Authorised and Regulated by the FCA

Spreads From

0.0 Pips

From one trading account

1M+

Registered Traders

3.9M

Open Accounts

786K

Trades Placed

18+

Years on the market

Based on reviews for all FXOpen companies.

Why trade with FXOpen?

A secure environment for trading

All client funds are fully segregated from FXOpen's own funds in accordance with FCA Client Asset Rules. Client funds are held in segregated accounts at Barclays Bank Plc and retail client funds are fully protected up to £85,000 by the FSCS.

Your success is our goal

We are a true ECN technology broker, so there’s no conflict of interest. You can confidently trade with us knowing we have your best interests at heart.

Make your money go further

Enjoy low cost trading with spreads from 0.0 pips and commission from $1.50 per lot. Our ECN account is the most cost-effective form of FX trading, with no fixed spreads or additional pips added.

Ultra-fast execution

Your trade is executed instantly through our wide range of liquidity providers streaming real-time prices. Apply for a free VPS (see Terms & Conditions) for enhanced trading flexibility and speed.

Your choice of trading strategy

High frequency trading, all types of expert advisors (EA’s) and scalping are all welcomed forms of trading.

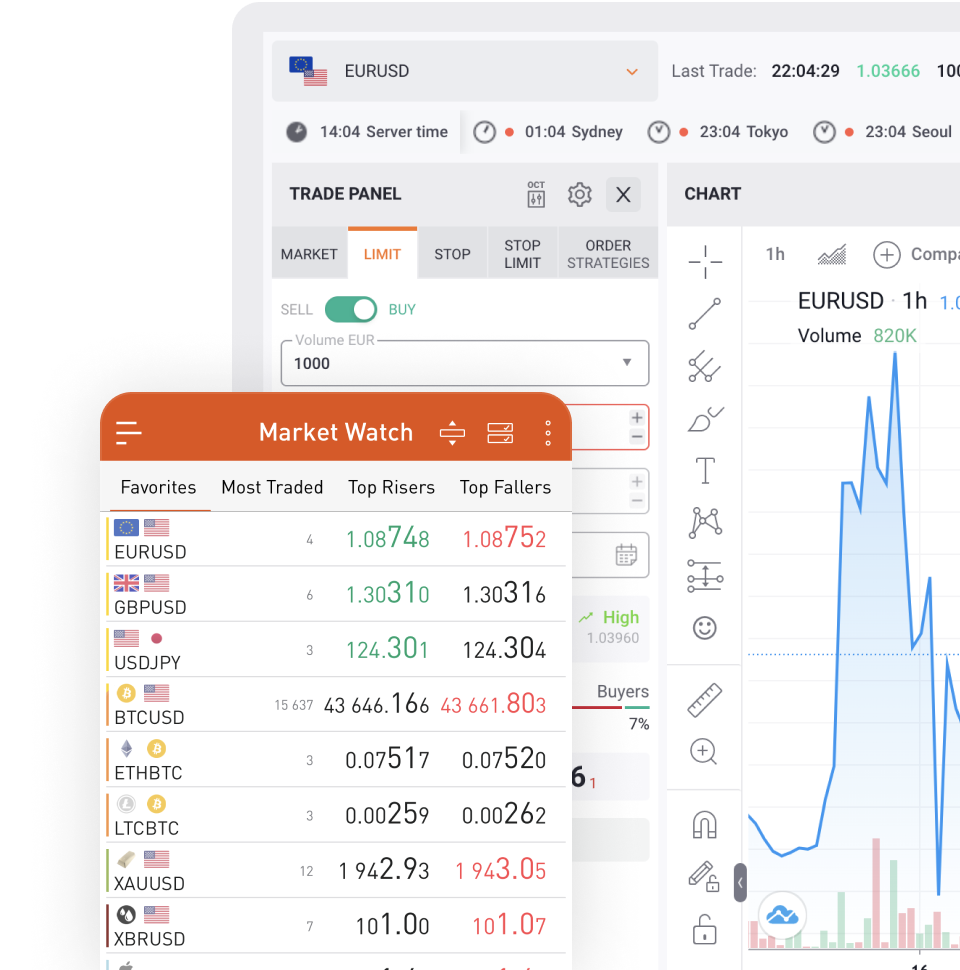

700+ markets offered

Trade global FX, index, commodity and share CFDs, on MT4, MT5, TickTrader or TradingView trading platforms.

One account. 700+ Markets.

Unlimited trading.

Our Trading Platforms

Trade hundreds of markets from one single platform

Freedom of choice

Choose from FXOpen’s own advanced multi-asset trading platform TickTrader; the powerful charting and social trading platform, TradingView; or the popular MetaTrader 4 and MetaTrader 5 trading platforms.

Trade wherever you are

Each platform is free and available on mobile, tablet, desktop and as a web app.

Explore infinite

trading opportunities

Our trading platforms feature extensive advanced trading tools alongside a whole host of fully customisable features, designed to meet the needs of even the most demanding of traders.

Fast and reliable

Fast execution, London-based server and no dealing desk intervention

Powerful, secure

and easy to use

Choose a trading platform that fits your needs and trade from anywhere.

TickTrader

TickTrader is our new technologically advanced multi-asset trading platform for the most demanding of traders. Available on desktop, browser, iOS and Android devices.

TradingView

TradingView is a powerful charting platform and social network. Available on desktop, browser.

MetaTrader 4

MetaTrader 4 (MT4) is the most popular platform for investors, especially for FX traders. Available on desktop, browser and Android devices.

MetaTrader 5

MetaTrader 5 (MT5) is the multi-asset successor to MT4, offering a number of additional benefits whilst still retaining the familiar user interface. Available on desktop, browser and Android devices.

Easy to start

Just a few steps to start trading

Open your account

Register easily and securely with FXOpen and verify your account

Choose your trading platform

Download TickTrader, Metatrader 4, Metatrader 5 or TradingView.

Fund and trade

Once verified, fund using our multiple funding options and start trading with spreads from 0.0 pips.

Your success is our priority

Whether you are an experienced trader or just starting out.

Already a trader?

Enjoy tight spreads from 0.0 pips and ultra-fast execution on the MT4, MT5, TickTrader or TradingView platforms.

- Your choice of trading platform

- View our live spreads on over 700 markets

- Discounted commission for high volume traders

- Free VPS for active traders

New to trading?

Let FXOpen provide insightful analysis and useful information to help inform your trading decisions.

Apply nowEconomic calendar

Company news

Trading Hours Schedule for the Christmas and New Year Holiday Period 2025–2026

Dear Traders,

Please be informed of the amended trading hours during the Christmas and New Year holiday period. All times are GMT +2.

We recommend taking these changes into account when planning your trading activity, as liquidity may be reduced

Trading Hours Schedule for 2025 Thanksgiving Holiday

Dear Traders,

Please note the amended trading hours for the 2025 U.S. Thanksgiving holiday (times are GMT+2):

Thursday, 27 November 2025

Commodities CFD:

- XAUUSD, XAGUSD – trading until 20:30;

- XBRUSD, XNGUSD, XTIUSD – trading until 20:15.

Indices:

- #J225,

Trading Hours Schedule for the Chung Yeung Festival

Dear Traders,

Due to the forthcoming Chung Yeung Festival in Hong Kong, trading hours for the Hang Seng Index will be changed on 28th, 29th and 30th October. Please see the schedule below and consider this information as you plan

Setting FXOpen Servers to Winter Time

Dear Traders,

Please be informed that on November 2, 2025, FXOpen will set its Metatrader 4/5 trading servers to winter time, moving from GMT+3 to GMT+2.

This change will take effect at the market opening on Monday,