FXOpen

Technical analysis is a cornerstone of trading, relying on historical price movements to anticipate future trends. Among its many tools and chart formations, the hammer candlestick pattern is a popular signal of potential reversals. This article explores the meaning of the hammer candlestick pattern and how traders can interpret it on forex, stock, and cryptocurrency* charts.

What Is a Hammer Candle?

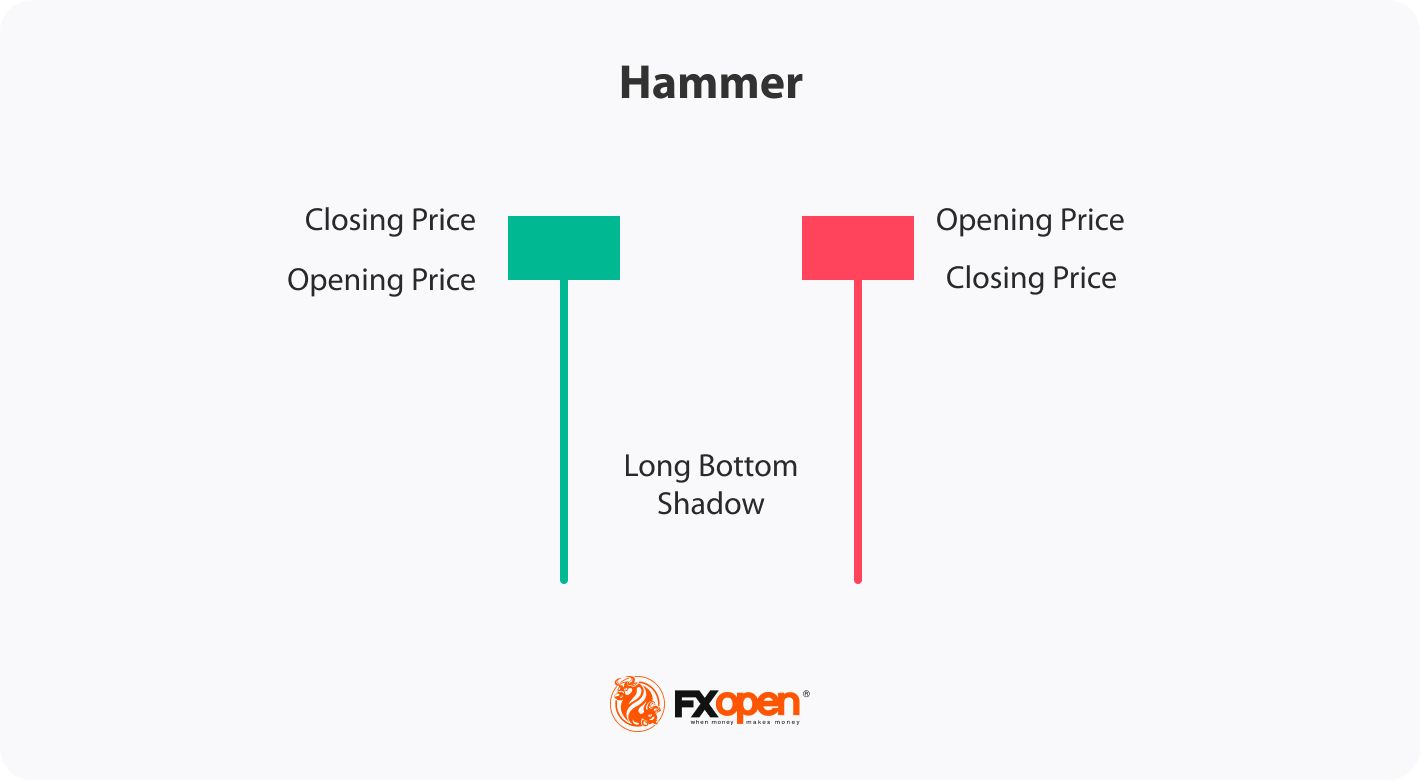

A hammer is a single-candle pattern that typically appears at the end of a downtrend, signalling a possible shift to bullish momentum. Recognised by its small body and long lower shadow, it suggests that sellers pushed prices lower during the session, but buyers regained control before the close.

To identify a bullish hammer candle on a price chart, traders do the following:

- Look for a significant downward movement: They begin by searching for a notable decline in an asset’s price.

- Observe the candle shape: The setup is characterised by a small body near the top of the candle and a long lower shadow. The lower shadow must be at least two times the length of the body. The colour of the candle doesn’t matter, but if it’s a green hammer candlestick, meaning it closed higher than it opened, the signal may be stronger.

- Analyse the context: Traders usually look for areas of support nearby as they may increase the setup's reliability.

Bullish Hammer Pattern: Trading Rules

Here are the common steps traders take when trading with a hammer:

- Confirm validity: Traders ensure that the hammer meets the criteria discussed earlier, such as a significant market decline followed by a candle with a small real body near the top and a large lower wick.

- Determine the entry point: Once the bullish hammer candlestick is confirmed, traders identify an appropriate entry point. Candlesticks don’t provide specific entry points. However, traders usually wait for the subsequent bar to close above and enter the trade if the market moves higher.

- Set stop-loss and take-profit levels: Traders place a stop-loss order below the low of the hammer to potentially limit risks. Traders determine a suitable take-profit level based on their trading approach, such as at the nearest resistance level or in accordance with the risk/reward ratio.

Trading Example

A trader spots a hammer on the hourly chart of the EURUSD pair. They wait for the candle to close above the hammer to enter the market. Their stop loss is below the hammer’s lower shadow, with the take profit calculated in accordance with the 1:2 risk/reward ratio.

To test your own trading strategy, you may consider using the TickTrader trading platform by FXOpen that provides over 1200 trading tools.

How May Traders Confirm the Hammer Candlestick?

Traders typically combine two-three tools to confirm a signal. Beyond the hammer’s basic identification, several techniques and indicators may help validate its potential bullish reversal signal.

- Volume Analysis: A significant increase in trading volume during the formation of the hammer candlestick suggests stronger confirmation. Higher buying volume indicates heightened interest and participation, reinforcing the potential reversal.

- Support Levels: The presence of a strong support level near the hammer adds credibility to the pattern. Support levels act as psychological barriers where buying interest may increase, boosting the likelihood of a reversal.

- Subsequent Candlesticks: Observing the price action of the next few candlesticks after the hammer can provide further confirmation. A bullish candle closing above the high of the hammer enhances its validity.

- Double Hammer Pattern: While rare, a double hammer candlestick pattern where two candles appear consecutively can offer strong confirmation of a bullish movement.

- Trend Indicators: Utilising trend indicators like moving averages may help confirm the hammer’s signals. A rising moving average confirming the upward trend or a hammer forming in line with a broader trend adds weight to the potential reversal.

- Divergence: Identifying divergence between the price and momentum indicators, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), can strengthen the pattern's reliability.

Hammer and Other Candlestick Patterns

Let’s compare the hammer to other candle formations you can spot on price charts.

Inverted Hammer

The inverted hammer is similar to the hammer but has a different appearance. It is characterised by a small body near the bottom of the candle and a long upper wick. The inverted hammer signals a potential bullish reversal as buyers start to gain strength and push the market up. The small body and small lower shadow reflect the rejection of lower prices, suggesting a shift in market sentiment from bearish to bullish.

Doji

In contrast to the red or green hammer candlestick pattern, the doji features a small real body with equal or close opening and closing prices and long upper and lower wicks. It represents market indecision, where neither buyers nor sellers have gained a clear advantage. While the hammer is potent during the downtrend, the doji can occur after both uptrends and downtrends, and it signals market consolidation or a potential trend reversal.

Shooting Star

The shooting star formation emerges at the top of an uptrend and suggests a potential bearish reversal. It is identified by a small real body near the bottom of the candle and a long upper wick, implying a rejection of higher prices and potential exhaustion of buying pressure.

Hanging Man

The hanging man emerges after an uptrend and suggests a potential bearish reversal. It resembles the hammer with a small real body near the top and a long lower wick, but the crucial difference is that it occurs in an uptrend. The hanging man implies that sellers are starting to exert influence, potentially leading to a reversal in the market.

Limitations of the Hammer Pattern

While the hammer is a valuable tool in technical analysis, it is not without its limitations.

- False Signals: It can sometimes produce false signals, leading to premature or incorrect trade entries. In certain market conditions, such as strong downtrends or highly volatile environments, the hammer might be less effective. Its success rate can vary across different assets and market scenarios.

- Dependence on Confirmation: The reliability of the hammer significantly depends on additional confirmation tools and indicators. Without these, alone it might not provide sufficient confidence for trading decisions.

- Short-Term Nature: The hammer primarily signals short-term price movements and typically can’t be used to anticipate medium or long-term price trends.

The Bottom Line

The hammer candlestick pattern is more than just a visual shape on a chart—it reflects a shift in market sentiment, where buyers begin to challenge downward pressure. While it can be a strong signal of a potential reversal, it should not be relied upon in isolation. Traders often combine it with volume analysis or trend indicators to strengthen their decisions.

If you want to apply this pattern to over 700 financial instruments and trade with spreads as tight as 0.0 pips, consider opening an FXOpen account.

FAQ

What Is a Hammer Candlestick?

A hammer candlestick is a bullish reversal pattern that forms after a downtrend. It has a small body near the top and a long lower shadow, showing that sellers pushed prices down but buyers regained control before the close.

Is a Hammer Candlestick Pattern Bullish?

Yes, the hammer candlestick pattern is generally considered bullish. It signifies a potential trend reversal after a downtrend, as buyers enter the market and drive the price higher from its lows. The long lower shadow indicates that the buying pressure is strong and can potentially lead to further upward movement in the market.

Can a Hammer Candle Be Bearish?

A hammer candle is generally considered a bullish reversal signal, signalling a potential upward price movement after a downtrend. There is no bearish hammer. If the market continues to move lower after it forms, it just means that bearish market conditions were stronger and didn’t allow buyers to change market sentiment.

What Is the Hammer Candle Rule?

The hammer candle rule states that it must occur after a significant downtrend, have a small real body near the top of the candle, and feature a long lower shadow at least twice the length of the body. This pattern indicates a potential bullish reversal if confirmed by subsequent price action.

What Is the Hammer Strategy?

The hammer trading strategy involves identifying a candlestick at the end of a downtrend, confirming its validity with additional indicators or signals, and then entering a long position. Traders typically set stop-loss orders below the hammer's low and determine take-profit levels based on risk/reward ratios or nearby resistance levels.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Stay ahead of the market!

Subscribe now to our mailing list and receive the latest market news and insights delivered directly to your inbox.