2014, influenced by the Federal Reserve's tapering of quantitative easing and a strengthening US dollar.

COVID-19 Pandemic (2020-2023)

The most notable event in the gold price over the last 5 years was the unprecedented global disruption caused by the COVID-19 pandemic. The pandemic led to a significant rise in the price of gold, which soared 27% from around $1,500 in January 2020 to over $2,000 by the summer of 2020. Prices consolidated between $1,700 and $1,900 before reaching new highs above $2,000 in late 2023.

Strong Performance 2024-2025 and Early 2026

Gold experienced a remarkable surge in 2024, driven by a combination of geopolitical tensions, economic uncertainty surrounding the US presidential election, and strong demand from emerging market central banks. By mid-December 2024, gold prices had climbed more than 30%.

Gold hit fresh records in early 2025 as markets reacted to escalating tariff announcements and renewed instability in Ukraine and the Middle East. March marked a turning point, with gold breaking above $3,000 for the first time after a series of selloffs in equities and bonds. So-called safe-haven positioning accelerated through April, and gold briefly touched $3,500 following an aggressive US trade action that triggered further volatility.

While the price ranged between April and September, momentum returned as the Federal Reserve signalled its first rate cut of the cycle, weakening the dollar and boosting gold demand from global investors as yields fell. By mid-October, gold peaked at $4,381, before surging to $4,550 by year-end.

The metal delivered one of its strongest annual performances on record, gaining roughly 65% amid dovish monetary policy expectations, heightened geopolitical tensions, and sustained central bank buying.

By 21 January 2026, XAU/USD had climbed further to $4,888, driven by escalating geopolitical risks, including US military action against Venezuela, unrest in Iran with the prospect of US involvement, and renewed rhetoric from Donald Trump regarding the takeover of Greenland.

Let’s now examine the factors that could influence gold prices in 2026 and the years ahead.

Analytical Gold Price Forecasts for 2026-2030

Is gold going up or down between 2026 and 2030? In this section, we’ll examine gold price predictions for the next 5 years from various algorithm-driven analytical resources.

The period from 2026 to 2030 is poised to be transformative for gold markets, influenced by a confluence of factors that could significantly impact gold prices. They collectively reflect a supportive environment for gold, potentially leading to elevated prices as the decade progresses.

Central Bank Diversification Away from the US Dollar

Central banks continued to play a major role in supporting gold demand through 2025, with reserve managers increasingly positioning gold as an alternative to the US dollar. Official sector buying exceeded 1,000 tonnes for the third year in a row in 2024, led by emerging markets such as China, Turkey, India, and Poland. Many of the institutions cited geopolitical risk, sanctions exposure, and concerns about US fiscal sustainability as major reasons for diversifying.

Surveys from the World Gold Council show this behaviour isn’t a short-term trend. By mid-2025, more than 70% of central bank respondents expected the share of gold in global reserves to continue rising over the next five years, while a similar proportion anticipated a gradual decline in the dollar’s dominance. Some reserve managers also highlighted the appeal of owning an asset with no counterparty risk, particularly as global debt levels increased and geopolitical blocs became more defined.

This shift contributes to the creation of a structural floor under gold prices in 2026 and beyond. With few signs of reversal, continued official-sector buying remains a supportive factor for analytical gold price forecasts in 2026 to 2030, especially if geopolitical fragmentation deepens and confidence in traditional reserve currencies weakens further.

Dollar Devaluation

The weakening of the US dollar’s purchasing power has become an increasingly influential factor in gold demand. While headline inflation cooled from its post-pandemic peak, the cumulative effect has been significant. Between 2021 and 2025, the dollar lost roughly 15–20% of its real spending value, depending on the inflation measure tracked. Everyday benchmarks such as housing, energy, and food costs rose sharply, highlighting the dollar’s deterioration as a store of value.

This erosion was echoed in gold-relative terms. In 2022, one ounce of gold cost around $1,700; by late 2025, it traded above $4,000. Put differently, the dollar now buys less than half the gold it did three years earlier. That decline reflects not only inflation but also reduced confidence in long-term dollar strength as government debt surpassed $38 trillion (Trading Economics) and global demand for US Treasury assets softened.

As purchasing power weakens, investors increasingly view gold as a more durable alternative to holding cash.

Geopolitical Tensions

Persistent geopolitical tensions are expected to sustain gold's appeal as a so-called safe-haven asset. Conflicts such as those in Ukraine and the Middle East have already driven investors toward gold. The question of Greenland became one of the most critical geopolitical issues in early 2026. Additionally, potential new flashpoints, like heightened tensions between China and Taiwan, could further escalate global instability.

Analysts note that during periods of significant geopolitical upheaval, gold demand tends to rise as investors seek protection against economic and financial fallout. This pattern is expected to continue through 2030, supporting higher gold prices.

Monetary Policy and Interest Rates

Monetary policy remains one of the most important forward-looking drivers for gold. After an extended tightening cycle, major central banks, including the Federal Reserve and the ECB, entered 2025 signalling a transition toward easing. Markets now expect rate cuts to continue into 2026 as growth slows and labour market data softens. This shift matters for analytical gold price predictions in 2026 and beyond because lower interest rates reduce the relative appeal of yield-bearing assets, encouraging capital to move into non-yielding stores of value.

Real rates will be especially important. If inflation proves sticky while nominal rates fall, real yields could turn negative again, historically a strong tailwind for gold accumulation. Investors are already positioning for this scenario, particularly as government borrowing remains elevated and fiscal policy stays expansionary.

If the easing cycle accelerates or recession risks rise, gold demand may strengthen further. Conversely, a pause or reversal in rate cuts could temper upside momentum but is not currently the base case.

Economic Indicators

Economic indicators such as inflation, currency fluctuations, and global economic growth significantly influence gold prices. A potential slowdown in the US economy, coupled with a weaker dollar, may bolster gold prices. As the dollar depreciates, gold becomes more affordable for holders of other currencies, increasing its demand.

Additionally, high global debt levels and potential devaluation of currencies like the US dollar are prompting a shift to gold. These economic factors are expected to play a pivotal role in shaping gold prices through 2030.

Supply Constraints

Global mine supply is modest but demand is high. High operating costs continue to pressure producers, with average All-In Sustaining Costs climbing above $1,500 per ounce in 2025 due to fuel, labour, and equipment inflation.

New large discoveries are rare, and most new output comes from expansions of existing sites rather than fresh deposits. Several projects in West Africa and Latin America also faced delays linked to permitting, power shortages, and security risks.

With limited new supply and declining ore grades, analysts expect output growth to flatten and potentially contract late in the decade.

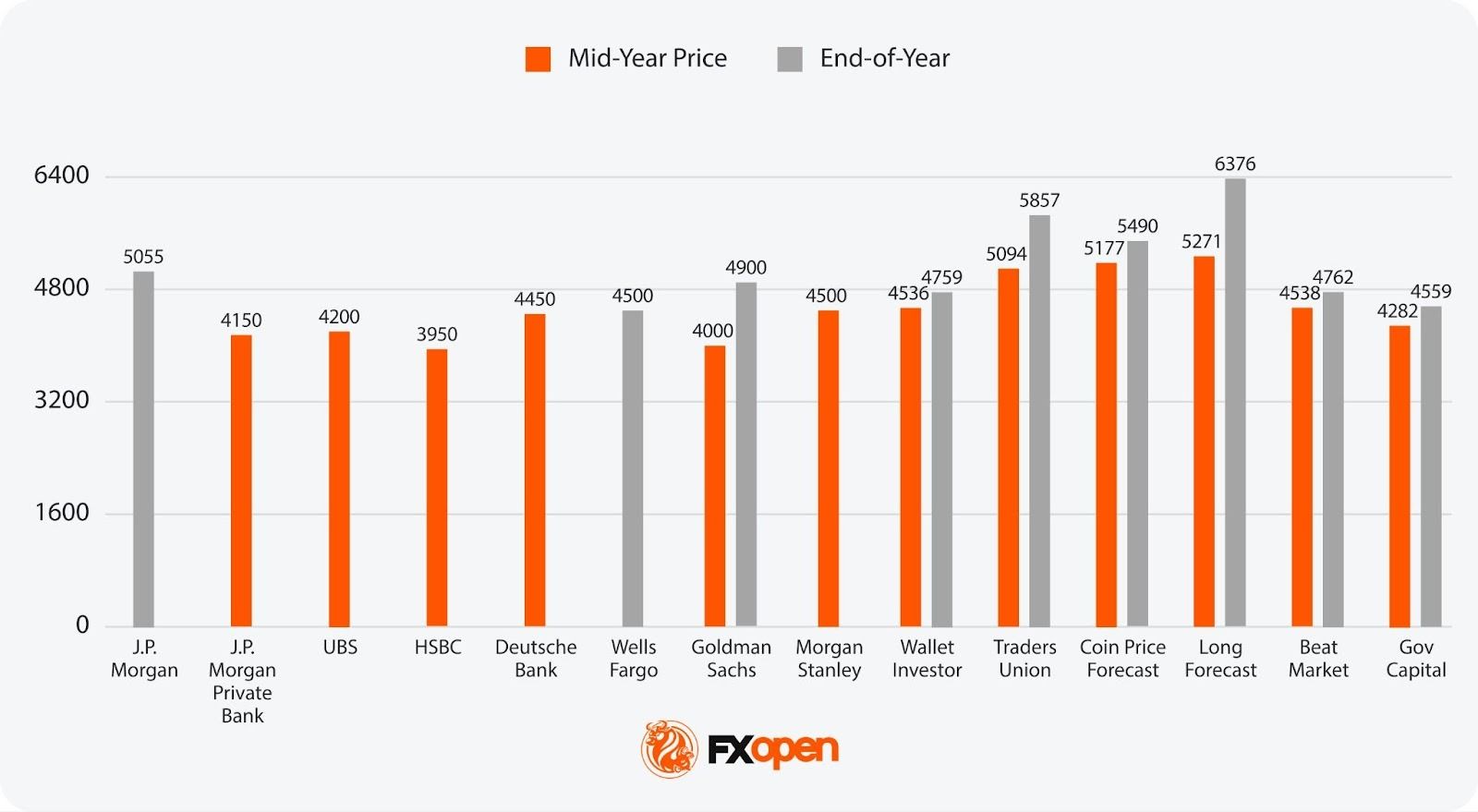

Gold Price Predictions for 2026

As we move into 2026, the expectations show a continuation of the upward trend, albeit with differences in the extent of growth anticipated by various sources.

- Most Optimistic Projection for Mid-Year 2026: 5,271 (Long Forecast)

- Most Pessimistic Projection for Mid-Year 2026: 3,950 (HSBC)

- Most Optimistic Projection for End-of-Year 2026: 6,376 (Long Forecast)

- Most Pessimistic Projection for End-of-Year 2026: 4,500 (Wells Fargo)

J.P. Morgan Private Bank forecasts gold at $4,050–4,150 by mid-2026, supported by the Federal Reserve’s looser policy. At the same time, J.P. Morgan projects that the metal could average $5,055 per ounce by Q4 2026, citing robust investor interest and steady central bank purchases, which could reach about 566 tons per quarter. "Gold remains our highest conviction long for the year, and we see further upside as the market enters a Fed rate-cutting cycle," stated Natasha Kaneva, Head of Global Commodities Strategy at J.P. Morgan.

Goldman Sachs projects gold to reach about $4,000 per ounce by mid-2026 and $4,900 by year-end, driven primarily by strong central bank demand and a more dovish Fed. Continued central bank buying will be the main driver of the uptrend. Daan Struyven, head of oil research at Goldman Sachs, stated, “We look for nearly 20% of additional price upside by the end of 2026, with our forecast at $4,900 per troy ounce by the end of ’26.” He noted that higher central bank purchases and the dovish Fed’s monetary policy will contribute to the rise.

Morgan Stanley offers the most bullish mid-year prediction from any bank here, forecasting that gold could reach around $4,500 per ounce by mid-2026, supported by strong demand from ETFs and ongoing central bank accumulation as uncertainty persists. While the outlook remains broadly positive, Morgan Stanley cautions that volatility, shifting investor allocation, or reduced central bank buying could limit upside.

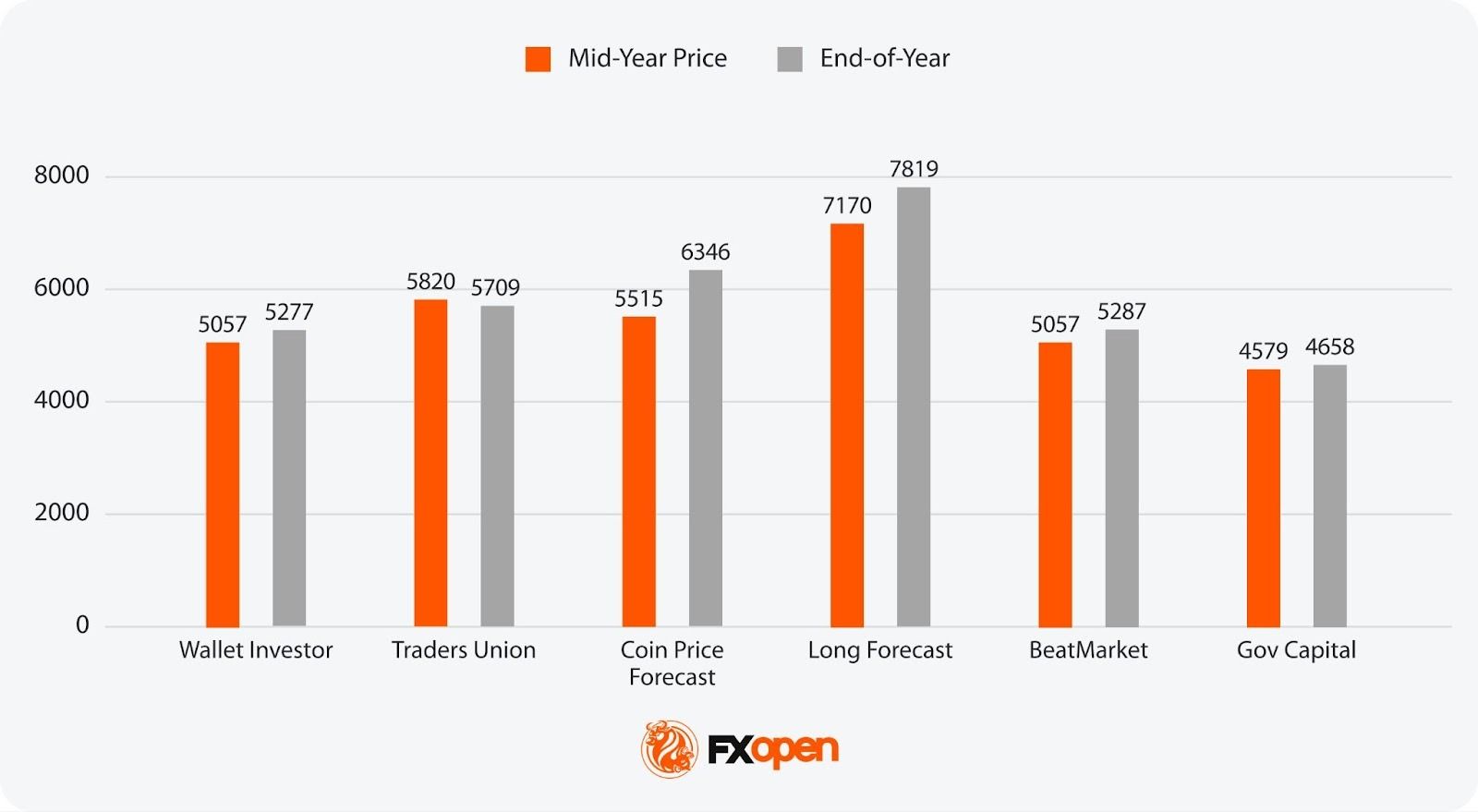

Gold Price Predictions for 2027

The projections for 2027 illustrate a continued rising trend, with certain forecasters predicting substantial gains.

- Most Optimistic Projection for Mid-Year 2027: 7,170 (Long Forecast)

- Most Pessimistic Projection for Mid-Year 2027: 4,579 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2027: 7,819 (Long Forecast)

- Most Pessimistic Projection for End-of-Year 2027: 4,658 (Gov Capital)

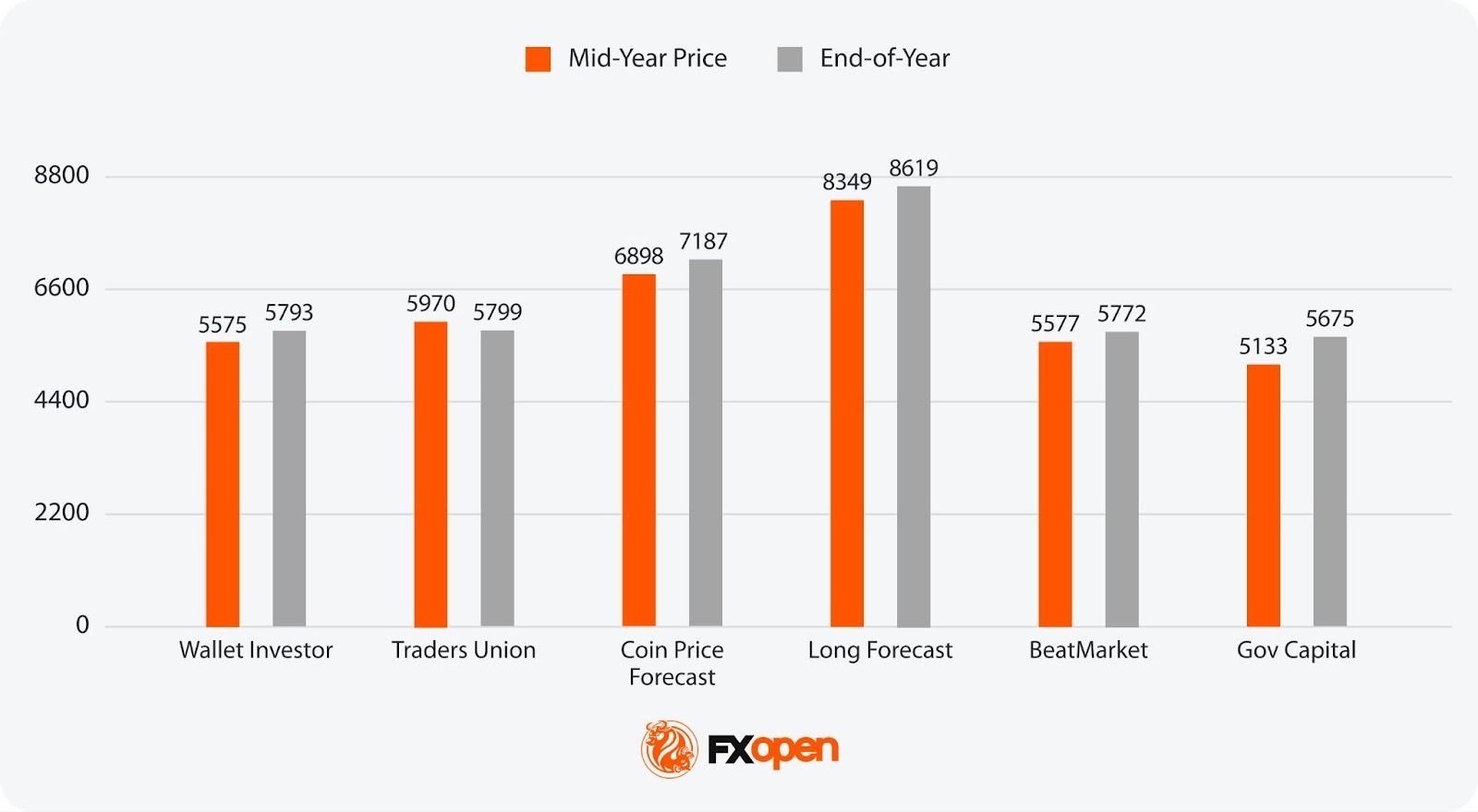

Gold Price Predictions for 2028

Looking towards 2028, the range of predictions indicates both caution and enthusiasm about gold's value in the market.

- Most Optimistic Projection for Mid-Year 2028: 8,349 (Long Forecast)

- Most Pessimistic Projection for Mid-Year 2028: 5,133 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2028: 8,619 (Long Forecast)

- Most Pessimistic Projection for End-of-Year 2028: 5,675 (Gov Capital)

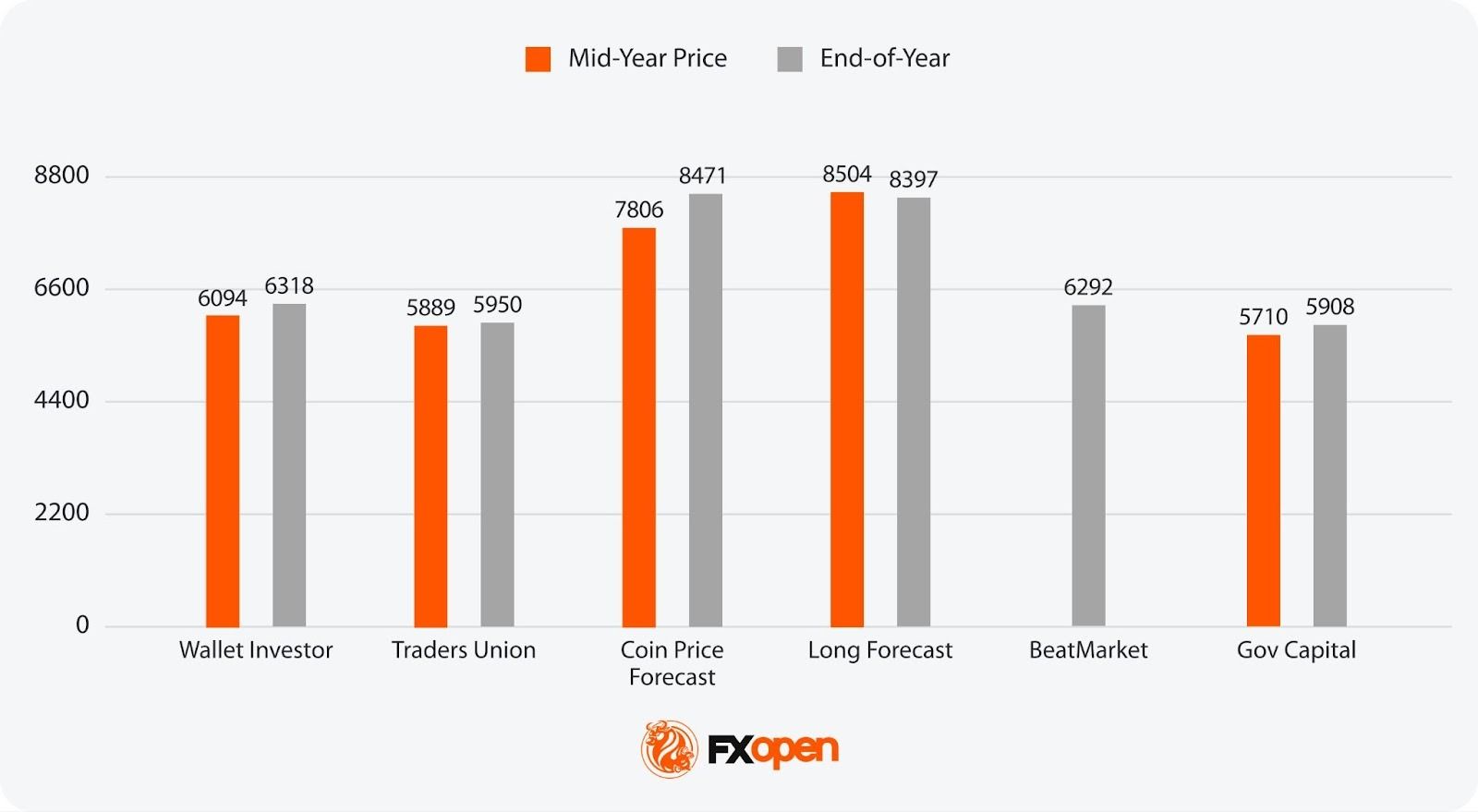

Gold Price Predictions for 2029

As we approach the end of the decade, forecasters remain optimistic about the yellow metal’s enduring value.

- Most Optimistic Projection for Mid-Year 2029: 8,504 (Long Forecast)

- Most Pessimistic Projection for Mid-Year 2029: 5,710 (Gov Capital)

- Most Optimistic Projection for End-of-Year 2029: 8,471 (Coin Price Forecast)

- Most Pessimistic Projection for End-of-Year 2029: 5,908 (Gov Capital)

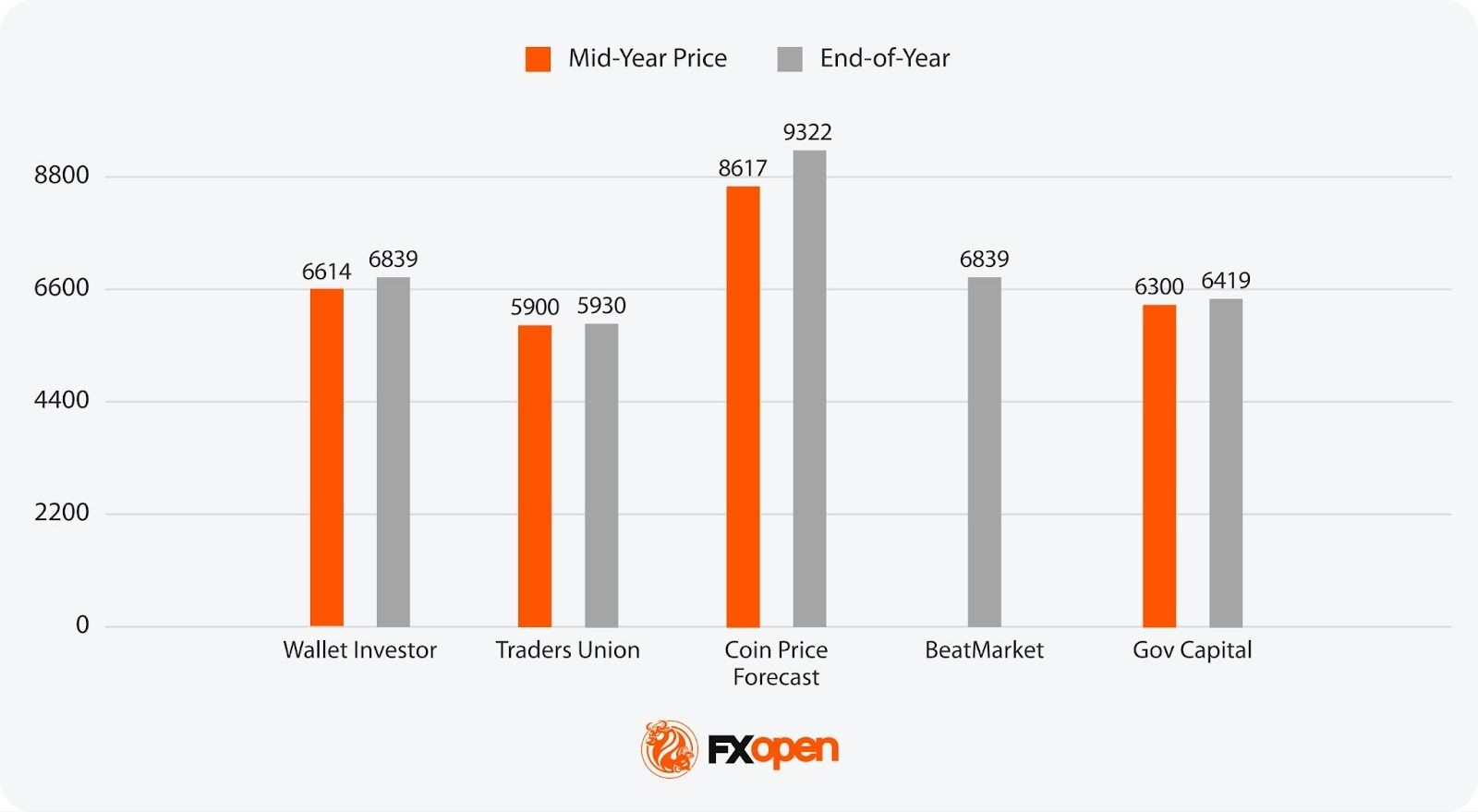

Gold Price Predictions for 2030

Gold projections remain strongly bullish for the end of the decade, with only one source expecting a price below $6,000 by the end of the decade.

- Most Optimistic Projection for Mid-Year 2030: 8,617 (Coin Price Forecast)

- Most Pessimistic Projection for Mid-Year 2030: 5,900 (Traders Union)

- Most Optimistic Projection for End-of-Year 2030: 9,322 (Coin Price Forecast)

- Most Pessimistic Projection for End-of-Year 2030: 5,930 (Traders Union)

Factors That May Affect the Gold Price Over 10 Years

As we look towards gold prices 10 years from now, several macroeconomic factors could shape the gold projections over the next 10 years.

- Inflation: While many assume a direct correlation between inflation and gold, the relationship is complex and not as straightforward. Inflation can impact the metal, but other factors often mitigate its effects.

- Currency Fluctuations: Gold and the US dollar share an inverse relationship. As the dollar weakens, gold often rises, becoming more attractive to investors holding other currencies.

- Geopolitical Tensions: Conflicts and political instability historically drive investors towards gold as a so-called safe haven, potentially boosting its price during periods of heightened uncertainty.

- Interest Rates: Gold's appeal can diminish with the expectation of rising interest rates, as higher yields on bonds and savings accounts compete with the non-yielding metal.

- Supply and Demand: The actions of large market players, including central banks and investment funds, significantly impact demand. Additionally, economic growth in countries like China and India may bolster demand for gold as an investment and reserve asset.

Advantages and Risks for Traders

Although analytical projections are optimistic, traders and investors should be cautious as the gold price movements are shaped by geopolitical, economic, and supply dynamics.

Advantages

- Safe-Haven Demand: Ongoing geopolitical risk remains one of the key drivers, with conflicts in Eastern Europe and the Middle East, plus rising US–China strategic tension, keeping demand elevated as investors seek protection during periods of market stress.

- Diversification: Central banks’ shift away from the US dollar suggests continued demand for gold, providing portfolio diversification in volatile currency markets.

- Inflation Hedge: With global debt levels climbing, gold’s historical role as a so-called safeguard against inflation remains relevant.

Risks

- Volatile Demand: Declining consumer demand in major markets like India and China due to economic shifts could impact gold prices.

- Regulatory Risks: Changes in taxation or import restrictions on gold in major markets could affect investment flows.

- Economic Recovery: A stronger-than-anticipated recovery in global economies or currencies, particularly the US dollar, may dampen gold demand.

The Bottom Line

Gold remains a vital asset in the global financial landscape, often viewed as a potential hedge against inflation, currency fluctuations, and economic uncertainty. Based on the analytical predictions for 2026-2030, evolving geopolitical events, central bank policies, and demand from investors will be the key factors, determining the gold market direction.

If you are looking to trade gold via CFDs, you can consider opening an FXOpen account and gain access to tight spreads and low commissions.

FAQ

What Will the Price of Gold Be in 2026?

Gold price future predictions vary, with estimates ranging from roughly $3,950 to above $6,000 depending on economic conditions, interest rates, and global stability. Many analysts view a price near $4,500 as a reasonable midpoint based on current momentum.

Will the Gold Price Go Down in 2026?

Short-term pullbacks are possible, especially if risk sentiment improves or monetary easing slows. However, most analytical outlooks still lean bullish, with geopolitical tension, high debt levels, and currency weakness providing support rather than downside pressure.

Will Gold Go Up in 2026?

Many analysts expect further upside if central banks continue cutting rates and inflation remains above target. Ongoing reserve diversification, a softer dollar, and continued geopolitical risk may extend gold’s multi-year upward trend.

What Drives the Price of Gold?

Major drivers include currency movements, real interest rates, inflation expectations, supply limitations, and investor sentiment. Central bank buying and geopolitical stress also play a significant role in shaping demand and long-term price direction.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.