FXOpen

The US dollar strengthened on Friday ahead of a series of highly anticipated central bank meetings next week, including the US Federal Reserve. The dollar rose 1.3% for the week, its biggest gain since mid-January, after a mixed batch of data showed the U.S. economy remained resilient. That suggests the Federal Reserve could keep interest rates high for longer or reduce its planned number of rate cuts this year. Data on Friday showed a strong US manufacturing sector, with output rebounding 0.8% last month after a downwardly revised 1.1% decline in the previous month. The University of Michigan's preliminary overall consumer sentiment index for the month was 76.5, down from a final reading of 76.9 in February. The Fed's measure of annual inflation expectations remained unchanged at 3.0% in March. The five-year inflation forecast also remained stable at 2.9% for the fourth month in a row, according to the survey. The US Federal Reserve meeting will take place on Wednesday and analysts do not expect officials to make changes to monetary policy, but expect to receive forecasts for borrowing costs for the current year. The market continues to price in at least three 25 basis point interest rate cuts before the end of 2024, the first of which could come in June.

EUR/USD

The EUR/USD pair shows mixed dynamics, remaining close to 1.0885. Immediate resistance can be seen at 1.0899, a break higher could trigger a move towards 1.0963. On the downside, immediate support is seen at 1.0872, a break below could take the pair towards 1.0840.

Market activity remains subdued at the beginning of the week as traders are in no hurry to open positions in anticipation of the emergence of new drivers. Today the eurozone will publish February inflation statistics. The forecasts do not assume any changes in the consumer price index compared to previous data. On Thursday, March 21, trading participants will evaluate March data on business activity in the eurozone, as well as the ECB's monthly economic report, which may clarify the prospects for the regulator's monetary policy for the current year. Forecasts for business activity indices suggest an increase in the indicator from 46.5 points to 47.0 points in the manufacturing sector and from 50.2 points to 50.5 points in the services sector.

Technical analysis of EUR/USD shows that a new downward channel has formed based on last week’s lows. Now the price is in the middle of the channel and may continue to decline.

GBP/USD

The GBP/USD pair is consolidating near the 1.2730 mark and the local lows of March 7, updated at the end of last week. Immediate resistance on the GBP/USD chart can be seen at 1.2758, a break higher could trigger a rise towards 1.2822. On the downside, immediate support is seen at 1.2725, a break below could take the pair towards 1.2690.

Traders are in no hurry to open new trading positions, preferring to wait for the emergence of new drivers from the UK and the USA. The central place among the weekly publications is occupied by the results of the meetings of the US Federal Reserve and the Bank of England. Both regulators are currently not expected to change monetary policy, but their minutes could clarify plans for an expected reduction in borrowing costs later this year. The Bank of England is likely to pay more attention to consumer inflation statistics due on Wednesday. In February, the consumer price index could gain 0.7% after -0.6% in the previous month, and the core annual rate is expected to reach 4.6% after 5.1%. Also during the day, data on the retail price index will be published: experts expect an increase of 0.8% month-on-month and 4.5% year-on-year after -0.3% and 4.9%, respectively.

Based on last week's lows, a new downward channel has formed. Now the price is in the middle of the channel and may continue to decline.

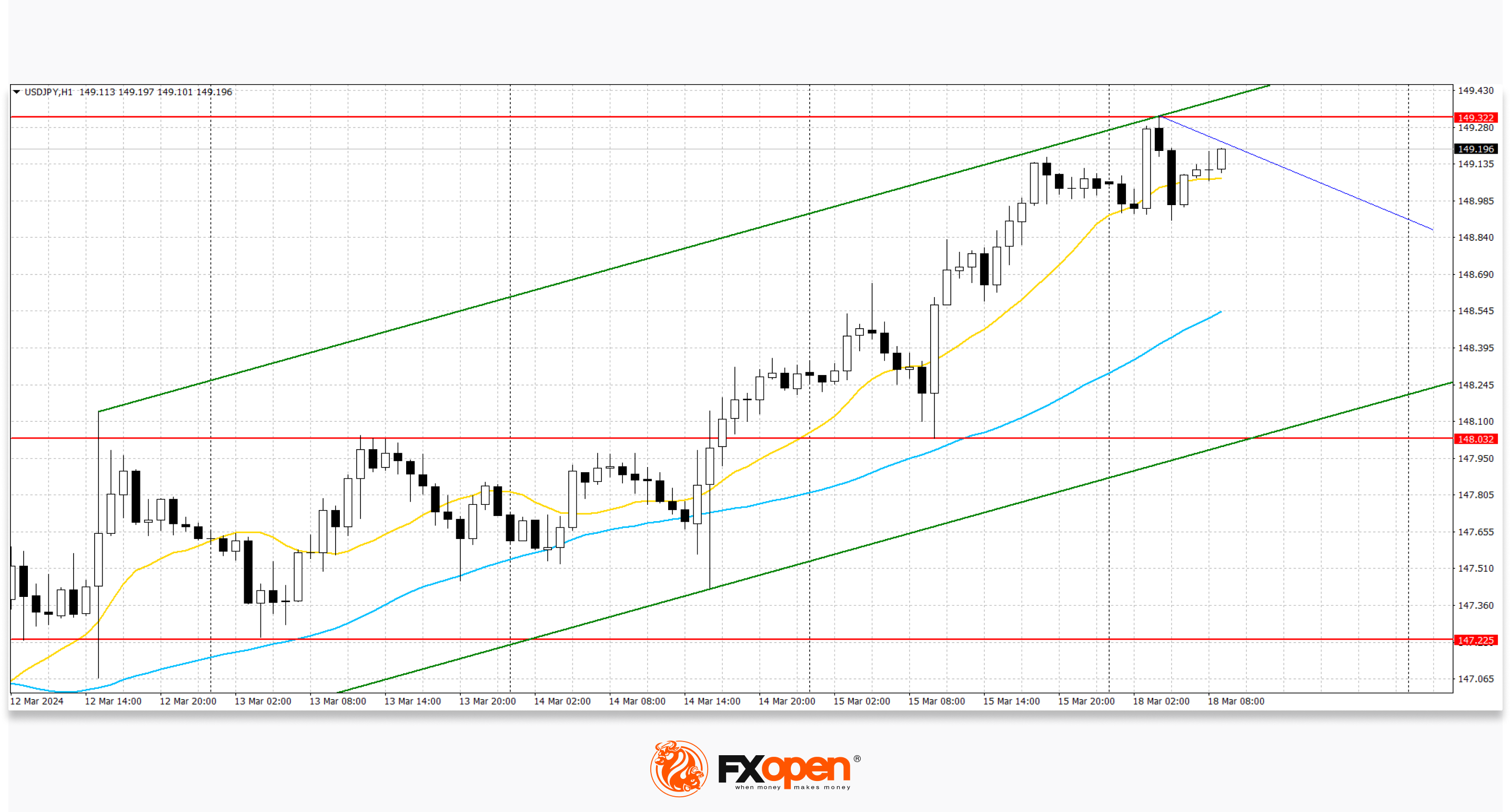

USD/JPY

The USD/JPY pair shows multidirectional dynamics: the instrument remains near the 149.15 mark, and trading participants expect new drivers to emerge. Strong resistance can be seen at 149.32, a break higher could trigger a rise towards 149.80. On the other hand, the nearest support on the USD/JPY chart is visible at 148.03. A break below could take the pair towards 147.22.

This week a block of macroeconomic data is expected to be published, and investors will focus on the results of the meetings of the US Federal Reserve and the Bank of Japan. The Japanese regulator will announce a decision on interest rates tomorrow. Some analysts believe that officials will abandon the eight-year policy of negative interest rates, adjusting the value from -0.10%. More cautious forecasts for borrowing costs suggest they will rise in April. In addition, tomorrow Japan will present January industrial production statistics, which reflect the amount of manufactured goods and utilities produced in the country, taking into account the manufacturing and mining industries, as well as the electric power industry. Forecasts call for a further decline in output of 7.5% on a monthly basis, after falling by a similar amount a month earlier, and on an annualised basis, production fell 1.5% in December.

On Friday, Rengo, Japan's largest labour group, which represents 7.0 million workers, said it had reached an agreement with companies that would raise wages for full-time workers by 5.28% this year and for part-time workers by 5.28% this year. 6.0%, which is the largest increase in the last 33 years. Experts believed that the correction of the indicator would be about 4.0%. Rengo CEO Tomoko Yoshino said the decision was driven by growing income inequality across businesses, accelerating inflation and the overall labour market crisis.

Based on the highs of last week, a new ascending channel has formed. Now the price has moved away from the upper limit and may continue to decline.

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.