FXOpen

The forex market operates 24 hours a day, five days a week, linking major financial centres around the world. However, trading activity is not evenly distributed throughout the day—certain hours are marked by higher liquidity and volatility.

The market is divided into four sessions: Sydney, Tokyo, London, and New York. When these sessions overlap, trading volumes surge, creating rapid price movements. Understanding the timing of these sessions may help traders identify when the market is most active and which pairs are likely to move. This article breaks down the major global trading sessions and explores how their timing influences market liquidity and volatility.

The 24-Hour Cycle of Forex Market Time Zones

The forex market's distinctive feature of being open 24 hours a day, five days a week, is a testament to its unparalleled accessibility, dynamics, and decentralised nature. Unlike traditional financial markets constrained by fixed trading hours, the forex market operates continuously, commencing in Asia on Monday and concluding in North America on Friday.

Major financial centres in different time zones steer the dynamics of the forex market, acting as the primary drivers of market activity during their respective business hours. That complex interplay creates distinct trading periods, each characterised by unique market conditions.

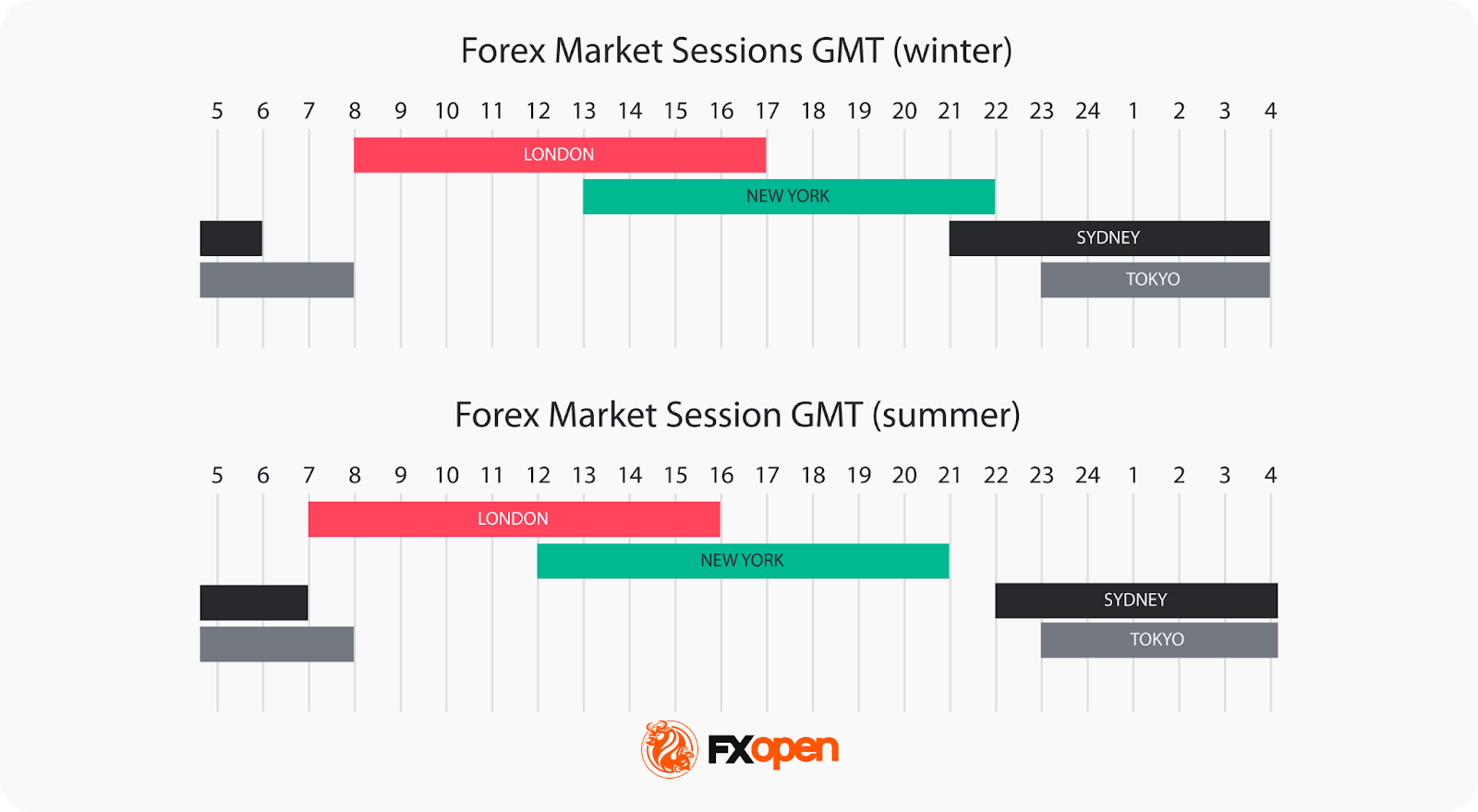

Forex Session Time Zones

Knowing the major forex trading hours is fundamental for any trader aiming to take advantage of the dynamic nature of the market.

Winter time:

- London Session: From 8:00 AM to 5:00 PM UTC

- New York Session: From 1:00 PM to 10:00 PM UTC

- Sydney Session: From 09:00 PM to 6:00 AM UTC

- Tokyo Session: From 11:00 PM to 8:00 AM UTC

Summer time:

- London Session: From 7:00 AM to 4:00 PM UTC

- New York Session: From 12:00 PM to 9:00 PM UTC

- Sydney Session: From 10:00 PM to 7:00 AM UTC

- Tokyo Session: From 11:00 PM to 8:00 AM UTC

Different Time Zones in Forex Trading

Each session of the diverse forex trading time zones presents distinct characteristics that traders can exploit.

London Session

The London session time is popular among traders who want to engage in high-liquidity markets. Currency pairs involving the euro (EUR) or the British pound (GBP), such as EUR/USD and GBP/USD, tend to be particularly active during this period. The early morning volatility during the London session trading time can be harnessed for quick trades or trend-establishing moves.

New York Session

As the New York session time kicks in, currency pairs involving the US dollar (USD) or other currencies of countries in the same time zone take centre stage. Pairs like USD/MXN and USD/CAD experience heightened volatility and amplified market activity.

Sydney Session

While the Sydney session may exhibit lower volatility, it sets the stage for the day's trading. Currency pairs tied to the Australian dollar (AUD) and the New Zealand dollar (NZD), like AUD/USD and NZD/USD, can witness initial movements during this period, creating conditions for strategic positioning.

Tokyo Session

The Tokyo session focuses on the Japanese yen (JPY) pairs, offering traders the chance to tap into the unique characteristics of this market. Currency pairs like USD/JPY and EUR/JPY may see increased activity, presenting conditions for trend-following or counter-trend strategies.

Session Trading Strategies

The convergence of major financial hubs during specific currency trading time zones creates a unique environment that can be exploited strategically. Let’s examine three strategies for each major forex time zone. If you’d like to test out these forex market session strategies, you can consider trying FXOpen's trading platform, TickTrader.

London Session Breakout Strategy

The London Session Breakout strategy is based on the significant increase in trading volume and volatility when the London market opens, specifically between 7:00 AM and 10:00 AM UTC (summer time) or 8:00 AM and 11:00 AM UTC (winter time). However, most focus is often placed on the range between 8:00 AM and 9:00 AM summer time or 9:00 AM and 10:00 AM winter time. This surge during the London trading session often leads to notable price movements, particularly in forex pairs like GBP/USD and EUR/USD, making it popular among those who prefer breakout strategies.

Entry

- Traders monitor the early London trading hours. The idea is to look for a specific range with clear high and low boundaries during this time.

- They set buy stop orders slightly above the high of this range and sell stop orders slightly below the low, aiming to capture the breakout direction.

Stop Loss

- Stop losses are strategically placed slightly below the most recent swing low for buy positions and vice versa, offering potential protection against false breakouts.

Take Profit

- Some traders may prefer to close the position as the New York session begins, as reversals are common during this session overlap.

- Alternatively, trailing stops might be employed to take advantage of extended price movements if the trend continues strongly after the breakout.

New York Reversal Strategy

The New York Reversal strategy exploits the heightened volatility and liquidity that occur at the start of the New York session. While there isn’t a perfect correlation, it’s common to see the initial London trend extended early into the New York session before a reversal, usually between 12:30 PM and 2:00 PM UTC summer time and 1:30 PM and 2 PM UTC winter time. This strategy is popular due to the influx of trading activity and market orders when the US markets open.

Entry

- Traders often monitor the market around the first couple of hours of the New York forex session time, looking for signs of reversal. This may be a divergence between a price and a momentum indicator, a reaction from a significant support or resistance level, a candlestick or chart pattern, and so on.

- Once the trader has confirmation that the London trend may be reversing, they enter a position.

Stop Loss

- Stop losses are generally placed just beyond the nearest swing high or low. This is supposed to help protect against losses if the anticipated reversal does not occur.

Take Profit

- Traders frequently set profit targets at significant support or resistance levels established during the London session.

- Alternatively, traders might trail their stop loss to follow the market movement and maximise potential gains.

Tokyo Volatility Breakout Strategy

The Tokyo Volatility Breakout strategy leverages the increased trading activity and liquidity at the start of the Tokyo session time. This strategy is popular among those who trade JPY pairs like USD/JPY, EUR/JPY, and GBP/JPY, which often see significant price movements due to the influx of market participants at Japan’s forex market open time.

Between 9:00 PM and 10:00 PM UTC summer time (8:00 PM and 9:00 PM UTC winter time), volume and liquidity dry up significantly as the New York session closes. 10:00 PM and 11:00 PM UTC summer time (9:00 PM and 10:00 PM winter time) sees some activity as Sydney session time begins, but the start of the Tokyo session forex time, between 11:00 PM and 12:00 AM, can kickstart a new trend and break out from the typical ranging conditions from the previous few hours.

Entry

- Traders often monitor the market and look for breakouts as the Tokyo session begins.

- Bollinger Bands can be used to identify these breakouts, typically characterised by the bands squeezing together before the price closes strongly outside the upper or lower band, potentially indicating the start of a trend.

Stop Loss

- Stop losses are typically set beyond the nearest swing high or low or beyond the opposite side of the Bollinger Band. This is supposed to help traders manage risks if the breakout does not result in a sustained trend.

Take Profit

- Profit targets are often set at significant support or resistance levels established in previous sessions.

- Alternatively, positions might be closed at the start of the London session (around 7:00 AM - 8:00 AM UTC) to avoid potential reversals that occur with the increased liquidity and trading volume as European markets open.

Tailoring Your Trading Schedule to Forex Currency Time Zones

Crafting a trading schedule involves a personalised approach, taking into account a trader's individual location and trading style objectives.

Different Trading Styles

Forex time zones often determine specific forex rate behaviours. For day traders, the volatility and liquidity during overlapping activity can provide conditions for executing rapid trades. The heightened volatility and liquidity are even more advantageous for scalpers seeking to capitalise on rapid price movements by executing trades with precision.

Overlapping sessions also often mark key points where trends may continue or reverse. Traders employing trend-following or breakout-based strategies can capitalise on that momentum.

Swing traders, on the other hand, who aim to capture trends over a slightly longer timeframe, may take advantage of the distinct characteristics of individual sessions, such as the so-called ‘stability’ of the Sydney session or the high volatility of the London session.

Economic Events and News Releases

Traders also consider the timing of major data releases and align that with their specific geographic location. During the London session, major European economic indicators and policy announcements can set the tone. Then, the market may respond to data from the United States that can significantly influence USD pairs, followed by economic reports from the Asia-Pacific region. The interconnectedness of the world economy can have cascading effects on currency values across the globe.

Currency Market Correlations

Currency pair correlations exhibit dynamic shifts depending on the timing and may lead to specific patterns. For example, the correlation between USD/JPY and EUR/USD can shift throughout the trading day, starting from positive during the Tokyo session and then shifting into negative during European and New York trading hours. Traders can leverage correlation analysis as a powerful tool for making trading decisions.

Final Thoughts

While the forex market never truly sleeps, understanding its rhythm is important. Each trading session presents unique characteristics—ranging from subdued activity in the Pacific hours to intense volatility during the London–New York overlap.

Traders adapt their strategies to these time-based dynamics, focusing on the sessions that align with their trading style, preferred currency pairs, and risk tolerance. By mastering the relationship between time zones, liquidity, and volatility, traders can transform market timing from a challenge into a strategic advantage.

If you want to gain access to tight spreads from 0.0 pips, commissions as low as $1.50 per lot, and 4 advanced trading platforms with powerful built-in analysis tools, you may consider opening an FXOpen account.

FAQ

What Are the 4 Forex Sessions?

The forex market operates 24 hours a day, divided into four main sessions based on key financial centres: the Sydney session forex time (10:00 PM to 7:00 AM UTC in the summer and 9:00 PM to 6:00 AM UTC in the winter), the Tokyo session forex time (11:00 PM to 8:00 AM UTC in the summer and winter), the London session forex time (7:00 AM to 4:00 PM UTC in the summer and 8:00 AM to 5:00 PM UTC in the winter), and the New York session forex time (12:00 PM to 9:00 PM UTC in the summer and 1:00 PM to 10:00 PM UTC in the winter).

When Does the London Session Start?

The London session starts at 7:00 AM UTC during summer and at 8:00 AM UTC during winter due to daylight saving time adjustments. This session is crucial for its high liquidity and significant overlap with other major sessions.

What Time Is the New York-London Session Overlap?

The overlap between the New York trading session time and the London session occurs from 12:00 PM to 4:00 PM UTC in summer and from 1:00 PM to 5:00 PM UTC in winter.

Do Tokyo and London Sessions Overlap?

The Tokyo and London sessions do not overlap significantly. The Tokyo session ends at 8:00 AM UTC, while the London session starts at 7:00 AM UTC in the summer. The minimal overlap from 7:00 AM to 8:00 AM UTC sees limited trading activity. In winter, sessions don’t overlap.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.