FXOpen

Inner Circle Trading, or ICT for short, is a methodology that explains how to determine the actions of large institutional players, or "smart money", in trading and build a structured trading approach. The methodology includes many concepts that allow traders to spot and follow institutional market participants in different conditions.

Explore the core ICT concepts and how traders typically apply them to refine directional bias, identify liquidity targets, and develop their trading strategies.

Key Takeaways

- ICT explains market movement through institutional behaviour, focusing on liquidity, structure, and order flow rather than indicators.

- The Inner Circle Trading method is used across forex, indices, and commodities on intraday and higher timeframes to interpret how major players influence price.

- Core ICT concepts include Break of Structure (BOS), Change of Character (CHoCH), Market Structure Shift (MSS), liquidity pools, order blocks, fair value gaps, optimal trade entries, and kill zones.

- ICT shows how price targets liquidity, reacts to imbalances, and shifts momentum, giving traders a clearer narrative of market intent.

- The framework combines structure, timing, and context, making it a detailed but discretionary approach to analysing market movement.

What Is ICT in Trading?

ICT, or Inner Circle Trading, is a price-based methodology developed by Michael J. Huddleston that offers a way to read institutional behaviour in the markets. It focuses on identifying where banks and large funds, the so-called “smart money,” enter, exit, and target liquidity. Traders use ICT across forex, indices, and commodities, mainly on intraday charts like the one-minute to one-hour, as well as higher timeframes when building directional bias.

The approach breaks price into structure, liquidity, and imbalance. It teaches traders to spot where the market takes stops, when momentum shifts, and where price often returns before moving again. Rather than relying on indicators, ICT centres on raw price action and the recurring patterns created by institutional order flow. This makes it a structured way to analyse short- and medium-term movements.

Who Is the Founder of ICT Concepts in Forex?

Inner Circle Trading was created by Michael J. Huddleston, widely known as “The Inner Circle Trader.” He is an online educator who built a large following by teaching institutional-style price action. Huddleston has produced extensive material over many years, including mentorship programmes and public lessons that shaped the terminology traders now associate with ICT. His work became a major reference point for those studying liquidity, structure, and institutional behaviour in forex markets.

How Do ICT Concepts Differ From Traditional Methods?

Inner Circle Trading differs from conventional methods because it focuses on reading institutional order flow rather than reacting to indicators. The approach strips charts back to structure, liquidity, and imbalance, giving traders a more price-driven way to analyse markets. The main differences include:

- Focus on liquidity: ICT centres on where stop orders sit and how the market seeks them, while conventional methods rely on indicators or pattern recognition.

- Institutional logic: ICT frames moves as deliberate actions by large players. Traditional analysis often treats price swings as neutral or random.

- Market structure detail: ICT breaks trends into Break of Structure (BOS), Change of Character (CHoCH), Market Structure Shift (MSS), offering a tighter read on shifts in momentum than generic swing-high/swing-low analysis.

- Imbalance and displacement: Inner Circle Trading highlights rapid moves and Fair Value Gaps as signals of strength, whereas standard approaches often minimise the relevance of these gaps.

- Time-based context: ICT uses kill zones to track when liquidity enters the market, while conventional methods rarely factor in session timing.

What Are the ICT Concepts in Trading?

Inner Circle Trading concepts are a group of price-action tools that explain how institutional traders move the market. They cover structure, which includes ideas like Break of Structure (BOS), a Change of Character (CHoCH), liquidity through pools, sweeps, and engineering, and order blocks that show where major players commit orders. It also works with fair value gaps, optimal trade entries built from retracements, and kill zones linked to specific trading sessions. Together, these concepts offer a clear framework for reading intraday and higher-time-frame behaviour.

Below, we’ve explained these fundamental ICT trading concepts. To understand them, you can consider following along in FXOpen’s TickTrader platform.

Structure

In the context of ICT, market structure is based on the idea that market direction can be identified through patterns of highs and lows. Within market structure, key structural events are split into distinct movements: a Break of Structure (BOS), a Change of Character (CHoCH), and a Market Structure Shift (MSS).

Market Structure

Market structure describes how price moves through a sequence of highs and lows. It shows whether the market trends up, trends down, or ranges, and gives traders a clear view of the current direction. In ICT, structure forms the foundation for reading intent behind price movements and deciding when a trend strengthens, weakens, or begins to reverse.

Specifically, structure is characterised by a series of higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. This sequential pattern provides a visual representation of market sentiment and momentum.

Importantly, market trends are fractal, replicating similar patterns at different scales or timeframes. For example, what appears as a bearish trend on a short timeframe might merely be a corrective phase within a larger bullish trend. Understanding this fractal nature may help traders align their strategies with the prevailing trend at different trading intervals.

Break of Structure (BOS)

A Break of Structure is a concept that confirms the continuation of the current market direction. It occurs when price moves beyond a key swing point that defines the current trend.

- Bullish BOS appears in an uptrend, when a candle moves above the most recent swing high while the prior swing low remains intact.

- Bearish BOS occurs in a downtrend, when a candle drops below the most recent swing low while the prior swing high holds.

Change of Character (CHoCH)

A Change of Character concept reflects a possible trend change. It occurs when price violates the swing point that protects the current trend, signalling the first meaningful shift in control. In an uptrend, a CHoCH forms when price fails to set a new high and then closes below the most recent swing low that previously held the trend. In a downtrend, it forms when price fails to create a fresh low and then closes above the most recent protective swing high.

Identifying a CHoCH may help traders recognise when the market momentum is shifting, which is critical for adjusting positions to capitalise on or protect against a new trend.

Market Structure Shift (MSS)

A Market Structure Shift is a significant change in the market that can disrupt the existing trend. This specific type of CHoCH is typically marked by a price moving sharply (a displacement) through a key structural level, such as a higher low in an uptrend or a lower high in a downtrend.

These shifts can signal a profound change in market dynamics, with the sharp move often preceding a new sustained trend. Recognising an MSS allows traders to reevaluate their current bias and adapt to a new trend, given its clear signal.

Order Blocks

Order blocks are a central component of ICT trading, providing insights into potential areas where the price may react strongly due to significant buy or sell interests from large market participants. There are a few different types of order blocks to be aware of: regular order blocks, breaker blocks, and mitigation blocks.

Regular Order Blocks

A regular order block is an area on the price chart representing a concentration of buying (demand zone) or selling (supply zone) activity.

A bullish order block appears during a downward price movement and marks the last area of selling before a substantial upward price movement occurs. Conversely, a bearish order block forms in an uptrend where the last buying action appears before a significant downward price shift.

In the ICT trading strategy, order blocks are seen as reversal areas. So, if the price revisits a bullish order block following a BOS higher, it’s assumed that the block will hold and prompt a reversal that produces a new higher high.

Breaker Blocks

A breaker block forms when price invalidates an order block that should have held if the trend remained intact. This formation indicates that liquidity has been taken (fueling the movement through the order block) and that the trend is likely shifting.

For instance, in an uptrend, if the price creates a new high but then reverses below the previous higher low, the bullish order block above the low becomes a breaker block. A breaker block can be an area that prompts a reversal as the new trend unfolds; it’s a similar concept to support becoming resistance and vice versa.

Mitigation Blocks

A mitigation block appears when institutional players place orders to offset (“mitigate”) losses from an earlier position that moved against them.

It usually forms after:

- An impulsive move (strong displacement)

- A counter-move that comes back to revisit the origin of that displacement

- Institutions use this revisit to mitigate their earlier positions and reopen in the direction of the original move

A bullish mitigation block forms when price returns to the last down candle before a strong upward displacement, allowing institutions to mitigate earlier losing sell positions and reopen buying. When price reacts upward from this candle, it signals continuation of bullish order flow.

A bearish mitigation block is the opposite: price revisits the last up candle before a strong downward displacement, where institutions mitigate losing buys and re-enter shorts, and a bearish reaction confirms continuation of the downtrend (as in the example above).

Liquidity

Liquidity refers to areas on the price chart with a high concentration of trading activity, typically marked by stop orders. Liquidity concepts under the ICT methodology include: buy- and sell-side liquidity, liquidity grabs, and inducements.

Buy- and Sell-Side Liquidity

Buy-side liquidity is found where there is a likely accumulation of short-selling traders' stop orders, typically above recent highs. Conversely, sell-side liquidity is located below recent lows, where bullish traders' stop orders accumulate. When prices touch these areas, activating stop orders can cause a reversal, presenting a potential level of support or resistance.

Liquidity Grabs

A liquidity grab occurs when the price quickly spikes into high-density order areas, triggering stops and then reversing direction. In ICT theory, this action is often orchestrated by larger players aiming to capitalise on the flurry of orders to execute their large-volume trades with minimal slippage. It's a strategic move that temporarily shifts price momentum, usually just long enough to trigger the stops before the market direction reverses.

Inducement

An inducement is a specific type of liquidity grab that triggers stops and makes other traders enter the market. It often appears as a peak or trough, typically into an area of liquidity, in a minor counter-trend within the larger market trend. Inducements are designed by smart money to create an illusion of a trend change, prompting an influx of retail trading in the wrong direction. Once the retail traders have committed, the price swiftly reverses, aligning back with the original major trend.

Trending Movements

In the Inner Circle Trading methodology, two specific types of sharp trending movements signal significant shifts in market dynamics: fair value gaps and displacements.

Fair Value Gaps

A fair value gap is a concept that reflects an imbalance in price caused by a fast, aggressive move where the market skips over prices that normally would be traded. It forms when a three-candle sequence leaves a space where the middle candle’s body and wick do not overlap with the wicks of the candles on either side. This shows that price moved so quickly in one direction that no trading occurred in that portion of the range.

Fair value gaps are important because they indicate areas on the chart where the price may return to "fill" the gap to establish equilibrium, usually before meeting an order block.

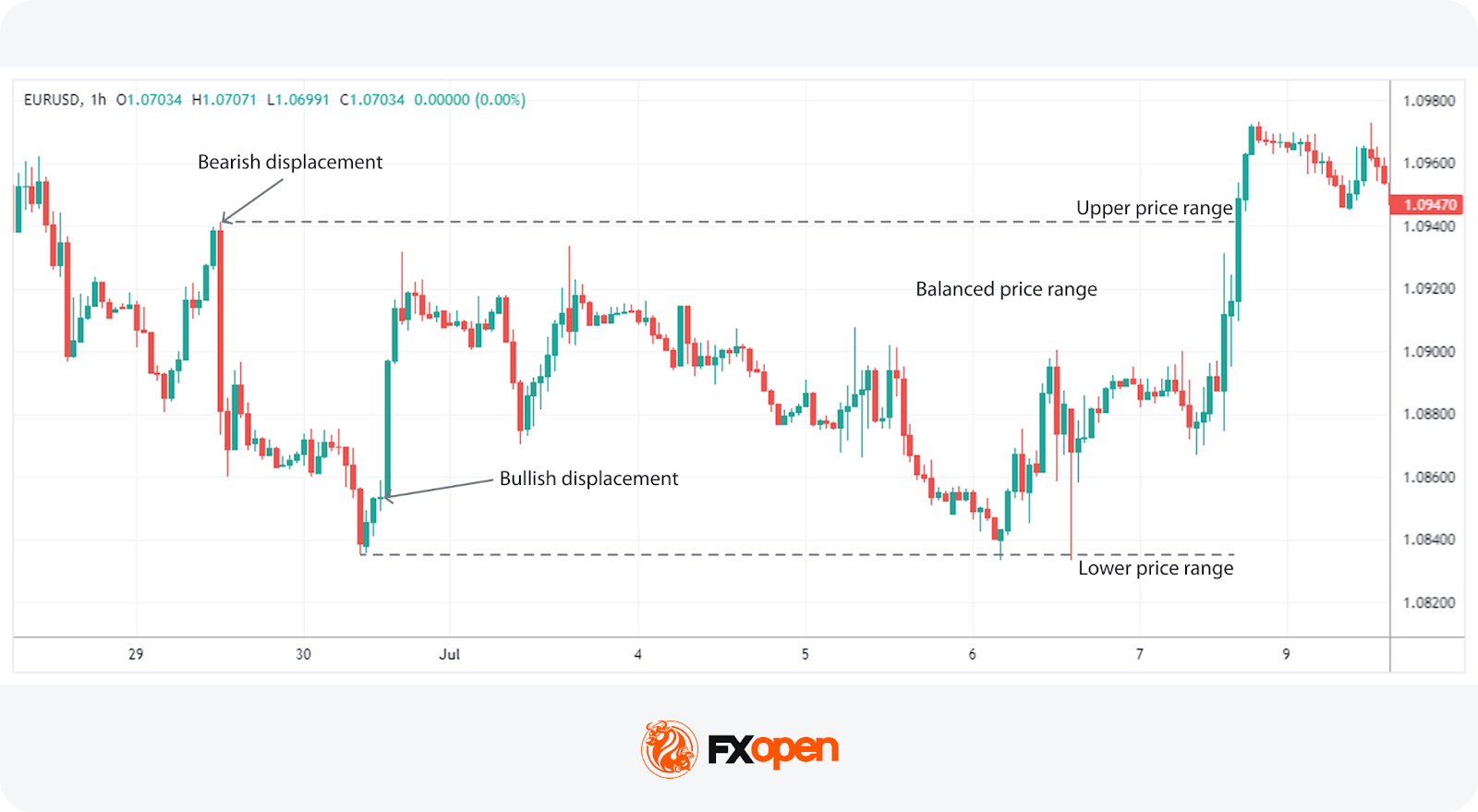

Displacements

Displacements, also known as liquidity voids, are characterised by sudden, forceful price movements and lacking the typical gradual trading activity observed in between. They are essentially amplified and more substantial versions of fair value gaps, often spanning multiple candles and FVGs, signalling a heightened imbalance between buy and sell orders.

Other Components

Beyond these ICT concepts, there are a few other niche components. These include Kill Zones, optimal trade entries, and balanced price ranges.

Kill Zones

Kill Zones refer to specific periods during the trading day when market activity significantly increases due to the opening or closing of major financial centres. These periods often set the tone for price movements based on the increased volume and volatility:

Optimal Trade Entry

An optimal trade entry (OTE) is a type of Inner Circle trading strategy, found using Fibonacci retracement levels. After an inducement that prompts a displacement (leaving behind an FVG), traders use the Fibonacci retracement tool to pinpoint entry areas.

The first point is set at the major high or low that prompts the displacement, while the second point is set at the next significant swing high or low that forms. In a bearish movement, for example, the initial point is set at the swing high before the displacement and the subsequent point at the new swing low. Traders often look to the 61.8% to 78.6% retracement level for entries.

Balanced Price Range

A balanced price range is a zone where price trades back and forth, rebalancing previous inefficiencies. Opposing displacements create overlapping FVGs, creating a temporary equilibrium between buying and selling pressure. During this phase, price often oscillates between the extremes of the range as it works to resolve the imbalance. This scenario offers traders potential zones for trend reversals as the price seeks to establish a new equilibrium, as well as key levels to watch for a breakout.

Step-by-Step ICT Trading Strategy

The ICT trading process follows a structured sequence, but traders treat it as a discretionary framework rather than a rigid rule-set. It blends systematic market reading with judgment, context, and experience. The goal is to build a coherent narrative from higher-time-frame bias down to precise execution zones.

- Establishing a Higher Timeframe Bias

Traders begin by analysing the weekly, daily, and four-hour structure to identify the prevailing trend, key swing points, and major liquidity pools. This step frames whether the market is delivering higher or lower prices and highlights the most relevant draw on liquidity.

2. Marking Liquidity and Structural Levels

Traders identify buy-side and sell-side liquidity, including equal highs/lows, obvious stop clusters, and major swing points. Structural markers like BOS, CHoCH, and MSS may help traders understand whether momentum is intact or shifting.

3. Locating Imbalances and Institutional Footprints

Fair value gaps, order blocks, mitigation blocks, and displacements provide clues about where institutional orders may sit. Traders study how price reacts around these levels to understand whether smart money is adding to, mitigating, or closing positions.

4. Assessing Session Timing and Volatility Windows

Kill zones filter periods of heightened activity, potentially helping traders judge when liquidity is likely to be taken. This timing component adds context that pure chart patterns cannot provide.

5. Building a Directional Narrative

Traders combine structural bias, liquidity targets, imbalances, and timing to form a cohesive idea of where price is likely to move next. This narrative creates expectations without forcing mechanical decisions.

6. Identify Potential Execution Zones

Areas such as retracements into order blocks, FVG fills, or OTE regions often align with points where momentum may resume. Traders use confluence, not a single signal, to refine these zones.

7. Review, Adapt, and Reassess

As price develops, traders reassess structure, liquidity, and displacement. ICT relies on active interpretation, so the process remains flexible rather than fixed.

What Are the Challenges of ICT When Trading?

ICT presents several practical challenges because it demands strong chart interpretation skills and a good grasp of context. Traders often find the approach mentally demanding, especially when markets move quickly or produce conflicting signals. The main challenges include:

- High complexity: ICT uses many concepts that interact with each other, so traders must read multiple layers of structure, liquidity, and imbalance at once.

- Context dependence: Signals rarely stand alone. Traders need to judge whether a displacement, BOS, or liquidity grab aligns with the broader narrative, which requires experience.

- Session-based variation: Price behaves differently across sessions, meaning traders must adapt to changing conditions rather than stick to fixed expectations.

- Discretion and nuance: ICT relies heavily on interpretation, so traders manage uncertainty and avoid forcing patterns that are not there.

- Emotional discipline: Because setups form quickly around liquidity events, traders face pressure to act without overreacting to noise.

ICT Trading Concepts: Advantages and Limitations

ICT trading offers a structured way to analyse price, but it also has clear limitations for traders to consider. The framework gives a detailed view of institutional behaviour, yet it remains demanding to apply consistently.

Advantages

- Institutional focus: ICT centres on how large players move price, giving traders a clearer read on why markets expand or reverse.

- Strong structural logic: Concepts like BOS, CHoCH, and MSS make trend shifts clearer than broad pattern-based methods.

- Precision in levels: Order blocks, liquidity pools, and FVGs provide well-defined areas that traders may use to take advantage of key price reactions.

- Multi-time-frame alignment: The framework links higher-time-frame bias with intraday execution, creating a coherent workflow.

Limitations

- Assumption of deliberate intent: ICT often interprets market moves as intentional actions by institutional traders, which may not always reflect how order flow actually operates.

- Steep learning curve: The depth of the framework means traders may require considerable time before applying it with consistency.

- Retrospective clarity: Many concepts appear clearer in hindsight, making them harder to apply consistently in real time.

- No fixed rules: The discretionary nature means consistency can be harder to maintain than with mechanical systems.

The Bottom Line

Understanding ICT concepts gives traders a structured way to read how liquidity, structure, and institutional order flow interact across different timeframes. The methodology is used for understanding why price targets certain levels, how momentum shifts form, and where imbalances shape future movement. Traders who study these elements may gain a clearer view of the narrative behind market swings rather than relying on indicators alone.

If you are looking to apply these trading techniques, you can consider opening an FXOpen account and gain access to tight spreads from 0.0 pips and low commissions from $1.50 per lot.

FAQs

What Are ICT Concepts in Trading?

ICT (Inner Circle Trading) concepts are a group of price-action tools designed to read institutional behaviour in the market. They focus on liquidity, structural shifts, imbalances, and session timing. Traders use them to analyse where price may draw to next, which levels hold significance, and how momentum changes across timeframes.

What Are the Main ICT Concepts?

The main ICT concepts include market structure (BOS, CHoCH, MSS), liquidity pools and liquidity grabs, order blocks, fair value gaps, displacement, optimal trade entries, and kill zones. Together, these form a framework for interpreting how institutional order flow drives expansion, retracement, and reversal phases.

What Is ICT in Trading?

ICT in trading refers to the Inner Circle Trading, a methodology developed by Michael J. Huddleston to align smaller traders’ actions with institutional market participants. It utilises specific market phenomena, such as order blocks and liquidity patterns, to analyse price movements and build a trading strategy with institutional insights.

What Is ICT Trading?

ICT trading refers to analysing markets using institutional order-flow principles like liquidity targeting, structural breaks, displacements, and imbalances. Traders apply these ideas to understand where price is drawn, how trends progress, and when sentiment shifts. The approach focuses on reading raw price behaviour rather than relying on indicators.

What Is the ICT Trading Strategy?

The Inner Circle Trading strategy is a structured method of analysing price through liquidity, structure, imbalance, and timing to reflect how institutional traders interact with the market. It evaluates which liquidity pools are likely to be targeted, where imbalances remain unfilled, how structure shifts unfold, and when sessions inject volatility.

Is ICT Better Than SMC?

Comparing ICT (Inner Circle Trading) and SMC (Smart Money Concept) is challenging as ICT is essentially a subset of SMC. While SMC provides a broader overview of how institutional money influences the markets, ICT offers more specific techniques and terms like inducements and displacements.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.