FXOpen

Any trader looks for ways to reduce trading risks. There are several methods, and hedging is one of them. Keep reading to understand the hedging meaning in Forex and to discover three common strategies.

What Is Hedging in Forex?

Hedging is a common concept that allows traders and investors to limit the risks of enormous price fluctuations and unwanted price movements. When talking about Forex trading, hedging is a strategy that enables the short-term protection of a currency trade from adverse price movements.

Usually, hedging is implemented when traders are unsure about an event or news outcome and want to limit possible losses as much as possible. It’s vital to understand that this approach won’t remove all risks; it’s used just to limit them.

There are some foreign exchange hedging strategies you could add to your trading tools.

1. Direct Hedging

This is the most common hedging strategy in Forex trading. This method implies opening opposite positions on the same currency pair. The strategy makes sense if you have a long-term trade that should be protected from unexpected short-term price fluctuations.

For instance, the market expects the Federal Reserve to cut the interest rate, so the US dollar may depreciate after the rate is announced. However, the trader is unsure about the USD’s reaction to the rate cut as this event may already have been priced in. If the trader has a long trade on EUR/USD and assumes USD may rise after the Fed’s meeting, they can open a short trade on the same amount of the EUR/USD pair and close it after the market stabilises.

At FXOpen, you can use this approach on MT4, MT5, and TickTrader gross accounts.

Pitfalls

The main drawback of this method is the lack of potential profit. When offsetting trades, the losses of one cover the profits of another.

2. Positively Correlated Currencies

If there is no opportunity to use a direct hedging method, you can use positively correlated currencies to hedge risks. A positively correlating currency hedging strategy is applied in this case.

Let us remind you that there are positive, negative, and neutral correlations.

- When currencies react to particular market conditions in a similar way, they are positively correlated. For instance, EUR/USD and GBP/USD.

- When currencies have a negative correlation, they move opposite to each other. EUR/USD and CAD/JPY have a highly negative correlation.

- A neutral correlation means that there is no interconnection between two pairs. USD/CNH and EUR/AUD are examples.

The strength of the correlation is measured on a range from 1 to -1, where 1 means assets move identically, 0 stands for the lack of any interconnection between assets, and -1 signals that assets always move in opposition to each other.

Let’s get back to the Forex trading hedging method. If you can’t open offset trades on a single currency pair, you may open positions on positively correlated ones. For instance, AUD/USD and NZD/USD. They usually move in the same way. If a trader is unsure about the reaction of the US dollar to the Fed’s rate decision, they could go long on AUD/USD and go short on NZD/USD or vice versa. The trades should be the same size.

Pitfalls

Despite a high positive correlation, there are differences in price movements, volatility, and liquidity levels. Usually, a pair has a correlation of 1 only with itself. The Australian dollar is a more liquid market than the New Zealand dollar. Therefore, there is a risk that losses in one position will exceed rewards in another.

3. Negatively Correlated Currencies

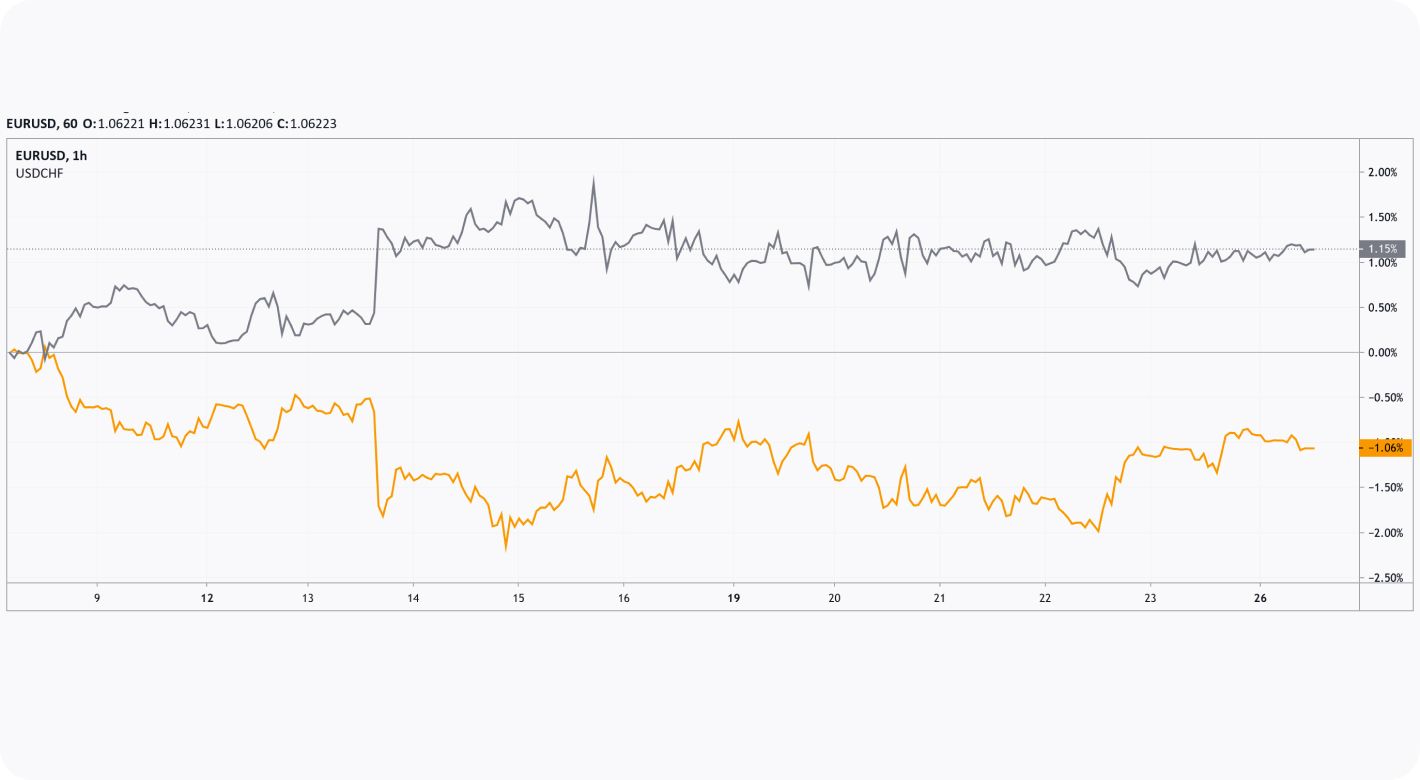

Another FX hedging strategy is based on negatively correlated pairs. The idea of this method is to find currency pairs with a negative correlation but that have one currency in common and open similar trades.

For instance, EUR/USD and USD/CHF have a negative correlation of over 0.8. Let’s consider the Fed’s meeting again. The trader expects USD to fall after the Fed’s meeting. However, they are unsure as the market may react differently if the Fed’s decision is priced in. They believe that it’s more likely the USD will fall. Therefore, they could keep their buy trade for EUR/USD as the pair is supposed to rise if the USD depreciates. Still, there is a chance the USD will increase. They may go long on USD/CHF.

A forecast and an actual interest rate decision are presented in the economic calendar.

Pitfalls

The market may move both ways before it stabilises. The strategy is risky when used in highly volatile markets. A trader needs to perform a comprehensive analysis before placing stop-loss orders. Otherwise, they may end up with losses on both trades.

Should You Use a Foreign Currency Hedge Strategy?

The answer depends on your trading approach. For instance, hedging doesn’t make sense if you trade on low timeframes where the price usually has a high degree of volatility. Short-term trading aims to gain profit, while hedging cuts it. Hedging is more common for swing or position traders who use this strategy to avoid closing open trades and prevent a margin call or stop out.

Note: hedging isn’t a method to gain more profits; it’s used to reduce potential losses. Moreover, there is no guarantee they will be fully reduced. Hedging requires traders to choose currency pairs based on a comprehensive analysis of average rate movements and standard price fluctuations. Otherwise, it may lead to losses.

A demo account could help you test hedging strategies without risks.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.